Hengtong Optic-Electric Co Ltd

SSE:600487

Net Margin

Net Margin shows how much profit a company keeps from each dollar of sales after all expenses, including taxes and interest. It reflects the company`s overall profitability.

Net Margin shows how much profit a company keeps from each dollar of sales after all expenses, including taxes and interest. It reflects the company`s overall profitability.

Peer Comparison

| Country | Company | Market Cap |

Net Margin |

||

|---|---|---|---|---|---|

| CN |

H

|

Hengtong Optic-Electric Co Ltd

SSE:600487

|

85.7B CNY |

Loading...

|

|

| JP |

N

|

Nakayo Inc

TSE:6715

|

111.4T JPY |

Loading...

|

|

| US |

|

Cisco Systems Inc

NASDAQ:CSCO

|

333B USD |

Loading...

|

|

| US |

|

Arista Networks Inc

NYSE:ANET

|

172.1B USD |

Loading...

|

|

| CN |

|

Zhongji Innolight Co Ltd

SZSE:300308

|

613.4B CNY |

Loading...

|

|

| US |

|

Motorola Solutions Inc

NYSE:MSI

|

69.9B USD |

Loading...

|

|

| FI |

|

Nokia Oyj

OMXH:NOKIA

|

32.7B EUR |

Loading...

|

|

| SE |

|

Telefonaktiebolaget LM Ericsson

STO:ERIC B

|

335.2B SEK |

Loading...

|

|

| US |

|

Lumentum Holdings Inc

NASDAQ:LITE

|

39.3B USD |

Loading...

|

|

| US |

|

Ciena Corp

NYSE:CIEN

|

37.2B USD |

Loading...

|

|

| US |

|

Ubiquiti Inc

NYSE:UI

|

37.6B USD |

Loading...

|

Market Distribution

| Min | -416 945.9% |

| 30th Percentile | -1.5% |

| Median | 3.5% |

| 70th Percentile | 8.9% |

| Max | 17 382.1% |

Other Profitability Ratios

Hengtong Optic-Electric Co Ltd

Glance View

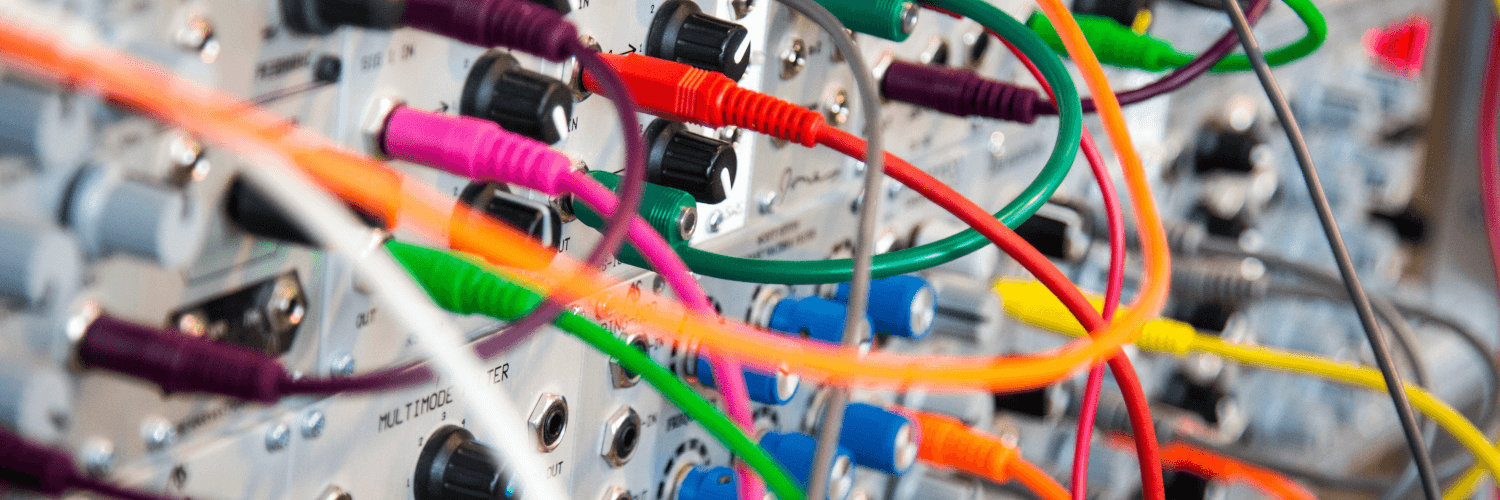

Hengtong Optic-Electric Co., Ltd. weaves its narrative through the intricate corridors of fiber optic technology, carving a path as one of the leading global players in the optical communication industry. Founded in China, Hengtong Optic-Electric has embodied the rapid technological advancements that define the modern era. The company specializes in the research, development, and production of advanced optical fiber and cable products, along with integrated solutions, serving as the connective tissue in the ever-evolving digital landscape. With the rise of data consumption and the insatiable demand for high-speed internet, Hengtong efficiently drives its business model by providing the essential infrastructure that supports telecommunication networks and data centers worldwide. The heart of Hengtong's economic engine lies in its vast product offerings, which include optical fiber preforms, cables, and submarine optical transmission solutions. Its business extends through a vast global footprint, powered by a robust network of subsidiaries and strategic partnerships that bolster its market penetration. By delivering customized, high-quality products, Hengtong serves a diverse clientele ranging from telecommunications giants to smaller-scale service providers. The synergy between its technological innovation and strategic investment in research and development continuously propels Hengtong's competitive edge, allowing it to ride the waves of digital transformation while securing its role in shaping the future of global communications.

See Also

Net Margin is calculated by dividing the Net Income by the Revenue.

The current Net Margin for Hengtong Optic-Electric Co Ltd is 4.2%, which is below its 3-year median of 4.4%.

Over the last 3 years, Hengtong Optic-Electric Co Ltd’s Net Margin has increased from 3.3% to 4.2%. During this period, it reached a low of 3.3% on Aug 30, 2022 and a high of 4.9% on Jun 30, 2024.