Ormat Technologies Inc

F:HNM

Net Margin

Net Margin shows how much profit a company keeps from each dollar of sales after all expenses, including taxes and interest. It reflects the company`s overall profitability.

Net Margin shows how much profit a company keeps from each dollar of sales after all expenses, including taxes and interest. It reflects the company`s overall profitability.

Peer Comparison

| Country | Company | Market Cap |

Net Margin |

||

|---|---|---|---|---|---|

| US |

|

Ormat Technologies Inc

NYSE:ORA

|

7.3B USD |

Loading...

|

|

| CN |

|

China Yangtze Power Co Ltd

SSE:600900

|

647.2B CNY |

Loading...

|

|

| ID |

B

|

Barito Renewables Energy PT Tbk

IDX:BREN

|

1 060.3T IDR |

Loading...

|

|

| CN |

|

Huaneng Lancang River Hydropower Inc

SSE:600025

|

164.7B CNY |

Loading...

|

|

| CN |

|

China Longyuan Power Group Corp Ltd

HKEX:916

|

149.7B HKD |

Loading...

|

|

| IN |

|

Adani Green Energy Ltd

NSE:ADANIGREEN

|

1.6T INR |

Loading...

|

|

| CN |

|

China Three Gorges Renewables Group Co Ltd

SSE:600905

|

117.5B CNY |

Loading...

|

|

| ES |

E

|

EDP Renovaveis SA

ELI:EDPR

|

13.3B EUR |

Loading...

|

|

| RO |

|

Societatea de Producere a Energiei Electrice in Hidrocentrale Hidroelectrica SA

F:E28

|

12.1B EUR |

Loading...

|

|

| CN |

|

Sichuan Chuantou Energy Co Ltd

SSE:600674

|

68.6B CNY |

Loading...

|

|

| NZ |

|

Meridian Energy Ltd

NZX:MEL

|

14.9B NZD |

Loading...

|

Market Distribution

| Min | -4 418 600% |

| 30th Percentile | -9.6% |

| Median | 3.1% |

| 70th Percentile | 11.3% |

| Max | 1 135 400% |

Other Profitability Ratios

Ormat Technologies Inc

Glance View

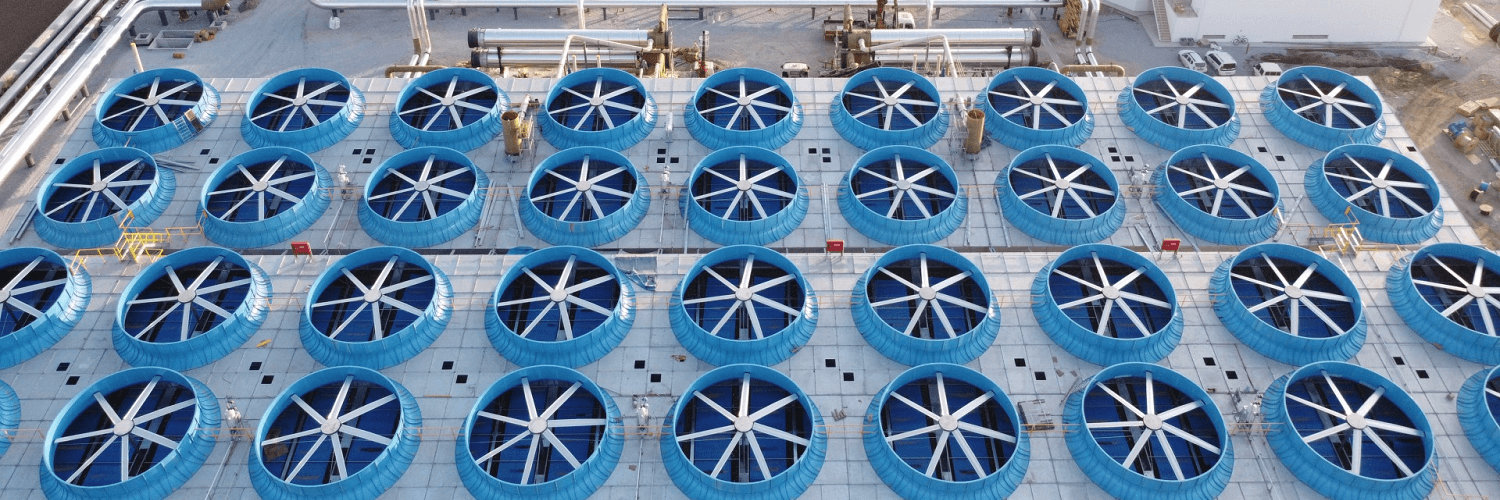

Ormat Technologies Inc. is a fascinating player in the renewable energy sector, distinguished by its focus on geothermal energy production. Headquartered in Reno, Nevada, Ormat has carved out a niche for itself by capitalizing on the Earth's natural heat to generate electricity. Unlike traditional solar or wind energy companies, Ormat taps into geothermal resources, which are considered a more reliable and constant source of renewable energy. This stability is derived from the fact that geothermal energy is largely unaffected by weather conditions, allowing Ormat to offer a steady stream of power generation. Their operational expertise spans across various geographies, including the United States, Kenya, and several other countries, underscoring the global demand for sustainable energy solutions. Ormat’s business model is multifaceted, encompassing both the construction and operation of its geothermal power plants, in addition to providing equipment to other energy companies. This dual approach not only diversifies its revenue streams but also positions Ormat as a leader in geothermal technology solutions. The company's revenues are largely drawn from the sale of electricity under long-term power purchase agreements, ensuring predictable income over extended periods. Furthermore, Ormat designs, builds, and sells power plants and geothermal equipment, thereby expanding its footprint in the industry and reinforcing its role as a crucial conduit for renewable energy. This blend of generating and technology sales empowers Ormat to remain resilient in the dynamic energy market, safeguarding its position as a pioneer in the sustainable energy frontier.

See Also

Net Margin is calculated by dividing the Net Income by the Revenue.

The current Net Margin for Ormat Technologies Inc is 14.1%, which is above its 3-year median of 13.7%.

Over the last 3 years, Ormat Technologies Inc’s Net Margin has increased from 9.3% to 14.1%. During this period, it reached a low of 9% on Dec 31, 2022 and a high of 15.4% on Mar 31, 2024.