Georg Fischer AG

SIX:GF

Gross Margin

Gross Margin shows how much money a company keeps from each dollar of sales after paying for the products it sells. It tells how profitable the company`s core business is before other expenses.

Gross Margin shows how much money a company keeps from each dollar of sales after paying for the products it sells. It tells how profitable the company`s core business is before other expenses.

Peer Comparison

| Country | Company | Market Cap |

Gross Margin |

||

|---|---|---|---|---|---|

| CH |

|

Georg Fischer AG

SIX:GF

|

4.5B CHF |

Loading...

|

|

| JP |

I

|

Ishii Iron Works Co Ltd

TSE:6362

|

304.2T JPY |

Loading...

|

|

| US |

|

Parker-Hannifin Corp

NYSE:PH

|

124.1B USD |

Loading...

|

|

| JP |

|

Freund Corp

TSE:6312

|

16.9T JPY |

Loading...

|

|

| JP |

|

Mitsubishi Heavy Industries Ltd

TSE:7011

|

16.8T JPY |

Loading...

|

|

| SE |

|

Atlas Copco AB

STO:ATCO A

|

926.2B SEK |

Loading...

|

|

| US |

|

Illinois Tool Works Inc

NYSE:ITW

|

87B USD |

Loading...

|

|

| US |

|

Barnes Group Inc

NYSE:B

|

82.3B USD |

Loading...

|

|

| SE |

|

Sandvik AB

STO:SAND

|

478.2B SEK |

Loading...

|

|

| JP |

|

Fanuc Corp

TSE:6954

|

6.3T JPY |

Loading...

|

|

| CH |

|

Schindler Holding AG

SIX:SCHP

|

30.9B CHF |

Loading...

|

Market Distribution

| Min | -13 700% |

| 30th Percentile | 34.9% |

| Median | 49.4% |

| 70th Percentile | 65.3% |

| Max | 137.7% |

Other Profitability Ratios

Georg Fischer AG

Glance View

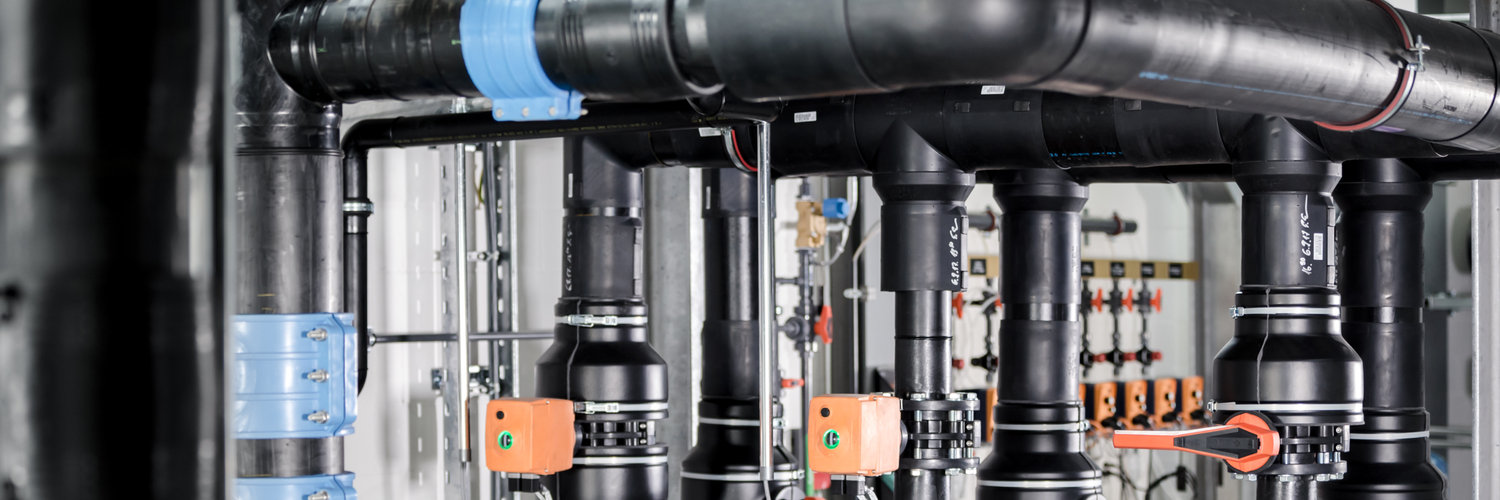

Georg Fischer AG, a Swiss-based company with a storied history, has navigated the industrial landscape for over two centuries, adapting to the ebbs and flows of technological and market demands. Founded in 1802, the company’s journey began in the age of wrought iron, and it rapidly evolved into a significant player in the global market, pioneering in the development of innovative piping systems, machining solutions, and lightweight aluminum components. At the heart of Georg Fischer’s operational ethos is its focus on sustainability and innovation, aligning its products with environmental needs and industrial transformation. The company generates revenue through its three distinct, yet interrelated divisions: GF Piping Systems, GF Casting Solutions, and GF Machining Solutions. GF Piping Systems offers a wide array of products for the safe transport of water, gas, and chemicals, utilizing both metal and plastic materials to serve diverse industries from utilities to marine applications. Meanwhile, GF Casting Solutions provides high-performance cast components for the automotive, aerospace, and energy sectors, emphasizing lightweight solutions that meet stringent industry standards. Lastly, GF Machining Solutions caters to highly precise manufacturing needs with its advanced machine tools, crucial for producing complex parts in aerospace and medical technology industries. Through this diversified approach, Georg Fischer AG continues to thrive by addressing changing market needs, ensuring its clients can rely on high-quality and innovative solutions.

See Also

Gross Margin is calculated by dividing the Gross Profit by the Revenue.

The current Gross Margin for Georg Fischer AG is 59.2%, which is above its 3-year median of 57.7%.

Over the last 3 years, Georg Fischer AG’s Gross Margin has increased from 54.3% to 59.2%. During this period, it reached a low of 54.3% on Jun 30, 2022 and a high of 59.2% on Jun 30, 2025.