Celestica Inc

TSX:CLS

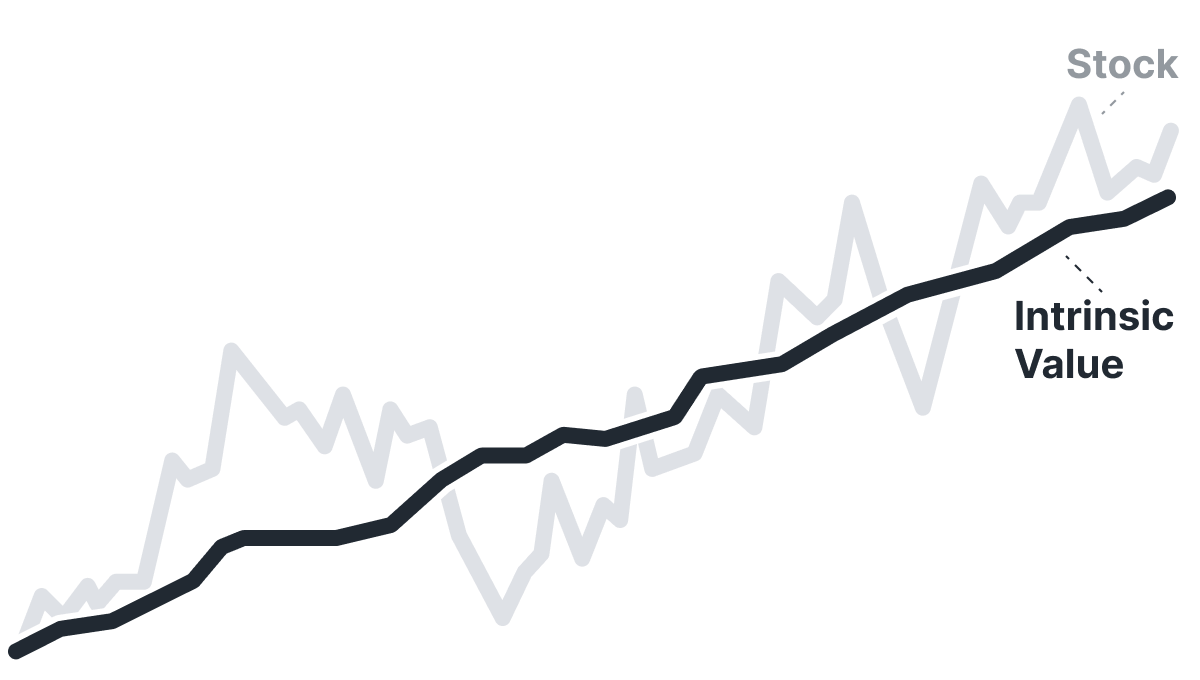

Intrinsic Value

The intrinsic value of one

CLS

stock under the Base Case scenario is

hidden

CAD.

Compared to the current market price of 400.86 CAD,

Celestica Inc

is

hidden

.

CLS

stock under the Base Case scenario is

hidden

CAD.

Compared to the current market price of 400.86 CAD,

Celestica Inc

is

hidden

.

Valuation History

Celestica Inc

CLS looks overvalued. Yet it might still be cheap by its own standards. Some stocks live permanently above intrinsic value; Historical Valuation reveals whether CLS usually does or if today's premium is unusual.

Learn how current stock valuations stack up against historical averages to gauge true investment potential.

Let our AI compare Alpha Spread’s intrinsic value with external valuations from Simply Wall St, GuruFocus, ValueInvesting.io, Seeking Alpha, and others.

Let our AI break down the key assumptions behind the intrinsic value calculation for Celestica Inc.

Fundamental Analysis

Celestica’s reliance on cyclical end markets, particularly aerospace and industrial, could amplify revenue volatility in an economic slowdown, exposing the company to sharper demand swings than more diversified peers.

Celestica’s focus on diversified, high-value segments like aerospace, defense, and healthcare can drive steadier revenue streams and higher margins as these markets grow and require more technically complex services.

Revenue & Expenses Breakdown

Celestica Inc

Earnings Waterfall

Celestica Inc

Wall St

Price Targets

CLS Price Targets Summary

Celestica Inc

According to Wall Street analysts, the average 1-year price target for

CLS

is 370.26 CAD

with a low forecast of 177.76 CAD and a high forecast of 451.5 CAD.

CLS

is 370.26 CAD

with a low forecast of 177.76 CAD and a high forecast of 451.5 CAD.

The intrinsic value of one

CLS

stock under the Base Case scenario is

hidden

CAD.

CLS

stock under the Base Case scenario is

hidden

CAD.

Compared to the current market price of 400.86 CAD,

Celestica Inc

is

hidden

.

Celestica Inc

is

hidden

.