Heliad AG

SWB:A7A

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

| 52 Week Range |

10.3

16.5

|

| Price Target |

|

We'll email you a reminder when the closing price reaches EUR.

Choose the stock you wish to monitor with a price alert.

This alert will be permanently deleted.

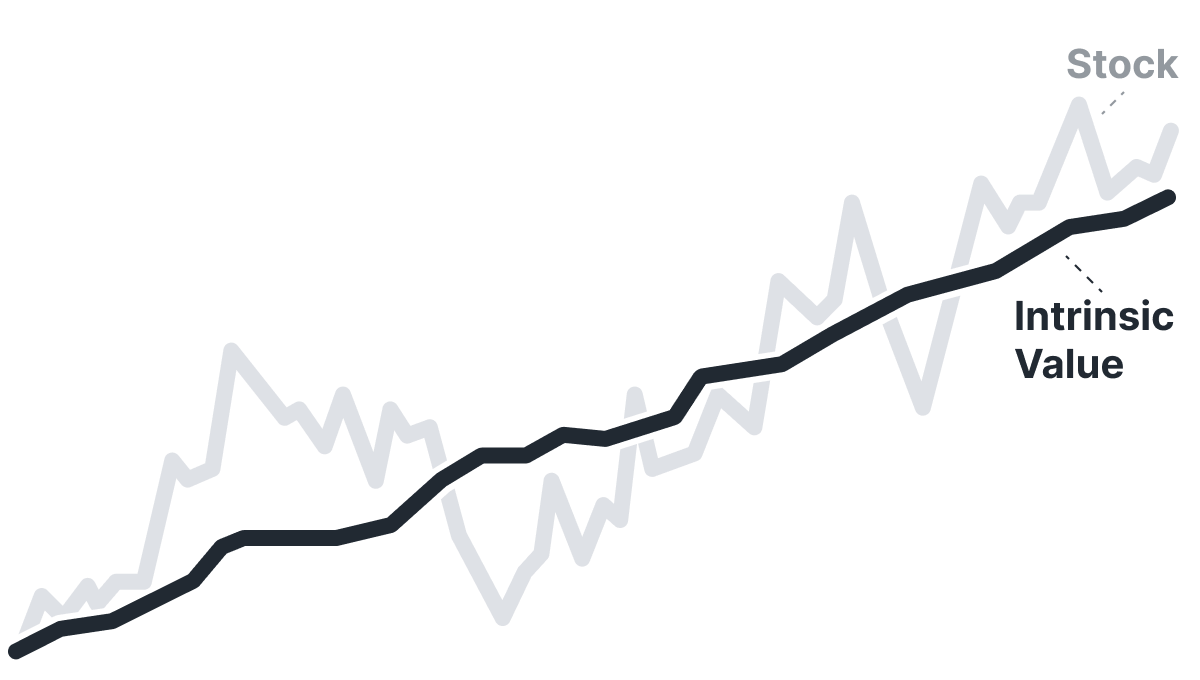

Intrinsic Value

The intrinsic value of one A7A stock under the Base Case scenario is hidden EUR. Compared to the current market price of 15.7 EUR, Heliad AG is hidden .

Valuation History

Heliad AG

A7A looks overvalued. Yet it might still be cheap by its own standards. Some stocks live permanently above intrinsic value; Historical Valuation reveals whether A7A usually does or if today's premium is unusual.

Learn how current stock valuations stack up against historical averages to gauge true investment potential.

Let our AI compare Alpha Spread’s intrinsic value with external valuations from Simply Wall St, GuruFocus, ValueInvesting.io, Seeking Alpha, and others.

Let our AI break down the key assumptions behind the intrinsic value calculation for Heliad AG.

Fundamental Analysis

A7A Profitability Score

Profitability Due Diligence

Score

A7A Solvency Score

Solvency Due Diligence

Score

Select up to 3 indicators:

Select up to 3 indicators:

Balance Sheet Decomposition

Heliad AG

Heliad AG

Free Cash Flow Analysis

Heliad AG

| EUR | |

| Free Cash Flow | EUR |

Earnings Waterfall

Heliad AG

Wall St

Price Targets

A7A Price Targets Summary

Heliad AG

According to Wall Street analysts, the average 1-year price target for A7A is 24.37 EUR with a low forecast of 24.13 EUR and a high forecast of 25.08 EUR.

Dividends

Current shareholder yield for A7A is hidden .

Shareholder yield represents the total return a company provides to its shareholders, calculated as the sum of dividend yield, buyback yield, and debt paydown yield. What is shareholder yield?

The intrinsic value of one A7A stock under the Base Case scenario is hidden EUR.

Compared to the current market price of 15.7 EUR, Heliad AG is hidden .