Proto Labs Inc

SWB:PRZ

Proto Labs Inc

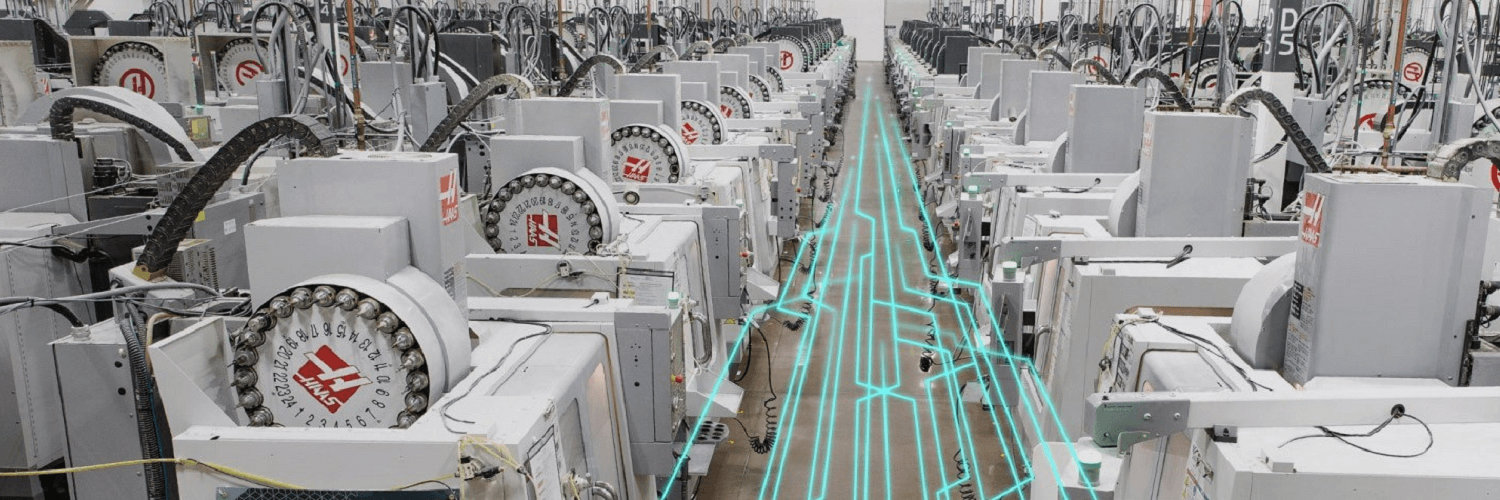

Proto Labs Inc. began its journey in the late 1990s with an innovative vision to revolutionize the world of manufacturing. At a time when speed and efficiency were becoming increasingly essential for businesses, Proto Labs emerged as a pioneer in rapid prototyping and custom manufacturing. The company harnessed advanced digital technologies to streamline the production of prototypes and small-batch parts by using CNC machining, injection molding, 3D printing, and sheet metal fabrication processes. Their approach drastically reduced the time required to bring new products from concept to market. By leveraging their proprietary software, Proto Labs simplified the intricate processes of design and production, allowing engineers and designers to quickly obtain prototypes and parts, accelerating innovation and reducing development costs.

Proto Labs' business model is rooted in providing unparalleled speed and flexibility, making it invaluable for industries ranging from aerospace and automotive to healthcare and consumer products. The company operates through a robust e-commerce platform that enables customers to easily upload their designs, receive instant quotes, and test functional prototypes within days rather than weeks. This agility has resonated well with both startups and established firms that have little room for manufacturing delays. By charging competitive prices for speed and precision, Proto Labs has carved out a profitable niche within the manufacturing sector. This unique mix of cutting-edge technology, strategic market positioning, and dedication to efficiency underpins their revenue generation, positioning Proto Labs as a formidable player in the realm of digital manufacturing solutions.

Proto Labs Inc. began its journey in the late 1990s with an innovative vision to revolutionize the world of manufacturing. At a time when speed and efficiency were becoming increasingly essential for businesses, Proto Labs emerged as a pioneer in rapid prototyping and custom manufacturing. The company harnessed advanced digital technologies to streamline the production of prototypes and small-batch parts by using CNC machining, injection molding, 3D printing, and sheet metal fabrication processes. Their approach drastically reduced the time required to bring new products from concept to market. By leveraging their proprietary software, Proto Labs simplified the intricate processes of design and production, allowing engineers and designers to quickly obtain prototypes and parts, accelerating innovation and reducing development costs.

Proto Labs' business model is rooted in providing unparalleled speed and flexibility, making it invaluable for industries ranging from aerospace and automotive to healthcare and consumer products. The company operates through a robust e-commerce platform that enables customers to easily upload their designs, receive instant quotes, and test functional prototypes within days rather than weeks. This agility has resonated well with both startups and established firms that have little room for manufacturing delays. By charging competitive prices for speed and precision, Proto Labs has carved out a profitable niche within the manufacturing sector. This unique mix of cutting-edge technology, strategic market positioning, and dedication to efficiency underpins their revenue generation, positioning Proto Labs as a formidable player in the realm of digital manufacturing solutions.

Record Revenue: Proto Labs reported record fourth quarter revenue of $136.5 million, up 11% year-over-year, and record full-year revenue of $533.1 million, up 5.7%.

Growth Drivers: Strong demand in CNC Machining (up 25% in the US for the year and 35% in Q4) and Sheet Metal (up 12%) powered growth, particularly from innovation-driven sectors like aerospace, defense, and data centers.

Margin Improvement: Non-GAAP gross margin improved to 44.8% in Q4, up 140 basis points year-over-year, with factory margins reaching 49%.

2026 Outlook: Management expects 2026 revenue growth of 6% to 8%, with Q1 2026 revenue guided between $130 million and $138 million and non-GAAP EPS of $0.36 to $0.44.

Strategic Transformation: The company is undergoing major organizational and operational changes to drive growth, expand production capabilities, and improve efficiency, aiming for sustained double-digit growth over time.

European Reset: Deliberate actions are underway to reaccelerate growth and restore margins in the European business, which has declined for two years but is seen as an execution opportunity, not a structural weakness.