O

ORG

vs

L

L

L

L

Over the past 12 months, ORG has underperformed L, delivering a return of +45% compared to the L's +56% growth.

Paid Plans

Want to analyze multiple companies at once? Paid plans let you compare up to 5 stocks side by side.

Sign Up

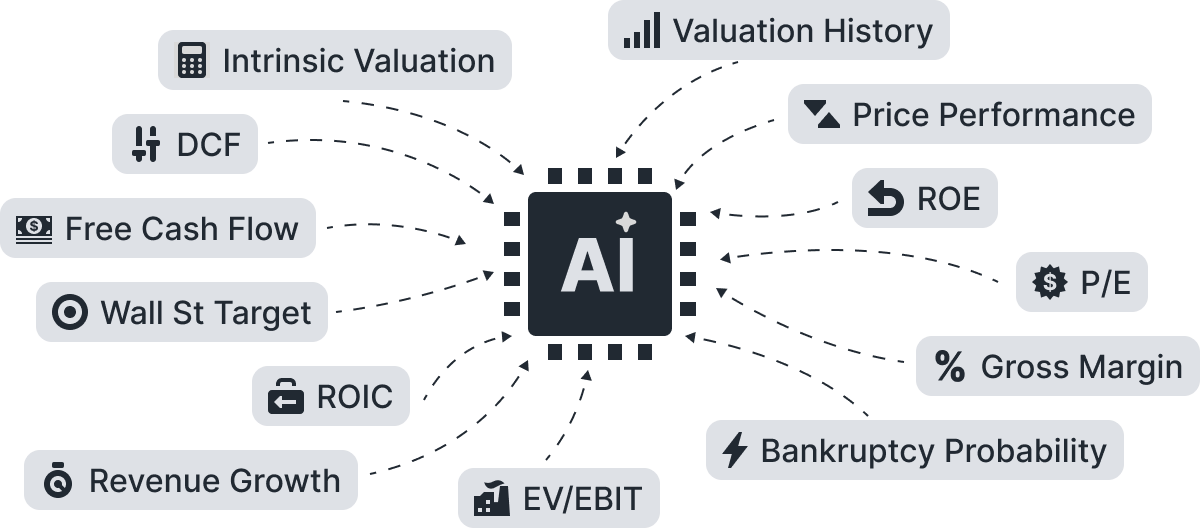

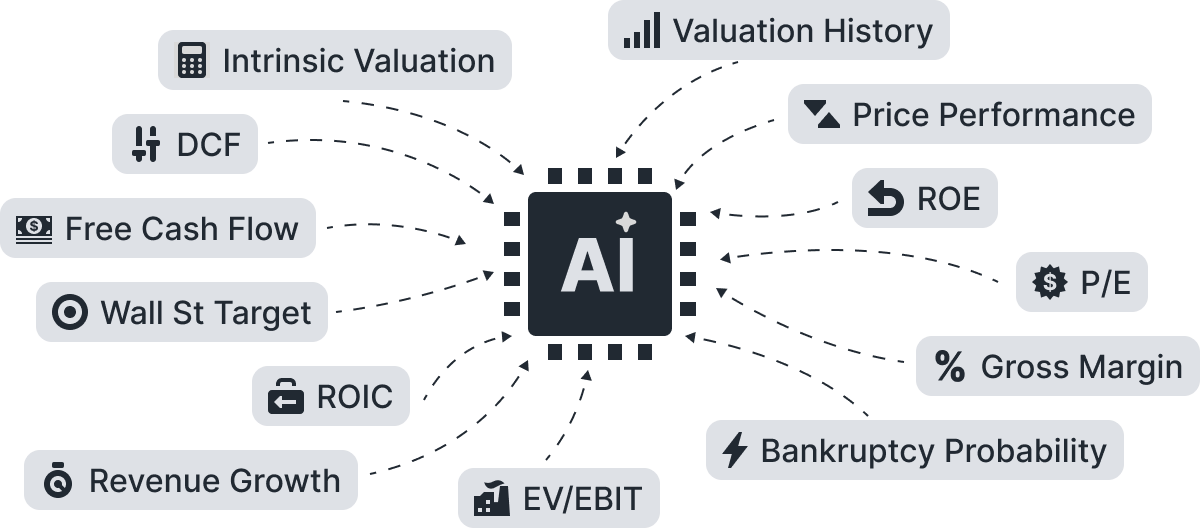

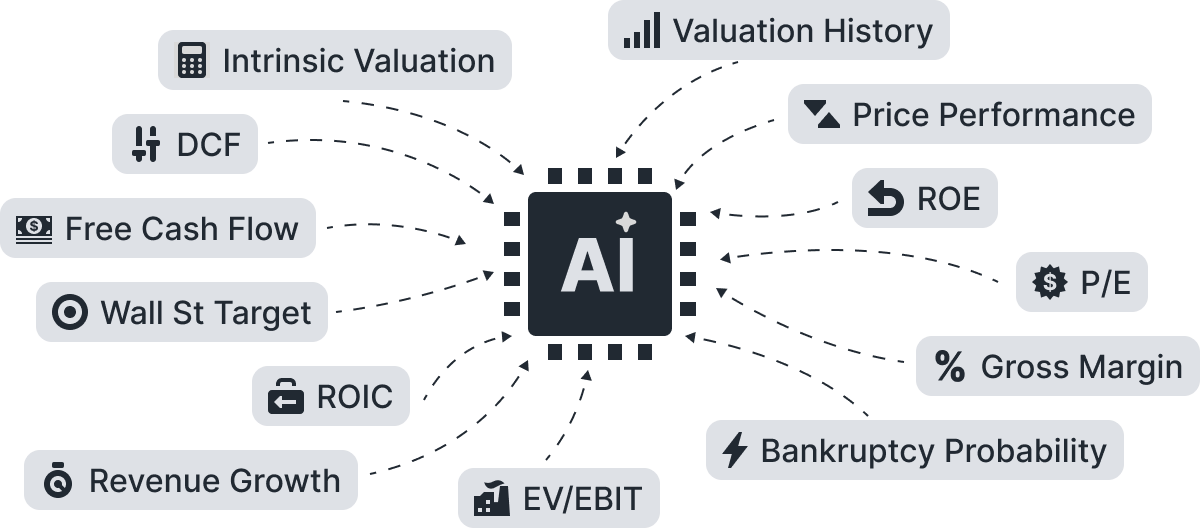

Smart Verdict

AI-Powered

Let AI Decide.

L

L

Valuation Comparison

| Company | Last Price | Intrinsic Value | DCF Value | Relative Value | Wall St Target | ||

|---|---|---|---|---|---|---|---|

|

O

|

Organic Farma Zdrowia SA

WSE:ORG

|

11.4

PLN

|

|||||

|

Loblaw Companies Ltd

TSX:L

|

68.33

CAD

|

|||||

Compare the stock's valuation with its competitors.

Growth Comparison

Growth Over Time

ORG, L

Compare company's financials with its competitors.

| Company | LTM | Historical Growth | Growth Streak | % Positive Years | Max Drawdown | Volatility | Forecasted Growth | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | ||||||||

|

O

|

Organic Farma Zdrowia SA

Revenue

|

|||||||||||

|

Loblaw Companies Ltd

Revenue

|

|||||||||||

All metrics are calculated based on data from the last 10 years.

Compare company's financials with its competitors.

Profitability Comparison

Free Cash Flow

ORG, L

Compare company's free cash flow with its competitors.

| Company | LTM | Average | Historical Growth | FCF Margin | Conversion | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| 3 Years | 5 Years | 3 Years | 5 Years | 10 Years | ||||||

|

O

|

Organic Farma Zdrowia SA

WSE:ORG

|

|||||||||

|

Loblaw Companies Ltd

TSX:L

|

|||||||||

Compare company's free cash flow with its competitors.

Gross Margin

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

O

|

Organic Farma Zdrowia SA | ||||

|

Loblaw Companies Ltd | ||||

Operating Margin

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

O

|

Organic Farma Zdrowia SA | ||||

|

Loblaw Companies Ltd | ||||

Net Margin

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

O

|

Organic Farma Zdrowia SA | ||||

|

Loblaw Companies Ltd | ||||

FCF Margin

| LTM | 3Y Avg | 5Y Avg | 10Y Avg | ||

|---|---|---|---|---|---|

|

O

|

Organic Farma Zdrowia SA | ||||

|

Loblaw Companies Ltd | ||||

Solvency Comparison

Compare company's equity waterfall with its competitors.

Stocks Performance

Stocks Performance

ORG, L

Performance By Year

ORG, L

Compare the stock's returns with its benchmark index and competitors. Gain insights into its relative performance over time.

| ZA |

S

|

Shoprite Holdings Ltd

JSE:SHP

|

|

| CA |

|

Loblaw Companies Ltd

TSX:L

|

|

| CA |

|

Alimentation Couche-Tard Inc

TSX:ATD

|

|

| US |

|

Kroger Co

NYSE:KR

|

|

| UK |

|

Tesco PLC

LSE:TSCO

|

|

| NL |

|

Koninklijke Ahold Delhaize NV

AEX:AD

|

|

| JP |

|

Seven & i Holdings Co Ltd

TSE:3382

|

|

| CA |

|

George Weston Ltd

TSX:WN

|

|

| IN |

|

Avenue Supermarts Ltd

NSE:DMART

|

|

| AU |

|

Woolworths Group Ltd

ASX:WOW

|