ADY

vs

ADY

vs

GLEN

GLEN

ADY

ADY

GLEN

GLEN

Over the past 12 months, ADY has underperformed GLEN, delivering a return of +20% compared to the GLEN's +41% growth.

Paid Plans

Want to analyze multiple companies at once? Paid plans let you compare up to 5 stocks side by side.

Sign Up

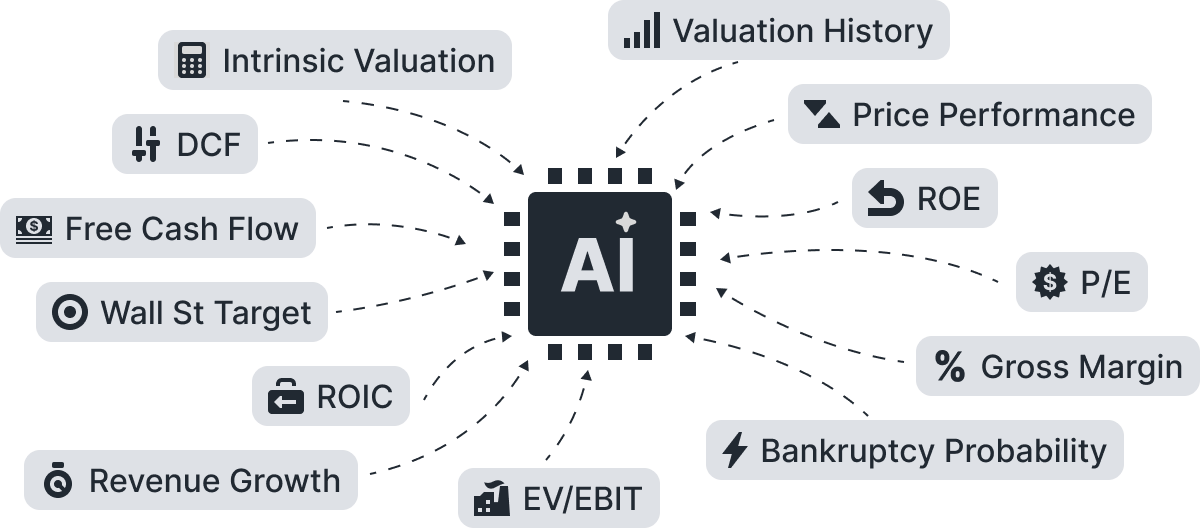

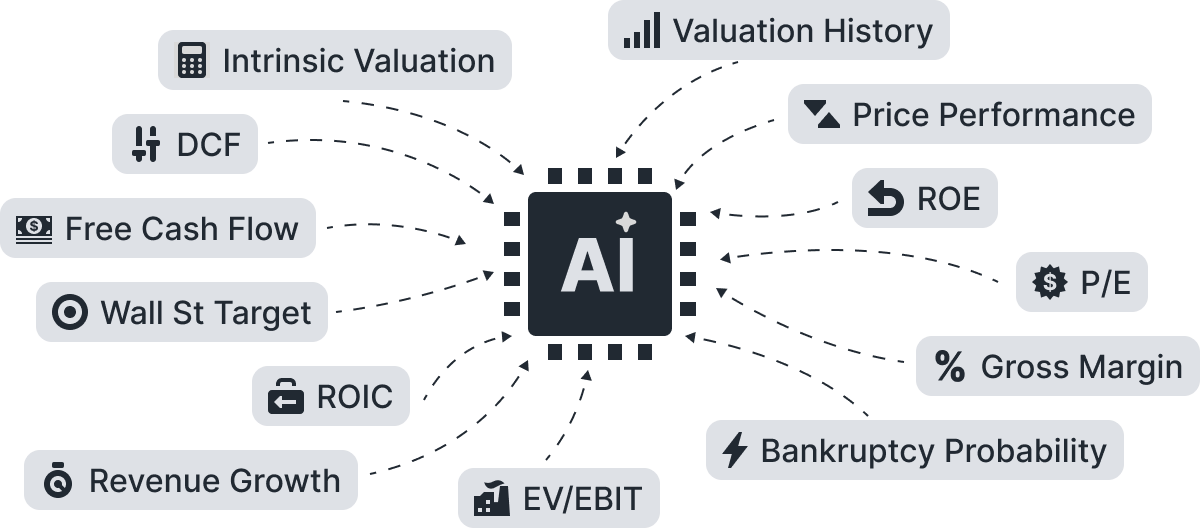

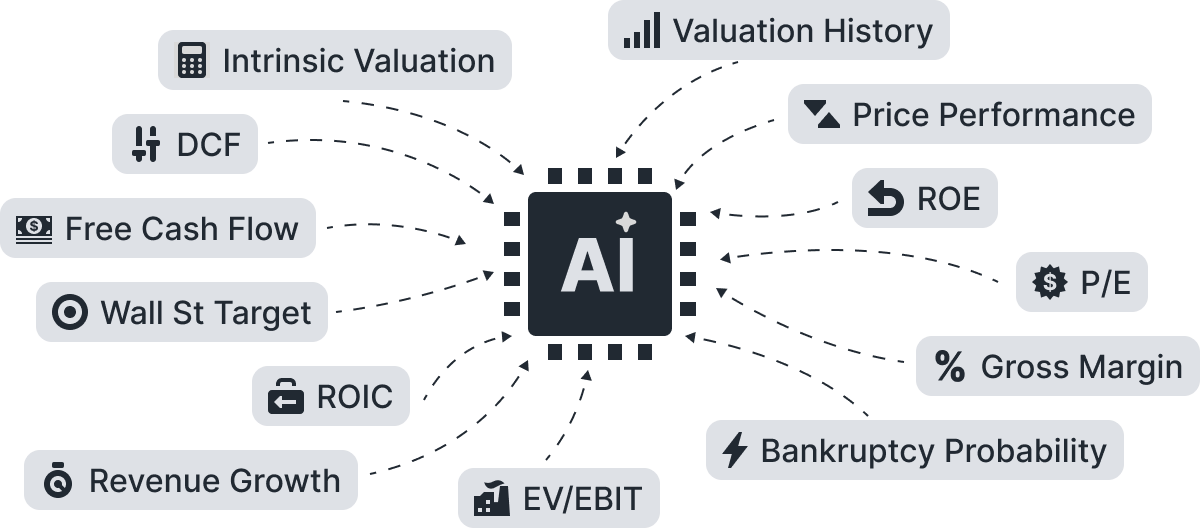

Smart Verdict

AI-Powered

Let AI Decide.

ADY

ADY

GLEN

GLEN

Valuation Comparison

| Company | Last Price | Intrinsic Value | DCF Value | Relative Value | Wall St Target | ||

|---|---|---|---|---|---|---|---|

|

Admiralty Resources NL

ASX:ADY

|

0.006

AUD

|

|||||

|

Glencore PLC

LSE:GLEN

|

492.6

GBX

|

|||||

Compare the stock's valuation with its competitors.

Growth Comparison

Growth Over Time

ADY, GLEN

Compare company's financials with its competitors.

| Company | LTM | Historical Growth | Growth Streak | % Positive Years | Max Drawdown | Volatility | Forecasted Growth | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | ||||||||

|

Admiralty Resources NL

Revenue

|

|||||||||||

|

Glencore PLC

Revenue

|

|||||||||||

All metrics are calculated based on data from the last 10 years.

Compare company's financials with its competitors.

Profitability Comparison

Free Cash Flow

ADY, GLEN

Compare company's free cash flow with its competitors.

| Company | LTM | Average | Historical Growth | FCF Margin | Conversion | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| 3 Years | 5 Years | 3 Years | 5 Years | 10 Years | ||||||

|

Admiralty Resources NL

ASX:ADY

|

|||||||||

|

Glencore PLC

LSE:GLEN

|

|||||||||

Compare company's free cash flow with its competitors.

Operating Margin

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

Admiralty Resources NL | ||||

|

Glencore PLC | ||||

Solvency Comparison

Compare company's equity waterfall with its competitors.

Stocks Performance

Stocks Performance

ADY, GLEN

Performance By Year

ADY, GLEN

Compare the stock's returns with its benchmark index and competitors. Gain insights into its relative performance over time.

| AU |

|

Rio Tinto Ltd

ASX:RIO

|

|

| AU |

|

BHP Group Ltd

ASX:BHP

|

|

| UK |

|

Rio Tinto PLC

LSE:RIO

|

|

| MX |

|

Grupo Mexico SAB de CV

BMV:GMEXICOB

|

|

| CH |

|

Glencore PLC

LSE:GLEN

|

|

| CN |

|

CMOC Group Ltd

SSE:603993

|

|

| SA |

|

Saudi Arabian Mining Company SJSC

SAU:1211

|

|

| CN |

C

|

China Molybdenum Co Ltd

OTC:CMCLF

|

|

| UK |

|

Anglo American PLC

LSE:AAL

|

|

| ZA |

A

|

African Rainbow Minerals Ltd

JSE:ARI

|