Ormat Technologies Inc

TASE:ORA

Ormat Technologies Inc

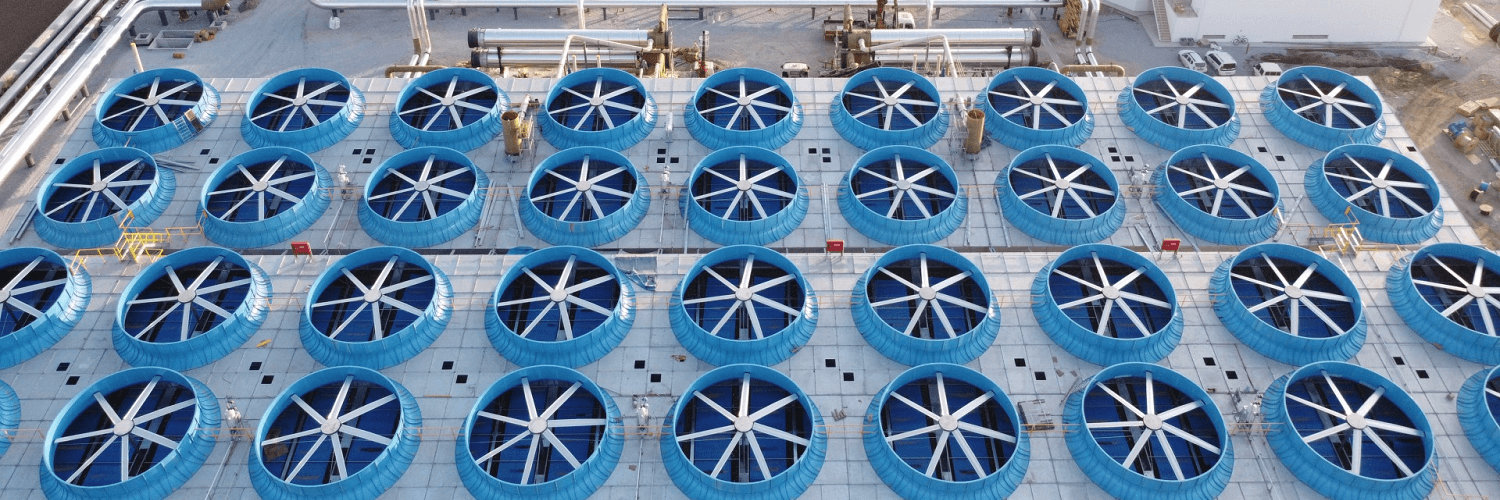

Ormat Technologies Inc. is a fascinating player in the renewable energy sector, distinguished by its focus on geothermal energy production. Headquartered in Reno, Nevada, Ormat has carved out a niche for itself by capitalizing on the Earth's natural heat to generate electricity. Unlike traditional solar or wind energy companies, Ormat taps into geothermal resources, which are considered a more reliable and constant source of renewable energy. This stability is derived from the fact that geothermal energy is largely unaffected by weather conditions, allowing Ormat to offer a steady stream of power generation. Their operational expertise spans across various geographies, including the United States, Kenya, and several other countries, underscoring the global demand for sustainable energy solutions.

Ormat’s business model is multifaceted, encompassing both the construction and operation of its geothermal power plants, in addition to providing equipment to other energy companies. This dual approach not only diversifies its revenue streams but also positions Ormat as a leader in geothermal technology solutions. The company's revenues are largely drawn from the sale of electricity under long-term power purchase agreements, ensuring predictable income over extended periods. Furthermore, Ormat designs, builds, and sells power plants and geothermal equipment, thereby expanding its footprint in the industry and reinforcing its role as a crucial conduit for renewable energy. This blend of generating and technology sales empowers Ormat to remain resilient in the dynamic energy market, safeguarding its position as a pioneer in the sustainable energy frontier.

Ormat Technologies Inc. is a fascinating player in the renewable energy sector, distinguished by its focus on geothermal energy production. Headquartered in Reno, Nevada, Ormat has carved out a niche for itself by capitalizing on the Earth's natural heat to generate electricity. Unlike traditional solar or wind energy companies, Ormat taps into geothermal resources, which are considered a more reliable and constant source of renewable energy. This stability is derived from the fact that geothermal energy is largely unaffected by weather conditions, allowing Ormat to offer a steady stream of power generation. Their operational expertise spans across various geographies, including the United States, Kenya, and several other countries, underscoring the global demand for sustainable energy solutions.

Ormat’s business model is multifaceted, encompassing both the construction and operation of its geothermal power plants, in addition to providing equipment to other energy companies. This dual approach not only diversifies its revenue streams but also positions Ormat as a leader in geothermal technology solutions. The company's revenues are largely drawn from the sale of electricity under long-term power purchase agreements, ensuring predictable income over extended periods. Furthermore, Ormat designs, builds, and sells power plants and geothermal equipment, thereby expanding its footprint in the industry and reinforcing its role as a crucial conduit for renewable energy. This blend of generating and technology sales empowers Ormat to remain resilient in the dynamic energy market, safeguarding its position as a pioneer in the sustainable energy frontier.

Revenue Growth: Ormat reported a 17.9% year-over-year revenue increase in Q3 2025, driven by strong gains in both the Energy Storage and Product segments.

Margin Pressures: Consolidated gross margin declined to 25.6% from 27.8% last year, hit by lower Electricity segment performance, although Storage and Product margins improved.

Raised Guidance: Management increased full-year 2025 revenue and adjusted EBITDA guidance, citing strong segment performance and a robust backlog.

Strategic Partnerships: Ormat announced significant progress on Enhanced Geothermal Systems (EGS) through new partnerships with SLB and Sage, aimed at driving future growth.

Product Backlog Surge: Product segment backlog reached $295 million, up 79% year-over-year, bolstered by a large new contract.

Energy Storage Momentum: Storage segment revenues more than doubled, and guidance for the year was raised; all current storage projects have secured procurement and are progressing on track.

PPA Negotiations: Management is in final negotiations for significant Power Purchase Agreements (PPAs) with hyperscalers and expects to finalize deals soon.

CapEx & Liquidity: Ormat expects to fully fund planned capital expenditures for next year with EBITDA and tax credits, and does not anticipate a need for equity financing.