Exchange Income Corp

TSX:EIF

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

Abbvie Inc

NYSE:ABBV

|

Biotechnology

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Realty Income Corp

NYSE:O

|

Real Estate

|

| US |

|

Walt Disney Co

NYSE:DIS

|

Media

|

| US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

Technology

|

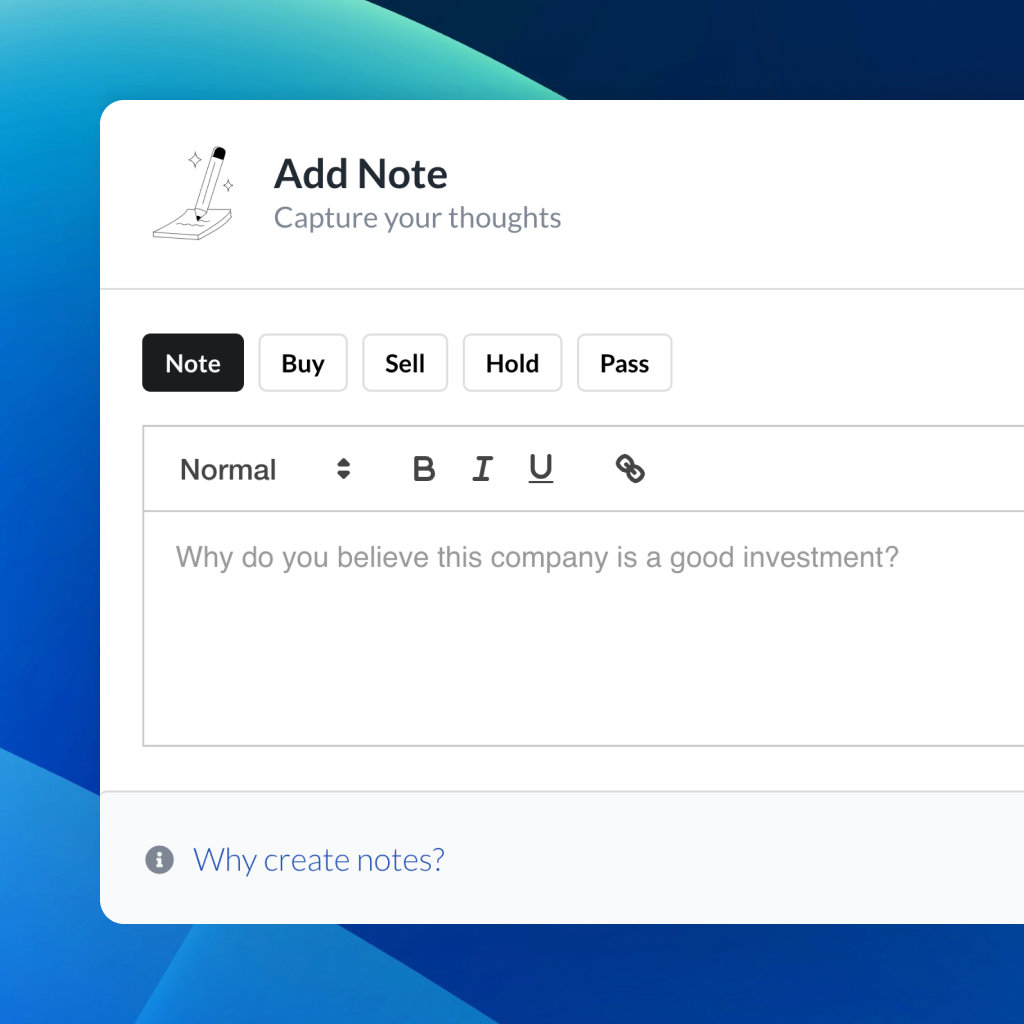

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

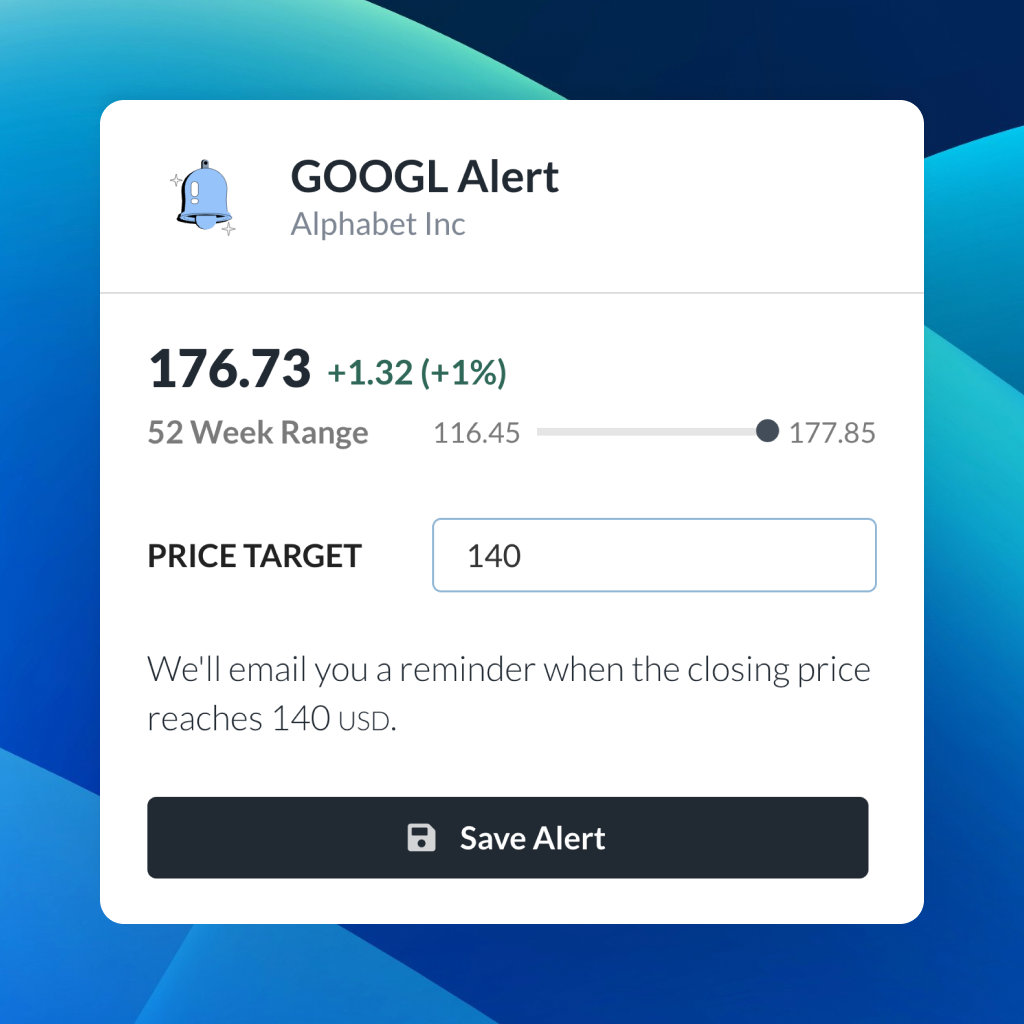

| 52 Week Range |

42.3007

51.39

|

| Price Target |

|

We'll email you a reminder when the closing price reaches CAD.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

Abbvie Inc

NYSE:ABBV

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Realty Income Corp

NYSE:O

|

US |

|

Walt Disney Co

NYSE:DIS

|

US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

US |

This alert will be permanently deleted.

Exchange Income Corp

Exchange Income Corp

You don't have any saved screeners yet

You don't have any saved screeners yet

Good morning, everyone. Welcome to the Exchange Income Corporation's Conference Call to discuss the Financial Results for the 3 months ended March 31, 2024.The Corporation's results, including the MD&A and financial statements were issued on May 7, 2024, and are currently available via the company's website on SEDAR+.Before turning the call over to management, listeners are cautioned that today's presentation and the responses to questions may contain forward-looking statements within the meaning of the safe harbor provisions of Canadian provincial securities laws. Forward-looking statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. For additional information about factors that may cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements, please consult the quarterly and annual MD&A, the Risk Factors sections of the Annual Information Form and EIC's other filings and Canadian securities regulators. Except as required by Canadian securities law, EIC does not undertake to update any forward-looking statements such as statements speaks only as of the date made.Listeners are also reminded that today's call is being recorded and broadcast live via the Internet for the benefit of individual shareholders, analysts and other interested parties.And I would like to turn the call over to the CEO of Exchange Income Corporation, Mike Pyle. Please go ahead, sir.

Thank you, operator. Good morning, everyone, and thank you for joining us on today's call.Yesterday was the 20th anniversary of our IPO and the completion of our first acquisition of Perimeter. And I will talk about the history of EIC and what makes us successful shortly. Yesterday, we also released our first quarter results for 2024. In announcing our results, we reported several records for our first quarter financial results, and this set the foundation for the remainder of the year. We set records for revenue, adjusted EBITDA, free cash flow and free cash flow less maintenance capital expenditures. Subsequent to the quarter end, we also completed the extension and upsize of our Corporation's credit facility to CAD 2.2 billion, which includes a new CAD 200 million social loan tranche. The social loan is one of the first syndicated social loans in Canada and is in alignment with the social loans principally established globally. This was a great achievement by Rich and his team as this provides us with significant liquidity to fuel our growth, whether via organic growth or acquisition, which I will touch on later in today's call.Our results demonstrate the success of our strategy. Firstly, we buy proven companies with excellent management teams. Secondly, we invest in those companies and nurture their growth. And lastly, in doing so, we can provide stable and growing dividends for our shareholders. This strategy has been the blueprint for our success for the past 20 years and is even more relevant today. The secret sauce is the disciplined nature of our acquisitions and investments in growth capital in our businesses and operational execution by our underlying subsidiaries. EIC preserves the cultures in our acquired entities and creates an environment where their management and employees can thrive.With me today is Richard Wowryk, our CFO, who will speak to our financial results; and Carmele Peter, our President, who will expand on our outlook for the second quarter and beyond. I will limit my discussion to some of the key consolidated performance indicators, and Rich will delve into the results by segment and provide some further insights on our financial performance.For our first quarter, revenue increased 14% to CAD 602 million. Adjusted EBITDA also increased by 14% to CAD 111 million. Net earnings were CAD 5 million compared to the prior year of CAD 7 million. Net earnings per share were CAD 0.10 per share compared to $0.16 in the prior year. Free cash flow less maintenance capital expenditures grew by CAD 4 million or 19% and to CAD 23 million. Adjusted net earnings were CAD 10 million compared to CAD 12 million in the prior period, and adjusted net earnings per share were CAD 0.20 compared to CAD 0.27. The payout ratio on our free cash flow less maintenance capital expenditure basis remained very strong from a historical perspective at 58% even with 3 dividend increases in the last 20 months.We are very pleased with these results, and they show the resiliency and the diversification of our business model. The main contributor to the results was the continued investment and resulting growth in our operating subsidiaries. 2023 was a year characterized by several announcements of acquisitions and contractual wins, whether it was our BC and Manitoba medevac wins, our U.K. Home Office contract for our Air Canada commercial agreement. Speaking of the Air Canada contract, we anticipate the expansion of this contract with additional routes, which will bring the total aircraft used for Air Canada from 4 to 6 by the end of 2024. We remain hopeful of the prospects being able to announce further contracts and acquisitions in the second quarter and throughout the remainder of 2024. The positive momentum achieved in 2023 is expected to continue into 2024.Let me delve into some of the opportunities that we are currently seeing. However, to be clear, we have not included any acquisitions or significant contract wins in our 2024 forecast. As discussed in last year's financial reports, contractual wins require upfront investment in capital and do take time to achieve the appropriate returns on this invested capital. There is a ramp-up period required before those investments start hitting the bottom line as opposed to acquisitions where the acquisitions are immediately accretive to the bottom line, of course, excluding any seasonality.Firstly, on the acquisition front, Adam and his team are working on a number of pursuits. In our year-end call, I mentioned that we are seeing more high-quality opportunities that has continued throughout the quarter. We are seeing these opportunities in both the manufacturing and aerospace and aviation segments. But consistent with our 20-year history, we will only execute on transactions that are both accretive and meet other qualitative acquisition criteria. Current opportunities are focused in manufacturing and aviation segments where we are already present and represent vertical, geographic or other expansion opportunities. On the contractual opportunities, our teams are waiting the resolution to submitted bids on a number of fronts. We remain optimistic. However, there is always uncertainty in the award of contracts by governments. The first contract relates to the future Air trading contracts. Skyline was named as the preferred bidder last year, and we were part of the Skyline bid team. The contract has not been formally awarded to the Prime. However, we remain hopeful that announcement will occur in the next number of months. We also submitted our proposal to the U.K. Home Office for the continuation and expansion of the services that we are currently performing. The existing contract will continue until November of this year. The strategic decision to procure a second aircraft that we've started to modify to support the U.K. Home Office contract should we win. However, we believe that based on the geopolitical situation, such aircraft could easily redeployed to other opportunities should we not be successful as the incumbent. We would anticipate hearing about the final award of the latter part of the second quarter or perhaps early in the third quarter.The third opportunity that I wanted to mention is the Newfoundland Fixed Wing Medevac Contract. In partnership with a strategic partner, we have submitted our collective proposal to the government of Newfoundland. Our proposed services would be for the operation of up to 6 Medevac aircraft in the province. We believe we are 1 of 2 proponents to bid on the contract and hope to hear the result of our bid during this second quarter.Lastly, we are seeing significant interest around the world for our aerospace services. We see large opportunities in Australia, Europe and expanded opportunities in Canada. We are very bullish about future opportunities, and these contracts are right in line with our EIC core capabilities and business model as they generate consistent cash flows throughout the term of the agreement. We brought our analysts to visit our aerospace operations in Newfoundland in April. And I think everyone left with the same view that we are a leader both in Canada and around the world with our capabilities. These opportunities are why we upsized and extended the credit facility are so important to us. It provides us the liquidity for significant capital expenditures to fund these hopeful contractual wins along with Adam and his team providing dry powder to them to execute on acquisitions.The social loan component of the credit facility is a new addition for us. That loan will be used exclusively to fund the acquisition of the King Air aircraft, which are being purchased with the BC Medevac contract. These new aircraft have improved performance characteristics, lower fuel burn and provide an essential service to BC's northern rural and indigenous communities. In order to define it as a social loan, Rich and his team did have to provide evidence to a third party to a test that we met these social loan criteria. This provides further recognition that the essential services of our aviation entities provide across Canada.Carmele will focus on the outlook for our segments for the second quarter. But firstly, I wanted to reiterate our guidance for 2024. We confirmed that adjusted EBITDA in the range of CAD 600 million to CAD 635 million. Our Q1 has set the foundation for the remainder of the year, and we are poised to continue to realize on the growth investments made in previous periods and continue throughout this year. We're excited about our future and intend to keep doing what we are doing because it works.I will now hand off the call to Richard, who will detail the first quarter results.

Thank you, Mike, and good morning, everyone.Revenue, adjusted EBITDA, free cash flow and free cash flow less maintenance capital expenditures were all first quarter high watermarks. Mike spoke about our key financial metrics, and I would delve into the segmented results and the remainder of the financial statements.Revenue in our Aerospace and Aviation segment increased by CAD 43 million or 13% to CAD 369 million. Adjusted EBITDA increased by CAD 20 million or 27% to CAD 94 million. The results in margin expansion were across all business lines. Looking at our Central Air Services business line, the improvements were driven by 4 key factors. First, previously, [Technical Difficulty] organic growth, capital expenditures in the aviation business over the past number of years. Secondly, our average load factors improved, which is a direct improvement on adjusted EBITDA. Third, the impact of routes flown on behalf of Air Canada; and fourth, the impact of the BC and Manitoba medevac contracts, which have not been fully implemented at this point. Our aerospace business line revenues increased over the prior period, while adjusted EBITDA expanded in an accelerated fashion. This is due to 2 reasons: first, the revenues and invested EBITDA expanded due to the increase of the ISR business, including the impact of the U.K. Home Office contract. This increase was offset by a decline in revenues within our training business powered by the product mix shifted, which resulted in profitability expansion within the training business, even with the revenue declines. This margin expansion in our training business is anticipated to be temporary, however, likely to continue into the second quarter. Lastly, our aircraft sales and leasing business continued to grow as the recent component of that business continue to improve. We are still anticipating that the leasing side will continue its step improvement until it reaches pre-pandemic levels by the end of the year. The growth within this business line and specifically the leasing business resulted in an improvement in the profitability of that business line as leasing margins are much higher than other revenue streams.Revenue in our Manufacturing segment increased by CAD 32 million or 16% to CAD 233 million. Adjusted EBITDA decreased by CAD 5 million or 16% to CAD 27 million. As expected, revenue and EBITDA within the Environmental Access Solutions business line decreased by 35% and 47%, respectively. As previously communicated in our year-end call, the first quarter of the comparative period had a number of seasonal anomalies, the first quarter ended and the second quarter of 2023 experienced an unusual number of rental mass deployed on long linear projects. This is outside the norm and weather factors also impacted year-over-year demand. Milder weather in 2023 required greater mat utilization for projects. However, this winter experienced very low snowfall in drove conditions, which generally lessens demand. Lastly, the prior year comparatives contained an unusual number of mats on rent -- that's right. Lastly, as the prior year contained an unusual number of mats on rent, the impact on adjusted EBITDA was outsized related relative to revenue.Our Multi-Storey Window Solutions business revenue increased by over 70% due to the acquisition of BVGlazing and adjusted EBITDA is up by over 300% due to BVGlazing coupled with improved performance due to increased throughput and increased insulation activities of windows manufactured by our subsidiaries.Lastly, our precision manufacturing and engineering business experienced relatively similar revenues compared to the prior period, while adjusted EBITDA decreased by 19%. The current year includes the financial results from both Hansen and DryAir, which were acquired in October and April and October in the prior year. The Manufacturing segment companies experienced reduced sales primarily driven by customers delaying large capital projects due to macroeconomic uncertainty. Additionally, the relative adjusted EBITDA decline was expected as DryAir experienced significant seasonality as they contribute virtually all of their adjusted EBITDA in the third and fourth quarter and have negative adjusted EBITDA in the first quarter and part way into the second quarter based on historical norms.Adjusted EBITDA margins were higher in the Aerospace and Aviation segment due to 3 factors. First, leasing revenue in Regional One continues its trajectory towards 2019 levels and leasing revenue generates very high adjusted EBITDA margin. Second, Aerospace contributed additional adjusted EBITDA from its own ISR assets, including in the U.K., and this revenue stream also generates higher adjusted EBITDA margin. Finally, our essential air services experienced higher average load factors improving margins over the prior period. Adjusted EBITDA margins were lower in the manufacturing segment for 3 reasons. First, as we expected, Environmental Access Solutions returned to a more normal seasonality, which resulted in a lower number of mats on rent. In the prior period, a large number of mats were rented on a long linear project, these rentals generate much higher margins, and this was abnormal for the first quarter. In addition, drug conditions in Western Canada lessened the need for mandate in certain markets. This decline in rental revenue was offset by increased mat sales in the current period, which generates lower margins. Second, DryAir acquired in the fourth quarter of 2023 generates also adjusted EBITDA in the third and fourth quarters and as we expected, generated negative adjusted EBITDA margins in the first quarter of 2024. Finally, within our precision manufacturing and engineering business line, business was a well slower than the prior period due to certain customers to burn capital spending and the impact of general economic uncertainties.Other items of note during the quarter were that interest costs were higher by approximately CAD 4 million due to increased benchmark borrowing rates compared to the prior period, coupled with increased debt outstanding due to the various growth capital expenditures in the prior year. However, when looking at our payout ratio remains consistent with our year-end ratio and prior quarter ratio of 57% and 58% respectively. Dividends increased by 16% when compared to the prior period. Depreciation on capital assets and amortization of intangible assets were also up due to the growth capital expenditures and acquisition activity in 2023. Lastly, our effective tax rate increased relative to the prior year due to 3 factors: first, being the tax allocation weighting between higher tax jurisdictions. Secondly, the prior period contained a non-taxable contingent consideration gain and lastly, the implementation of new minimum tax regime resulted in additional term taxes.The proportion of our earnings by jurisdiction in any given quarter can have a significant impact on our tax rate, but this is particularly true in the first quarter of the year. In addition, the impact of non-deductible items such as acquisition costs and mats have an outsized impact on our tax rate in our seasonally slowest quarter as we generated our lowest earnings for taxes in this quarter. We would anticipate our effective tax rate to be in the range of 27% to 29% on an annual basis. Free cash flow and free cash flow expenditures increased by 4% and 19%. Free cash flow reached a record CAD 62 million in the first quarter, and free cash flow from capital expenditures increased by CAD 4 million to CAD 23 million, which was also a Q1 record.Lastly, from a working capital perspective, our working capital remained virtually flat with the prior year-end. The non-cash investment in working capital was CAD 19 million and is fully explained by the collection of a large CAD 30 million receivable prior to December 31, 2023, with the corresponding payable settled in the first quarter of this year. This is consistent with the prior year first quarter, which also had a similar transaction. We continue to actively manage our working capital and are proud of the successes amongst our various subsidiaries.As Mike had mentioned, we amended and extended our credit facility. The net result was an increase in our facility to approximately CAD 2.2 billion from approximately CAD 2 billion with an extension in maturity to May 2028. This was achieved with consistent pricing with the prior facility. Included within our new facility is a dedicated CAD 200 million social loan tranche, which will be used to fund the purchase of the new King Air aircraft for the BC Medevac contract. This fortifies our balance sheet and provides us with liquidity of approximately CAD 1.1 billion we utilized and to execute growth capital expenditures and potential acquisitions. The CAD 200 million social loan tranche included within the new facility permits the AC to draw on that portion of the facility as the new aircraft delivered and modified for medical purposes. As Mike mentioned, as part of the transaction, ISS Corporate provided a second-party opinion and concluded the loan is in alignment with the social loan principles as issued by the Loan Market Association. While the social one is new to EIC, it is simply a validation of the work our subsidiaries have been doing since their inception. This loan specifically will fund the purchases for Carson Air's BCEHS contract. We also provide essential medical services from coast to coast to coast in Canada across EIC subsidiaries and have done some for decades. We are proud of the work that our subsidiaries do and to receive recognition of the social benefits that we provide publicly both from our syndicate of lenders who supported the deal and through the second-party opinion was satisfying. I would like to thank our lending syndicate for the support provided to us in both the overall renewal and the social loan tranche specifically, which was over-subscribed and above our expectations.Our total leverage ratio continues to moderate as we continue to generate returns from growth capital expenditures. As previously noted, organic growth results lag between -- sorry, organic growth results result in a lag between the time of the investments are made and when returns become evident through our financial results. During the first quarter, EIC made both capital expenditures of CAD 39 million with capital expenditures primarily related to the Aerospace & Aviation segment and were driven primarily by investment in aircraft. Our Manufacturing segment had negative growth capital expenditures primarily related to the sales from the mating fleet within the Environmental Access Solutions business line. Maintenance capital expenditures for the first quarter were CAD 39 million compared to CAD 41 million in the prior period. In our year-end conference call, we indicated that we anticipate maintenance capital expenditures to increase in line with our adjusted EBITDA. However, there were some maintenance events that fell outside of the first quarter and will be funded in later quarters. Carmele will provide more insight in her outlook.With that being said, I now turn the call over to Carmele.

Thank you, Rich, and good morning.We are very proud of the results we achieved in the first quarter, and our outlook for 2024 is for continued growth driven by the diversification and resilience of our business model and investments we have made in prior periods to build our future.As Mike mentioned, we have reiterated our guidance of 2024 adjusted EBITDA of between CAD 600 million to CAD 635 million. I will focus my comments on our expectations for each of the segments and trends we are seeing. Firstly, our seasonality in the split amongst quarters is discussed in the outlook section of the MD&A. Perhaps a couple of comments on the seasonality that may exist in Q2.Our Environmental Access Solutions business is always impacted by the winter season as we generally see that fewer mats are required to navigate the frozen terrain. However, we did see an anomaly in Q1 of 2023 and partly through Q2 of 2023 as we had a couple of long linear projects in Western Canada where the matting and the rentals continued through the winter months, which is not the norm. We will continue to see that impact when comparing Q2 2024 to the prior year as those mats came off rent partly through the second quarter. The second factor is our most recent acquisition, DryAir, which is also seasonally impacted. It is a hydronic heating company and the vast majority of its revenues are recognized in the third and fourth quarters. As a result, the adjusted EBITDA is negative to breakeven during the first 2 quarters based on historical seasonality. This is the norm for the business and was identified during the due diligence process.We are anticipating a flat to small increase in revenues in our manufacturing segment during the second quarter. We're also anticipating a decline in adjusted EBITDA due to the seasonality factors I just spoke about relating to our Environmental Access Solutions business line and DryAir. All of the businesses within the manufacturing segment are experiencing a strong level of customer inquiries. However, due to macroeconomics, uncertainty with the closing ratio of increase has been below historical trends. We believe that the businesses are primed for growth when some of the uncertainties abate, particularly interest rates.Specifically looking at the underlying business line. As previously noted, we are anticipating a reduction in revenues and adjusted EBITDA in our Environmental Access Solutions business due to the seasonality in the long linear project previously discussed. Furthermore, Western Canada is in the midst of a significant drought to start the spring and that results in reduced mat utilization. We are continuing to monitor the weather during the quarter and have proactively been reviewing our cost structure, capital expenditures and mat fleet. There are a number of opportunities in Western Canada and Eastern Canada for mat rentals and mat sales, and we anticipate normalization of year-over-year comparatives after Q2. However, it's important to note that the adjusted EBITDA run rate is based on projections remain consistent with our original acquisition metrics and remain accretive to the shareholders. Multi-Storey Window Solutions will see moderate growth in Q2 over prior year. The primary driver is the acquisition of BV, which is acquired partway through the comparative quarter. Quoting in Canada and the U.S. continues to be extremely active, but the conversion of those quotes in the backlog is being delayed with uncertain economic conditions and higher interest rates. We remain bullish on this business line as the longer-term fundamentals with drive demand, meaning immigration and lack of affordable housing, remain incredibly strong throughout various regions across Canada and in the U.S. Also later in 2024, we expect to start to see the financial benefit of synergies being captured between Quest and BV.The precision metal and engineering business is expected to be consistent with prior year. Although DryAir does not have a comparative for Q2, the seasonality of DryAir's business causes its revenue and its profits to be concentrated in Q3 and Q4. Similar to my comments on the Multi-Storey Windows business line, the precision metal and engineering business line is also very active from an interest in quoting perspective.Our essential air service business will see significant growth driven by a multitude of factors compared to the prior period. These include the full quarter deployment of 4 Q400s to provide service under our agreement with Air Canada with an additional 2 aircraft being added by the end of the year. We also expect to continue to see enhanced load factors and growth when compared to 2023 due to our investments in aircraft throughout our operations. Lastly, we expect continued growth in the Medevac business with both the 10-year BC and Medevac contract continuing to contribute to financial results in the quarter. As a reminder, the BC Medevac contract returns are expected to be muted until we redeploy the existing aircraft being used to service the contracts in the interim. Offsetting some of these gains is the impact of the continued labor shortages and supply chain challenges. Although we are not seeing a worsening of these dynamics, and in fact, we are seeing stabilization of these related costs, the challenges still remain.The Aerospace business line is also expected to have adjusted EBITDA growth in Q2, primarily driven by the full engagement of course multiplier doing maritime surveillance work for the U.K. Home Office, which started operations in May of 2023, and the product mix shift in our training business, which will result in higher margins in that business for Q2 this year comparatively to last year. Our aircraft sales and leasing business is also expected to experience growth when comparing to 2023 comparatives. This anticipated growth is driven primarily by increases in leasing revenue. Although we are still off pre-pandemic levels, we expect Q2 to continue to build upon the positive momentum we experienced in the first quarter. We anticipate the leasing portfolio to continue its recovery through the latter part of 2024.With respect to maintenance capital expenditures for Q2, we anticipate levels being higher than last Q2. Overall, we expect maintenance capital expenditures to increase roughly consistent with increases in adjusted EBITDA. Higher flight hours to support increased volumes together with inflation, labor shortages, supply chain issues, growing fleet size and acquisitions are some of the factors contributing to the expected relative percent increase. Growth investments in Q2 were primarily for the Aerospace and Aviation segment and include the upgrade of the second surveillance aircraft for the renewed Curacao contract, the first being completed, the continued construction of the Gary Filmon Indigenous Terminal, investments in aircraft for the BC Medevac contract and additional aircraft to support the Air Canada commercial agreement and continued construction for the King Air simulator. Also Regional One is working on some opportunistic aircraft and engine acquisitions, which may result in growth investments being made in aircraft sales and leasing business.As Mike highlighted, our acquisition pipeline continues to be very strong with liquidity on hand, EIC will continue to be active in the acquisition market. Overall, we remain confident that we are on track with our 2024 adjusted EBITDA guidance. This confidence is underpinned by the essential nature of our businesses. The fact that a significant portion of our revenues are backed by long-term contractual arrangements, the growing need for aerospace solutions, the recovery of our aircraft leasing business and the investments we have made in prior periods for future growth.Thank you for your time this morning, and we would now like to open the call for questions. Operator?

Thank you. [Operator Instructions] And your first question will be from Steven Hansen at Raymond James.

It sounds like on the matting business, it sounds like we're going to see a few continued headwinds into Q2, but then we should baseline out. Is that the way to think about it, Mike, from a sort of a seasonality standpoint? Like do you expect any further downside? Or is there room for more downside?

I mean, you don't have a perfect set of goggles into the future. But no, we think Q2 is kind of when the inflated comps go away. We've struggled a bit with particularly at the end of Q1, beginning of Q2, which is how dry it is in some of our territories, which limits the need for matting. We're starting to see the impact of [indiscernible] with the big rainstorm Alberta had, early Southern Alberta had. And so with a return to normalcy on that front. And then, quite frankly, Steve, we're very bullish on Eastern Canada starting later in 2024 and beyond. Both Hydro One and Hydro-Quebec have announced very ambitious distribution line maintenance and upgrade programs, which drive our business. And so we're really quite bullish that we may see a return in future periods, the kind of '21 and '22 performance where we actually generated a bigger percentage of our revenue in Eastern Canada than Western Canada.

And just maybe just sticking on the manufacturing side, again, it sounds like on the precision side, understandable that the dryer is more seasonal. But even underneath that, some of the core businesses have had some slowdown. Is there any sense for, again, whether that's a trend we're seeing. You described some slower project delivery or deferred capital projects. But how do you think about that through the back half of the year?

I think we started to have a in quotation marks normal volumes through that period. Our bidding remains quite high. The closing rate is slightly lower. And I think it's because guys are reticent to pull the trigger. We keep getting these false starts on interest rates coming down. I think you're going to see a cascading of things without actually changes, not because a quarter of a point makes that much difference to the viability of a project, but more so just the sentiment will make a difference.

And the other thing is I just want to make it clear, we're not losing any work. This is work that's just simply not coming to fruition. And I think if you start seeing interest rates coming down, that will be helpful. I think also the U.S. election, and we've seen this trend before. We're building up to an election. You tend to have larger projects just put on hold until that occurs and then kind of letting of those capital projects. So from our perspective, it's more timing than whether these things are going to -- whether the projects are going to be let. So we're hopeful towards the back end of the year.

Next question will be from Cameron Doerksen at National Bank Financial.

I just wanted to get an idea on the growth CapEx sort of cadence for the remainder of the year. I mean, obviously, you're still making the investments here in the medevac fleet. And then you as a few other things you've highlighted in the MD&A. But just kind of want to understand sort of over the next several quarters, what we should expect from a growth CapEx perspective.

Sure. Well, we look at the 2 medevac contracts, Dave White and his team have largely made all the investments for the Manitoba marketplace. We own all the aircraft. The turbo pops are flying and the jets were just finalizing the medical interiors and they'll be flying towards the end of the summer. So not much left to go there. The BC medevac of that contract is a little slower than we had anticipated. Textron isn't quite hitting their delivery promises. So it's extended out the CapEx on that. I would probably see the balance of that contract being invested kind of over the next 4 quarters, potentially could stick in a little bit into Q2 2025, but most of it should be done by the end of Q1 of next year. The simulator project is well underway. We have vision most of that being done in the current year, maybe a little bit in Q1 of next year. And same with Gary Filmon Terminal, we're super ecstatic that the new portion of it is going to open during the very beginning of Q3. And that's a real passion project for us at EIC. We've more of tripled the size of our terminal for our First Nations customers here in Winnipeg and the buildings were built with our partners within DIC. We're going to be the first airline with Quest windows in it. So we can't wait to show that off later this year.In terms of other major projects, they would tend to be more ad hoc. It's really hard for me to predict what Hank and the team are going to find something at Regional One. There's nothing really scheduled at this point on that. So what we've got going forward in CapEx, co-CapEx is for us relatively modest other than the BC contract. We've probably got 3 quarters of that left to go.

And the other kind of 2 that are not material and global sense of what we spend on growth CapEx. But the Curacao upgrades that will continue throughout the year. We also have a second aircraft Q400 that we want to acquire later in the year for the Air Canada contract. We're acquiring one and that's the second one, the first one in Q2. The Carson-BC contract, my guess is that might slip a little -- I'm probably not as optimistic as Mike on the manufacturer end of things. I think you'll actually see that probably trend-out towards end of 2025 as far as kind of the total spend in that regard. And then we've got bids in, as Mike spoke about in his comments that if we're successful, we'll also see some capital expenditures, for instance, the Newfoundland Medevac contract in the U.K. Home Office bid, where we have a second aircraft that we're working on to support either that contract or other opportunities throughout the world.

Both of those that Carmele mentioned are pure new revenue for us, the BC contract where we won, we had part of it. But like the Manitoba medevac contract, where we didn't have any of that work before, we really don't have any material portion of 6 aircraft in Newfoundland. And the U.K., should we win that the second aircraft will be more than doubling the flying we're doing with the existing first aircraft.

Right. Okay. So lots going on there, but all the investments are supporting growth or future growth. So that's good. Just maybe 1 very quick additional thing from me. Just on Regional One. I mean we've seen the leasing revenue continue to trend pretty positively. I mean, you're sounding pretty bullish that we'll have kind of a full recovery by end of the year. I guess, could you just talk about, I guess, the visibility you have on the leasing side of the Regional One business on getting kind of back to pre-pandemic levels?

Yes. The pilot crisis hasn't gone away, but it's gotten much better. And demand in the general aviation space has sort of normalized. And so what that's resulted in is airlines are now trying to put the right plane in the right place as opposed to a plane in the right place. And so the demand for our regional jets is increasing. We see a lot of change in various airlines fleets, whether it's plans that some of the U.S. carriers have to switch from CRJs to ERJs or taking existing CRJs and reducing the number of seats on them and making them a more business-friendly airplane. So we see increased demand. We're in constant conversation, not just in North America, but in Europe and to a growing extent in Africa. The engine leasing has accelerated very quickly. And part of the reason we're confident about the continuing trend in the leasing is because we have contracts for things that are starting in addition to what's already out. The beauty of leasing is that once it's out, it's out, whereas each time you sell a park, you've got to find another sale to stay in the same place. So it's slightly easier to predict a big black swan events like the pandemic was.The other thing I'd like to point out there, Carmele relates to that is, I said on a number of times that we expect to get to pre-pandemic levels. We're not happy with that. We've made other investments, and we intend by the end of this year and into next year to see us grow past 2019 levels. We use 2019 levels as kind of a benchmark or a rule of thumb, but we see growth beyond that. This is the most bullish we've been on Regional One's business since the mid-teens when we made a big investment in assets that we're very comfortable with our position, the aircraft we have and where the airlines are going with it. It's really the arbitrage created by 1 airline changing at another airline extending that lets us step in the middle and make money, and we're excited about that with respect to Regional One.

Next question will be from James McGarragle at RBC Capital Markets.

So just on the commentary Carmele made regarding some of the returns not being fully utilized on the medevac contracts until some of those aircraft are redeployed. I'm just trying to think about how we should be thinking about the margin impact on the Aviation segment here. And again, I don't want to get too far ahead of myself here, but 2025 consensus is kind of in and around that CAD 695 million level. Should we be now kind of anticipating a bigger step down in margin in '25 and then a further recovery in 2026. I just want to put some numbers around that commentary.

Yeah. No, I wouldn't be stepping anything down. It's more about the full return. When we talk about returns, everything we do is based on our investments and how many dollars are left after maintenance CapEx or a return on that investment. And because we had some of the BC medevac work, we've replaced all the aircraft. So our return on the work we already had isn't as high because we were already getting paid for part of it with the old aircraft, but we have the old aircraft. And I can tell you, the opportunities for them are quite good, just as an example, not suggesting that this is the only place where we might put them, but the Northwest territories is just put out an RFP for aircraft and the aircraft that would be coming from Carson Air would be suitable for that. So we'd be able to pick up a new contract with virtually no capital investment. And so it's redeploying those to add additional investment. When you're looking at margins, you're looking at a return on sales, which isn't impacted by this. It's the return on capital we're talking about, which gives us the opportunity for further accretion out of that investment.

And then on the surveillance deals, I saw you made a purchase of an aircraft to assist with the U.K. Home Office contract bid. So this is kind of a 2 part. I guess, did you guys typically purchase aircraft before you have won contracts? And then as a follow-up, you mentioned that is easy to redeploy this aircraft if you weren't successful. Is there any other types of opportunities you're working on there that you didn't flag in the release that you can provide some color on.

So in answer to your first question, do we normally buy the assets before we win, I would say this is definitely an anomaly as it relates to that. And the decision is driven by 2 things. One is the time line to get the second plane up and running is very short. And we don't want to disappoint the customer. We are the incumbent. And so we are cautiously optimistic. We don't know. There is an RFP process. We're bidding against other people. So I can't provide any certainty that we're going to witness, but we are cautiously optimistic because we're the incumbent and we don't want to drop the ball. But the second half of it, and perhaps equal equal importance is the fact that we're in discussions with other European countries. The issue about border security is not lessening, it's accelerating. We've seen even in the short period of time we've been with the U.K. Home Office that our surveillance has changed how people are sneaking into the country. They're coming from different places, creating different challenges for the government there. And what U.K. is going through is no difference than what France is dealing with or Spain is dealing with or Greece is dealing with, they're all slightly different in how they need to police it. And so basically, we're putting ourselves in the position where when we bought the Force Multiplier a number of years ago, we said there is going to be short-term demand in the world that we want to be the guys that could step into. Britain has been the exact example of how that model is supposed to work. That plane has been fully deployed. Quite frankly, if we win, that plane is not going to come back. That plane is going to be permanently put on that. So in addition to the second plane that we bought already, it's highly likely you'll see us buying 1 or 2 more to replace them as our short-term rental alternatives. And so it's really part of a more comprehensive strategy. The decision to do at this moment was driven by the U.K. opportunity, but it's a much bigger universe than that.

And the interest is not just in Europe, I mean, Canada, for instance, I mean, we're flying at very high tempo our DFO aircraft, so potential opportunities there. Australia, there's opportunities that we spoke about in the past in that region. So I guess it's a state or a world environment right now, but there's lots of areas that could use this type of capability. And so that's why we weren't hesitant at all to invest the dollars and advance the contract to ensure that we're able to seize these opportunities.

One last comment just before we leave this. The challenge is that depending on which equipment we're putting it on and we use the term surveillance aircraft like it's homogenous, and that's really not true. There's a lot of options. You have planes as inexpensive as CAD 40 million or CAD 50 million or as expense of us, what a UA north of CAD 200 million. So depending on what sense of equipment you want. But even in the most basic configuration, you're talking close to a year to build those. If you've got the aircraft and you've ordered the parts, it will take you about a year to put it together. So we got to be ahead of the curve, not behind it.

Next question will be from Krista Friesen at CIBC.

I was just wondering on the Air Canada contract. Obviously, great news that you have another aircraft added there. What are the conversations like now? You guys have been a great partner for them so far. Are there conversations of being able to increase that further? What's going on there?

One of the things we've been talking about with Air Canada, to-date, all of our work for them has been purely domestic in the Maritimes area. They've asked us to look at routes out of Halifax, so the same hub, same thing, but into the Northern U.S., which is a new thing for any of our airlines. We've never flown cross-border on a scheduled basis. And so you can see in Air Canada's scheduling later in the year, we will start flying into a couple of centers for them. Our relationship with Air Canada is remarkably good. Them taking the option on the next 2 aircraft, I think, is testament to that. And we believe that there's opportunity if we continue to execute the way we have to do more in that region. And I want to be clear here. Our strategy was the stuff centered in the Maritimes and Halifax in particular, where we have a base. It's consistent with our strategy and it's consistent with our aircraft type. So while I'm not in a position to say what [indiscernible] to do in the future, there will be discussions about other opportunities with them, assuming we continue to execute like we have on the first 4 as the remaining 2 go into service throughout the balance of the year.

And then maybe just on the matting side. We talked a lot about the kind of the environmental impact right now. Can you just comment on what's going on in the industry in terms of supply and pricing and what you're seeing there?

In Western Canada, because of the dryness, there's more supply that is required. Pricing has stayed reasonably consistent. It really hasn't changed a whole lot. There's stuff that's going to happen in the oil patch and there's a large number of people tend to think of pipelines as the massive ones like we just completed with Trans Mountain and those kinds of things. But there's a lot of smaller pipelines of the oil fields into the bigger pipelines, and there's a bunch of that work that's imminent. And so even the long-end of the short term or the medium term looks quite good, particularly as soon as we see a little normalization of weather, it's been so dry. And with the forest fires, there weren't really forest fires, thunder fires we've had in Alberta last year. The number of stuff has been delayed or done without mats. That will normalize as we go through [indiscernible]. And then when you get into the back end of the year and into 2025, the stuff that's going on in Quebec and Ontario is very bullish. We've talked about potentially increasing our ability to distribute there and creating a bigger infrastructure, and we're actively looking at opportunities for that, not only in Eastern Canada, but quite frankly, in the eastern half of the United States. And so I haven't got anything to tell you about for sure yet, but we're very active in those areas.

Next question will be from Matthew Lee at Canaccord Genuity.

Maybe to start off, just a little bit of update on the additional aircraft being deployed for AC. Can you just give us an idea on the timing of those interim service and what kind of revenue they add to the airline business?

Well, if I was -- like I said, we don't give specifics, and I don't really like giving my competitors exactly what I make. But I think the way I would look at this is the second one will be in service, reasonable. The first of the 2 new ones will be in service very soon and the other one later this year. So by the end of this year, we'll be fully running the 6 aircraft. In terms of the return on the other 2, when they're up and running, I think it's -- what I would do is these are basically CAD 10 million aircraft, give or take, in Canadian dollars. We're pretty clear about what returns we expect. So I would work backwards off of that and then annualize that. Clearly, we're not going to have that in the current year. But when you're looking at for the back end of this year and into 2025, I would just come up with a return of a high single digits, CAD 10 million-ish price of those aircraft.

And then maybe in terms of the manufacturing business as a whole, it sounds like for Q1, the latter margin was due primarily to mat sales mix. But maybe help us understand the other moving parts in the overall manufacturing business and maybe how the margin trajectory looks for the rest of the year?

Well, I think in the short term, I don't think it's a lot changed, it's probably slightly below historical norms, because of the lower rental mats in Northern. As we get to the back end of the year, that normalizes. In the window business while we're seeing an improvement in the results there, it's nowhere near the improvement that's the potential for there as these jobs are left. And so those tend to be at least 12 months out when we get them. So the impact of that on our margins, Matt is probably a 2025 story later in the year next year as we do it. We've actually -- it's one of the most frustrating things in the world when we're not converting some of these things, but we've actually had to hire more engineers and more bidding people to keep-up with all of the opportunities our developers are asking us about. And so I might be on the more bullish end of this of other people. But I think that's a damn when that bursts when 1 or 2 people step out and say we're going, I think there's going to be instantly people worried about a supply issue on the window side. And so I think you see those margins get better next year. I don't think you see a lot of that this year because even if we get new jobs, they're not going to fall into this year. And with the balance of our business, it's pretty status quo. It's slightly softer than it is, but it's almost bang on to what we saw in '20 and '16, where some people held on to the projects with the U.S. Presidential election coming, especially at the business-to-business stuff like big expansions or stainless steel tanks and those kinds of things. Closer to the election, we'll see that go. And then the other -- the last piece of it is to the extent we're exposed to the defense business through bed machine and their business, that is bullish and strengthening. But much like the maritime surveillance businesses, the outlook for that in the medium term is also quite good.

The other thing is DryAir, will assist in margins in Q3 and Q4 as well.

Right. So more specifically, I mean, should we be thinking about 2024 EBITDA margin in manufacturing kind of being like the mid-teens range?

That's probably reasonable. I got to be honest with you, it's not how we look at the business. We look at our business specific and to get product mix stuff. But mid-teens, assuming the rental business is what we think it's going to be in that business, that's probably a reasonable estimate.

Next question will be from Konark Gupta at Scotiabank.

So maybe I can dig into EBITDA a little bit here, Mike, in terms of [indiscernible]. You're guiding 8% to 14% growth for the full year. Q1, you were already at 14%. And several contracts are ramping up over the next 3, 4 quarters. Northern Matt comps are easing, but obviously, you're lapping Hansen in Q2 and DryAir in Q4. Would you expect to sustain this kind of 14% growth in each of the next 3 quarters, would you say? Or would there be some variations?

I mean there's slight seasonal variations. And as you mentioned, the comps change period to period. But we don't -- there's no big leap in a given quarter. So when you're looking at that 14%, we may be slightly higher than that in Q3, Q4, maybe slightly less tight in Q2, but it's fairly straight line over the balance of the year. And then quite frankly, a lot of the stuff we do continues into the next year, like where you see it with Regional One as an example, is that lease thing strengthens, by the time we rolled of Q1 next year, we're going to have 3 more quarters of strengthening to hit next year. And so a lot of this growth -- 14% is not done this year. It rolls organically into 2025.

In DryAir, I understand the seasonality you guys have of that, but don't quite understand why it would be losing money in Q1 and Q2. I mean, I guess it seems like the only subsidiary you have that incurs a loss in a few quarters. Can you explain like why is that cost issue in Q1 and Q2?

Yes, it's really simple. What their built building and selling are heating capability. So we're selling to construction companies and to rental companies. And so they're used for various projects, whether it be replacing a boiler in a place where you need temporary heating or falling the ground and dig something out in the winter. It's project-oriented, and it's almost exclusively utilized in the winter. And so when you get into the end of the winter, which is what Q1 is, the rental companies aren't going to purchase or the construction companies aren't going to purchase new equipment doesn't sit there for the next 6 months until they need it. So the revenue is very seasonal. And I'd point out, it's exactly where we thought it would be. When you look back, I don't have the number in front of me, and I'll get yelled at for guessing. But bottom line is, I think we made CAD 4 million or CAD 5 million in the fourth quarter in this business. And we didn't even have it the whole fourth quarter. And so sell a lot of stuff in the back half of the year. We produce throughout the year, and a lot of our engineering and R&D costs are fixed. And in fact, they may even be front-end weighted because they've got more time to deal with it at that point in the year. So we would buy a business as seasonal as DryAir, if it was as big as our airlines or whatever because that would kick saw our working capital needs all over the place, but it's relatively modest in size. And the aggregate return when you look on it on a 12-month basis is very strong. So it's really just driven by the demand profile of our customers that they really don't want to buy these and then have them sit at their yard for 6 months, they say, okay, we'll take them in July, we'll take them in August, we'll take them in September, so that they're ready to go when the frost comes.

And then last one before I turn it over. Regional One leasing, obviously, you're expecting to rebound here and Q1 was pretty much in line with Q1 of 2019. So that's great. But on the sales side and service side, any incremental opportunities you have today? I think it seems like revenue is pretty stable for now in that business in the sales and service. Last year, you had some big opportunities in Q3, I guess. So any upside here you see in the short term?

Yeah. I would say in the short to medium, the biggest challenge we have in selling parts, quite frankly, in Regional One is not demand, is we've got aircraft to part out and the lineups to get the bid to MROs to disassemble the aircraft. We're actually looking at more creative solutions like parking some of these things at our customers and actually taking the parts off as we need them, consigning them that way. We'll be creative because of that relatively short labor supply, the ability to get the plates taken apart isn't as fast as we'd like it to be. And Pyle, who was supposed to be our ace in the hole out of this with MRO has selfishly got all these maritime surveillance contracts. So our internal capacity that we thought was our backup is busy doing other things. So you'll see that strengthen over-time as we can access more of our own inventory.

I think the other thing to point out is just that like large aircraft and engine sales can vary from period to period. So when you're talking about that wider -- talking about sales and service revenue in totality, when you have kind of the ups and downs of the sales -- the large aircraft sales that can sometimes mask and that was the case in Q1, where we have strong part sales. Part sales are up year-over-year, but kind of fluctuating period-to-period variability in the larger sales make it seem like we're not generating stronger sales on the part side, which we are, which is coming from previous investments we've made into the portfolio of part sales or parts for re-sales.

Next question will be from Tim James at TD Cowen.

I wanted to actually stay on that Regional One topic and specifically parting out aircraft. Is it possible to provide a bit of a sense for -- on a quarterly basis, I guess, how much or the value of parts that are being moved from the fleet into inventory for sales and service. I guess I'm trying to get a sense for how much of the inventory investment that we're seeing is actually not really require any cash because it's just transferring aircraft or parts other than obviously, the MRO cost to tear down the aircraft. But can you give us a bit of a sense of what the flow of value is from the fleet into inventory just or even a range per quarter?

All my guys are pulling up numbers, but I think it's important for people may not understand this as well as you do, Tim, is that when you look at our business model, and I'm going to simplify so people understand that we buy an aircraft that's got green time left. And we make a decision that we're going to lease it out. So we send it over to Tim Airways and he leases it for 2 years. And then we're at a stage where the plane needs a big overhaul. So we decide that it's not worth putting the money back into it, so we part it out. And then so when the plane then will move out of fixed assets and into inventory. And so you've got stuff that goes in and out of our fixed asset category. We're buying new planes to replace a lot that we just used up. And then we move the cost or the net book value of that aircraft into our inventory. And so inventory goes up and down every quarter. And sometimes, it's a massive use of capital and sometimes it's a provider of capital, depending on what we do in that given the period. So cost of sales has a cash cost, but most of what's done would be something we bought in quarters or years previous that we've moved over and become. But the other side of that story is we're going to put something back in fixed assets to replace it because if we don't, we're depleting our long-term ability to generate cash.

Yeah. So it really varies from quarter-to-quarter, as you would imagine. But I'll give you a sense for the quarter we just had to Q1, it was a couple of million dollars. Can it be higher? Yeah, absolutely. But as Mike indicated, like we're replenishing the portfolio with higher kind of cost base assets, these are depreciated and moving into inventory.

And then that movement out of fixed assets, that does get reflected in or correct me if I'm wrong, maybe I am, when you report proceeds from disposals of assets, that shows up in that. Does it not?

It shows us a negative CapEx. It shows as a sale of assets. Actually, what it does is we transfer it to cost of sales. So if we transferred CAD 1 million worth of parts of an airplane, we would reduce our fixed assets by CAD 1 million, increase our inventory by CAD 1 million, and then it would flow through cost of sales. We're taking it out of inventory where we finally swale the asset. So when we do this, yes, it comes on the fixed assets. And then when we report what we've invested, it's obviously in that number, what went out versus what went in.

Just to kind of give you maybe a more wholesome explanation as to why it's variable. I mean, we really look at the marketplace and demand. So we made decisions to, is it worth putting some dollars into the aircraft and continuing to rent it out or are parts demand such that it actually makes more sense to part out and hence we move it to inventory. So those are the types of things that guide us from quarter-to-quarter as to what we do with the fleet.

But quite frankly, that's why we're as good as what we are in that business is because it's our knowledge of the demand for the parts that drives this business. The leasing is actually a part of the liquidation. We're taking a plane that ultimately is going to be parts when we're done with it, but one of the assets we have to sell is the green time. And so we lease it up to use that. Now occasionally, we'll overall refill the green time, the most time we'll part it out and then go buy another one.

Right. I'd just like to have a bit of a sense just because it's a great, I mean you get inventory without having really a cash outflow for that component of your inventory, which is obviously a great model. My next question, just returning to kind of the seasonal change from Q4 to Q1. Obviously, comparing this year to last year is tricky in part because of DryAir and other factors. But can you just sort of touch on the key factors when we think about next year from Q4 to Q1 that will be different from this year from Q4 to Q1, if in fact, there are any. I mean revenue -- and I'm thinking, sorry, manufacturing specifically, revenue manufacturing was down 14%, I think, sequentially Q4 to Q1. What would cause it to be different from a decline of 14% next year, if at all? Or maybe that's a good proxy going forward, I don't know. Again sort of get put too fine a point on it, but just generally speaking.

I think the only thing you'll see as we go forward that changes the margin profile on the manufacturing is as the Windows business strengthens from increased demand, the margin profile will be stronger in all the quarters. That business isn't particularly seasonal. There's slight variations with nothing material. So as we talked about that business strengthening, you'll see that affect all quarters. The Q1 is always going to be the lightest. But what's fascinating our business, we did a study of this a couple of months ago where, what do we expect in Q1, if we looked at the seasonality historically of what percentage of the annual EBITDA is generated in the first quarter. And within 1 or 2 percentage points, it's been the same since we started. And that's really driven by the fact that aviation is always going to be slower in the first quarter because of winter roads in the north. It's mitigated by the increase in our aerospace business, which isn't seasonal at all. And so that offsets that a bit, but then we've added some manufacturing in both Northern Mat and to a lesser extent because of its size, DryAir, which is also seasonal. So when you add it all up, the relative amount of our business that shows up in Q1 is remarkably consistent year-to-year.If you're talking about margins, I wouldn't see any reason for things to be materially different a year from now other than I do expect margins to strengthen in the Window business over time. Whether we'll have that by Q1 of 2025, I can't answer that yet. But on a longer-term trend, the strength in the Window business will because it will become a bigger piece of manufacturing, which will incur strength of those numbers. Outside of that, I don't see a big change. Pyle, am I missing anything?

The other one that comes to mind is just Environmental Access Solutions and just this year, the severe drought that we've had. And if you had a more normal -- while Q1 is still going to be their slowest period March depending on presentation levels can be busier for them. So if you had a more normal or a period of above normal precipitation next winter and into the early spring in Western Canada, that could positively impact results in 2025 versus 2024.

Yeah. Because their sales mix this quarter was more actual sales than lease. So obviously impacting margins in that regard, too.

Just a quick follow-on to that then. Are there any drawbacks to the seasonality? I mean other than it would be great to have everything evenly distributed. But just from a cost or a planning or a business perspective. And what I'm trying to ask, I guess, is, is there enough of a drawback to the seasonality that you would specifically target to reduce it or is it just kind of a fact of life for the business, at the end of 12 months, you've got your numbers and so that's fine. Or is there any desire to reduce seasonality or it's not significant enough to have a particular.

Our seasonality has been roughly the same for 20 years. I mean, in a perfect world, I would continue to find things that are really consistent quarter-to-quarter. But with our balance sheet and if something makes more money in Q3 than Q1, that's okay as long as it's predictable. We've got a balance sheet that really doesn't affect much. And quite frankly, you see it because our working capital needs always go down in the first quarter because we're slightly less busy absent that abnormal transaction that Rich described. But our core business need for cash goes down in the first quarter. And then as we accelerate later in the year, it goes up. And so we're well capitalized. It really doesn't preclude us. Now would I do a CAD 500 million acquisition with DryAir's seasonality, I'd have to think long and hard about that and see what the impact would be on our capital requirements. But as long as we're talking about modest sized investments in businesses that we really like, we can withstand the seasonality.

I mean, as long as the economics make sense after 12 months, that's the important thing. Last quick question. Mike, you made reference to the Air Canada agreement and flying that's being done and talk about sort of high single-digit returns. Just to confirm, what earnings metric are you using in that return when you --

Yeah, the high single digit, if I send that I just not what I was looking for, we're looking for that 15% free cash flow return on the investments. So just use a notional one. If I invested CAD 100 million in something, I'd expect free cash flow after maintenance reinvestment to be at least CAD 15 million. And then to get to an EBITDA number, you'd have to add back that CAD 15 million, whatever the maintenance CapEx is. So it's always going to be something higher than that in terms of an EBITDA return on the investment.

The high single digit was in reference to the cost of the asset in terms of high single-digit millions.

Yeah, high single-digit million is right. Like somewhere CAD 8 million, CAD 9 million, CAD 10 million in aircraft, depending on which one we bought.

Next question will be from Chris Murray at ATB Capital.

Mike, just maybe continuing on with a bit of a theme here. I think you're picking up on some of the seasonality and the variability. As we think about acquisitions, historically, when you guys have done acquisitions, part of the rationale anyway was to make the cash flow streams a little more predictable. I think about Regional One coming in to help offset some of the maintenance costs and some other U.S. transactions that kind of helped offset currency, Dry is maybe an extreme example of this. But I guess now that you've got a nice shiny a couple of billion dollars to go play with, can you just maybe talk about what you guys are looking at in the acquisition pipeline? And even if you're maybe comfortable to your last comment about maybe picking up something because your balance sheet can absorb it, that may be weighted to one-half or one-quarter over year more than something else. Is there anything out there that you would think that either would dampen volatility across earnings or is this just going to be a function of the size of acquisitions you guys have to look at now to move the needle that maybe it's never going to be that kind of fit that you've had in the past?

Yeah. I don't think that we see very many transactions that are materially seasonal that we're interested in. DryAir was a rarity in so as Northern Mat. I think if we're going to get any more seasonal stuff, I think it will be in my aviation business. We haven't conquered the whole north yet, and that's our goal. So whether it be medavac which aren't seasonal at all or scheduled freight and charter business, which is somewhat seasonal, the further north you go, the less seasonal it is. It's sort of northern part of the province is where there's winter roads that it tends to be the most seasonal. So if you look forward, as we grow our mat business into the U.S., that will reduce the seasonality of the business because that seasonal nature isn't the same in the United States. And it's even lesser in Eastern Canada because it's warmer in the winter and the ground is still soft. So there's less of a seasonal nature in Eastern Canada than there is in Western Canada. So if I put up my Nostradamus hat, 3 years from now, the percentage of our business, all things being equal, that's in the first quarter will be equal or perhaps somewhat less than it is what it is now. But some of our core businesses, I've been talking about seasonality of road since 2004 ever since we bought Perimeter. And it's actually improved in terms of cash flow. We actually would generate negative distributable cash at certain times that we were just a smaller line 16, 17, 18 years ago in Q1. That's no longer the case because of the diversity of the cash flow. But I don't see us being able to eliminate that with something that's got a reverse seasonality. I mean it would be awesome if we found it. But I haven't bumped into that yet.

I'll leave it there. Just it's interesting to see how even 1 acquisition can throw around the earnings pattern a little bit. So the other question I had for you was just on your core costs. You made the comment that there might be some more variability and slightly up this year. Historically, these things have tracked pretty close to growth in revenue. So you think about around CAD 10 million this quarter, you think about a little bit of growth in revenue, probably mid-40s full year would be normally what we would think about. Is there something kind of outside of that number that you're trying to highlight or something like that with that commentary?

No, that's a reasonable analysis. It grows roughly. It's not directly proportional but roughly in proportion to the size of the business. I think in the last 2 or 3 years, we've had maybe a slightly disproportionate increase as it relates to building our IT cybersecurity team. We are very proud of the fact that we're state-of-the-art in cybersecurity. We are authorized and certified at the highest levels of that in Canada comparable to much bigger companies like insurance companies and banks. And that's cost. So that's in the historical numbers, but I don't see a delta for that in the future other than as we grow.

Next question will be from [indiscernible] at Laurentian Bank.

I just had 1 question. It's related to the Australian surveillance contract RFP process. I was wondering if there were any updates on that and the RFP is still likely to happen in the second half of the year?

Yes. They had expressions for interest was that late last year, and we moved on. We made it through that process. We're one of a limited number of people that will be bidding on an RFP. We are excited about seeing what it looks like because it's going to be very large, how very large, depends on what aircraft they want to use, how do they are with how much of it's jet, how much of its turboprops. And so we're really looking forward to dig in our teeth into that. Quite frankly, it's what we're good at. It's big enough that we're going to be competing with some of the biggest people in the world in this segment. But as you've seen with what we've been able to do in Europe going from nothing to a significant player in a couple of years, we're excited about this opportunity, and we're going to take a good hard swing on it.

Next is a follow-up from Steve Hansen at Raymond James.

I just wanted to go back to your M&A comments around similar or like businesses. Are there any assets or capabilities that you might want to acquire that would bolster your chances of winning some of these future contracts you've described, I'm thinking a little bit about the Carson Air playbook here that obviously pretty instrumental in the BC contract, but particularly in the international arena, as you think overseas. Is there anything that becomes a target of interest things?

I think the one thing we'd like to do is when we do our first big jet version of this, we'll have to develop some of the mods and some of the things that we've already developed from a turboprop point of view. But those are more genome we do it as opposed to acquiring it. I would say, Steve, that the single biggest factor in our capabilities outside of our track record was the decision to acquire CarteNav now a number of years ago. That is the life blood, that's the software that makes all these super high-tech disparate systems talk to one another. And a lot of what we compete against would be a signal manufacturer environment. So [indiscernible] aircraft. But if you buy that, you get subs infrared, subs ultrasound, subs radar, subs computer and that may or may not be what you want. I mean no way criticizing them. But what I'm saying is where we are is, if you want the Israeli radar with the South African infrared and the American computer system, we've got the piece that makes all of those talk to one another. And it gives us such a competitive advantage. We often have our competitors ask if they could use CarteNav software and you can guess that we're not really that interested in sharing our secret sauce for somebody else. But that was the key decision a while ago when we bought that. It stood alone on a cash flow basis on what it did. But the reason we bought it was to internalize the capability.

The other thing we think about aerospace environment is oftentimes, we look to partner if it's obviously in a jurisdiction that we don't have a significant presence with a local operator to bolster a bid for kind of the nationalistic perspective that governments have or if there's a capability that they're looking for that we don't have like UAV, for instance, those are all examples where we might look to partner and acquisition perhaps, but we look at both.

Thank you. And at this time, Mr. Pyle, we have no other questions registered. Please proceed.

I want to thank everybody for joining us this morning. I look forward to seeing some of you over at our annual meeting in a couple of hours over at the Winnipeg airport. For those of you who are out of town, we'll speak again at the end of our second quarter. Thanks, and have a great day.

Thank you, sir. Ladies and gentlemen, this does indeed conclude your conference call for today. Once again, thank you for attending. And at this time, we do ask that you please disconnect your lines.