Pixium Vision SA

PAR:ALPIX

Net Margin

Net Margin shows how much profit a company keeps from each dollar of sales after all expenses, including taxes and interest. It reflects the company`s overall profitability.

Net Margin shows how much profit a company keeps from each dollar of sales after all expenses, including taxes and interest. It reflects the company`s overall profitability.

Peer Comparison

| Country | Company | Market Cap |

Net Margin |

||

|---|---|---|---|---|---|

| FR |

|

Pixium Vision SA

PAR:ALPIX

|

1.5m EUR |

Loading...

|

|

| US |

|

Abbott Laboratories

NYSE:ABT

|

192B USD |

Loading...

|

|

| US |

|

Intuitive Surgical Inc

NASDAQ:ISRG

|

174.6B USD |

Loading...

|

|

| US |

|

Stryker Corp

NYSE:SYK

|

136.5B USD |

Loading...

|

|

| IE |

|

Medtronic PLC

NYSE:MDT

|

131.8B USD |

Loading...

|

|

| US |

|

Boston Scientific Corp

NYSE:BSX

|

112.1B USD |

Loading...

|

|

| US |

|

Becton Dickinson and Co

NYSE:BDX

|

59.8B USD |

Loading...

|

|

| DE |

|

Siemens Healthineers AG

XETRA:SHL

|

46.4B EUR |

Loading...

|

|

| US |

|

IDEXX Laboratories Inc

NASDAQ:IDXX

|

51.6B USD |

Loading...

|

|

| US |

|

Edwards Lifesciences Corp

NYSE:EW

|

45.4B USD |

Loading...

|

|

| US |

|

Resmed Inc

NYSE:RMD

|

39.5B USD |

Loading...

|

Market Distribution

| Min | -147 400% |

| 30th Percentile | -2.2% |

| Median | 2.6% |

| 70th Percentile | 7.1% |

| Max | 14 243.8% |

Other Profitability Ratios

Pixium Vision SA

Glance View

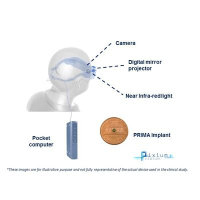

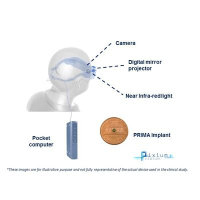

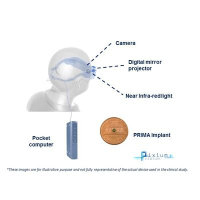

Pixium Vision SA conducts research and development on retinal implants. The company is headquartered in Paris, Ile-De-France. The company went IPO on 2014-06-19. The firm is focused on the development of implantable medical devices for the treatment of blindness caused by degeneration of photoreceptor cells in the retina. The firm develops two Vision Restoration Systems (VRS) platforms, including IRIS and PRIMA. The Company’s implant technology replaces the signal processing functions in the retina by electrically stimulating the retinal cells, enabling them to transmit the stimulation signals to the brain’s visual cortex via the optic nerve, and its other systems initially enables patients with retinitis pigmentosa to partially recover their vision. The firm has collaboration with technology and academic institutions, including the Institut de la Vision (Paris), Universite Pierre et Marie Curie (Paris), Stanford University (the United States) and University of Ulm (Germany).

See Also

Net Margin is calculated by dividing the Net Income by the Revenue.

The current Net Margin for Pixium Vision SA is -581.2%, which is in line with its 3-year median of -581.2%.

Over the last 3 years, Pixium Vision SA’s Net Margin has decreased from -414.6% to -581.2%. During this period, it reached a low of -581.5% on Jun 30, 2022 and a high of -411.7% on Dec 31, 2021.