Parker-Hannifin Corp

XBER:PAR

Net Margin

Net Margin shows how much profit a company keeps from each dollar of sales after all expenses, including taxes and interest. It reflects the company`s overall profitability.

Net Margin shows how much profit a company keeps from each dollar of sales after all expenses, including taxes and interest. It reflects the company`s overall profitability.

Peer Comparison

| Country | Company | Market Cap |

Net Margin |

||

|---|---|---|---|---|---|

| US |

|

Parker-Hannifin Corp

NYSE:PH

|

123.3B USD |

Loading...

|

|

| IE |

|

Eaton Corporation PLC

NYSE:ETN

|

147.9B USD |

Loading...

|

|

| SE |

|

Atlas Copco AB

STO:ATCO A

|

912.3B SEK |

Loading...

|

|

| US |

|

Emerson Electric Co

NYSE:EMR

|

88.3B USD |

Loading...

|

|

| US |

|

Illinois Tool Works Inc

NYSE:ITW

|

85.1B USD |

Loading...

|

|

| US |

|

Rockwell Automation Inc

NYSE:ROK

|

47.1B USD |

Loading...

|

|

| US |

|

Dover Corp

NYSE:DOV

|

30.7B USD |

Loading...

|

|

| JP |

I

|

Ishii Iron Works Co Ltd

TSE:6362

|

304.2T JPY |

Loading...

|

|

| JP |

|

Freund Corp

TSE:6312

|

16.9T JPY |

Loading...

|

|

| JP |

|

Mitsubishi Heavy Industries Ltd

TSE:7011

|

16.7T JPY |

Loading...

|

|

| US |

|

Barnes Group Inc

NYSE:B

|

75.9B USD |

Loading...

|

Market Distribution

| Min | -4 418 600% |

| 30th Percentile | -9.6% |

| Median | 3.1% |

| 70th Percentile | 11.3% |

| Max | 1 135 400% |

Other Profitability Ratios

Parker-Hannifin Corp

Glance View

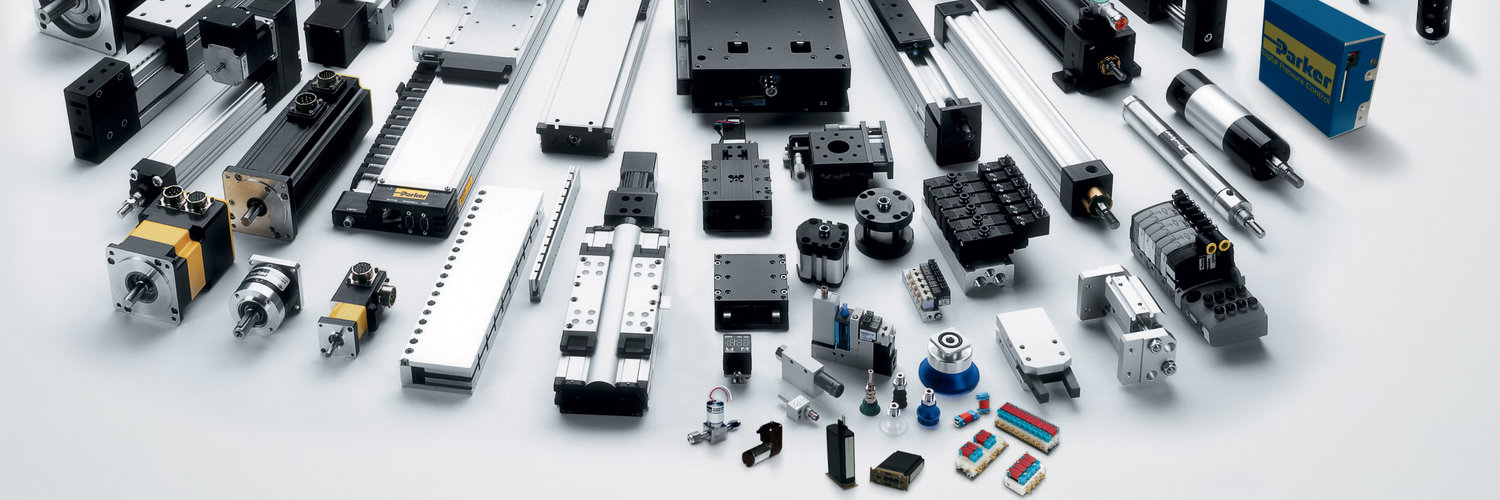

Parker-Hannifin Corp., a stalwart in the realm of motion and control technologies, has carved its niche by engineering a diverse array of products that harness the power of hydraulics, pneumatics, electromechanics, filtration, and instrumentation. Founded in the early 20th century, the company evolved from its original focus on pneumatic brake systems for buses and trucks, to becoming a key player in providing highly engineered solutions across various industrial sectors. With operations extending across aerospace, climate control, electromechanical, filtration, fluid and gas handling, hydraulics, pneumatics, process control, and sealing and shielding, Parker-Hannifin integrates its technical expertise to address complex engineering challenges. At the heart of Parker-Hannifin's financial success is its decentralized business model, which encourages innovation and agility across its numerous divisions. This structure allows the company to tailor its offerings to meet specific customer needs, generating revenue through the manufacture and sale of parts, systems, and services that power machinery, equipment, and vehicles worldwide. By prioritizing customer-focused innovation and a strategic emphasis on solving system-level challenges, Parker-Hannifin is able to cultivate long-term partnerships with its clients, thereby ensuring repeat business and stable revenue streams. Additionally, the company’s investments in research and development fuel technological advancements that provide a competitive edge within its industries. The combination of a robust global footprint and a commitment to operational excellence underscores Parker-Hannifin's enduring presence in the industrial landscape.

See Also

Net Margin is calculated by dividing the Net Income by the Revenue.

The current Net Margin for Parker-Hannifin Corp is 17.3%, which is above its 3-year median of 14.4%.

Over the last 3 years, Parker-Hannifin Corp’s Net Margin has increased from 7.3% to 17.3%. During this period, it reached a low of 7.3% on Dec 31, 2022 and a high of 18.2% on Sep 30, 2025.