Europris ASA

OSE:EPR

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

Abbvie Inc

NYSE:ABBV

|

Biotechnology

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Realty Income Corp

NYSE:O

|

Real Estate

|

| US |

|

Walt Disney Co

NYSE:DIS

|

Media

|

| US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

Technology

|

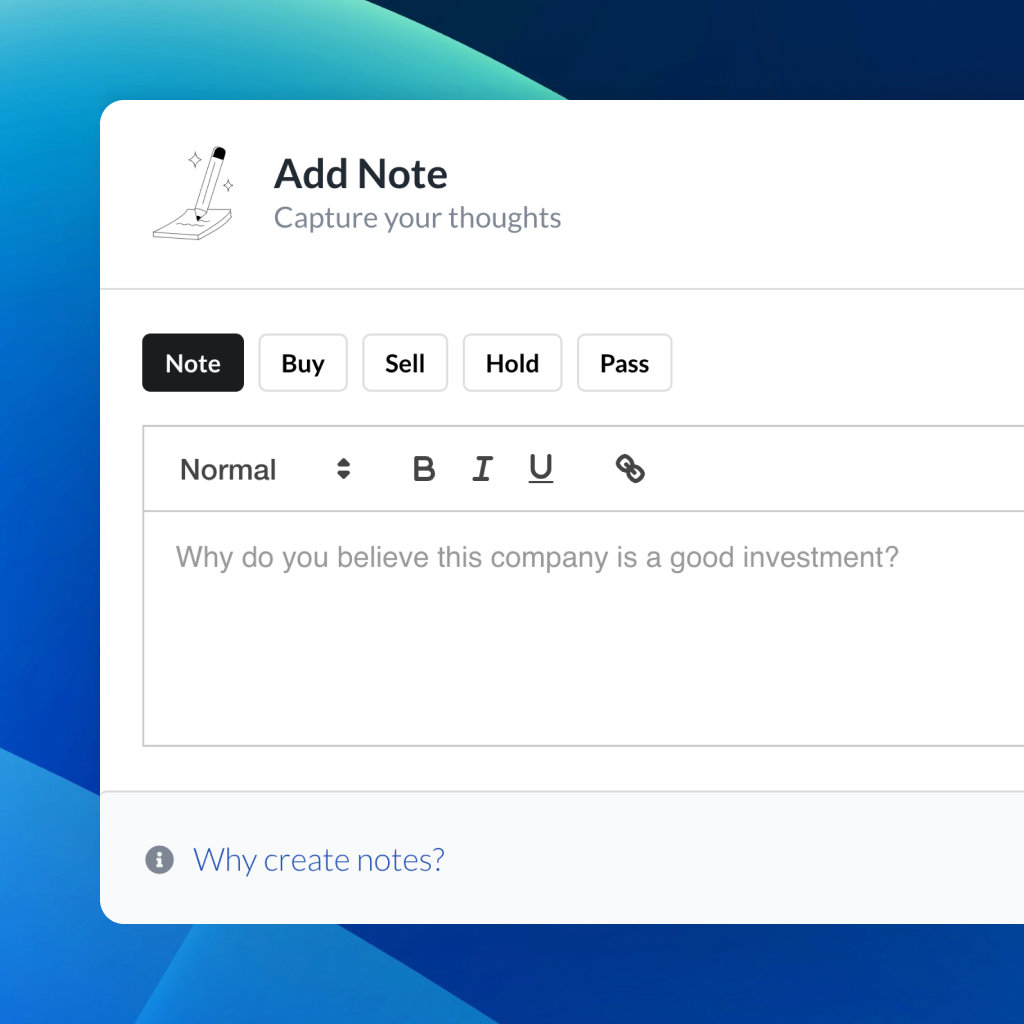

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

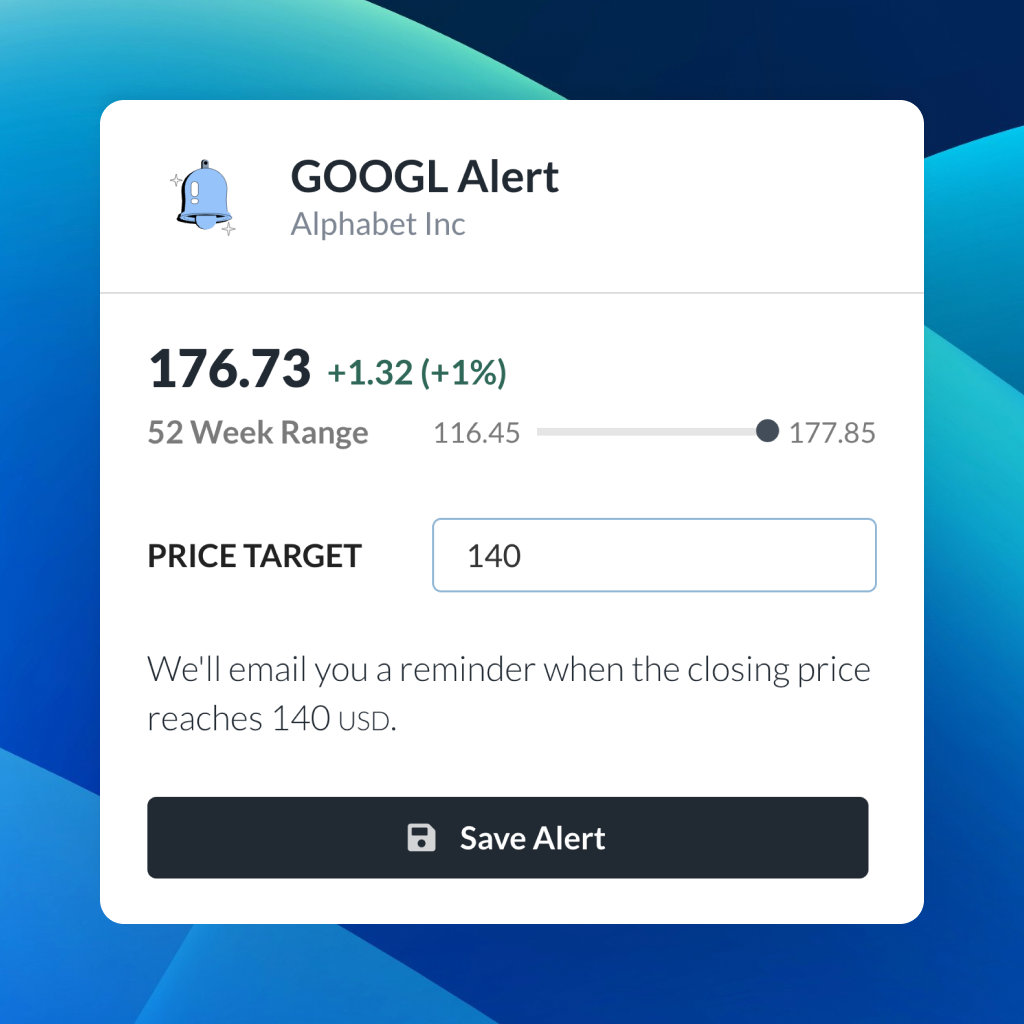

| 52 Week Range |

58.05

82.05

|

| Price Target |

|

We'll email you a reminder when the closing price reaches NOK.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

Abbvie Inc

NYSE:ABBV

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Realty Income Corp

NYSE:O

|

US |

|

Walt Disney Co

NYSE:DIS

|

US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

US |

This alert will be permanently deleted.

Europris ASA

Europris ASA

Earnings Call Analysis

Q4-2023 Analysis

Europris ASA

Q4-2023 Analysis

Europris ASA

Europris delivered a complex narrative in 2023, marked by a steadfast commitment to growth amidst a turbulent retail landscape. CEO Espen Eldal highlighted the company’s consistent rise since its first store opening in 1992, culminating in store sales flirting with the NOK 9 billion mark and a strong presence across Norway with 282 stores. The pivot towards Nordic expansion through the full acquisition of the Swedish retailer OoB signals confidence in amplifying shareholder value. Despite these advances, Europris faced a mixed Q4 due to underestimation in Christmas inventory which restricted sales growth to a mere 1.2%. The reduced sales cast a shadow on profits. However, full-year performance remained robust, buoyed by a discount-driven consumer behavior and a pivot to private labels and low-ticket items, resulting in a solid EBITDA near NOK 2 billion.

The financial health of Europris in 2023 is pronounced by a stunning NOK 2.2 billion in cash and liquidity reserves. This monetary prowess is leveraged to propose a shareholder dividend of NOK 3.25 per share, marking a continued trajectory of dividend growth since 2015. Chief Financial Officer Stina Byre outlined disciplined operational spending and adept cost control, manifesting in competitive gross margins and effective cost savings, like the NOK 50 to 60 million saved in electricity costs over the past five years. Counterbalancing the company's solid financial standing are the economic pressures such as inflation on operating expenses and lease rates, dictating further cost-efficiency measures.

With the acquisition of OoB, Europris sets its sights on creating a more robust entity capable of better managing purchase volumes. CEO Pål Wibe highlighted that the combined strength will enable both entities to realize greater sourcing-related synergies. However, details on timelines and investment plans for upgrading OoB stores remain under wraps until discussions about final purchase prices and transaction closings conclude. Moving forward, the company anticipates leveraging this strengthened partnership to capitalize on advantages in assortment combinations and cost reductions. Moreover, Executive Pål Wibe reassured investors regarding a fixed price freight agreement in place for 2024 despite external surcharges imposed due to geopolitical situations like the conflict in the Red Sea.

You don't have any saved screeners yet

You don't have any saved screeners yet

Good morning, everyone, and welcome to Europris presentation of the fourth quarter and the full year 2023. Joining me on stage today -- and my name is Espen Eldal, CEO of Europris; and joining me is Stina Byre, the CFO. And Trine Englokken, the IR Officer, will manage the Q&A at the end of the presentation, but please feel free to type in your questions as we talk, and we will summarize at the end. We will start with questions in the audience here at SEB in Oslo. So thank you to SEB for hosting the presentation, and we will summarize then with the questions from the web audience at the end. Europris is the #1 discount variety retailer in Norway. We have store sales of close to NOK 9 billion and 282 stores across the country. And since 2018, we've had a 20% ownership stake in the Swedish discount variety retailer, OoB, operating around 90 stores with SEK 4 billion turnover. And yesterday, we announced that we exercised our option to acquire the remaining shares of OoB. And we are excited about this opportunity for Nordic expansion, and are confident that this will contribute to further growth of Europris and of course, also creating shareholder value. We will come back with some more details later in the presentation on this important transaction. Europris has a significant and good track record of growth, and we've had growth every year since the first store opened back in 1992. And 2023 was no exception. We continue to grow. And I think it's a strong record of growth we've had since the pandemic. Of course, during the pandemic, we had very high growth. We have been able to maintain that high level also in the years following, and that, I think, is a strong achievement. But looking at the fourth quarter, I'm going to be very honest and say that we have actually a quite mixed result. We have a mixed conclusion to what I would say was a very solid year. And starting with what I'm pleased with, and that is that the Europris concept is very relevant to the consumers in the current market. We see very strong sales of consumables. We see very good performance of the campaigns that we run, and we see that we are attractive for consumers when it comes to everyday products. But where we had the miss was on the Christmas items. And hindsight, it's always easy to see, but we actually were too conservative when we put our purchase estimates in for the Christmas season of '23, and we sold out of some bestsellers too early in the season. It's always difficult to make these purchase decisions almost a year ahead. But looking back, of course, we should have been more aggressive and taken a larger bet on the Christmas season.

We had the backdrop of seasonal overlayers when we made the purchase decision. And we are too cautious. We also looked at the market seeing that the consumers didn't buy too much high-ticket items. So we hold back on the purchases and saw that the market was there during Christmas, and actually missed on sales and, of course, then also sales on high-margin items. That resulted in limited sales growth in the fourth quarter. The sales grew by only 1.2%. The gross margin ended at 43.9%. On the cost side, we see a very healthy cost control, and we see OpEx to sales levels on the same level as last year. Stina will come back with more details on the P&L later on. But of course, the reduction in sales also hit the profits. When we look at the full year, I think we have demonstrated a very strong performance in a challenging environment. Consumer behavior has changed significantly over the past year, focusing on the discounters, and that is favorable for Europris, but also looking at consumables. And we see a change in sales mix towards more private label, more campaign sales and also more sales of low-ticket items. That is, of course, good for the Europris concept, and I think we have positioned ourselves well during the year. We have focused our campaigns around consumables, low price points and managed to attract more customers than the year before, and that is a very strong signal for the concept. On the gross margin side, it's, of course, impacted by the change in sales mix, but as we've said quite detailed before, we expected the gross margin to remain above the pre-pandemic levels, and it is also for the full year of 2023. On the cost side, we have operated for the first time, all operations out of the new central warehouse in Moss. So we have consolidated now everything into 1 distribution center, fully automated, both with a high base storage and also automated picking of goods. And this is, of course, contributing to the good cost control we've had during the year. EBITDA ended at close to NOK 2 billion, a reduction of 4% compared to the year before, and net profit ended on NOK 908 million, a reduction of 11% from the year before. We end the year with a very strong financial position. We have cash and liquidity reserves of NOK 2.2 billion, and the positive cash development is mainly driven by lower inventory.

On the dividend, the Board of Directors proposes to pay out NOK 3.25 per ordinary share, and that is a continued growth in the dividend. We have increased the dividend per share every year since we were listed back in 2015. During the pandemic, we paid out extraordinary dividends to reflect the high financial performance in those years. But it's good to see that we continue to grow the dividend and continue to pay out excess liquidity to the shareholders. And I mentioned it a couple of times, the Europris concept is very relevant in this type of market that we are experiencing at the moment. But it is a very mixed market out there. I mean if you see retail news in January, we see that many retailers are struggling, but there are also some very good performance. And most of the good performers that has released numbers are those operating in the discount variety retail segments. So we are in a good spot in the market that is performing well, and we are actually outperforming that segment of the market. In 2023, we've delivered a growth of 4.2% for the chain compared to 2.9% for the variety retail segment. Not surprisingly, groceries are the best performers in the market, growing by 7.7%. That is the true necessities everybody needs and has also been subject to price increases during the year. Total retail grew by 2.2%, while the shopping centers actually had a good development with 4.3% growth, but they also had the first quarter of '23 compared to '22 when we had lockdowns also during COVID. So it's a reason for why they are delivering that strong growth back in 2023. Looking at the longer picture, I think outperforming the market is a key essence for Europris, and that is how we demonstrate good growth over time. And we have outperformed the market every year since we were listed, except for 2022. That came on the backdrop of very strong growth during the pandemic. So I think delivering this sales growth over time and actually taking market share and growing the market in a market that is being more crowded with competitors, that's a strong signal there. It says that the concept is strong. We are facing a lot of international competitors coming to Norway, and we are fighting good with them, and we see that our concept is very solid. And that is also very confident for us going forward when it comes to opening new stores and continue to develop the concept we have.

With those comments, I think I will leave the word to Stina to give you some more details on the financials.

Thank you, Espen. I will then take you through the financials for the fourth quarter. Group sales were NOK 3.1 billion, up by 1.2%. For the Europris chain, the total growth was 1.8%, and the like-for-like growth was 0.4%. Europris is a campaign-driven low-price retailer, and we saw that the customers clearly appreciated our campaigns, and they also came for products they need in their everyday lives. And this was demonstrated by the good development for especially the products on the front page of the marketing leaflet for consumables and for private labels.

As Espen mentioned, we did see, in retrospect, that we had been too conservative on the volume estimates for some of the seasonal items. And unfortunately, some of the best sellers sold out early. But we did exit 2023 with a healthy inventory level and good cash development. Total e-commerce sales were NOK 406 million, down by 4.5%. Lekekassen had sales decline in all markets, and the fierce price competition that we have seen in Sweden and Denmark continued also in the fourth quarter. The Strikkemekka group, in total, had sales growth, but the main revenue contributor of yarn sales in Norway fell behind last year. It has been a tough full year on the top line for our pure players, but they are operationally good companies. And this was also illustrated by Lekekassen that had lower OpEx in 2023 compared to the year before. The gross margin was 43.9%, down 1.6 percentage points. The product mix had a negative impact as the higher share of consumables was only partly offset by a higher share of private labels. Obviously, also the product on the front page of the marketing leaflet have a lower-than-average margin. And although we welcome these sales and the footfall it creates, it has a dilutive effect on the margin. We also saw that especially on some seasonal items, it was tough price competition, and this was in combination with higher input costs following a weaker NOK. A bit technical, but I will give it a go. In 2022 and previously, we booked calculation differences when we did the inventory accounting. Meaning that in 2022, the gross margin was actually a little bit too high in the second half compared to a little bit too low in the first half. While in 2023 and going forward, we book this calculation differences as they occur. So going forward, you no longer need to worry about this. But for the fourth quarter isolated, this had a negative impact of 0.7 percentage points. There was unrealized loss on currency hedging contracts in both the fourth quarter of '23 and '22, but it was higher in '22, meaning that the margin change was positively impacted by 0.9 percentage points. OpEx was NOK 625 million, up by only 0.9%. I must mention that this includes a reversal of previously booked costs of NOK 11 million that will be reimbursed following the OoB arbitration. But the cost control has been good throughout the year. And both for the fourth quarter and the full year, the OpEx to sales ratio ended on a par with last year. EBITDA was NOK 723 million, down by 4.9%, and this mainly reflected a lower gross margin. The EBIT was NOK 554 million, down 8.4%, and this reflected higher lease depreciations following CPI adjustments on rent. The total net profit was NOK 435 million, down 1.1%. And I would like to remind you that the remaining 33% of Lekekassen was acquired in 2023, meaning that the minority share was lower in '23 compared to '22. The net profit to majority was NOK 434 million, up by 2.8%. And on the 20% stake that the group already holds in OoB, there has been a write-down on goodwill of NOK 43 million following weaker results. For the remaining 80%, an option to acquire this was ruled valid in December. And due to this, a value of NOK 102 million has been booked. And the net effect is positive with NOK 59 million on the net profit from these 2 elements combined. Interest rate swaps had a negative effect of NOK 24 million in the fourth quarter compared to NOK 9 million negative the year before. I will comment on the full year figures. Operating -- cash flow from operating activities was close to NOK 1.8 billion compared to NOK 1.25 billion the year before. This positive development was mainly related to the development in inventory, where we, in 2022, had seasonal summer overlayers, we exited 2023 with a very healthy inventory level. The net change in cash was positive with NOK 212 million compared to negative with NOK 105 million. The net debt was NOK 3 billion, and excluding lease liabilities, it was NOK 371 million. And the financial position remains strong with cash and liquidity reserves of NOK 2.2 billion. Thank you. And back to Espen.

Thank you, Stina. It's been more than a year now since back in December '22 when we presented our updated strategy on the capital markets update here in Oslo. And I think it's worth taking a look back and looking at what we have achieved and what we have delivered on in that period. We said that we should strengthen our price and cost position. And I truly believe that with the focus you put on campaigns, being relevant for consumers in a tougher environment for them, selling the everyday products they need at good prices, we see good attention to the campaigns and how we have worked, that is truly delivered on the price position. And of course, on the cost position, getting now 1 operation out of the warehouse in Moss, we see that we have been able to keep OpEx to sales ratio during the year, that is also a strong achievement that we see that we are getting the synergies that we have been looking for from the investments done in the new warehouse.

On improving customer experience, we continue to upgrade categories, and we see that the new categories we upgrade, they perform above the average sales growth. So it's good results from those projects. And also on driving customer growth, we see that the customer club we built is truly generating more traffic, and we see that we have grown the number of customers in 2023. On acting responsible, we have done several initiatives. And for me, creating the local store Europris is one of the most important. We are playing a much more important role in our local communities where we operate our businesses than we did before. On the more global perspective, we have reduced our emissions from sea freight by more than 90% by introducing eco fuel on the shipments from Far East. And we have also taken a large commitment by joining the Science-Based Target initiative. So I think we're making progress and we are on a good track to deliver on the long-term ambitions we presented on the Capital Markets update. Let's have a look at the category upgrades. And this is still very well received by the customers. The personal care category was the first one we upgraded -- no, the last one we upgraded. That was at the end of the third quarter. And that has been very well received, and we see strong sales growth in the fourth quarter. And for toys, which we upgraded in the fourth quarter of last year, '22, that is, of course, a very important category for the fourth quarter, and we've actually seen double-digit sales growth in the fourth quarter of '23. So putting this assortment together with Lekekassen and actually been able to grow our sales significantly in the operating current stores. So it's a good collaboration between Lekekassen and Europris that we can get benefits from that acquisition. And in the first category -- the first quarter of '24, we are now preparing to upgrade the kitchen category. And for those of you with a strong memory, you remember that we upgraded that also back in 2020. So this is making the kitchen version 2.0 for Europris. We're really looking forward to make another upgrade on this important category. That is also a margin driver for the concept. So stay tuned, and we set the stores to see the new concept now later in the first quarter. I talked about the customer base. And what we've done with the customer club is quite extraordinary. We started the club back in 2019 and had close to 300,000 members. And in January now, we reached 1.5 million. And for us, this is a very important tool to drive traffic to the stores. We get now a communication channel with the customers. We interact, and we see that they actually engage. And we see that the opening rate on the newsletters we send out is actually above 40%. So this is communication the customers want, and they actually use it. And the most interesting thing is that what they're doing when they open the newsletter is actually they click on, move into the website and they look at the digital version of the marketing leaflet. So this is a tool for us where we can stay in touch with the customers and also reach out to the consumers with direct marketing leaflet on the digital base. We see that development in customer club also impacts the overall impression of Europris. We do our annual customer survey, and we see that now in 2023, still, we see that the impression of Europris continue to be more positive. Now 67% of the respondents have a very positive impression of Europris, while only 6% are negative. So I think this is also a strong achievement, demonstrates that the concept fits well with the current environment, and we see that the consumers are liking the concept. And of course, the most important thing for the consumer's impressions of Europris is, of course, what happens in the stores. And we continue to open new stores. And in the fourth quarter, we opened 1 store at the CC shopping mall in Drammen, and we opened one at Rognan in Nordland outside of [indiscernible]. Both stores have performed well, and I'm particularly proud of the store in Rognan where it's actually only 5,500 inhabitants. And actually, over the first 2 days we had the store open, more than 50%, actually, we have more than 2,500 customers visiting the store. So we really demonstrate that we can open stores in areas with a small catchment area like Rognan. So it was a big event, and we are really proud to be there with a very good team and dedicated staff. We have 7 new stores in the pipeline for '24 and '25. Two are subject to planning permissions. And we will continue to open new stores. We will continue to refurbish and relocate as that is a very important driver for growth also for the future. And of course, I will give you some more details on Sweden and OoB. As I said, we are very excited about the exercise of the option to acquire the remaining 80% of the shares in OoB. As I said, OoB has around 90 stores in Sweden with around SEK 4 billion in sales. The concept is very similar to Europris. It's a large product overlap. Store sizes are also quite similar. And it's a leading discount variety retailer in Sweden. But it is in need of a turnaround process, and we need to work with them, but it's a very good footprint of stores. It's dedicated staff in the stores, and we're looking forward to work together with them to make this journey. And I'm sure that Europris can contribute with some competence. And of course, with the dedication of the staff in OoB, I'm sure that this will be a success. On the financial details, we acquired the first 20% of OoB back in 2018 at a cost price of NOK 120 million. And there has been discussions regarding the option strike price, but that has now been settled, and it's set at approximately NOK 211 million. And it will be settled in Europris shares, and we have treasury shares to settle this. It's still a discussion regarding the final purchase price, which will be based on the 2019 and 2020 results of Runsvengruppen. But we do not expect any significant changes to the final purchase price. So if you use the preliminary -- the option strike pricing new calculations, that will be as good as it gets. We will come back with some more information later on regarding dates of closing and also operational plans we have together with OoB. What we're doing now is, of course, that we initiate the process to sign the final agreement and prepare the closing with the sellers of the company. I will conclude by having a look at the outlook. And I think that what we have seen now in the start of '24 and what we are expecting is basically a lot of the same as we saw during last year. And in this market environment, Europris is a very good fit. We offer the consumers products they need in their everyday life at affordable prices and also with attractive campaigns. So I think the market conditions overall, they favor us, but we also acknowledge that it still will be a tougher financial climate for the consumers, and that will last for a period. I think we are in a very healthy position when it comes to inventory and also when it comes to the balance sheet. We have a strong position when it comes to cash, and we actually have a very also good and strong cost control in our business. In January, we've seen that the freight rates has been changed in the market by the events we've had in the Red Sea and the ships are now going around Africa rather than the Suez channel. This is impacting the costs of all the customers of the freight. And it's imposed some additional charges that everybody has to pay to get the goods around Africa. And this will impact our cost for the coming year as it will for all other retailers. We also see that the lead times has been longer. We have not experienced any delays on our goods that are outside of the security limit we have of around 2 weeks on every delivery. But we have, to be on the safe side, increased our lead times on all the orders from the Far East to make sure that we get all our goods on time back to Norway. With that, I think we will open up for some questions, and I will invite Stina back on stage.

Thank you very much for the presentation. [indiscernible] from SEB. Could you give us some comments on the loss revenue potential from the lack of seasonal goods in the fourth quarter?

That will be tempting, but it's very difficult to say how much we lost. We just recognize that we sold out too early. And then that we didn't have enough to sell during the last campaigns and the last few weeks. So it's hard to tell how much we lost, but we, for sure, have a healthy inventory, and we have easy comps for the fourth quarter of '24.

And I have a follow-up there. How is the footfall in your stores in Q4? And did the lack of goods impact this in any way?

The footfall was slightly below last year, but we had 2 fewer shopping days. So if you had adjusted for that, we would have had somewhat higher footfall.

And on your product mix for 2024, do you expect lower or higher share of consumables compared to 2023?

Yes, that's a good question. I don't know, if you want to guess, but I think people are preoccupied about getting everything they need. So potentially, that trend will also continue. At the same time, we have had an increase over time. So how much it will change, I don't want to speculate it, but...

I think it's too early to say. But what we've seen in the January is basically the same picture as we saw in the second half of last year. Consumables is important. But of course, we have also had a good winter season so that drives demand for seasonal products. So it's a mixed bag.

And a final one for me. How would you say your inventory mix is for 2024 in terms of seasonal goods?

It's a very healthy inventory now. And I think it's a good mix. Most of our products are -- around 90% is less than a year old, and it's good to go. We have the products we need now.

Yes, absolutely. And I think it's -- the question you're not asking is maybe what we should answer as well is that we are well prepared for the summer season. And we were not as cautious on the summer season of '24 as we were for the Christmas season of '23. So we have plans for growth, and we also see that we get a good shipped on time. So we are ready for the summer season.

Then we go over to the questions from the web. Joachim Huse, Pareto. With too low order volumes of discretionary items for Q4, how will this impact Easter sales? Have you have been equally cautious regarding seasonal items in Q1? If so, and given the current freight disruptions, will you be able to get more seasonal items delivered on time?

Yes. It's a very good question and, of course, a valued one after the miss in the fourth quarter. But we have planned better for the summer season and the seasons we see in the first quarter. We have sufficient order volumes to cover the demand we expect and the goods are delivered on time. So despite the challenge in some freight, we see that goods are coming in on time, and we expect that also to continue. So we see no issues on that.

[indiscernible] asked sort of kind of same question that how will updated freight rates affect your earnings? And will longer lead times affect your turnover?

Well, the freight rate hit everyone in the market. So unless someone decides not to compensate for this, and then everyone will at least have a basic need to compensate this. So hopefully, it should not have a margin impact, and that will be what we will be working for.

[indiscernible]. What is the private label share in Q4 and for 2023? And what are your expectations for this in 2024?

Well, same as it's hard to speculate, but we have seen a growth in private labels over time. So it could be reasonable to expect that this will either stabilize or increase further. But for the full year, it was around 45% of private labels. It increased with around 1 percentage point compared to '22.

How was the mix on volume and price for 2023 and Q4?

In both the fourth quarter and for the full year, it has been lower volumes but higher price, and we see that the inflationary pressure also continues. So continued price increase is likely expected.

How do you see the prices on imported goods year-on-year?

Well, the weaker NOK will continue to impact us. So there is still inflationary pressure going forward.

What have been the key lessons learned so far since you made the first investment in OoB? And what makes you comfortable that Europris will be able to execute the successful turnaround?

I think we have seen, over time that Europris' concept is very strong. We've seen that we have developed an even stronger concept and the business model here in Norway. And of course, we also get to know the company on the Swedish market. We acknowledge it's a tougher market in Sweden, but we also faced some -- a lot of the same competitors here in Norway where we do the same discount variety retailers operating in Norway as we will see in Sweden. So I think, together we will be a stronger company. We will have a larger volume. We will get better scale on purchase volumes. And we will be able to take the best out of both concepts and learn from [indiscernible]. I think it -- together, it will be a stronger company.

Underlying inflation on several OpEx elements are expected to continue to be high, both on salaries and lease rates. What measure have you been implemented to offset this negative impact?

Well, we are a low-price retailer. So of course, we always work on our cost base. And as Espen was talking about, we have now all operations from 1 warehouse. We still have a lease on the old warehouse throughout the first half of the next year, but we are running all operations from 1 place. And we continuously try to be as efficient as we can.

[indiscernible] said, in terms of competition, how crowded is the Norwegian market? Do you see any room to grow your current number of stores in Norway?

Yes, we will continue to open new stores, and we have a target of around 5 new stores a year, but if it's going to be 3, if it's going to be 7 like last year, let's see. But we are open to continue the store rollout in Norway, and we still see potential for new more stores.

And how is the variety retail market in Sweden different from Norway?

I think it's -- overall, it's demonstrated by somewhat lower margins because it's more competition, but it's the same players in Norway as what you see in Sweden, more or less.

Do you expect change in product mix and increased competition to continue to hurt gross margin in 2024 and 2025?

Well, we have said that we expect, over time, to be above pre-pandemic levels. And I think we have, despite all headwinds, proven that in '23, and that will be what we continue to work for. There can, of course, be short-term fluctuations, but is our overall long-term target.

[indiscernible]. You highlight seasonal items having higher gross margin. Is it possible to say anything about the gross margin impact from the sold-out situation on seasonal items in Q4?

It's difficult to say how much -- it was difficult to say how much sales you lost because you didn't have it. So it will just be assumptions. So we are not going to provide that. But we know that the seasonal sales has above-average margins and that the gross margin would have been slightly better if we had that sales.

Regarding the new warehouse, is it more efficiency gains to expect in 2024? And how do you see OpEx development year-on-year in 2024?

Well, as we didn't run operations fully from 1 location throughout '23. So that will be a difference. We will do that throughout the entire year. But we do still have some lease obligations throughout the first half. But we expect to continue seeing good results, and we are more efficient now. And over time, we have worked hard to kind of control the cost elements that we can. So for instance, when it comes to electricity, if we look at including '24 and over the past 5 years, we will have avoided costs of NOK 50 million to NOK 60 million. But in '23 and '24 isolated on the P&L, the prices will have increased somewhat. But we continue to work with what we can impact, and we'll do so also going forward.

[indiscernible] OoB. Several questions on OoB. I understand that this is still fresh. But then should we expect that you revert with more information on time line and on the transaction?

That is actually hard to say because we now need to go in dialogue with the sellers and actually agree on the final purchase price and also discuss the closing. So when that is done, we will come back with more details. I cannot give a time frame for that at the moment.

And how will this change the joint venture you have with Tokmanni, OoB given Dollarstore Norway is owned by Tokmanni.

I think it will be very positive that we bring both Tokmanni and Europris is now bringing more volumes into the pool, and that is what this game is about. In sourcing, what counts is the volumes. And you need to get more volume. And now we will get that, and that will benefit both companies.

And how do you expect to spend on refurbishing OoB stores? And what is the time line on that CapEx?

Yes. As I said, we will come back with more details when we know this time line. We have prepared the plan, and we will come back with -- and tell that to the market when we have more certainty on the actual closing of the transaction and when that will happen.

But where do you see the lowest hanging fruit in terms of synergies?

I think it's like always in retail. This partnership was based on sourcing. And of course, the lowest hanging fruit will be on combining the assortment, getting lower purchase prices and of course, harmonizing the assortment.

And here's another one from Ole Martin Westgaard. What happened to the fixed price freight agreement? Has this been canceled or renegotiated given your comments that you are exposed to higher rates?

We have a fixed price agreement, but there has been a ruling saying that all the freight carriers can impose an additional charge due to the conflict in the Red Sea and that they have to reroute their traffic. And this fee hits all the buyers of freight regardless of the contract you have. But beside that, we think that we have a favorable freight agreement with fixed rates for '24, but we will have this additional surcharge for that period it lasts. And we also have fixed allocation of containers on the ships. So we are sure that we get our goods back in, and we also get it at the price that I would think is competitive in today's market.

And [indiscernible], I think I've touched upon this before, but does the current sourcing cooperation with OoB limit the expected sourcing synergies compared with a total of EUR 15 million in synergies that Tokmanni expects from the Dollarstore acquisition?

I'm not able to answer on the synergies that Tokmanni expects from their acquisitions. But of course, there will be some synergies for Europris when we pull volumes with OoB. And we will come back with more details on that when we are presenting the operational plan.

Thank you.

Thank you.