Fujitsu Ltd

TSE:6702

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

Abbvie Inc

NYSE:ABBV

|

Biotechnology

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Realty Income Corp

NYSE:O

|

Real Estate

|

| US |

|

Walt Disney Co

NYSE:DIS

|

Media

|

| US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

Technology

|

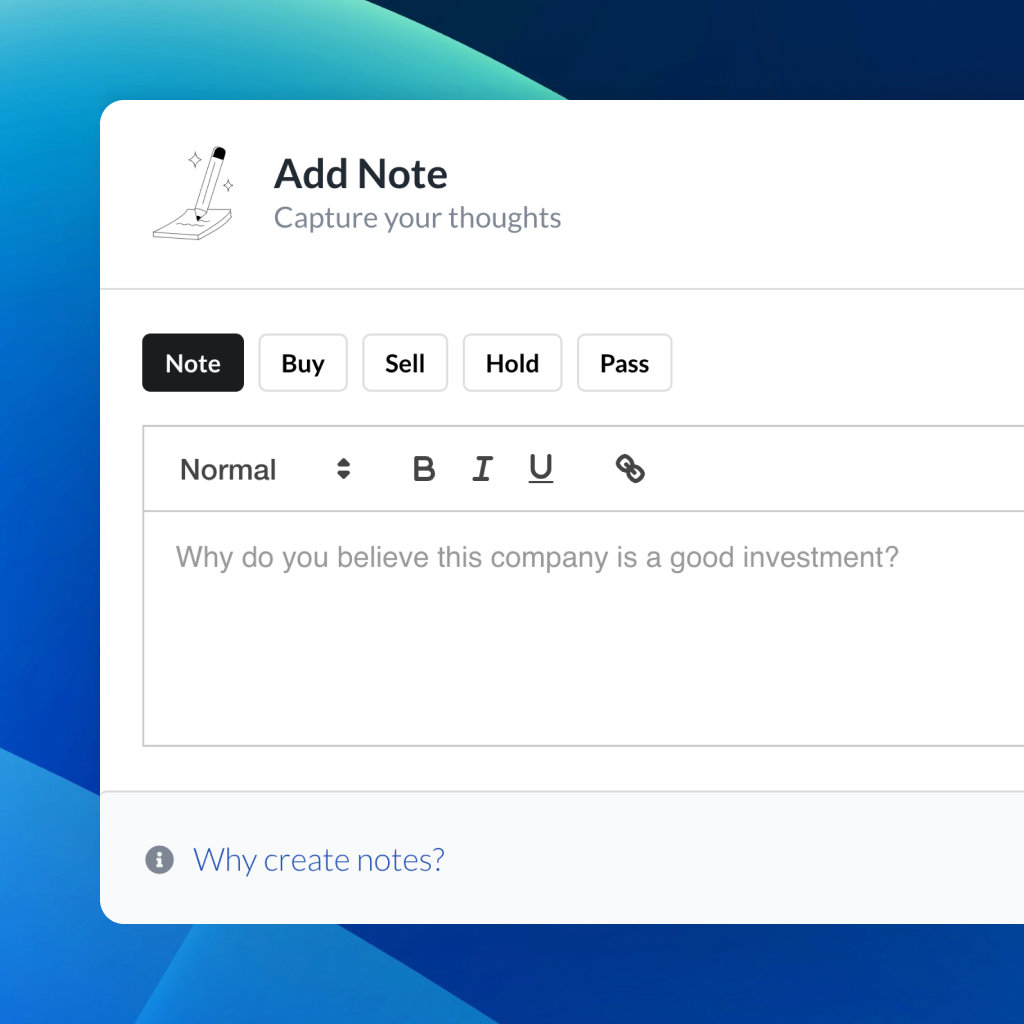

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

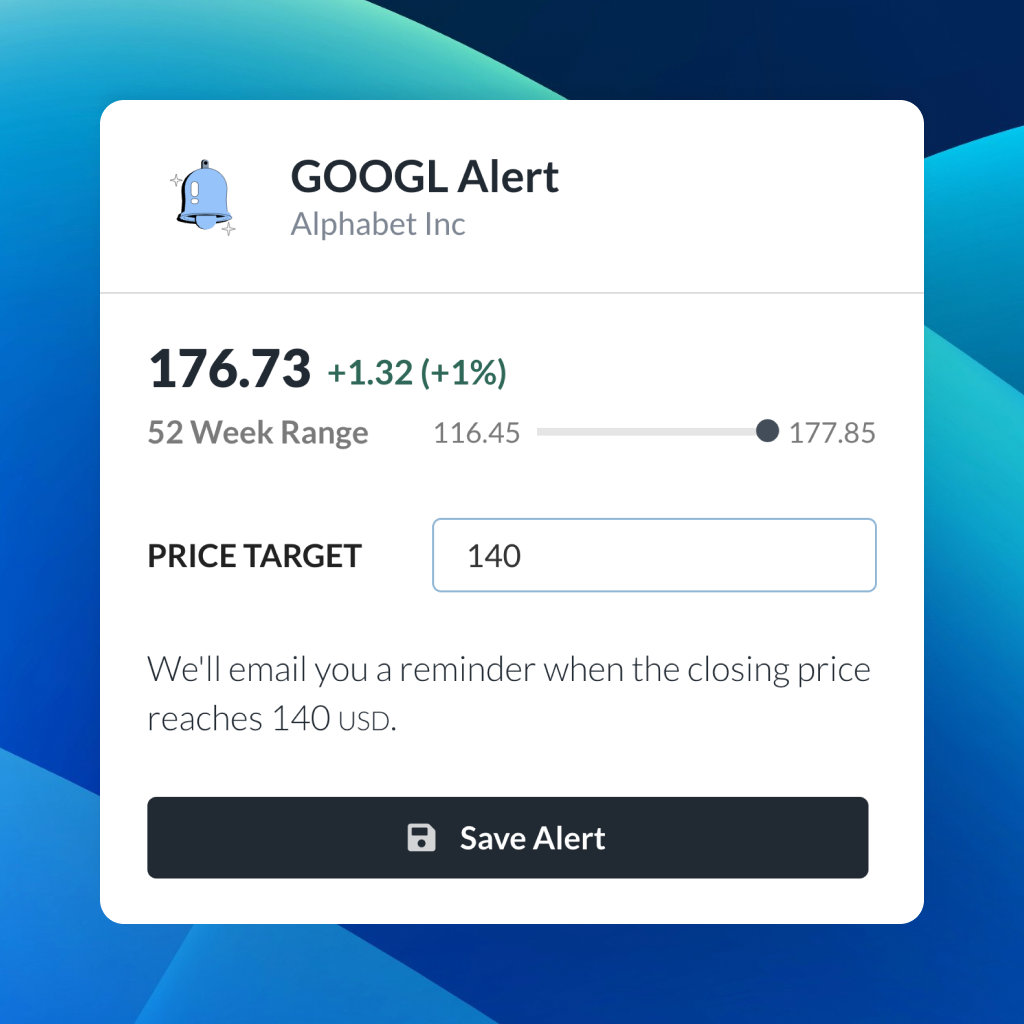

| 52 Week Range |

1 622.2369

2 700

|

| Price Target |

|

We'll email you a reminder when the closing price reaches JPY.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

Abbvie Inc

NYSE:ABBV

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Realty Income Corp

NYSE:O

|

US |

|

Walt Disney Co

NYSE:DIS

|

US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

US |

This alert will be permanently deleted.

Fujitsu Ltd

Fujitsu Ltd

Earnings Call Analysis

Q3-2024 Analysis

Fujitsu Ltd

Q3-2024 Analysis

Fujitsu Ltd

In the evolving landscape of digital and technological demands, the company firmly rooted its growth in the Service Solutions segment, which surged by 12.9% to JPY 1.522 trillion, dismissing the restructuring impacts. The Japanese market fed this appetite, basking in a strong inflow of orders due to digital transformation and modernization fervor. Adjusted operating profit for the segment mirrored this success, more than doubling to JPY 116.3 billion, a testament to strategic profitability enhancements. However, the hardware solutions and network products, previously basking in high demand, took a downturn along with Device Solutions since the last half of the previous year. Overall, the company's consolidated revenue inched up by 1.7% to JPY 2.6427 trillion, but its adjusted operating profit dipped by JPY 32.9 billion.

With a keen eye on their most significant segment, Service Solutions, the company saw a profit jump of 13.6% year-over-year. Despite the slump in Hardware Solutions, efforts in the Service Solutions have been busy sowing seeds for future harvests. The company increased its growth investments, particularly under its ambitious Fujitsu Uvance vision, propelling a considerable 67% revenue increase in that area alone. Robust demand for consulting and cloud migration was the wind beneath the wings of this upsurge. These actions are galvanized by a dedicated plan to bolster growth through investments in trailblazing fields like AI and quantum computing, spearheading towards long-term growth.

The seamless cadence of growth in the Service Solutions segment didn't falter, echoing across all quarters with revenue growth standing tall at 13% over the nine months. Operating profits followed suit, magnifying from 4.5% to 9.8% through the quarters. The overall financial canvas sketched a service segment overpowering the lapses observed in other segments. On international fronts, despite a slight decline in Europe and the Asia Pacific, orders in the Americas celebrated a monumental rise of 35%.

Strategic reshaping overshadowed traditional operation methods, aiming for an international metamorphosis with Fujitsu Uvance taking precedence. Financial carve-outs in Germany and a business focus shift in Hardware Solutions manifested these decisions. Despite a one-time hit due to restructuring, expectations are set on eradicating such losses in the near future. The CCD business in Europe is also set for closure, aligning with the strategic redirection towards prioritizing the Japanese market.

The company withheld its fiscal year 2023 forecasts, envisaging a revenue of JPY 3.810 trillion. An anticipated adjusted operating profit of JPY 320 billion remained unscathed by the restructuring, with its adjusted profit for the year still projected at JPY 208 billion. The Service Solutions segment is predicted to extend its triumph into the fourth quarter, with the forecast promising a further profit increase of JPY 30.1 billion. This optimistic foresight, coupled with the backlog of orders, positions the company stably on the course, investors have been charted on. Furthermore, the company is prepped to plunge into a stock split geared at enhancing investor access and share liquidity.

You don't have any saved screeners yet

You don't have any saved screeners yet

This is Isobe. I would now like to start explanation about the fiscal year 2023 third quarter consolidated financial results. I will use the presentation material to explain.

Page 3. First, the financial highlights for the first 9 months of fiscal 2023. The most important segment is Service Solutions. Revenue in this segment was JPY 1.522 trillion, an increase of 12.9%, excluding impact of PFU restructuring. Primarily for business in Japan, there was a strong increase in orders and revenue. Results were driven by demand related to digital transformation and modernization projects.

Adjusted operating profit was JPY 116.3 billion, an increase of JPY 61.8 billion year-on-year. In addition to the impact of higher revenue, progress was made as expected in improving profitability, such as by transforming the delivery of services. This resulted in an operating profit more than twice as high as that of the prior year.

On the other hand, there was a pullback from the previous year's strong demand for hardware solutions and network products. In addition, demand for Device Solutions has been decreasing since the second half of last year.

Total consolidated revenue was JPY 2.6427 trillion, an increase of 1.7%, excluding the impact of restructurings. Adjusted operating profit was JPY 118.8 billion, a decline of JPY 32.9 billion year-on-year.

Page 4 shows an overview of the financial results for each business segment. This page shows an overview of the segments, and I will discuss the results for each segment starting with the next slide.

At the very top is Service Solutions, our most important segment, which continued to increase in size while also improving profitability. Excluding PFU, which had been included in the consolidated results through the first half of the previous year, total cumulative revenue from continuing operations for the first 9 months increased by JPY 174.1 billion. Operating profit also increased by 13.6% year-on-year.

On the other hand, revenue and profit in Hardware Solutions, which includes network products and Device Solutions, which both performed well in the prior year, decreased.

In Intersegment Eliminations and Corporate, we are pursuing a plan of increasing growth investments to achieve growth over the medium and long term. The following pages show results for each business segment.

Page 6, Service Solutions. Cumulative revenue for the first 9 months was JPY 1.522 trillion, which on a continuing operations basis represented an increase of 12.9% year-on-year. For customers both inside and outside Japan, there was an acceleration in DX initiatives as well as sustainable transformation initiatives. As a result, there was greater demand for consulting services, modernization projects and cloud migration support. Fujitsu Uvance benefited from this robust demand with a 67% increase in revenue.

Adjusted operating profit was JPY 116.3 billion, up JPY 61.8 billion from the prior year. Although we increased growth investments related to Fujitsu Uvance, operating profit rose significantly because of the impact of strongly higher revenue and measures to improve profitability. I will shortly explain the contributing factors of this increase in profits with a waterfall chart.

First, I will touch upon the breakdown of results by quarter. At the top shown in bright blue, growth in revenue was 10% in the first quarter, 17% in Q2 and 12% in Q3, resulting in 13% growth for the first 9 months and a continuation of solid results as expected.

The blue bars show adjusted operating profit. Adjusted operating profit was 4.5% in Q1, 8.2% in Q2 and 9.8% in Q3, showing a steady increase. Adjusted operating profit for the first 9 months was 7.6%, reaching a level twice as high as the prior year. In addition to the impact of higher revenue, we are pursuing progress in profitability improvements. Page 8. This chart shows the factors that caused increases or decreases in adjusted operating profit in the first 9 months in Service Solutions compared to the prior year. On the far left, adjusted operating profit for the first 9 months of fiscal 2022 was JPY 54.4 billion. The first factor is an increase of JPY 58.1 billion in adjusted operating profit from the impact of higher revenue. In part because of solid increase in revenue in Fujitsu Uvance, overall revenue rose by 12.9%.

The second factor is an increase of JPY 27.9 billion from improved profitability. We continue to make progress in initiatives to improve productivity, such as the expanded use of Global Delivery Centers and standardization in development work. Although there is an impact from the increase in labor costs, the improvement in profitability fully covers these costs.

The third factor is a decline of JPY 24.1 billion from higher expenses, primarily investments in growth areas. As we projected, we actively made growth investments, including investments in the development of Fujitsu Uvance offerings, employee training and development and enhanced security.

Adding these up, cumulative adjusted operating profit for Service Solutions in the first 9 months of fiscal 2023 was JPY 116.3 billion.

Page 9, I will now provide supplemental information on each of the factors in the previous waterfall chart. First, status of orders, which led to the increase in revenue. This page shows orders in Japan. Continuing from the first half, orders in Japan remained solid, increasing by 16% in the first 9 months compared to the prior year.

I will now comment on each industry segment. First is the Private Enterprise Business segment in which orders were up 7% from the prior year. Growth was driven by orders in manufacturing, mobility and retailing and distribution sectors, primarily for modernization projects.

Finance Business segment, orders were up 21%. In addition to deals to upgrade mission-critical systems for megabank and insurance institutions, we also won modernization project deals, resulting in a significant increase in orders from the prior year.

Public and Healthcare segments, orders were up 26%. In Q3, we received multiple orders for system upgrades from government agencies and ministries, resulting in solid growth. Among customers in the health care industry, we are also seeing strong investments in electronic medical record systems and health care information systems.

In the Mission critical and other segment, orders were up 15%. Continuing on the first half, orders benefited from multiple large projects in the national security field. Due to sustained robust demand from the first half of the fiscal year, the order backlog of our business in Japan is increasing, which will lead to higher revenue in Q4 and next fiscal year.

Page 10 shows the orders in Regions (International). The Fujitsu Uvance business is solidly expanding globally. Orders for the Europe region for the first 9 months of the year declined by 1%, reflecting large-scale project wins concentrated in the third quarter. Orders in the Americas region increased by 35%, a big rise over the prior year, as we won multiple private sector business application deals.

Orders for the Asia Pacific region were down 17%. There was a pullback from the large-scale public sector deals in the prior year, resulting in a decline.

Page 11 shows the progress of Fujitsu Uvance, which we are positioning as the most vital area for the growth of our business and the transformation of our business portfolio. Fujitsu Uvance consists of a total of 7 key focus areas, including 4 vertical areas, which are cross-industry areas that focus on the solution of societal issues and 3 horizontal areas, which are technical platforms that support the vertical areas.

In the first 9 months of fiscal 2023, we released roughly 40 new offerings, resulting in a total of 110 offerings at present. We are accelerating the release of offerings in vertical areas in particular.

Overall revenue for the first 9 months was JPY 247.3 billion, up 67% from the prior year. Business is progressing at a pace that should exceed our Fujitsu Uvance revenue target for the full year of JPY 300 billion.

Fujitsu Uvance now accounts for 16% of total revenue in the Service Solutions segment, up from 11% in the prior year. In our medium-term management plan, we are seeking to achieve revenue of JPY 700 billion, representing 30% of our total revenue in fiscal 2025.

Orders leading to revenue are now JPY 295.6 billion, up 79% from the prior year. High demand is continuing from what we call the 3S business applications, consisting primarily of SAP, ServiceNow and Salesforce, and we expect to build on our business in these areas in the fourth quarter and fiscal 2024.

On Page 12, I would like to comment on profitability improvements and the status of growth investments. Profitability increased by JPY 27.9 billion and the gross margin improved by 1.5 percentage points. We are making steady progress in the standardization of development work, automation, the expansion of insourcing and use of offshoring to our Japan Global Gateway and our Global Delivery Centers. Growth investments and expenses increased by JPY 24.1 billion. We continued to proactively invest in areas directly related to business growth, such as the development of Fujitsu Uvance offerings, investments needed to develop specialist human resources and investments to strengthen our security.

This concludes my supplemental explanation of the increases and decreases in profit outlined in the chart on Page 8.

Page 13, I will briefly touch upon the status of each subsegment in Service Solutions. First is Global Solutions. Revenue was JPY 331.5 billion, up 18.4% year-on-year. On an adjusted basis, the subsegment posted an operating loss of JPY 3.3 billion, but it is an improvement of JPY 10.1 billion compared to the loss in the prior year.

Growth of Fujitsu Uvance was faster than anticipated and large-scale sales of software supporting modernization drove revenue growth. We are currently in a phase of making aggressive growth investments, but in addition to the impact of higher revenue, profitability is also steadily improving, which resulted in a large decline in losses.

In Regions (Japan), revenue from continuing operations was JPY 886.3 billion, up 12.2% year-on-year. The adjusted operating profit was JPY 122.8 billion, an increase of JPY 49.6 billion. DX business deals and upgrades of mission-critical systems are increasing in a wide range of sectors, primarily in the public and health care sectors. In addition to the impact of higher revenue, we made steady progress in improving profitability.

In Regions (International), operating profit was JPY 444.5 billion, up 7.5% -- revenue was JPY 445.6 billion, up 7.5% against the backdrop of expansion at Fujitsu Uvance and the impact of foreign exchange movement.

On an adjusted basis, the subsegment posted an operating loss of JPY 3.2 billion, a reduction in loss by JPY 2.1 billion from the previous year. In terms of profitability, conditions continue to be difficult, primarily in Europe. We will steadily transform our business portfolio to accelerate improvements in our profitability.

On Page 14, I will now explain about the performance of segments besides Service Solutions. First is Hardware Solutions. Revenue for the first 9 months of fiscal 2023 was JPY 748 billion, decreases of 6% year-on-year. The adjusted operating profit was JPY 37.1 billion, down JPY 19.7 billion year-on-year.

In system products, revenue increased largely due to foreign exchange movements. On the other hand, in network products, there was a large pullback from the strong demand of the previous year in both Japan and the Americas, resulting in a significant drop in revenue.

Whereas sales are decreasing due to the large-scale demand cycle, we are expanding our development investments for the next growth cycle for network products this fiscal year. This includes investments to achieve high-speed, high-capacity, low-latency and low-energy consumption networks.

On the bottom of the slide, you can see Ubiquitous Solutions. Revenue was JPY 197.5 billion, down 3.2% year-on-year. Adjusted operating profit was JPY 16.7 billion, up sharply by JPY 10.9 billion year-on-year.

Regarding the higher component costs, including the impact of foreign exchange movements, we are advancing efforts to cut costs and pass on higher costs to customers, and we are steadily increasing our resilience to changes in the external environment.

Page 15, Device Solutions. Revenue was JPY 212.4 billion, down a massive 30.2% year-on-year. Adjusted operating profit was JPY 12.7 billion, down JPY 58.2 billion year-on-year. Demand for semiconductor packaging, which has been very strong through the first half of the prior year, significantly decreased in the second half of the year. In this year's Q3, the decline seems to have ended, but demand continues to be weak.

In addition to lower capacity utilization from lower product unit volumes, there was a significant decrease in operating profit. We anticipate a recovery towards fiscal 2024, but current conditions in the segment remain severe.

At the bottom, there is Inter-segment Elimination and Corporate. This segment posted an operating loss of JPY 64.1 billion with a JPY 27.7 billion increase in expenses year-on-year. We continue to expand our investments in medium- to long-term business growth, including enhancing advanced research in cutting-edge areas such as AI, quantum computing and energy-saving processors and promoting the One Fujitsu program for strengthening our management foundation as well as enhanced global security.

Page 16. Here, I would like to describe our initiatives to transform our business structure.

Page 17. First, I will describe our initiatives in the Regions (International). We are accelerating the shift in our business portfolio to improve profitability. Our first focus is the growth in Fujitsu Uvance. The ratio of revenues in Regions (International) increased from 20% in fiscal '22 to 25% in the first 9 months of fiscal '23. Our goal is to increase the revenue from Fujitsu Uvance to 45% of the total revenue by the end of fiscal '25.

Our second focus is to consolidate our business mainly on Fujitsu Uvance. To this end, we have strategically reformed our Service business.

In Germany, we carved out low-margin existing businesses, such as private cloud business and on-premises managed services. As a result, we recorded a onetime loss of approximately JPY 30 billion as part of our adjusted items for the third quarter. The loss expected from this business in fiscal '23 is nearly JPY 10 billion, but losses are expected to be eliminated starting from next fiscal year as a result of the carve-outs.

Next is Page 18. I will explain about our ongoing initiatives in Hardware Solutions. In April 2024, we will launch Fsas Technologies, Inc., a dedicated company for servers and storage solutions. Fsas Technologies will integrate product development, manufacturing, sales and maintenance functions to build an integrated entity, accelerating management decision-making and pursuing thorough improvement of business efficiency to provide comprehensive added-value solutions with advanced technologies.

The establishment of Fsas Technologies did not have direct impact on consolidated financial results. Moving forward, we will achieve improved outcomes by streamlining the business.

Page 19. This is Ubiquitous Solutions. The Client Computing Devices or CCD unit in Europe, which has been facing severe competition and difficulties in maintaining profitability, will be shut down with a target of April '24. As a result of exiting that business, we recorded a onetime loss of approximately JPY 20 billion recorded as adjusted items to operating profit in the third quarter.

The expected loss from this business in fiscal '23 is expected to be roughly JPY 5 billion. Regarding CCD business, we are planning to redirect our focus on business in Japan.

Page 20, Device Solutions. We concluded the transfer agreement of shares in Shinko Electric. This sale is scheduled to take place in fiscal '24 after various examination and a tender offer. Although this will not impact the consolidated financial results for fiscal '23, in fiscal '24, we expect to record a onetime gain of approximately JPY 150 billion from discontinued operations.

In addition, Shinko Electric's annual financial results for fiscal '23 are projected to be sales of JPY 230 billion and operating profit of JPY 35 billion. Of this, we anticipate that JPY 12 billion of Shinko Electric's net income will apply to Fujitsu, the parent company.

Page 21. Of the transformations described so far, a onetime loss of approximately JPY 30 billion from the sale of private cloud business in Germany and a onetime loss of approximately JPY 20 billion from exiting the CCD business in Europe, were major items that were recorded as adjusted items from GAAP operating profit in the third quarter. We will continue to steadily work on reviewing our business portfolio and transforming our business structure to achieve sustainable growth in our corporate value.

Page 22. This page shows the status of cash flows and status of assets, liabilities and equity.

Page 23. Core free cash flow, which excludes onetime expenses, was JPY 75 billion, up JPY 39.2 billion from the previous year. In addition to the increase in accounts receivables, progress has been made in the contraction of inventories, which increased during the previous year and working capital has improved.

Page 24. Core free cash flow and adjusted items from GAAP free cash flow. The breakdown is as shown on this page. As I mentioned previously, in Regions (International), we anticipate an impact of cash flow from the sale of private cloud computing business in Germany and exiting of CCD business in Europe to come after fourth quarter.

At the bottom of the page is free cash flow, which was JPY 69.5 billion, an increase in JPY 19.8 billion from the previous year.

Page 25 shows the status of our assets, liabilities and equity, but I will omit an explanation of these figures.

This concludes my summary of the financial results from the cumulative 9 months of fiscal '23. Although each segment had its strength and weaknesses in terms of performance, we are still progressing in line with our forecast. In Service Solutions, the strong pipeline of orders and business deals, primarily in Japan, is in the first half of the fiscal year continued into the third quarter, in line with our forecasts. Against this backdrop, we believe that we can fully anticipate strong growth past the fourth quarter as well.

In addition, in Hardware Solutions and Device Solutions, demand continues to be low, but it is within what we had expected. We will continue to make solid progress, including further business efficiency improvements.

I would like to take this opportunity to offer a comment regarding the ongoing inquiry into the U.K. Post Office Horizon system, which has been covered widely in the news reports and media globally since the beginning of the year.

First and foremost, on behalf of Fujitsu Group, I would like to convey our deepest apologies to the sub-postmasters and their families and reiterate that we regard this matter with utmost seriousness.

Our company's U.K. subsidiary has been cooperating fully with the ongoing U.K. statutory inquiry, which has been investigating complex events that have unfolded over many years. And going forward, we remain fully committed to offering our complete support and cooperation.

I would like to emphasize that our global Board of Directors is maintaining strict supervision over the matter, including handling of ongoing inquiry. It is our hope that inquiry allows for a swift resolution that ensures a just outcome for the victims. Thank you. Now I will continue with my explanation of our financial results. I will explain our financial forecast for full year on the following pages.

Page 27. This is the financial forecast for fiscal '23. We are projecting revenue of JPY 3.810 trillion, adjusted operating profit of JPY 320 billion and adjusted profit for the year of JPY 208 billion. There has been no change to these forecasts.

Page 28. As you can see, there have also not been any changes in our forecast by segment.

Page 29 shows our forecast for the fourth quarter. The only segment I will briefly touch upon is Service Solutions. The 9-month cumulative adjusted operating profit is JPY 116.3 billion, an increase of JPY 61.8 billion from the previous year. Our forecast for the segment's fourth quarter adjusted operating profit is JPY 138.6 billion, an anticipated increase of JPY 30.1 billion from the previous year. Although the trend of profit being skewed toward the fourth quarter remains, the progress made during the 9 cumulative months of fiscal '23 was better than the previous fiscal year. We believe that we will achieve the target through ensuring that high levels of order backlogs are converted into sales. This concludes our forecast for adjusted operating profit.

Page 30. I will explain the adjusted consolidated results and adjusted items on this page. First, the 9-month cumulative results on the left. The second item on the column is operating profit. From the left is adjusted operating profit was JPY 118.8 billion in adjusted items, there was a onetime loss of JPY 70.7 billion from the transformation activities and the total of these is the profit for the year before adjustments.

Next is the forecast for fiscal '23 on the right. The adjusted operating profit is projected to be JPY 320 billion and adjusted profit for the year is JPY 208 billion. As I explained earlier, these remain unchanged from our previous forecast.

Adjustments to operating profit results in a loss of JPY 70 billion in the results through the third quarter, but we plan for further transformation activities in the fourth quarter to offset this onetime loss. We expect that adjusted profit for the year will remain at previous forecast level of JPY 208 billion.

Page 31. We forecast core free cash flow of JPY 215 billion. It remains unchanged from our previous forecast.

Next, I will explain bringing down the investment unit price through a stock split.

Page 33. Today, Fujitsu decided to carry out a 1:10 stock split effective April 1, 2024. The purpose of stock split is to improve share liquidity and further expand the investor base through bringing down the investment unit price. Through this, investment price per share will be lowered from current price of approximately JPY 2 million to approximately JPY 200,000. For details regarding this, please see the timely disclosure announced today. We will continue to implement financial measures while keeping in mind the perspective of the capital market.

This concludes my presentation on our consolidated financial results for the first 9 months of fiscal '23 and the full year financial forecast for fiscal '23.

[Statements in English on this transcript were spoken by an interpreter present on the live call.]