Stock Screener

How it works

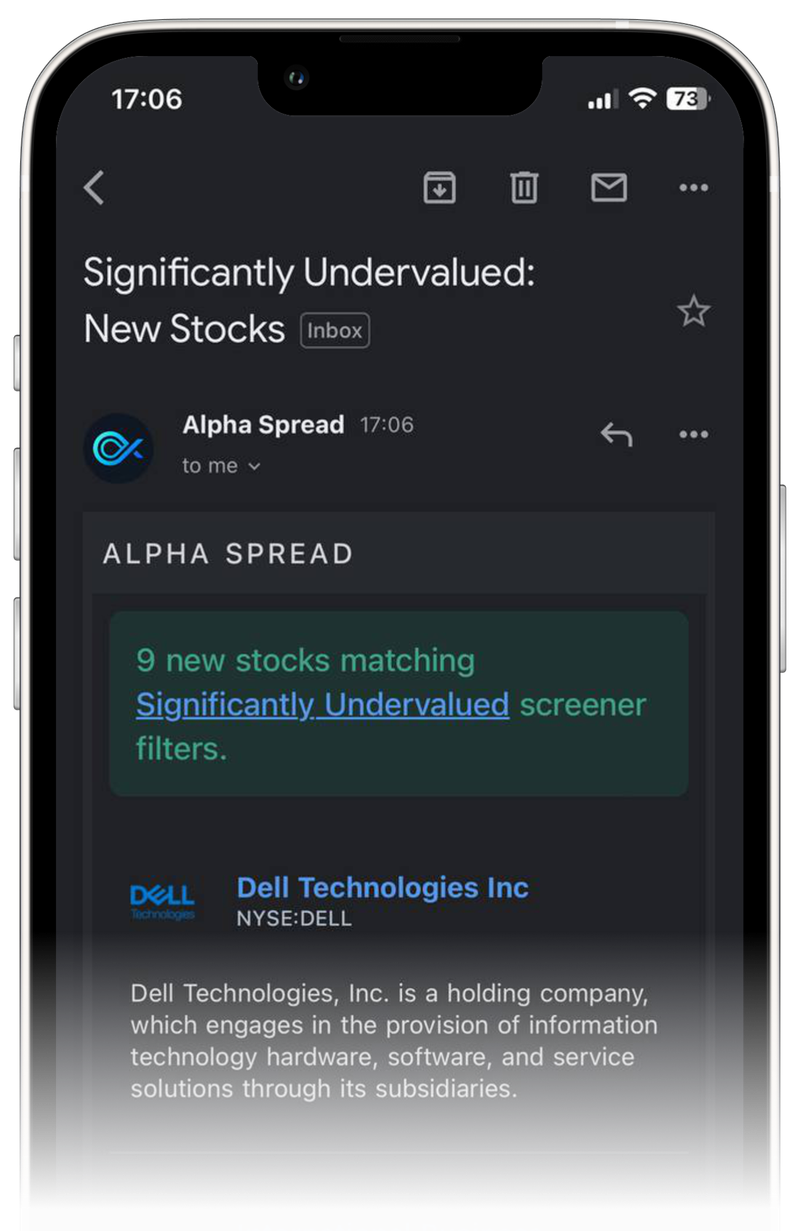

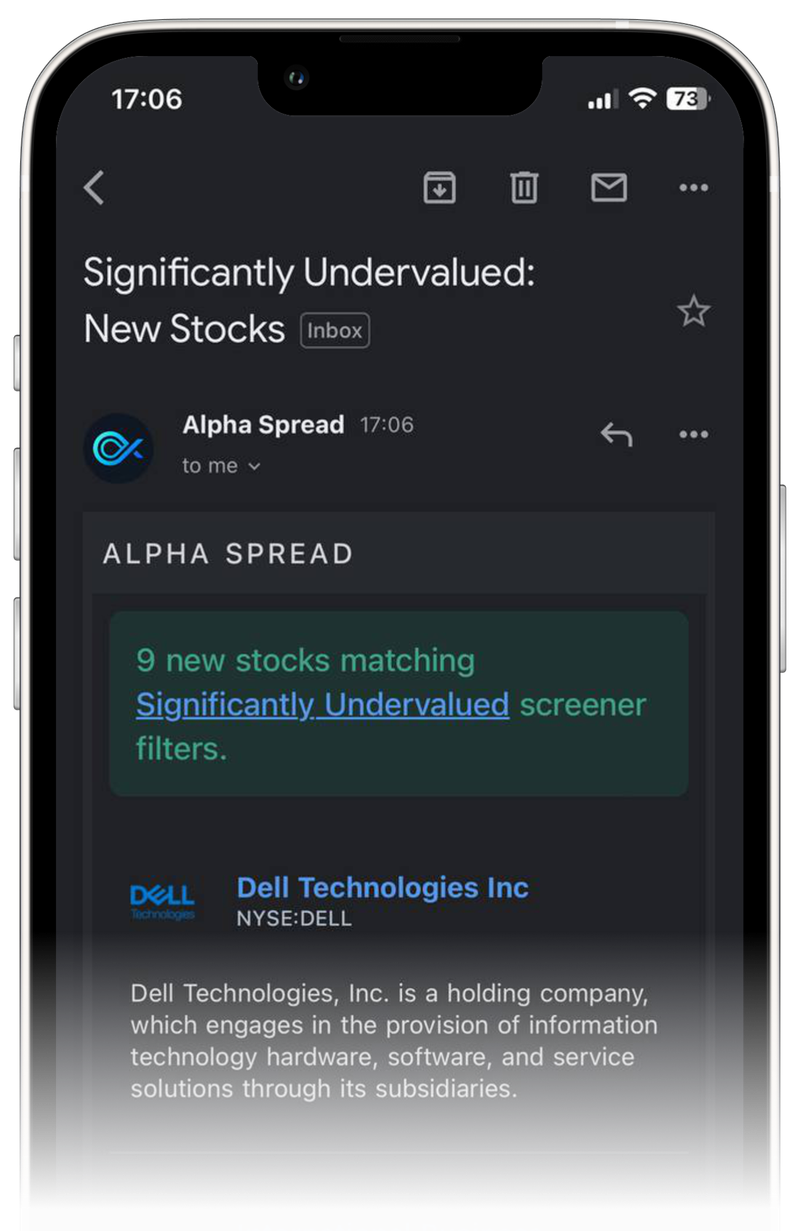

Automatic

Intrinsic Valuation

Understanding the difference between a stock’s current price and its intrinsic value could be the difference between a terrible investment and a great one.

We use proven and science-based valuation methods to automatically estimate the intrinsic value of stocks.

Quickly capture a

valuation range

A stock has no absolute intrinsic value because the future is not predetermined.

The true intrinsic value lies somewhere between the worst and best case scenarios. Gaining insight into the full range of potential stock intrinsic values provides a comprehensive understanding of the investment's risks and opportunities.

Valuation History

Learn from the Past

A great product. When a friend of mine suggests a stock, I pickup my phone and immediately go straight to the Alpha Spread to look through all of the important valuations.

Easy to use and very helpful. I favor technical analysis but Alpha Spread allows me to incorporate complex fundamental analysis into my long term strategies. I highly recommend this platform.

Simple Pricing

100% Money Back Guarantee. Try Risk Free.

Explore limited features,

discover unlimited potential.

No restrictions, no limits.

All stocks, all tools.

Enough to check your investments

from time to time.

Ready to give it a go?

Join over 317,600 successful value investors already using Alpha Spread.