Minebea Mitsumi Inc

TSE:6479

Minebea Mitsumi Inc

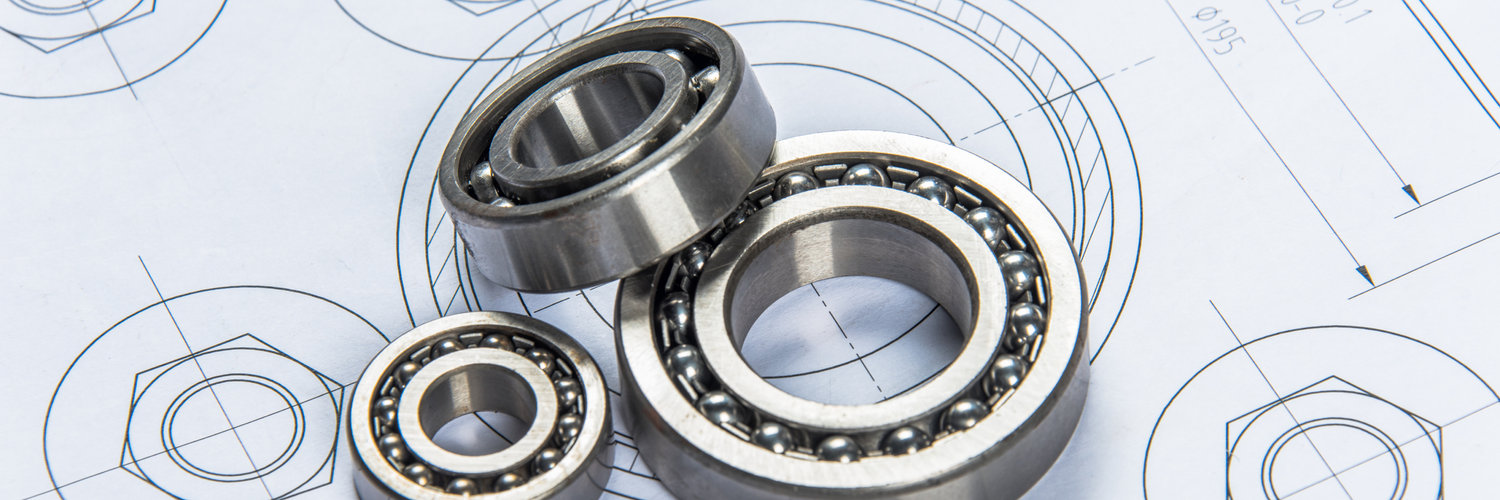

In the vast landscape of precision component manufacturing, Minebea Mitsumi Inc. stands out as a global powerhouse with a legacy rooted in innovation and relentless pursuit of quality. The company's journey began in 1951, initially as a small ball bearing manufacturer. Over the decades, it evolved into a multifaceted entity producing a wide array of precision components, including motors, electronic devices, and even cutting-edge sensor technology. This transformation was driven by its commitment to serve industries ranging from aerospace to consumer electronics, and its ability to adapt to the shifting sands of technology. Minebea Mitsumi's operations are deeply integrated, with its subsidiaries and affiliates spanning the globe, creating a symbiotic ecosystem that enhances efficiency and innovation.

Minebea Mitsumi makes money by leveraging its diverse product portfolio and deep market penetration. Its revenues are anchored in its robust production of bearings, a staple component used in countless mechanical applications. The company capitalizes on economies of scale, producing billions of units annually and fulfilling the cornerstone needs of automotive, industrial, and electronic clients worldwide. Moreover, its strategic acquisitions have strengthened its foothold in the electronics sector, enabling it to supply key components like LED backlights and antennas to leading tech manufacturers. By constantly refining its manufacturing processes and embracing technological advancements, Minebea Mitsumi ensures a steady stream of revenues and sustains its position as a critical supplier in multiple high-demand markets.

In the vast landscape of precision component manufacturing, Minebea Mitsumi Inc. stands out as a global powerhouse with a legacy rooted in innovation and relentless pursuit of quality. The company's journey began in 1951, initially as a small ball bearing manufacturer. Over the decades, it evolved into a multifaceted entity producing a wide array of precision components, including motors, electronic devices, and even cutting-edge sensor technology. This transformation was driven by its commitment to serve industries ranging from aerospace to consumer electronics, and its ability to adapt to the shifting sands of technology. Minebea Mitsumi's operations are deeply integrated, with its subsidiaries and affiliates spanning the globe, creating a symbiotic ecosystem that enhances efficiency and innovation.

Minebea Mitsumi makes money by leveraging its diverse product portfolio and deep market penetration. Its revenues are anchored in its robust production of bearings, a staple component used in countless mechanical applications. The company capitalizes on economies of scale, producing billions of units annually and fulfilling the cornerstone needs of automotive, industrial, and electronic clients worldwide. Moreover, its strategic acquisitions have strengthened its foothold in the electronics sector, enabling it to supply key components like LED backlights and antennas to leading tech manufacturers. By constantly refining its manufacturing processes and embracing technological advancements, Minebea Mitsumi ensures a steady stream of revenues and sustains its position as a critical supplier in multiple high-demand markets.

Strong Q3 Results: Net sales and operating income both exceeded internal plans, with sales up 22.8% year-on-year and 10.3% quarter-on-quarter.

Profitability Milestone: Management emphasized surpassing the JPY 100 billion operating income hurdle, driven by strong growth in Precision Technologies (PT).

Upward Guidance Revision: Full-year forecasts for both net sales and operating income were raised, reflecting continued momentum, despite factoring in JPY 4 billion in restructuring costs.

Bearing & Motor Growth: Ball bearings and fan motors, especially for data centers and automotive uses, hit record production and are expected to grow further next year.

Segment Outperformance: PT, Motor Lighting & Sensing (MLS), and Semiconductors & Electronics (SE) all outperformed expectations; Access Solutions (AS) lagged due to supply chain issues, but recovery is anticipated.

Cost Pass-Through: Management stated cost increases, such as copper, can generally be passed through to customers to protect margins.

Minimal Memory Risk: Rising memory prices and shortages are not seen as a significant risk due to focus on high-end products.