Fujifilm Holdings Corp

TSE:4901

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

Abbvie Inc

NYSE:ABBV

|

Biotechnology

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Realty Income Corp

NYSE:O

|

Real Estate

|

| US |

|

Walt Disney Co

NYSE:DIS

|

Media

|

| US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

Technology

|

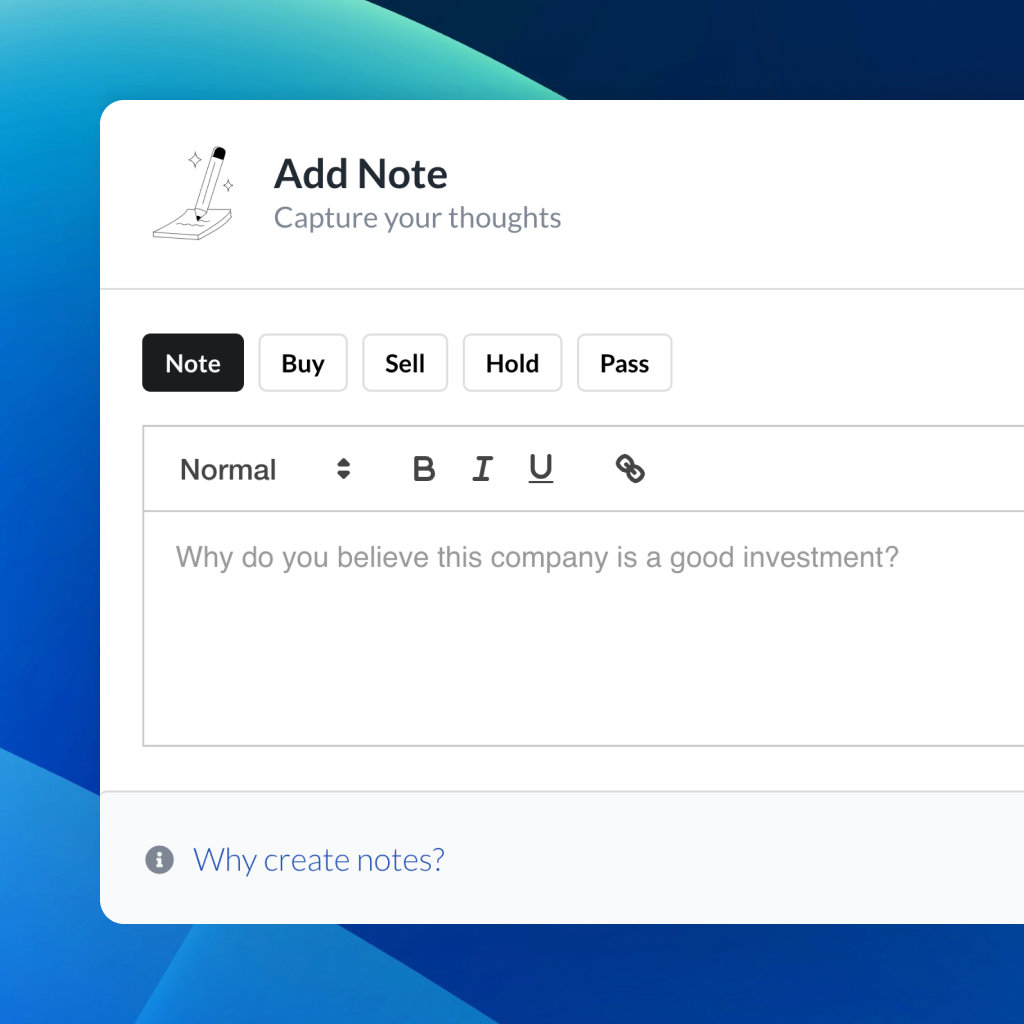

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

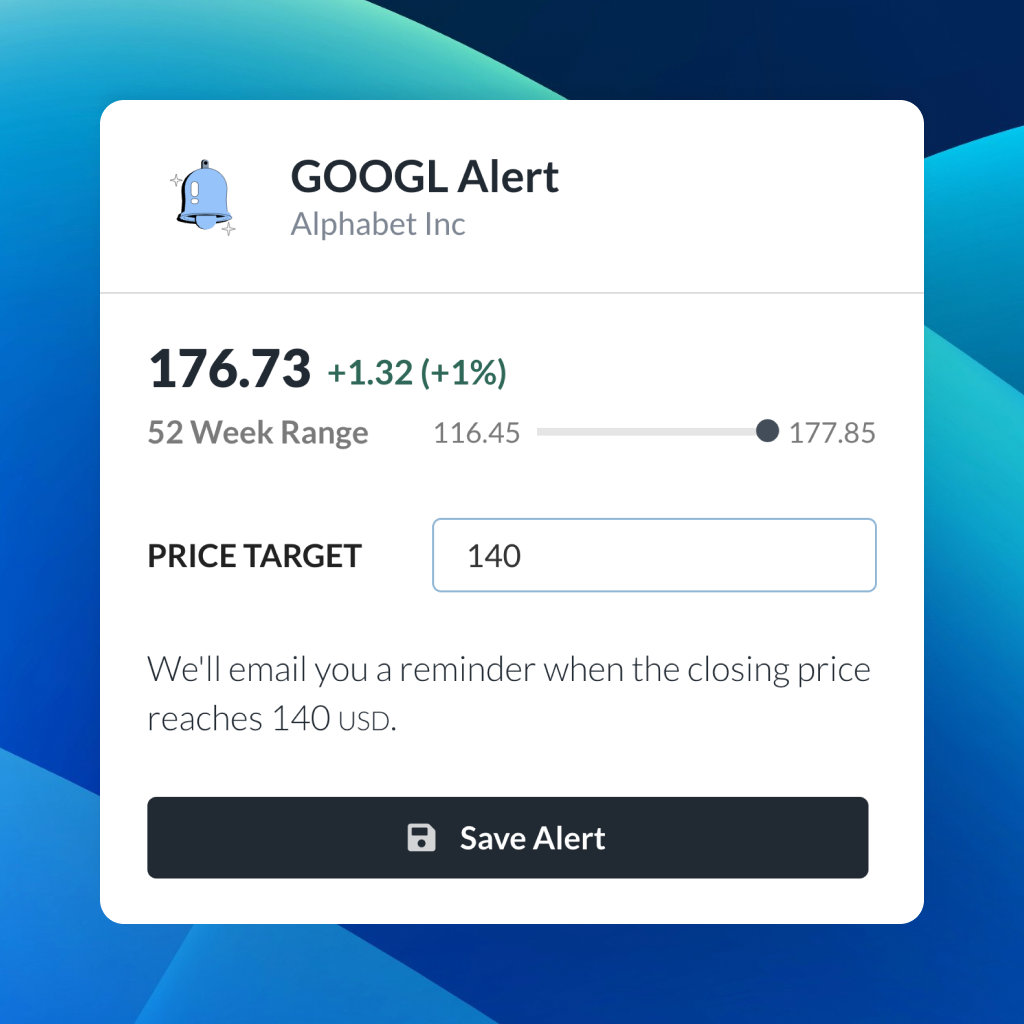

| 52 Week Range |

2 582.9809

3 982

|

| Price Target |

|

We'll email you a reminder when the closing price reaches JPY.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

Abbvie Inc

NYSE:ABBV

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Realty Income Corp

NYSE:O

|

US |

|

Walt Disney Co

NYSE:DIS

|

US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

US |

This alert will be permanently deleted.

Fujifilm Holdings Corp

Fujifilm Holdings Corp

You don't have any saved screeners yet

You don't have any saved screeners yet

I would like to present FUJIFILM Holdings' financial results for the third quarter of the fiscal year ending March 2019.

Let me explain the main points for the third quarter of the fiscal year. In the third quarter of the fiscal year, both revenue and operating income were in line with the plan. Compared to the previous fiscal year, revenue remained at the same level while operating income largely increased. Regarding performance by segment. Sales increased in the medical systems, Bio CDMO, regenerative medicine and electronic materials business. Those sales decreased in the document business due to a reduction in low-profit, low-end printers and a change in an accounting method for recognizing revenue from purchased products. If these negative impacts are excluded, the overall revenue had increased.

Operating income increased mainly in the medical systems, Bio CDMO and the electronic materials business and largely increased in the document business by over 80%.

Operating income of JPY 74.4 billion is a record high in the third quarter. In the share buyback plan of up to JPY 100.0 billion, we bought back JPY 53.2 billion by the end of December, and the total value of shares bought back amounted to JPY 75.4 billion.

Let's move on to detailed performance information for the third quarter of the fiscal year ending March 2019. Consolidated revenue totaled JPY 1,799.8 billion at the same level as the previous fiscal year. Operating income increased due to a positive impact from structural reforms in the document business and improvements in profitability in each business, including the document business to JPY 158.3 billion, up 28.6% from the previous fiscal year.

Income before income taxes came to JPY 154.6 billion, down 11.4% from the previous fiscal year. Net income attributable to FUJIFILM Holdings totaled JPY 101.1 billion, down 18.8% from the previous fiscal year. These reductions are mainly because of a profit gained from a stock valuation of about JPY 20 billion booked in the previous fiscal year at the time of consolidating Wako Pure Chemical Industries, Ltd., as well as other loss on revaluation of equity securities of JPY 5.4 billion due to a change in the accounting standard enforced in this fiscal year.

Let's move on to segment-specific information. The Imaging Solution segment recorded revenue of JPY 303.8 billion, up 2.1% year-on-year. Operating income totaled JPY 48.0 billion, down 3.8% from the previous fiscal year due to such factors as upfront advertising and promotion costs and R&D investment. The Healthcare & Material Solution segment recorded revenue of JPY 758.9 billion, up 4.2% year-on-year.

Operating income totaled JPY 70.0 billion, up 17.0% from the previous fiscal year due to such factors as increased profit in accordance with the revenue growth. Within the Healthcare & Material Solution segment, the health care business recorded revenue of JPY 342.9 billion, up 10.9% year-on-year. Operating income totaled JPY 17.4 billion, 2.7x the level of the previous fiscal year.

The Document Solution segment recorded revenue of JPY 737.1 billion, down 5.9% year-on-year due to such factors as a reduction in low-profit, low-end printer business and a change in an accounting method for recognizing revenue from purchased products.

Operating income totaled JPY 66.9 billion, up 82.2% from the previous fiscal year due to improved profitability and a positive impact from structural reforms.

First, I would like to present the results of our Imaging Solution segment. In the photo imaging business, sales were strong for instant photo systems, such as the instax series and instax films. The sales volume of the instax series totaled 8.5 million units in the 9 months of this fiscal year. Instax SQUARE SQ20, the new hybrid instant camera, capable of editing images before printing and a global promotion featuring Taylor Swift, instax's global partner, contributed to the sales increase.

In the electronic imaging business, good sales were maintained in the active market for mirrorless digital cameras. FUJIFILM X-T3 launched in September 2018 contributed to a revenue growth value for its compact and lightweight body, high-speed, high-precision autofocus function and high-video function.

In November 2018, FUJIFILM GFX 50R, a medium format, mirrorless digital camera with a large-sized sensor was launched. It is highly acclaimed for realizing both ultra-high image quality and operability.

In the optical device business, sales maintains solid for various industrial-use lenses such as vehicle-mounted lenses.

In October 2018, we announced the launch of ultra-high resolution lenses for machine vision cameras and the new entry into the surveillance camera market, targeting further business growth by the expansion of business fields.

In the Imaging Solution segment, revenue increased due to solid sales in each business, while operating income decreased due to such factors as advertising and promotion costs and R&D investment for next-generation products to achieve further sales expansion.

Next is our Healthcare & Material Solution segment. In the Healthcare business field, the medical systems business enjoyed brisk sales in all business fields, such as X-ray imaging diagnostics and endoscopes.

In the Bio CDMO business, the contract process development and manufacturing business of biopharmaceuticals progressed favorably. Expansion of facilities, which has been conducted since last year, contributed to the sales increase. In the regenerative medicine business, sales increased due to the acquisition of FUJIFILM Irvine Scientific, a leading company in cell culture media in June 2018. As for the highly functional materials business field, in addition to solid sales of TAC products, strong sales of products related to touch panels were seen in the display materials business.

In the electronic materials business, sales increased mainly for advanced products of photoresists and peripheral materials related to photolithography. For further growth an investment of JPY 10 billion in total in the U.S. side was decided upon to expand facilities for the development, manufacture and quality assurance of cutting-edge semiconductor materials.

In the graphic systems business, sales decreased due to a decline in total demand for graphic arts film and CTP plates. In the printing plates field, we're expanding the sales of such high value-added products as process-less plates with high-environmental performance, including a newly launched process-less plate for a newspaper.

In the Healthcare & Material Solution segment, revenue increased due to strong sales in the medical systems, Bio CDMO, regenerative medicine and electronic materials business. Operating income increased primarily by improvements in profitability of each business.

Lastly, I would like to talk about the Document Solution segment. First, as for the office products business within the office products and printers business, though the overall sales volume decreased, the sales of small-sized multifunction devices developed for the Chinese market remained solid. In the office printer business, the sales volume decreased by reducing business of low-profit, low-end printers.

In the production services business, though the overall number of sales units fell, strong sales were seen for an on-demand production color printer, called the Iridesse Production Press, mainly in the U.S. and Europe.

In January 2019, Fuji Xerox announced the launch of 11,000 inkjet press, a high-speed roll color inkjet printer for commercial printing with image quality comparable to that of offset printing. Its sales start from February 2019 in Japan with the name for further expanding the digitalization of commercial printing.

In the solutions and services business, though the sales of BPO, business process outsourcing, contracts showed steady growth, overall sales decreased due to a change in an accounting method for recognizing revenue. With a new value-creation strategy called Smart Work Innovation, we aim for further growth in the service field by continuously providing services that support our customers in improvements of work efficiency and productivity. Revenue in the Document Solution segment declined due to a reduction in some low-profit, low-end printer business and so on.

Operating income largely increased by such factors as a positive impact from structural reforms and improvements in profitability. We will continue our efforts to expand growth areas, such as the solutions and services business and the production services business, while enhancing profitability by accomplishing structural reforms.

Next, let's look at our balance sheet. Assets, as of the end of December 2018, totaled JPY 3,413.4 billion, down by JPY 79.5 billion from the end of March 2018, mainly due to a decrease in cash and cash equivalents.

Liabilities decreased by JPY 22.9 billion to JPY 1,171.3 billion, while shareholders' equity decreased by JPY 37.9 billion to total JPY 2,041.2 billion. The current ratio increased by 9.4 percentage points to 289.5%.

Our debt-equity ratio remained at 57.4%, and our shareholders' equity ratio increased by 0.3 percentage points to 59.8%.

Next, with regard to our cash flow, net cash provided by operating activities totaled JPY 143.6 billion. Net cash used in investing activities amounted to JPY 159.4 billion, mainly due to the acquisition of Irvine Scientific Sales Company and IS JAPAN. As a result, free cash flow without acquisitions of businesses and others, was JPY 82.3 billion.

Let me talk about our initiatives for structural reforms of Fuji Xerox, a consolidated subsidiary. As for our initiatives for structural reforms of Fuji Xerox announced on January 31 last year, onetime expenses, including structural reform costs in the 9 months of the fiscal year, ending March 2019, totaled JPY 8.4 billion, while a positive impact from the structural reforms was JPY 18.0 billion. By executing structural reforms, we aim to establish a business space where sustainable growth can be realized by reducing expenses and maintaining profitability and productivity to withstand market changes and competition while reinvesting in new growth areas.

Regarding our consolidated financial forecast for the fiscal year ending March 2019, no changes have been made from the forecast announced on November 7, 2018.

We will continue to advance our growth strategy while promoting further expansion of sales and improvement in profitability in order to achieve our consolidated financial forecast. The buyback of the company's shares of up to JPY 100.0 billion, which started in August last year, has proceeded according to the plan. The annual dividend for the fiscal year ending March 2019 is expected to be JPY 80 per share, an increase of JPY 5 from the previous fiscal year.

The dividend increase is expected for 9 consecutive years. We will strengthen shareholder returns in addition to achieving the operating profit target through business activities.