Alibaba Group Holding Ltd

NYSE:BABA

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

Abbvie Inc

NYSE:ABBV

|

Biotechnology

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Realty Income Corp

NYSE:O

|

Real Estate

|

| US |

|

Walt Disney Co

NYSE:DIS

|

Media

|

| US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

Technology

|

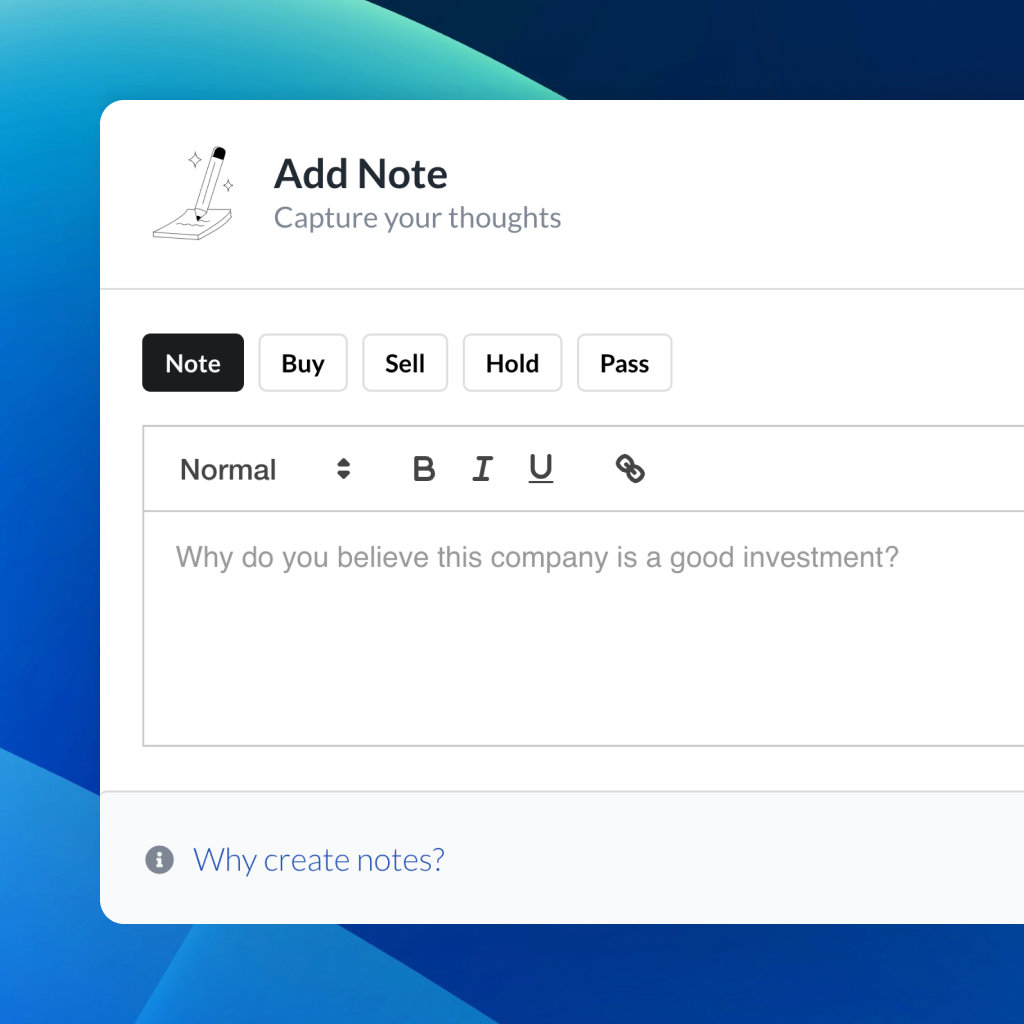

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

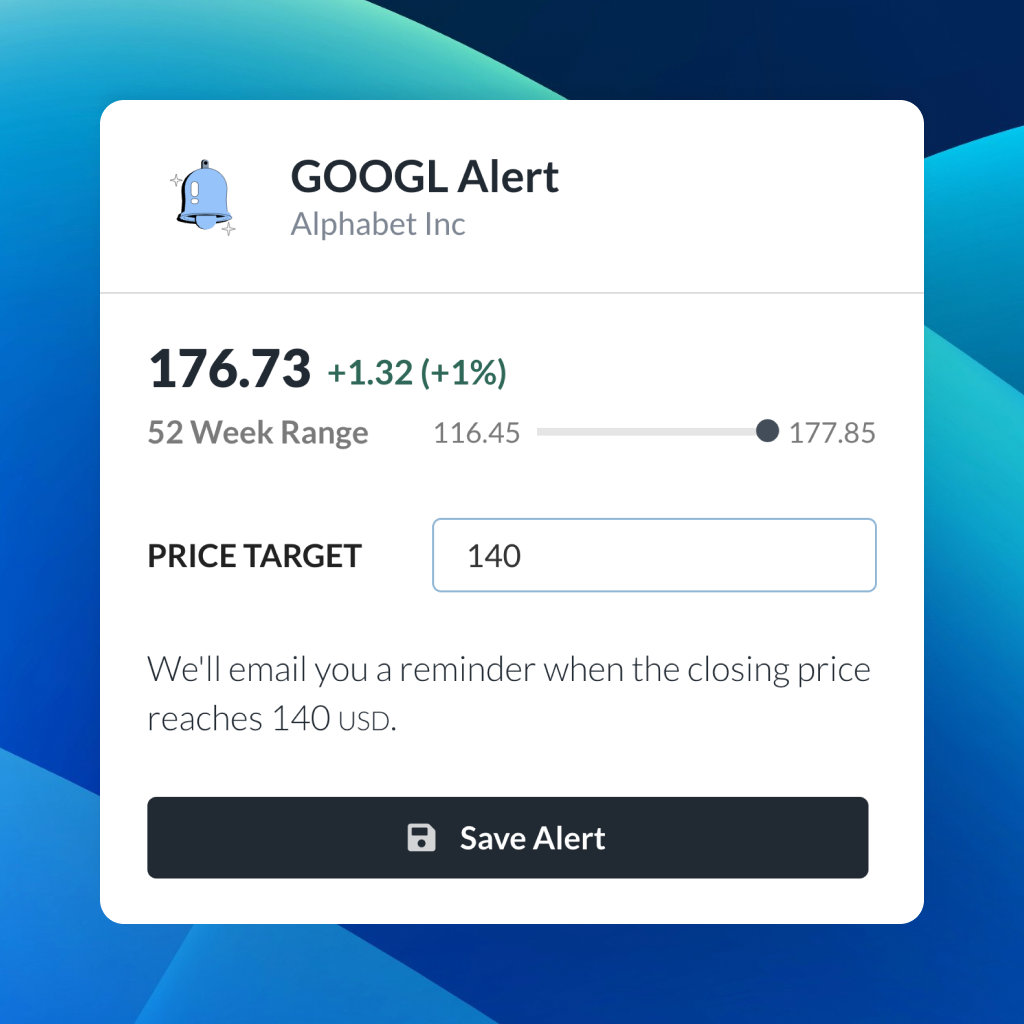

| 52 Week Range |

68.05

102.16

|

| Price Target |

|

We'll email you a reminder when the closing price reaches USD.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

Abbvie Inc

NYSE:ABBV

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Realty Income Corp

NYSE:O

|

US |

|

Walt Disney Co

NYSE:DIS

|

US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

US |

This alert will be permanently deleted.

Alibaba Group Holding Ltd

Alibaba Group Holding Ltd

You don't have any saved screeners yet

You don't have any saved screeners yet

Good day, ladies and gentlemen. Thank you for standing by. Welcome to Alibaba Group's December Quarter 2020 Results Conference Call. [Operator Instructions]

I would now like to turn the call over to Rob Lin, Head of Investor Relations of Alibaba Group. Please go ahead.

Thank you. Good day, everyone, and welcome to Alibaba Group's December Quarter 2020 Results Conference Call. With us are Daniel Zhang, Chairman and CEO; Joe Tsai, Executive Vice Chairman; Maggie Wu, CFO. This call is also being webcast on our IR section of our corporate website. A replay of the call will be available on our website later today.

Now let me quickly cover the safe harbor. Today's discussion may contain forward-looking statements. Forward-looking statements involve inherent risks and uncertainties that may cause actual results to differ materially from our current expectations. For detailed discussions of these risks and uncertainties, please refer to our latest annual report on Form 20-F and other documents filed with the U.S. SEC or announced on the website of Hong Kong Stock exchange. Any forward-looking statements that we make on this call are based on assumptions as of today, and we do not undertake any obligation to update these statements, except under applicable law.

Please note that certain financial measures that we use on this call, such as adjusted EBITDA, adjusted EBITDA margin, adjusted EBITA, adjusted EBITA margin, marketplace-based core commerce adjusted EBITA, non-GAAP net income, non-GAAP diluted earnings per share or ADS and free cash flow are expressed on a non-GAAP basis. Our GAAP results and reconciliations of GAAP to non-GAAP measures can be found in our earnings press release. Unless otherwise noted, growth rate of all stated metrics mentioned during this call refer to year-over-year growth versus the same quarter last year.

In addition, during today's call, management will give their prepared remarks in English, a third-party translator will provide simultaneous Chinese translation on another conference line. Please refer to our press release for details.

During the Q&A session, we will take questions in both English and Chinese and a third-party translator will provide consecutive translation. All translations are for convenience purpose only. In the case of any discrepancy, management's statement in the original language will prevail.

With that, I will now turn over to Daniel.

Thanks, Rob. Hello, everyone. Thank you for joining our earnings call today. Alibaba Group delivered another strong quarter. Our revenue increased 37% year-over-year to reach RMB 221 billion, while adjusted EBITDA increased 21% year-over-year to reach RMB 61.3 billion. Annual active consumers and GMV of our China retail marketplaces continue to enjoy healthy growth with Taobao Deals suppressing 100 million mobile MAUs for the first time.

We celebrated another milestone with Alibaba Cloud, which achieved its first profitable quarter with positive adjusted EBITDA. These business trends are all quite encouraging and are supported by a China economy that has recovered rapidly from the pandemic. Maggie will provide more details on our operating and financial performance in a few minutes.

I would like to address another subject that everyone is equally focused on, which is the potential impact of China's changing regulatory environment on Internet platform companies. I will share the latest updates on this topic.

This past quarter, Alibaba experienced the suspicion of Ant Group's IPO due to change in the fintech regulatory environment as well as the initiation of an antimonopoly investigation by regulators in China.

On December 24, 2020, Alibaba Group received a notice of an investigation from the State Administration for Market Regulation, or SAMR, that it has commenced an investigation pursuant to the PRC Antimonopoly Law. The investigation is ongoing, and we are fully cooperating with the SAMR. We have established a special task force with leaders from our relevant business units to conduct internal reviews. We will continue to actively communicate with the SAMR on compliance with regulatory requirements. We will further update the market when the investigation is concluded.

We approach this antimonopoly investigation with a cooperative, receptive and open mindset. As a China retail marketplace connecting hundreds of millions of consumers and millions of merchants in transactions valued in trillions of RMB, we have a deep appreciation of the significant social and public responsibilities of operating our platform. Beyond complying with regulatory requirements, we will continue to do our best to fulfill our responsibilities to society and continue to causes, such as consumer protection, digitalization of retail and industrial upgrading.

Regarding Ant Group, as you know, in early November, Ant Group announced the suspension of its proposed dual listing and initial public offering on the Shanghai Stock Exchange STAR board and the Hong Kong Stock Exchange. Due to recent significant change in the fintech regulatory environment in China, Ant Group is in the process of developing its ratification plan, which will need to go through the relevant regulatory procedures. Therefore, Ant Group's business prospects and IPO plans are subject to substantial uncertainties. Currently, we are unable to make a complete and fair assessment of the impact that these changes and uncertainties will have on Alibaba Group. We will update the market when -- once Ant Group has completed the relevant regulatory procedures for its ratification plan.

We received questions regarding whether any potential reduction in available consumer credit where Ant Group offerings, such as Huabei, would impact consumer spending on our China retail marketplaces. I want to highlight that the availability of credit is not a major reason that motivates consumers to shop on our China retail marketplaces. They are attracted by our comprehensive and high-quality product and service offerings, our competitive pricing and our ability to satisfy and stimulate consumption needs.

Payments using Huabei on our China retail marketplaces only represent a very small percentage of total credit granted under Huabei, and the vast majority of our consumers have linked their payment accounts to multiple funding sources, including credit cards. And Huabei is only one of the funding channels. Although the changing regulatory landscape applicable to fintech and Internet platform companies present near-term challenge to Alibaba, we regard this as important opportunities for reassessing and improving our business practices.

In this highly competitive market environment, we will further challenge ourselves to constantly deliver and enhance value creation for customers through innovation. In multiple areas, such as China commerce retail, local services, cloud computing and international commerce, we see challenges and fierce competition, but also tremendous potential. Looking forward, we will be even more committed to investing in these core areas, investing for innovation, for value creation and for long-term growth.

Here, I will elaborate a little bit more on our thinking in 4 core areas. First, in China retail marketplaces, we will continue our user acquisition efforts, especially in less developed areas. We will build on Taobao Deals 100 million mobile MAU base and further invest in expansion of the user base and the product supplies targeting less developed area -- markets.

In addition, in the community group purchase space, we are developing a unique model based on consumer value proposition as opposed to subsidization to ensure good consumer experience and a business sustainability.

Second, our local service flagship, Ele.me, will continue to strengthen its partnership with Alipay to expand location-based on-demand delivery services to additional categories beyond the meals, such as groceries and pharmaceuticals. On-demand deliveries of non-meal categories are growing rapidly on Ele.me, which shows significant market potential. The current regulatory trend towards more healthy competition will benefit all market participants as consumers and merchants look for diversified supply. We will leverage this opportunity to continue investing to strengthen our local service business.

Third, in cloud computing, we are pleased to have delivered our first quarter of positive adjusted EBITDA. This is the result of years of investment in pursuit of long-term value creation. Alibaba Cloud continues to grow at a rapid rate with 50% revenue growth year-over-year in December quarter, reflecting the massive potential of China's cloud computing market. We believe the market is still at an early stage as data intelligence applications and the demand for computing power will become universal across all industry sectors. We will leverage Alibaba's unique advantage in technology and data intelligence applications while continuing to invest for growth.

Finally, for globalization, Southeast Asia, which is a core market for our international commerce business, is witnessing Lazada's rapid growth in both user base and transaction volume. We have spent several years upgrading Lazada's technology infrastructure, business model and operating efficiency. We believe we are now well positioned to capitalize on the Southeast Asia market, which is experiencing accelerated growth through further investment into long-term opportunity with the goal of increasing our market share and users' mind share.

As China is fully evolving into a digital economy, Alibaba continues to be the best position in this historical transformation with our digital infrastructure in commerce, financial services, logistics and cloud computing that we have been building over the last 20 years. We continue to be confident about our 3 growth engines of domestic consumption, cutting-edge technology and globalization as these drivers are also consistent with China's policy direction in its economic development.

Thank you all. Now I would like to turn it over to Maggie, who will walk you through the details of our financial results.

Thank you, Daniel. Thank you, everyone, for joining us today. Let me start with financial highlights for the quarter. Our annual active consumer in our China retail marketplace reached 779 million, and mobile MAUs reached 902 million. So both have shown net adds of over 20 million in the quarter's time.

Our total revenue was RMB 221 billion, up 37% year-on-year. Starting from this quarter, we consolidated Sun Art, which is a newly acquired company. And if we take out the impact of Sun Art consolidation, the revenue growth will still show a strong growth of 27% year-on-year.

Okay. So this strong revenue growth, mainly coming from the strong growth of our core commerce business as well as the strong revenue growth of our cloud computing business. Our adjusted EBITDA was RMB 68 billion, up 22% year-on-year, and adjusted EBITDA was RMB 61 billion, up 21% year-on-year, primarily driven by healthy profit growth of our core commerce segment. If taking out Sun Art, the adjusted EBITDA growth would have been 21% year-over-year.

Our cloud computing business continued to deliver solid revenue growth of 50%. And we're very pleased that the adjusted EBITDA for AliCloud turned positive for the first time. We continue to maintain a strong cash position of USD 70 billion. Our non-GAAP free cash flow grew 23% year-over-year to RMB 96 billion during this quarter.

Let's look at our cost trends for the quarter. Excluding SBC, total costs and expenses as a percentage of revenue increased by 3 percentage points, mostly due to our investment in strategic important areas, which I'll talk about in detail later.

Now let's look at our long-term investment approach and how it drives behind our multi-engine growth driver. So this multi-engine growth driver actually is very unique for Alibaba if you compare to our peer companies. We're the only one has so many -- all the building blocks for the core commerce, including all of these infrastructures. So our ecosystem has developed many growth businesses because of our focus on innovation and our steadfast approach of investing in our businesses for long term. Over the years, our businesses have become more diversified and more integrated as we provide more value-added service to merchants and businesses.

The value we add is reflected not only in our original Taobao and Tmall business, but also in new retail, Cainiao, international commerce, local consumer service and cloud computing. We categorized these businesses into 3 development phases of seed, traction and profitability as highlighted during the Investor Day back in September last year.

So for instance, businesses such as Alibaba Cloud has graduated to profitability stage after over 10 years of investment. Several developing business within core commerce, such as Cainiao, have graduated into traction stage as they expand their addressable markets and gain scale of economy.

So business in the profitability stage has never stopped innovating either. Within the core commerce, we further invested in local service, new retail, logistics and globalization. Even within our core, core, which is the most profitable China retail marketplaces, we have also incubated and stepped up investments in new seed businesses such as Taobao Deals, Taobao Live, Taoxianda, Taobao Short Video and Taobao Grocery. These businesses address new consumption demand and behaviors and will continue to expand our addressable markets in China.

Let's look at our core commerce segment. The core commerce revenue grew 38% year-on-year to RMB 196 billion. Within the core commerce revenue, CMR grew 20% year-on-year to RMB 102 billion.

Customer management revenue growth is driven by the solid growth of our China retail marketplace. Tmall online physical goods paid GMV grew 19%, mainly driven by rapid growth of FMCG and home furnishing category as well as accelerated growth of consumer electronic categories. Taobao online physical goods paid GMV was also strong, which was driven by growth of apparel and accessories, home furnishing and consumer electronic categories. The success of the China retail marketplace is an increasing number of value-added services we provide to merchants, attracted increasing number of paying merchants and a higher average spending per merchant.

CMR grew 20%. This is primarily due to the robust growth in revenue from new monetization formats such as recommendation fees, an increase in the average unit price per click in search monetization as well as the fast growth of the Tmall online physical goods GMV.

China retail other revenue grew 100% year-on-year due to impact of Sun Art consolidation, strong growth of Tmall Supermarket. Taking out the impact from the consolidation Sun Art, China retail others revenue still growing over 40%.

Cainiao logistics revenue grew 51% year-on-year, primarily driven by increase in volume of orders fulfilled from our fast-growing cross-border and international commerce retail businesses. International commerce retail grew 37%, primarily driven by robust growth of Lazada trend deal as well as GMV recovery of AliExpress. Lazada recorded another quarter of triple-digit order growth by ongoing market consolidation in Southeast China region.

Local consumer service revenue grew 10% due to an increase in GMV as well as more efficient use of subsidies. Core commerce adjusted EBITDA reached RMB 66 billion, growing at 15% year-on-year. Our original business in China retail marketplaces, including Taobao, Tmall, Alimama, this business continued to maintain strong adjusted EBITDA growth and stable margins during the quarter. And these trends were partially offset by increased investments in certain new businesses, such as Taobao Deal, Live and Taobao Groceries. Investments in these new seeds business will continue to enhance consumer experience and engagement as well as helping increase -- increasing Alibaba ecosystems penetration into developing areas of China.

After development business such as local consumer service, international commerce retail, new retail and direct import, logistics continued to show solid progress and improving operating efficiencies. The combined losses of these developing businesses narrowed by RMB 1.6 billion from RMB 8.3 billion to RMB 6.7 billion. Importantly, we're also pleased that has Cainiao recorded positive operating cash flow after intercompany eliminations.

Next, Alibaba Cloud continued to empower the digital transformation of enterprises by providing comprehensive technology solution and services in the cloud for wide range of industries. In December quarter, cloud computing revenue grew 50%, and this is primarily driven by robust growth in revenue from customers in Internet, retail and public sectors. After our continuous investment for years, AliCloud achieved a positive EBITDA growth, a positive EBITDA during the quarter.

So for DME, we continue to improve the operating efficiency through disciplined investment in content and production capability. During the quarter, adjusted EBITDA loss for this segment continued to narrow, primarily due to reduced losses in Youku and increased the contribution from our online game business.

Let's take a look at revenue and adjusted EBITA growth for the first 9 months of 2021. So this is important to note that our core commerce segment has many businesses that target the same consumer base in China. As such, we take a holistic investment approach when allocating resources and capital across the segment by always reinvesting part of the incremental profit into new businesses. Despite increased investment in new businesses, our core commerce segment, excluding impact from Sun Art consolidation, achieved a robust revenue growth of 30%. This is for the year-to-date and how the -- adjusted EBITA growth of 19%. Our investments will continue to focus on increasing consumer base, improving user experience and enhancing supply chain logistic infrastructures.

Selected financial metrics summary. So let's take a look at several items. One is the interest investment income, which was RMB 40 billion, shows a big year-on-year increase. The increase is primarily due to an increase in the net gain from increases in market prices or public equity investments. And share of results of equity method investees was a loss of RMB 3.6 billion. It is a result of a impairment loss recorded, which was partially offset by a RMB 4.8 billion in profit share of Ant Group September quarter's financial results. So we record these equity pickup 1 quarter lag.

Non-GAAP net income was RMB 59 billion, an increase of 27% year-on-year.

Cash flow and CapEx. For the quarter, free cash flow was RMB 96 billion, which increased 23%, mainly due to our robust profitability growth. And as of December 31, 2020, cash, cash equivalents and short-term investments were RMB 456 billion, approximately USD 70 billion.

On December 28, our Board of Directors has authorized to upsize our share repurchase program from USD 6 billion to USD 10 billion. We have commenced a share repurchase program during the quarter and repurchased around USD 118 million of ADS in this quarter.

Let's take a look at -- have this outlook discussion. 2020 was an unprecedented year. A year has passed since the pandemic started, and it continues to create uncertainties and disruptions to business globally. Given the Chinese government has taken effective measures to limit the spread of virus earlier, China's economy saw a quick recovery, which, in turn, supported the solid growth recovery of our business.

Looking ahead, we will continue to invest in user growth, user engagement, digital transformation of businesses and our people. In fiscal '21, we have started to increase spending in new business initiatives. In fiscal '22, we plan to step up our reinvestments of the incremental profits generated into our seed businesses and the strategic growth areas in order to create long-term value to our customers, employees and shareholders.

That concludes our prepared remarks. Let's open the floor for questions. Thank you.

Hi, everyone. For today's call, you are welcome to ask questions in Chinese or English. A third-party translator will provide consecutive interpretation for the Q&A session. And our management will address your question in the language you asked. Please note that this translation is for convenience purpose only. In the case of any discrepancy, our management statement in the original language will prevail. [Foreign Language]

So operator, please connect speaker and SI conference line now. And then please start the Q&A session when we're ready. Thank you.

[Operator Instructions] First question comes from the line of Eddie Leung of Bank of America.

My question to you has to do with your relationship with merchants. We know that online, there are an increasing number of different channels available to merchants, including your traditional competitors and also new and emerging competitors and with the popularity of many programs on the rise. At the same time, we note the increasing scrutiny of antimonopoly practices by the regulatory authorities in China.

So I'm wondering if in that context, you're seeing any changes in terms of merchant retention rates. And also from an operational perspective, is there anything you can do to improve given that merchants now have more available different channels?

Thank you. This is Daniel, and I will take that question. Indeed, it's true that today, there is an increasing diversity in terms of the variety of Internet user products available, and all of them can be utilized as an opportunity to engage in e-commerce. If you have the users, and you're able to hold on to those users and you couple that user base with online payment capabilities and third-party delivery capabilities then anybody essentially can engage in e-commerce. It's a way of taking advantage of that user traffic.

At present, the reality for most merchants, if not all, is that there are multiple different platforms out there that they can choose to work with, and that is the reality. Although we do have very few exclusive flagship store arrangements with a small number of merchants even with respect to those merchants, the fact is that their goods are also available through other channels through their own channels with distributors or other channels, and that is a fact that's for everybody to see.

Our advantage is that we are extremely focused on consumption, and we are the #1 platform when it comes to consumer mind share for consumption, and we're providing a very high-quality consumer experience. So that is why for all merchants, although they do have a choice of multiple platforms and are present on multiple platforms, we are probably, for most of them, the most important platform.

Looking at merchants, be it in terms of retention rates, in terms of activity or their focus on the platform, we see no decline. And to the contrary, we tend to see increases, and that is because e-commerce is becoming a more and more important retail format for merchants, in general.

Alibaba provides a wide range of services, including sophisticated management tools for merchants to manage their online business as well as their online and offline combined businesses that contribute to enhanced overall efficiency for merchant operations. So this is fundamentally different from a one-off campaign-driven approach that you would see, for example, with live streaming or short-form videos that drives a single campaign. We are focused, in contrast to that, on providing that whole suite of tools and services to drive overall merchant performance, helping them increase their sales and maintain healthy profitability. And that is the reason why we are the premium platform that merchants choose to work with.

Our next question is from the line of Gregory Zhao of Barclays.

Just a very quick question as to whether you could give us any guidance on capital expenditure trends in the next few years. We know that there are a number of important new technologies where you're making progress coming out of DAMO Academy with the cloud. We can expect perhaps to see expenditures in infrastructure, cloud infrastructure, R&D as well as in computing power. If you could just please give us some guidance on where you see capital expenditure heading in the next few years.

Thank you for your question. Well, on the issue of CapEx, if you look back to the presentation, I just delivered, you'll see that we gave the figure there for the December quarter. For the quarter as a whole, it was RMB 5.8 billion. And included within that figure was RMB 4.9 billion for operating CapEx, so that covers IT.

So in absolute terms, that is a relatively small figure. And indeed, as a proportion of our revenues, it would still be a single-digit percentage, in the mid-single digits. Comparing that against our international peers, it's not very high. Going forward, our plans for the future will be to strengthen, increase our investment in technology, in R&D and in the DAMO Academy. And so we hope to see, going forward, CapEx increasing, both as an absolute value as well as a percentage of revenue.

Next question is from the line of Alex Yao of JPMorgan.

My question has to do with Daniel's opening statement in which he talked about the evolving policy environment and Alibaba's commitment to take on more social responsibility. So specifically, my question is taking on more social responsibility, how will that translate in operational terms into changes on the operations side and if you could perhaps help us think through a bit how those kinds of operational changes may have an impact on the company's financials?

Thank you for your question, and I do think that is a very good question. As a platform economy, Alibaba has always taken very seriously its social responsibility and has made this very much part of the mainstream of our efforts to develop as a platform. And in years past, we've indeed done a lot of work on this front.

Going forward, as a platform economy ever more deeper integrated with the overall economic and social development of the country, we do plan to take on yet more social responsibility. Something very important for Alibaba, in particular, is mainstreaming that responsibility and making it part and parcel of everything we do, be it helping to create jobs, to stimulate employment, helping SMEs on every front from product distribution all the way through manufacturing. On the manufacturing side, we can play a role and also helping them to export their products. There are many things that Alibaba can do. And I think the key point here is the social responsibility for Alibaba is not something separate from our operations, and our business rather is at the mainstream of everything we're doing around operations and business as a platform.

So taking on more social responsibility in the sense is conducive to driving prosperity of the platform. And more prosperity on the platform, again, enables us to take on more social responsibility, the 2 are mutually reinforcing. So we don't look at it in terms of the economic value that can be generated by social initiatives, rather we see this in terms of holistic ecosystem value. That's how we've always approached it, and we will continue to approach it in that same way.

Our next question is from the line of Alicia Yap of Citigroup.

Congrats on the solid results. My question is related to the reinvestment in strengthening your overall marketplace business. So I understand this will be for some time, and you will continue to deleverage the marketplace EBITDA. But then is there any way management could help us rank in terms of the investment stages and also the resource that we will put into accordingly, for example, Taobao Deals, Taobao Live, the Short Videos and also the Taobao Grocery. How do we evaluate some of these reinvestment has achieved the certain results and then that you will scale back? So any colors in terms of ranking the importance and also the stages of some of these seed investment currently?

Thanks. Let me answer this question. First of all, I think as we always said, we always invest for the future. And for our investment in the seed business, in new business, in core commerce, actually, we think these are new businesses, but we view these new opportunities from the entire, I mean, ecosystem point of view. So we think to enhance our leadership position in core commerce, we need a different, I mean, applications, different services to meet different -- to meet the customers demand from different perspective. So like today, as we -- as you know, that we -- our Taobao Deals enjoyed very rapid growth. And this quarter, we reported our MAU for Taobao Deals surpassed 100 million.

We are very happy to see the initial results. But we strongly believe that the investment in Taobao Deals is very important measures for us to target the customers in low-tier cities even in the rural areas and leverage our supply power from like other business in Alibaba, like 1688, so on and so forth. We have very effective supply, and value for money supply to meet the demand of the customers with low purchasing power.

And in terms of our investment in Taobao Live, it has been for a while. And today, if you look at the Taobao Live business, it's very -- it's already very sizable. And every day, we have tens of thousands of live streaming on our platform, which not only initiated by the KOL, but also done by many storefront owners. So I think we are -- we highly integrate the live streaming together with our retail platforms. And live stream become a very effective marketing tool for our storefront and also create new business opportunities for KOL. So in this regard, we will continue to invest in the live streaming. But we don't -- once again, we don't view live streaming as a separate business. Instead, actually, live streaming is a very important new retail format in the commerce platform. So I will stop here for translation first.

[Foreign Language]

Well, in terms of Taobao groceries, as I said in my script, we are developing a very unique model based on the customer value proposition as opposed to subsidization to ensure the good user experience and the business sustainability. I think the very important thing is that we try to build a -- our own model as opposed to what you see in the market, just burn money for -- certify the customers for scale. I don't think this is a sustainable model. Instead, we have such a tremendous user base already in Taobao. And so that's why we position -- we -- in Taobao mobile app, we have our Taobao Grocery as a major customer interface for this new business. And so far, we -- based on our initial test, we saw very good results. And this Taobao Grocery business not only help us to have more supplies to the local customers, especially in the low-tier cities, but also help us to recruit many new customers while assistance of these, I mean, community leaders.

So we will continue to invest in this business, but we will try to leverage all the resources we have in Alibaba and in some new retail business, in our investing companies and in our multiple supply channels. So from a financial perspective, I think we don't manage our core commerce business by EBITDA. We think the growth of the user base and growth of the consumption in multiple categories across countries is a key. So we -- our strategy is very clear, and we are very confident to invest more in this area. Thank you.

[Foreign Language]

Yes. Just to add one more point on Taobao Grocery. Today, we're still in the pilot test for Taobao Grocery in some of the cities. And so today, only a small portion of Taobao users can access the service. But over time, we will roll this service out across the country and the collaboration with multiple suppliers across Alibaba business. Thank you.

[Foreign Language]

Our next question is from the line of Thomas Chong of Jefferies.

Congratulations on the positive EBITDA for the Cloud business. May I ask about how we should think about the competitive landscape on the cloud business in the coming years as well as our strategy in the IaaS, PaaS and the SaaS side? And how we should think about the margin trend as well?

[Foreign Language]

Thank you. Yes, cloud community is a very promising business. We do believe that in the future, all the industrial sectors, they need cloud services. Today, the market also has in the market, we also see a very fierce competition. But obviously, we -- Alibaba has a very big advantage in term -- in many areas. First is that by leveraging our huge scale, e-commerce, financial services and logistics, we are able to build a very scalable cloud infrastructure, which support our own business first today, and we roll out this infra to serve third-party clients. So in this case, in terms of internal scalability, we are in a very superior position.

[Foreign Language]

The second advantage we have is the data intelligence capabilities and applications we have to serve our clients. Actually, in China, today, when you talk with many clients who want to use cloud, actually, their purpose is not about only moving to the cloud. Instead, what they want is by moving to the cloud, they are able to better usage -- to better use of their data. So the data intelligence capability and applications are the key. In this regard, we are obviously in a -- once again, in a very superior position. We have a lot of expertise -- experiences in internal data usage and data intelligence.

[Foreign Language]

Yes. And the third advantage we have is about the technology. For years, we invested in the cutting-edge technology for cloud very aggressively via our DAMO Academy, via our recruitment of the first-class engineers and the scientists. So today, we are -- in terms of some of the key product features in cloud such as database, such as storage, such as the middleware services, so on and so forth, we are -- our product and services, our quality of the product and services are very -- are better than our competitors. So I think we get very good feedback from our customers. So I think the technology is still the key.

[Foreign Language]

In summary, we invest a lot in technologies in the area of IaaS and PaaS. In terms of SaaS, we work very actively with our partners in different industries, try to create a SaaS ecosystem, cloud-based SaaS ecosystem. So this is our general strategies for cloud, and we are very confident about the future of this business. Thank you.

[Foreign Language]

Our next question is from the line of Jerry Liu of UBS.

My question has to do with the investments that you've talked about that you intend to be making in the next period to come, including around Taobao Deals, live streaming and so on and so forth. And the impact that, that will be expected to have on EBITA or EBITDA growth because if you look at EBITA or EBITDA growth over the past few years, the pace of growth has really remained quite stable. Going forward, would we expect to see that growth rate moderate as a result of those investments? Or would that possibly be offset by improvements in the profitability of other new businesses like cloud, Ele.me or Trendyol?

Thanks very much. And indeed, it's very interesting that whenever we talk about Alibaba's financial performance and future outlook, we always get questions about our profitability and our margins and whether we expect to be able to sustain them at the same levels that they have been at. And we're very grateful for that. And it's very much a function of the fact that we have created high expectations by always being able to create profit and maintain healthy margin levels. And we know that others in the same market are getting different kinds of questions, and the expectations are different.

Now of course, we are in the same market with all the other companies, and it is a valid question as to whether we would prioritize and put in first place profit growth going forward or whether, instead, we would prioritize investing in our future growth and in new businesses? And Alibaba's answer to that is very clear. It's not a question that we even need to think about. We are always investing in future growth.

If you look at where Alibaba is today in terms of profitability, looking at the last 12 months or actually the figure I can give you is from the last 9 months, the past 3 quarters, adjusted EBITA was RMB 147.8 billion. That's very strong. But that figure already includes various reinvestments of profit that we have made. So I think we're in a good place and have the ability to continue to invest.

You can also look at our profit increment, say, over the last 2-year period, if you compare the first 9 months of this year to the first 9 months of the year before last, you're talking about a fairly substantial figure of RMB 30 billion. So this is our development strategy. We continue to invest in the future. And as we see that strategy paying off and as the new businesses grow, we will expect to continue to scale up our investments.

So looking at the potential, the huge potential that exists in the market, today's situation of competition and our own progress and where we're at, as I said in my prepared remarks earlier, our approach will be to continue to invest, to scale up our investment. We will never prioritize margin that will never be #1 for us, and it never has been in the past. And when it comes to profit growth, I think we have a very strong foundation in place, in particular with Taobao, Tmall and the China retail marketplace. We're building on a very strong foundation of profitability.

Our next question is from the line of Youssef Squali of Truist Securities.

Just a very quick one. I was wondering if you could -- if you guys can discuss the impact of the reimposition of restrictive measures due to COVID-19 so far what you've seen in January and just a sustainability of the recovery short term for -- in the -- as we go into the fourth quarter.

[Foreign Language]

Thank you. For the impact of the COVID, here in China, in some cities, government take new approaches to lockdown some of the areas in the cities and encourage people to stay at the home cities instead of going back to the hometown for their Chinese New Year. So we are closely monitored the progress of these new measures. And so far, I think we haven't seen a very material change of the consumption of the business. But obviously -- because for January, it's very -- if you look at apple-to-apple to last year because last year, Chinese New Year is in late January, while this year is in the middle of February. So we have some time gap between 2 Chinese New years.

[Foreign Language]

As a result of the -- of some lockdowns in some of the cities, from the logistic perspective, we see some challenge because of this lockdown. But I think because for the last mile delivery force, because of the staying at the city policy, I was -- we expect this -- I mean, last -- the capacity will be enough for the last mile while the transportation might be a challenge because of some lockdowns. Thank you.

[Foreign Language]

Our next question is from the line of James Lee of Mizuho Securities.

Can you talk about maybe investment in some of the new innovations that you see in a marketplace like smart transportation and autonomous driving? It seems like government is making a concerted effort in terms of building up smart transportation nationally. And talk about maybe how you're participating in that build down and how are you positioned to win that market.

[Foreign Language]

For this smart transportation and autonomous driving, I think we do it from different angles. For smart transportation -- for our AliCloud business, actually, we closely worked with some partners in create the smart transportation solutions based on the cloud infrastructure. And I think this vertical solution will be widely used in many areas to create this, I mean, smart transportation capabilities.

Well, for autonomous driving, actually, our DAMO -- in our DAMO Academy, we have a dedicated team working on this for years. And so far, what we focus is about to apply this autonomous driving into the logistics area. And we've already deployed many -- I mean, autonomous cars are in school campuses, in some residential areas to the last-mile delivery and from the service station to the buyers at home or student's dormitories. So -- and so I think this will have -- today, I think this is still under early stage. But I would say autonomous driving will have the wider range of the applications. So we will closely monitor the progress, and once again, we will invest for the technologies to make sure we are in the leading position in this area. Thank you.

[Foreign Language]

Our next question is from the line of Binnie Wong of HSBC.

My question is about the new businesses you're investing in. I'm wondering if you could tell us which of those you see as having the largest addressable markets and the greatest amount of synergy because we know that in new retail and in cloud, Alibaba was the first company to get into those spaces. You've been very successful. And now you're the largest in those spaces. So looking at the new businesses, how do you see the synergy, the addressable market? Are there any cross-selling metrics that you could share with us to exemplify that kind of synergy that exists?

And then the other question, perhaps for Maggie is around the new initiatives. You told us earlier that losses are narrowing. If you could give us a little more color on which ones are narrowing and the expectations there?

Thank you. This is Daniel, and I'll take the first part of that question. Indeed, we're constantly working to incubate new businesses, including in core commerce. We've talked quite a bit about that today, but also in other areas. And our approach in terms of the incubation process is always to be patient and to make it a long-term commitment. So some of these, we're already starting to see become -- well, to gain traction and become quite successful already, including Taobao Deals and including Taobao live streaming. And in all of these cases, these are businesses that have been through a period of incubation and investment, and it's taken patients to get to where they are.

Any business that we incubate, we're constantly looking for ways to create new differentiated value, a good user experience and to drive efficiency, and we're indeed investing in some even earlier stage offerings as well, both in core commerce and in other segments seeking, in all instances, to differentiate a solution or a service to satisfy customer demand.

Part of your question was about which of the businesses are seeing losses narrow the most? And my answer to your question in a nutshell would simply be that all of the businesses that have been loss-making, we're seeing losses narrowing across the board. So with respect to Ele.me, digital, media and entertainment, New retail, Lazada, even the smaller businesses like cross-border and, of course, the larger businesses like cloud and Cainiao where losses have been relatively large in the past, as you see now, they're solidly on track towards healthy profitability.

So I guess the biggest change looking at where things are now would be with local services. So certainly, Ele.me and also Cainiao. And this is also a question that we ask ourselves on a daily basis and have had a lot of internal discussion around, i.e., in our loss-making businesses, should our primary goal be trying to further narrow the losses or should it be trying to further drive business growth? And you know our answer to that has been that we're reinvesting selectively and following a lot of study and discussion, reinvesting to grow the business. Now the next quarter will be the final one of the financial year and an appropriate time for us to look forward to and offer overall guidance for the next year. And so we expect to be doing that with you the next time we see you.

Thank you, Binnie. Sorry for the interruption before. And thank you everyone for joining us today. If you have any questions, please do reach out to our IR team, and all the materials should be available on our IR website. Thank you again.

Thank you. Ladies and gentlemen, that concludes the conference for today and thank you for participating. You may now all disconnect.