Enphase Energy Inc

NASDAQ:ENPH

Enphase Energy Inc

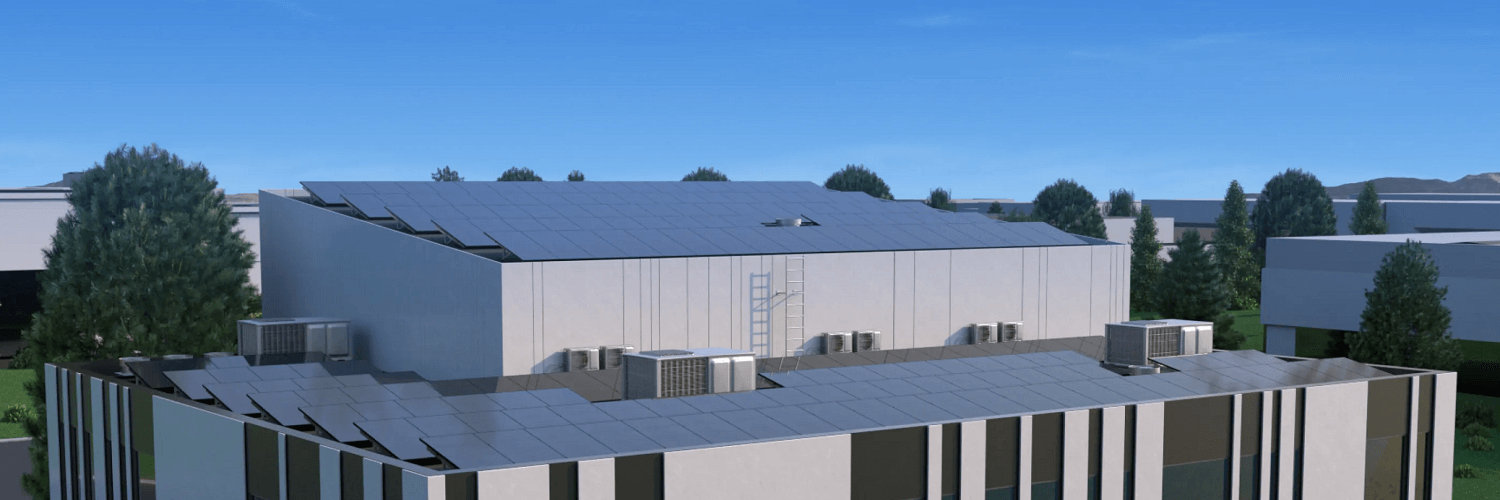

Enphase Energy Inc. is a standout player in the renewable energy sector, crafting its narrative around the efficient harnessing of the sun's power. Founded in 2006, the company carved its niche in the solar industry by innovating microinverter technology, which breaks down the inefficiencies typically associated with traditional solar energy systems. Unlike conventional inverters that connect to all panels in a solar array, Enphase’s microinverters attach directly to individual solar panels. This allows each panel to operate independently, optimizing energy harvest and reliability even in varied environmental conditions such as shading or debris. The move revolutionized how solar installations are managed, providing not only increased resilience and performance but also simplifying installation for residential and commercial users.

Revenue streams for Enphase are carefully structured around its technology offerings, focusing primarily on the sale of microinverters, energy management systems, and a suite of software solutions that enable homeowners and businesses to monitor and manage their energy production. In recent years, Enphase has expanded its horizons to include energy storage systems, capitalizing on the growing trend towards complete energy independence. Their batteries work seamlessly with their solar solutions, providing backup power and load management, thereby creating a comprehensive ecosystem for energy consumers. This integration of technology ensures a loyal customer base, who benefit from not just producing their own electricity, but efficiently managing and storing it, positioning Enphase as a formidable entity in the future of energy sustainability.

Enphase Energy Inc. is a standout player in the renewable energy sector, crafting its narrative around the efficient harnessing of the sun's power. Founded in 2006, the company carved its niche in the solar industry by innovating microinverter technology, which breaks down the inefficiencies typically associated with traditional solar energy systems. Unlike conventional inverters that connect to all panels in a solar array, Enphase’s microinverters attach directly to individual solar panels. This allows each panel to operate independently, optimizing energy harvest and reliability even in varied environmental conditions such as shading or debris. The move revolutionized how solar installations are managed, providing not only increased resilience and performance but also simplifying installation for residential and commercial users.

Revenue streams for Enphase are carefully structured around its technology offerings, focusing primarily on the sale of microinverters, energy management systems, and a suite of software solutions that enable homeowners and businesses to monitor and manage their energy production. In recent years, Enphase has expanded its horizons to include energy storage systems, capitalizing on the growing trend towards complete energy independence. Their batteries work seamlessly with their solar solutions, providing backup power and load management, thereby creating a comprehensive ecosystem for energy consumers. This integration of technology ensures a loyal customer base, who benefit from not just producing their own electricity, but efficiently managing and storing it, positioning Enphase as a formidable entity in the future of energy sustainability.

Revenue: Enphase reported Q4 2025 revenue of $343.3 million, with guidance for Q1 2026 between $270 million and $300 million, above the prior view of $250 million.

Gross Margin: Q4 gross margin was 44.3%, with Q1 2026 guidance of 40% to 43%, impacted by about 5 percentage points from reciprocal tariffs.

Free Cash Flow: Generated $37.8 million in free cash flow in Q4 and $95.9 million for the full year 2025.

Product Launches: Rolled out new IQ9 Commercial Microinverter, began shipping IQ EV Charger 2, and advanced on its fifth-generation battery and bidirectional EV charger.

Battery & Storage: Shipped 150.1 megawatt hours of batteries in Q4; battery sell-through in the U.S. was up 27% quarter-over-quarter.

Geographic Trends: U.S. revenue fell 13% and Europe dropped 29% sequentially, with ongoing pricing pressure and targeted cost reductions in Europe.

Outlook: Management expects Q1 to mark the low point for demand, with improvements anticipated through 2026, supported by higher utility rates and new financing options.

Cost Actions: Recently reduced headcount by 6% and plans to lower non-GAAP operating expenses to $70–75 million by Q3 2026.