Wonderful Sky Financial Group Holdings Ltd

HKEX:1260

Intrinsic Value

The intrinsic value of one

Wonderful Sky Financial Group Holdings Ltd

stock under the Base Case scenario is

hidden

HKD.

Compared to the current market price of 0.54 HKD,

Wonderful Sky Financial Group Holdings Ltd

is

hidden

.

Wonderful Sky Financial Group Holdings Ltd

stock under the Base Case scenario is

hidden

HKD.

Compared to the current market price of 0.54 HKD,

Wonderful Sky Financial Group Holdings Ltd

is

hidden

.

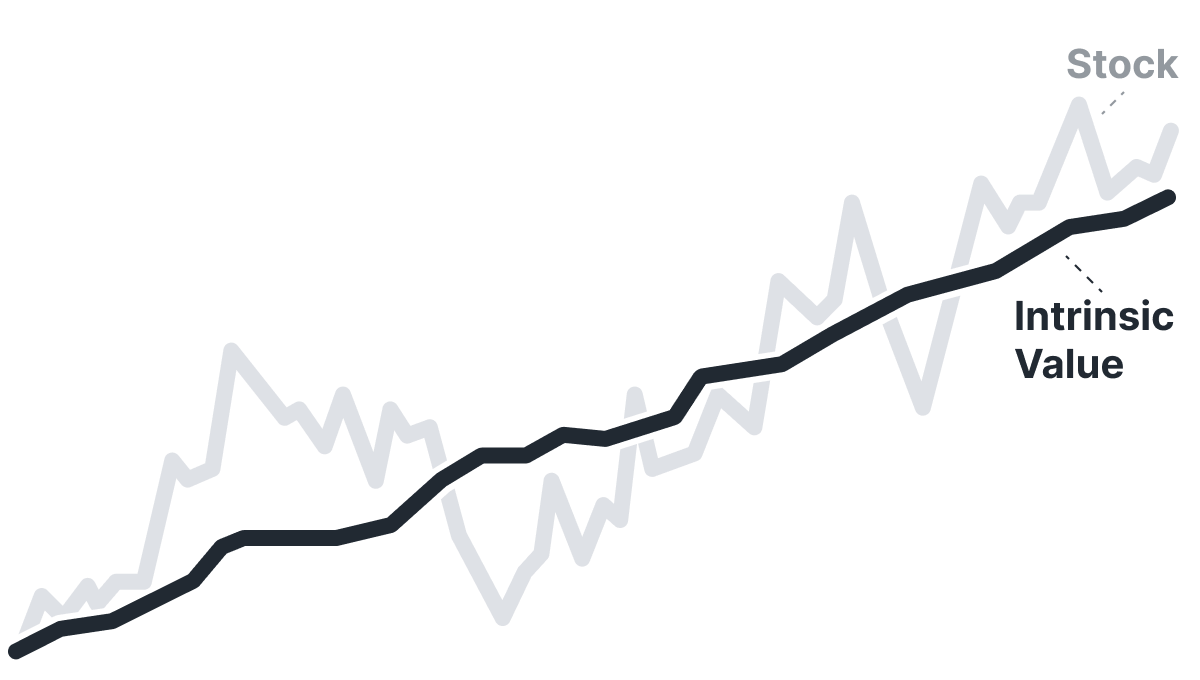

Valuation History

Wonderful Sky Financial Group Holdings Ltd

Wonderful Sky Financial Group Holdings Ltd looks undervalued. But is it really? Some stocks live permanently below intrinsic value; one glance at Historical Valuation reveals if Wonderful Sky Financial Group Holdings Ltd is one of them.

Learn how current stock valuations stack up against historical averages to gauge true investment potential.

Let our AI compare Alpha Spread’s intrinsic value with external valuations from Simply Wall St, GuruFocus, ValueInvesting.io, Seeking Alpha, and others.

Let our AI break down the key assumptions behind the intrinsic value calculation for Wonderful Sky Financial Group Holdings Ltd.

The intrinsic value of one

Wonderful Sky Financial Group Holdings Ltd

stock under the Base Case scenario is

hidden

HKD.

Wonderful Sky Financial Group Holdings Ltd

stock under the Base Case scenario is

hidden

HKD.

Compared to the current market price of 0.54 HKD,

Wonderful Sky Financial Group Holdings Ltd

is

hidden

.

Wonderful Sky Financial Group Holdings Ltd

is

hidden

.