Readytech Holdings Ltd

ASX:RDY

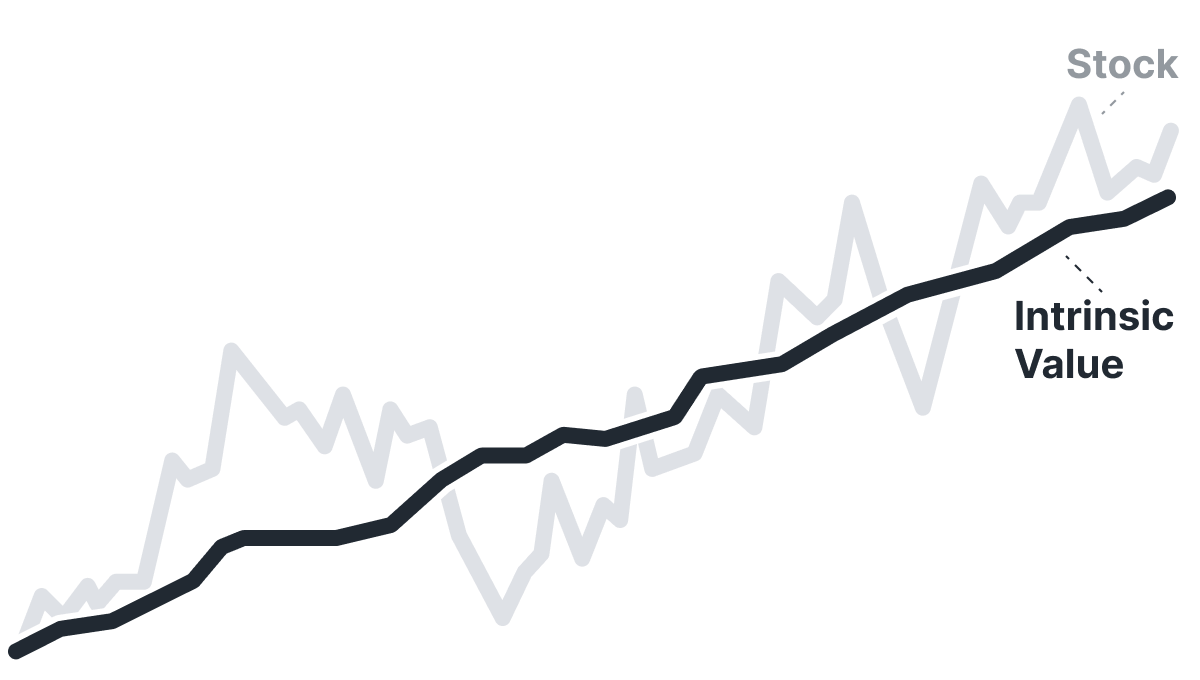

Intrinsic Value

The intrinsic value of one

RDY

stock under the Base Case scenario is

hidden

AUD.

Compared to the current market price of 2.12 AUD,

Readytech Holdings Ltd

is

hidden

.

RDY

stock under the Base Case scenario is

hidden

AUD.

Compared to the current market price of 2.12 AUD,

Readytech Holdings Ltd

is

hidden

.

Valuation History

Readytech Holdings Ltd

RDY looks undervalued. But is it really? Some stocks live permanently below intrinsic value; one glance at Historical Valuation reveals if RDY is one of them.

Learn how current stock valuations stack up against historical averages to gauge true investment potential.

Let our AI compare Alpha Spread’s intrinsic value with external valuations from Simply Wall St, GuruFocus, ValueInvesting.io, Seeking Alpha, and others.

Let our AI break down the key assumptions behind the intrinsic value calculation for Readytech Holdings Ltd.

Fundamental Analysis

Readytech’s reliance on the highly competitive Australian education and workforce solutions market could limit its ability to generate significant organic growth if it cannot effectively differentiate from larger, more established rivals, such as TechnologyOne, in key software segments.

Readytech’s strong presence in the Australian vocational and higher-education space provides a stable recurring revenue base that can be leveraged for expansion into adjacent market segments and additional cross-selling opportunities.

Earnings Waterfall

Readytech Holdings Ltd

Wall St

Price Targets

RDY Price Targets Summary

Readytech Holdings Ltd

According to Wall Street analysts, the average 1-year price target for

RDY

is 3.11 AUD

with a low forecast of 2.63 AUD and a high forecast of 4.41 AUD.

RDY

is 3.11 AUD

with a low forecast of 2.63 AUD and a high forecast of 4.41 AUD.

The intrinsic value of one

RDY

stock under the Base Case scenario is

hidden

AUD.

RDY

stock under the Base Case scenario is

hidden

AUD.

Compared to the current market price of 2.12 AUD,

Readytech Holdings Ltd

is

hidden

.

Readytech Holdings Ltd

is

hidden

.