Clorox Co

NYSE:CLX

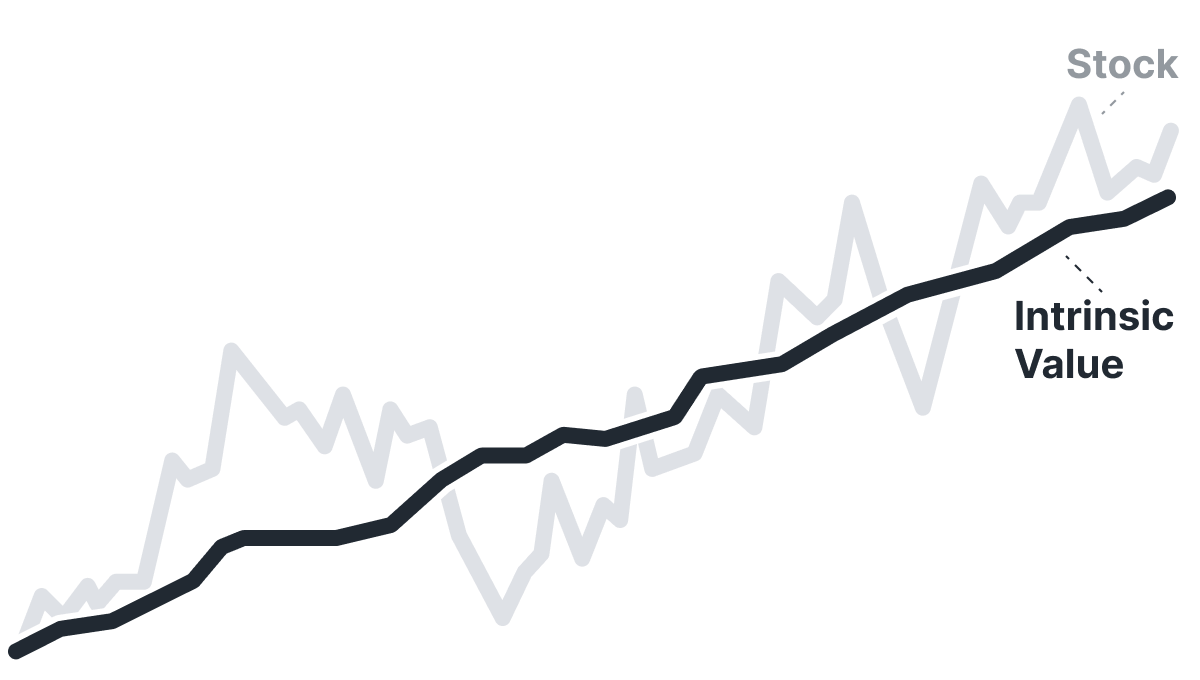

Intrinsic Value

The intrinsic value of one

CLX

stock under the Base Case scenario is

hidden

USD.

Compared to the current market price of 117.79 USD,

Clorox Co

is

hidden

.

CLX

stock under the Base Case scenario is

hidden

USD.

Compared to the current market price of 117.79 USD,

Clorox Co

is

hidden

.

Valuation History

Clorox Co

CLX looks undervalued. But is it really? Some stocks live permanently below intrinsic value; one glance at Historical Valuation reveals if CLX is one of them.

Learn how current stock valuations stack up against historical averages to gauge true investment potential.

Let our AI compare Alpha Spread’s intrinsic value with external valuations from Simply Wall St, GuruFocus, ValueInvesting.io, Seeking Alpha, and others.

Let our AI break down the key assumptions behind the intrinsic value calculation for Clorox Co.

Fundamental Analysis

As Clorox’s core products rely heavily on bleach and chemical solutions, shifting consumer preferences toward eco-friendly and natural alternatives could erode its market share and undermine brand loyalty in the long run.

Clorox’s iconic brand portfolio and leading position in cleaning and sanitation provide pricing power and consistent consumer demand, even in periods of economic downturn.

Revenue & Expenses Breakdown

Clorox Co

Earnings Waterfall

Clorox Co

Wall St

Price Targets

CLX Price Targets Summary

Clorox Co

According to Wall Street analysts, the average 1-year price target for

CLX

is 123.8 USD

with a low forecast of 94.94 USD and a high forecast of 180.63 USD.

CLX

is 123.8 USD

with a low forecast of 94.94 USD and a high forecast of 180.63 USD.

The intrinsic value of one

CLX

stock under the Base Case scenario is

hidden

USD.

CLX

stock under the Base Case scenario is

hidden

USD.

Compared to the current market price of 117.79 USD,

Clorox Co

is

hidden

.

Clorox Co

is

hidden

.