Proto Corp

TSE:4298

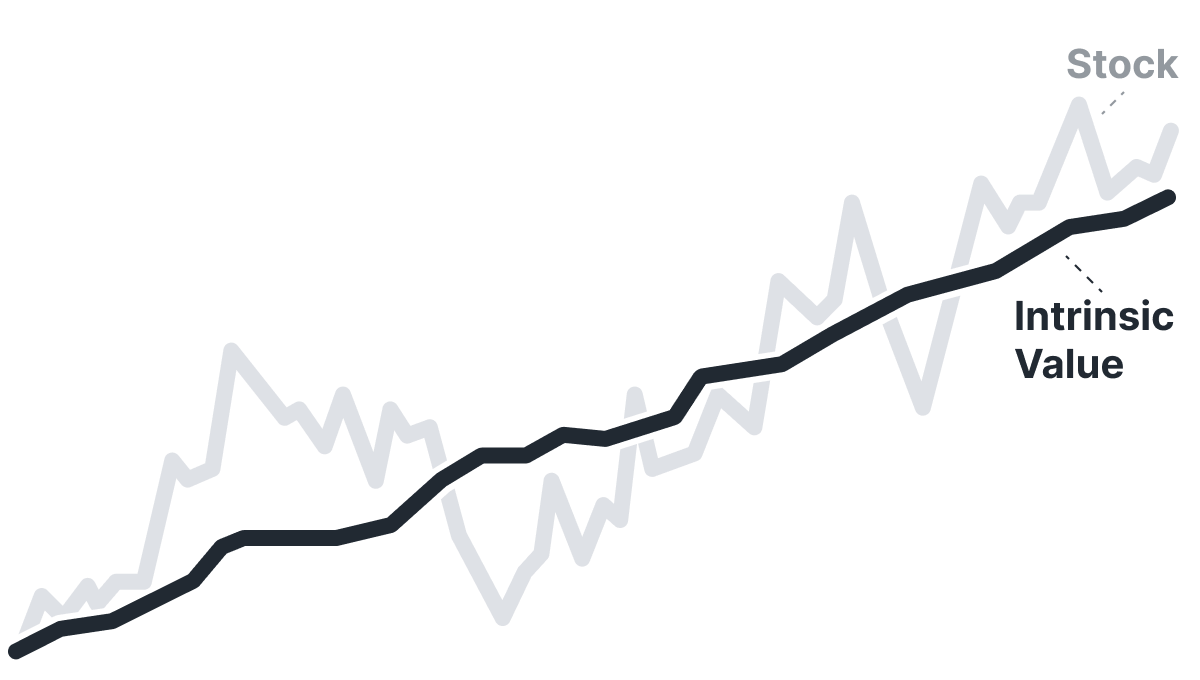

Intrinsic Value

The intrinsic value of one Proto Corp stock under the Base Case scenario is hidden JPY. Compared to the current market price of 999 999.9999 JPY, Proto Corp is hidden .

Valuation History

Proto Corp

Proto Corp looks undervalued. But is it really? Some stocks live permanently below intrinsic value; one glance at Historical Valuation reveals if Proto Corp is one of them.

Learn how current stock valuations stack up against historical averages to gauge true investment potential.

Let our AI compare Alpha Spread’s intrinsic value with external valuations from Simply Wall St, GuruFocus, ValueInvesting.io, Seeking Alpha, and others.

Let our AI break down the key assumptions behind the intrinsic value calculation for Proto Corp.

Fundamental Analysis

Revenue & Expenses Breakdown

Proto Corp

Earnings Waterfall

Proto Corp

The intrinsic value of one Proto Corp stock under the Base Case scenario is hidden JPY.

Compared to the current market price of 999 999.9999 JPY, Proto Corp is hidden .