Escorts Kubota Ltd

BSE:500495

Escorts Kubota Ltd

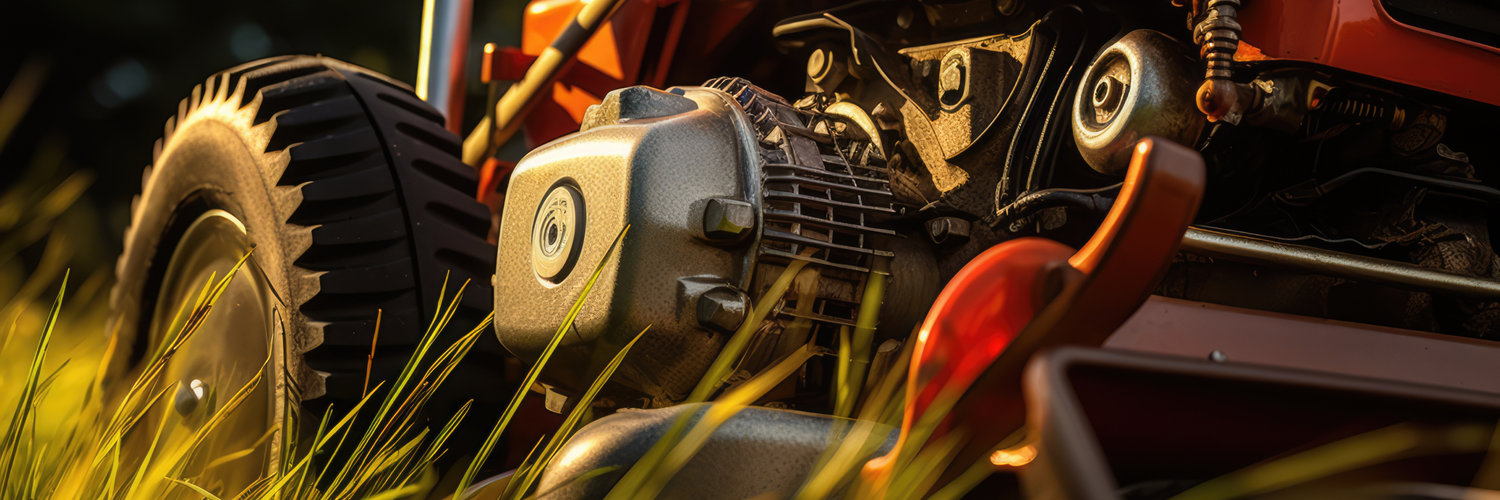

In the sprawling expanse of India's industrial landscape, Escorts Kubota Ltd. stands out as a testament to innovation and partnership. Born from the merger of India's robust Escorts Group and Japan's engineering giant Kubota Corporation, this company effortlessly blends local expertise with global standards. Escorts Kubota specializes predominantly in the production of agricultural tractors, construction equipment, and railway equipment. With a keen understanding of the agrarian needs of India, the company's offerings are tailored to enhance productivity and efficiency in farming practices, providing reliable machinery that caters to the specific demands of the region's diverse agricultural challenges.

Their revenue model primarily hinges on the sale of agricultural and construction machinery, which remains in constant demand due to the country's agricultural prominence and burgeoning infrastructure needs. While tractors form the cornerstone of their operations, the company also capitalizes on a growing market for construction machinery and railway components. The collaboration with Kubota infuses advanced technological prowess into their manufacturing processes, enhancing product quality and broadening their market reach. Additionally, after-sales service and parts supply ensure a stable recurring revenue stream, bolstering customer loyalty. This symbiotic alliance of cutting-edge engineering with local know-how not only furthers Escorts Kubota's mission of sustainable growth but also reinforces its position as an industry leader in the Indian subcontinent.

In the sprawling expanse of India's industrial landscape, Escorts Kubota Ltd. stands out as a testament to innovation and partnership. Born from the merger of India's robust Escorts Group and Japan's engineering giant Kubota Corporation, this company effortlessly blends local expertise with global standards. Escorts Kubota specializes predominantly in the production of agricultural tractors, construction equipment, and railway equipment. With a keen understanding of the agrarian needs of India, the company's offerings are tailored to enhance productivity and efficiency in farming practices, providing reliable machinery that caters to the specific demands of the region's diverse agricultural challenges.

Their revenue model primarily hinges on the sale of agricultural and construction machinery, which remains in constant demand due to the country's agricultural prominence and burgeoning infrastructure needs. While tractors form the cornerstone of their operations, the company also capitalizes on a growing market for construction machinery and railway components. The collaboration with Kubota infuses advanced technological prowess into their manufacturing processes, enhancing product quality and broadening their market reach. Additionally, after-sales service and parts supply ensure a stable recurring revenue stream, bolstering customer loyalty. This symbiotic alliance of cutting-edge engineering with local know-how not only furthers Escorts Kubota's mission of sustainable growth but also reinforces its position as an industry leader in the Indian subcontinent.

Record Profitability: Escorts Kubota reported its highest ever quarterly EBITDA and net profit, with EBITDA up 30.9% and net profit up 24.7% year-on-year.

Revenue Growth: Standalone operating revenue rose 11.1% year-on-year, and consolidated revenue increased 11.3% year-on-year.

Margins Expanded: EBITDA margin improved to 13.5%, up 203 basis points year-on-year, driven by easing material costs and cost controls.

Tractor Industry Momentum: Domestic tractor industry grew strongly, aided by positive government policies and healthy agricultural conditions, though regional disparities affected Escorts' market share.

Exports Surge: Tractor export volumes jumped 63% year-on-year, with Kubota Global Network accounting for 68% of exports.

Construction Equipment Stabilizing: Although the industry declined sharply year-on-year, sequential volumes improved, signaling initial signs of stabilization.

CapEx Plans: Board approved land acquisition for a new greenfield plant; full investment timeline is flexible and linked to demand.

Cautious Outlook: Management expects robust near-term growth but remains cautious about FY '27 due to high base effects and dependency on monsoon.