m

MCOM

vs

9680

9680

9680

9680

Over the past 12 months, MCOM has significantly outperformed Chenqi Technology Ltd, delivering a return of -1% compared to the Chenqi Technology Ltd's 26% drop.

Paid Plans

Want to analyze multiple companies at once? Paid plans let you compare up to 5 stocks side by side.

Sign Up

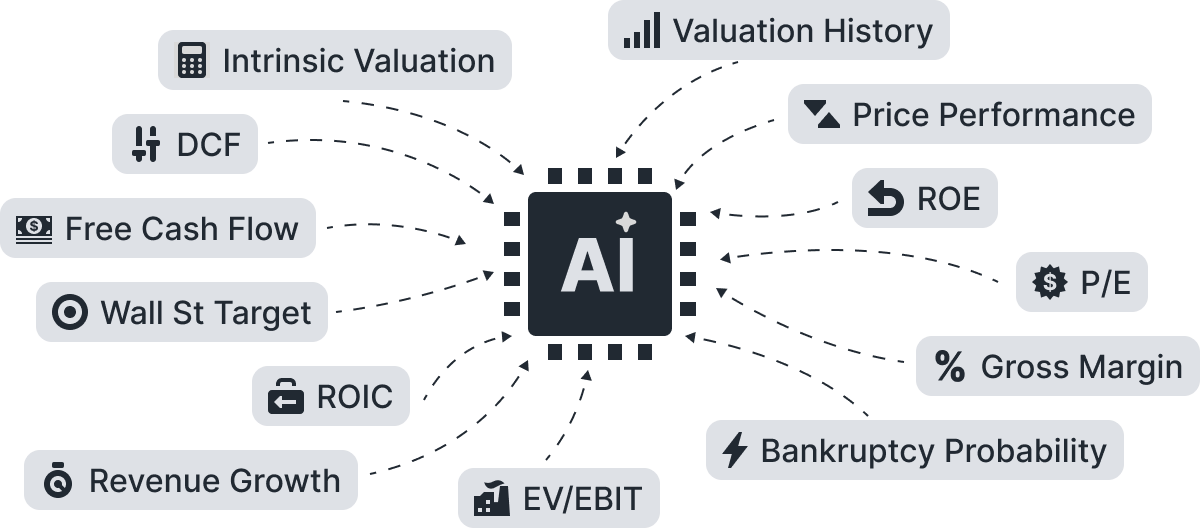

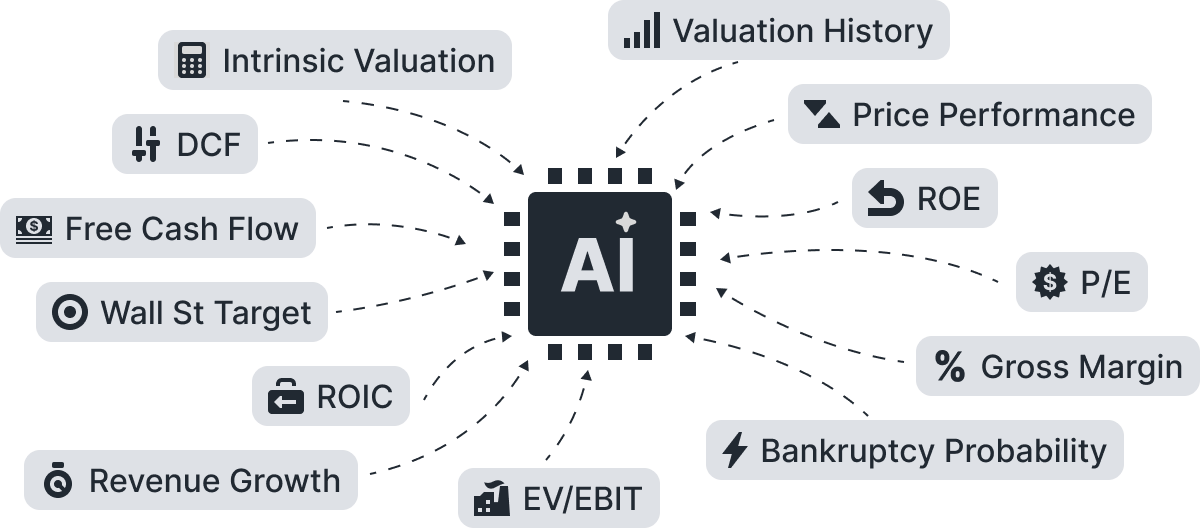

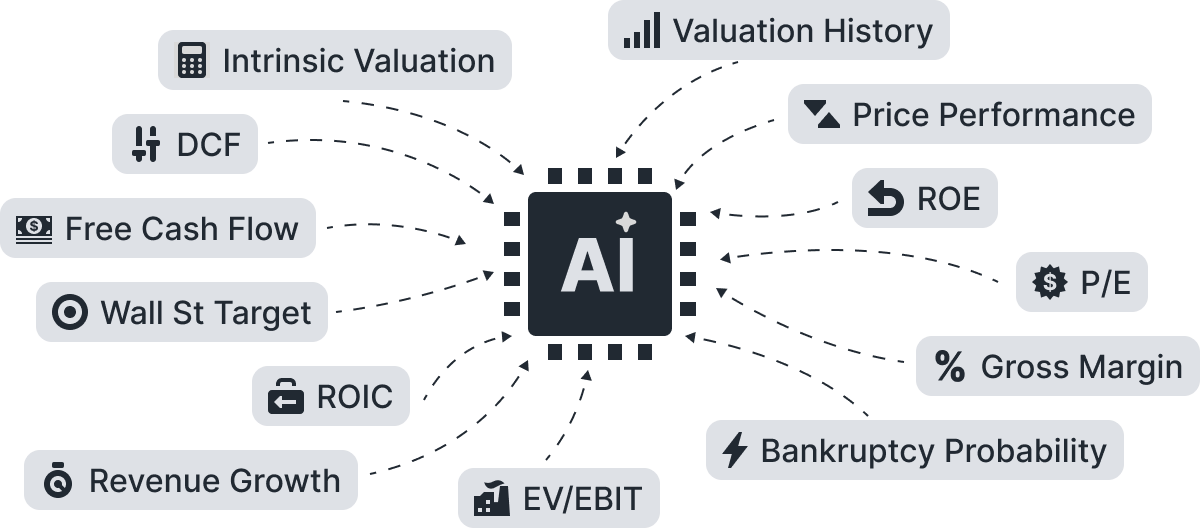

Smart Verdict

AI-Powered

Let AI Decide.

9680

9680

Valuation Comparison

| Company | Last Price | Intrinsic Value | DCF Value | Relative Value | Wall St Target | ||

|---|---|---|---|---|---|---|---|

|

m

|

micromobility.com inc

OTC:MCOM

|

0.0079

USD

|

|||||

|

Chenqi Technology Ltd

HKEX:9680

|

9.29

HKD

|

|||||

Compare the stock's valuation with its competitors.

Growth Comparison

Growth Over Time

MCOM, 9680

Compare company's financials with its competitors.

| Company | LTM | Historical Growth | Growth Streak | % Positive Years | Max Drawdown | Volatility | Forecasted Growth | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | ||||||||

|

m

|

micromobility.com inc

Revenue

|

|||||||||||

|

Chenqi Technology Ltd

Revenue

|

|||||||||||

All metrics are calculated based on data from the last 10 years.

Compare company's financials with its competitors.

Profitability Comparison

Free Cash Flow

MCOM, 9680

Compare company's free cash flow with its competitors.

| Company | LTM | Average | Historical Growth | FCF Margin | Conversion | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| 3 Years | 5 Years | 3 Years | 5 Years | 10 Years | ||||||

|

m

|

micromobility.com inc

OTC:MCOM

|

|||||||||

|

Chenqi Technology Ltd

HKEX:9680

|

|||||||||

Compare company's free cash flow with its competitors.

Gross Margin

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

m

|

micromobility.com inc | ||||

|

Chenqi Technology Ltd | ||||

Operating Margin

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

m

|

micromobility.com inc | ||||

|

Chenqi Technology Ltd | ||||

Net Margin

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

m

|

micromobility.com inc | ||||

|

Chenqi Technology Ltd | ||||

FCF Margin

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

m

|

micromobility.com inc | ||||

|

Chenqi Technology Ltd | ||||

ROE

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

m

|

micromobility.com inc | ||||

|

Chenqi Technology Ltd | ||||

ROA

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

m

|

micromobility.com inc | ||||

|

Chenqi Technology Ltd | ||||

ROIC

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

m

|

micromobility.com inc | ||||

|

Chenqi Technology Ltd | ||||

ROCE

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

m

|

micromobility.com inc | ||||

|

Chenqi Technology Ltd | ||||

Solvency Comparison

Compare company's equity waterfall with its competitors.

Stocks Performance

Stocks Performance

MCOM, 9680

Performance By Year

MCOM, 9680

Compare the stock's returns with its benchmark index and competitors. Gain insights into its relative performance over time.

| FR |

A

|

Ayvens SA

OTC:ALLDF

|

|

| CN |

C

|

CaoCao Inc

HKEX:2643

|

|

| TR |

B

|

Bin Ulasim ve Akilli Sehir Teknolojileri AS

IST:BINBN.E

|

|

| CN |

D

|

Dida Inc

HKEX:2559

|

|

| ID |

|

Blue Bird Tbk PT

IDX:BIRD

|

|

| ID |

|

Adi Sarana Armada Tbk PT

IDX:ASSA

|

|

| CN |

|

Chenqi Technology Ltd

HKEX:9680

|

|

| UK |

|

Mobico Group PLC

LSE:MCG

|

|

| IT |

S

|

Sicily By Car SpA

MIL:SBC

|

|

| IN |

E

|

ECOS (India) Mobility & Hospitality Ltd

NSE:ECOSMOBLTY

|