AUB Group Ltd

ASX:AUB

Intrinsic Value

The intrinsic value of one

AUB

stock under the Base Case scenario is

hidden

AUD.

Compared to the current market price of 27.795 AUD,

AUB Group Ltd

is

hidden

.

AUB

stock under the Base Case scenario is

hidden

AUD.

Compared to the current market price of 27.795 AUD,

AUB Group Ltd

is

hidden

.

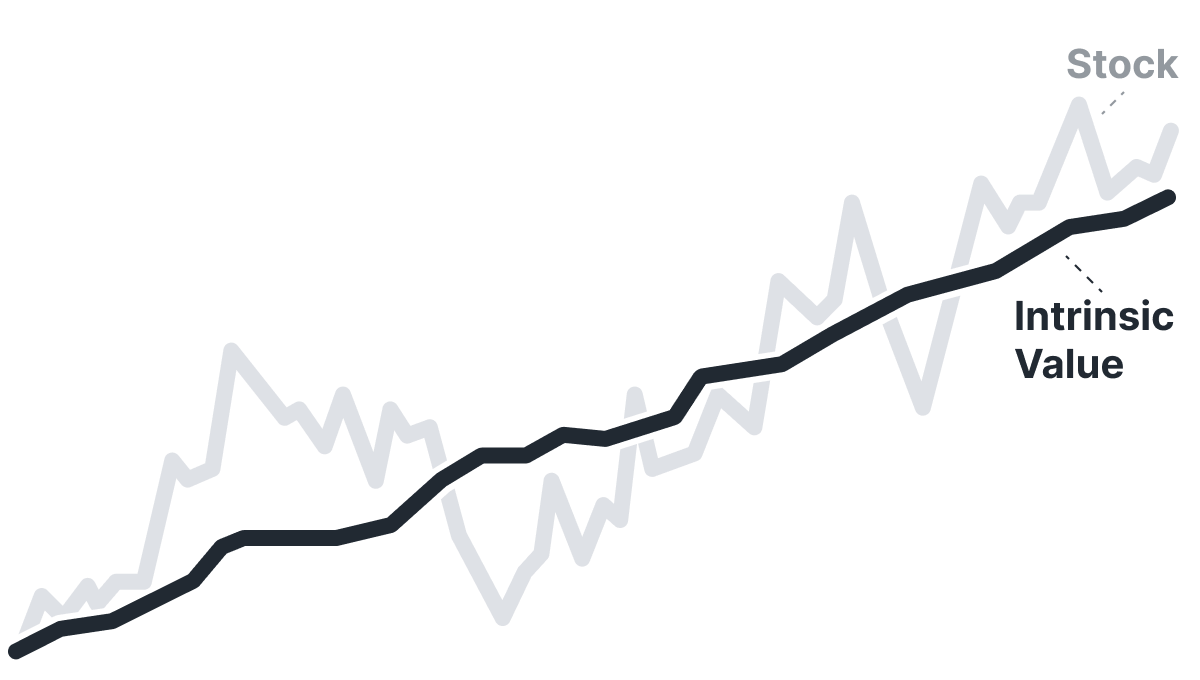

Valuation History

AUB Group Ltd

AUB looks undervalued. But is it really? Some stocks live permanently below intrinsic value; one glance at Historical Valuation reveals if AUB is one of them.

Learn how current stock valuations stack up against historical averages to gauge true investment potential.

Let our AI compare Alpha Spread’s intrinsic value with external valuations from Simply Wall St, GuruFocus, ValueInvesting.io, Seeking Alpha, and others.

Let our AI break down the key assumptions behind the intrinsic value calculation for AUB Group Ltd.

Fundamental Analysis

Intensified competition from other broker networks and direct insurers targeting mid-market clients could pressure commission rates and limit AUB’s ability to pass on premium increases, compressing margins.

AUB’s extensive broker network across Australia and New Zealand provides scale advantages and diversified revenue streams, boosting its bargaining power with insurers and enhancing client retention.

Earnings Waterfall

AUB Group Ltd

Wall St

Price Targets

AUB Price Targets Summary

AUB Group Ltd

According to Wall Street analysts, the average 1-year price target for

AUB

is 38.768 AUD

with a low forecast of 35.35 AUD and a high forecast of 47.25 AUD.

AUB

is 38.768 AUD

with a low forecast of 35.35 AUD and a high forecast of 47.25 AUD.

The intrinsic value of one

AUB

stock under the Base Case scenario is

hidden

AUD.

AUB

stock under the Base Case scenario is

hidden

AUD.

Compared to the current market price of 27.795 AUD,

AUB Group Ltd

is

hidden

.

AUB Group Ltd

is

hidden

.