IONOS Group SE

XETRA:IOS

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

Abbvie Inc

NYSE:ABBV

|

Biotechnology

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Realty Income Corp

NYSE:O

|

Real Estate

|

| US |

|

Walt Disney Co

NYSE:DIS

|

Media

|

| US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

Technology

|

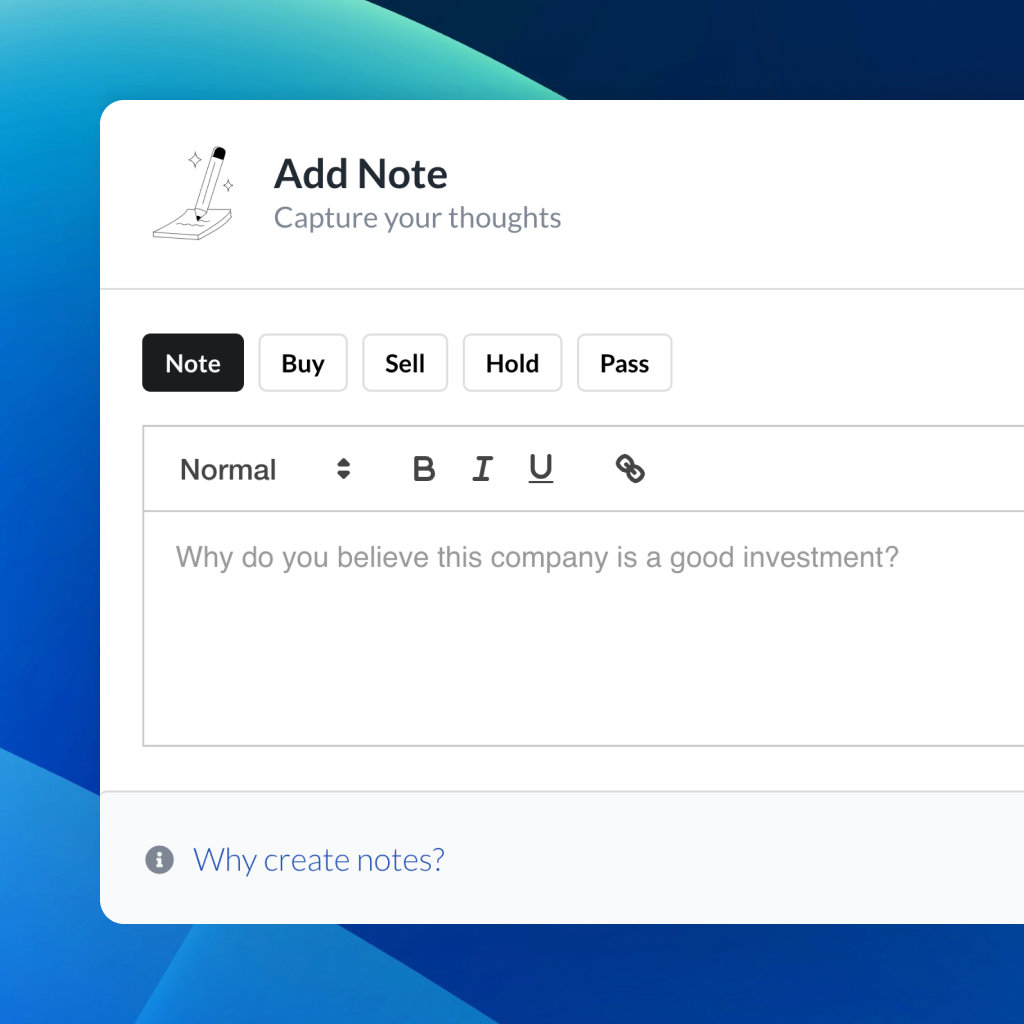

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

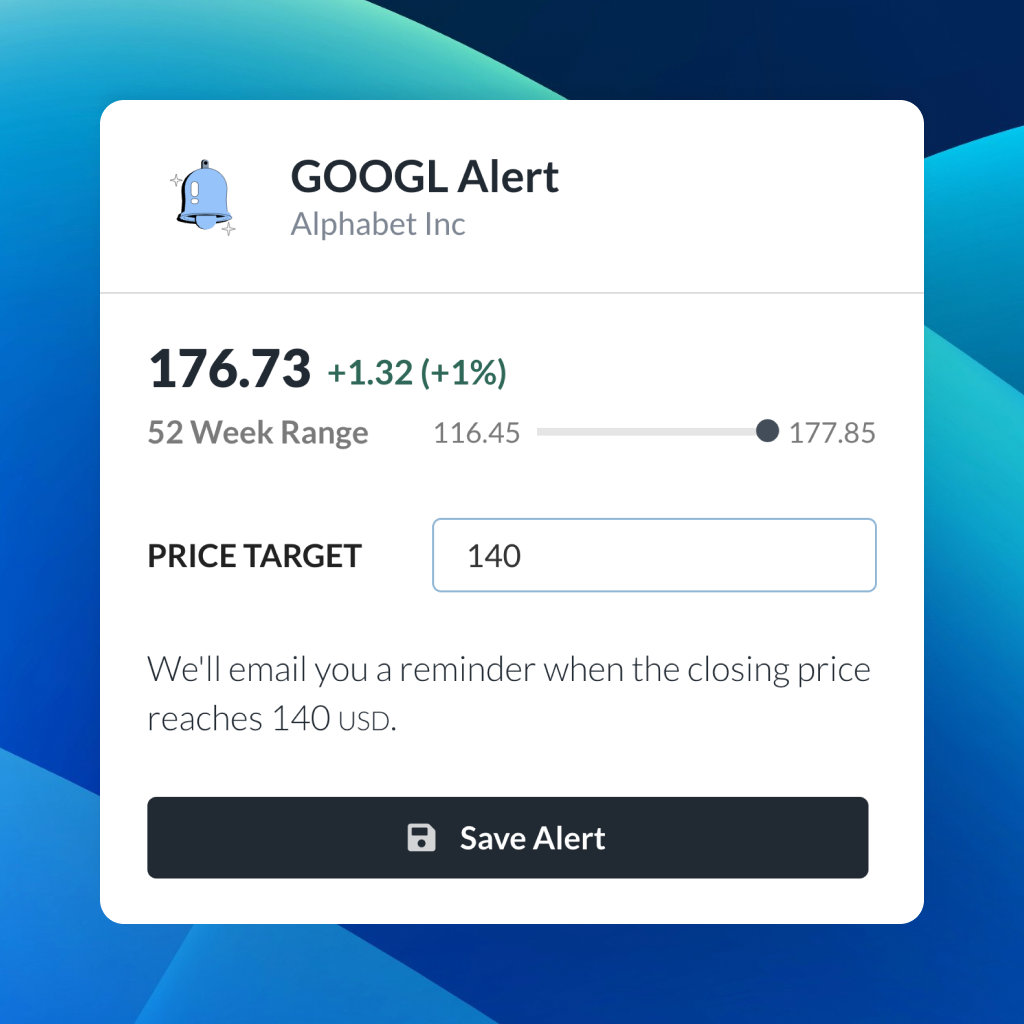

| 52 Week Range |

12.34

29.7

|

| Price Target |

|

We'll email you a reminder when the closing price reaches EUR.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

Abbvie Inc

NYSE:ABBV

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Realty Income Corp

NYSE:O

|

US |

|

Walt Disney Co

NYSE:DIS

|

US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

US |

This alert will be permanently deleted.

You don't have any saved screeners yet

You don't have any saved screeners yet

Ladies and gentlemen, welcome, and thank you for joining the IONOS Group SE publication of the Q1 Results 2024 conference call and video webcast. Throughout today's recorded presentation all participants will be listen only mode. The presentation will be followed by a question-and-answer session. [Operator Instructions] I would now like to turn the conference over to Stephan Gramkow. Please go ahead.

Hello, and good morning, everybody. I would like to welcome you to the analyst and investor call of IONOS on the Q1 2024 results. Thank you for joining. My name is Stephan Gramkow, and I'm responsible for Investor Relations at IONOS. Let's have a look at the agenda for today's call. Britta Schmidt, CFO of IONOS will walk you through the operational development of the business in the first three months, 2024 and the financial details of the first quarter. We also want to take a look at the guidance and our expectations going forward. Britta will then be happy to answer any open questions. Let's get into it. Britta, the floor is yours.

Thank you very much, Stephan. Good morning, ladies and gentlemen, and welcome to our Q1 2024 webcast. I'm Britta Schmidt, CFO of IONOS, and it's a pleasure to have you with us today as we dive into our Q1 performance and operational trends. Let's revisit some operational KPIs from the last year on Page 5. From the EUR 1.42 billion revenue, we have generated EUR 390 million in adjusted EBITDA with a very nice 90% cash conversion. Roughly 80% of our revenue is subscription-based, providing a very reliable and stable foundation. The other 20% is transaction-based, originating mainly in our aftermarket business, such as trading or parking of domains. Our NPS score is around 32, which compares to 34 at the end of 2022. This is not surprising given new pricing structures introduced in Q3 last year. While these changes will gradually lead to higher value contribution, there was a temporary negative impact on customer satisfaction. We are pleased to report that this effect is smaller than expected and already leveling off. Furthermore, I'd like to highlight that we report the overall NPS combining post contact NPS and online NPS. Unlike some large peers who only report post contact NPS, which tends to be notably higher but doesn't provide an accurate overall view of customer satisfaction. Our marketing operations are driven by very sophisticated machinery, resulting in more than 14x CLTV over CAC. That means that for every Euro we invest in marketing, we earn over EUR 14 over the lifetime of these new customers with a typical payback period of only 12 months for the customer acquisition cost. To remind you, IONOS is the clear #1 European SMB digitalization partner and trusted cloud enabler. I would like to highlight our robust business pillars that serves as the driving force behind our success. The foundation, which you see at the bottom is our web presence and productivity business, excluding aftermarket, which is the largest pillar, contributing EUR 256 million or around 70% in revenues in the first 3 months of 2024. This business area again showed remarkable resilience and steady growth through -- throughout the first quarter of this year with a very strong underlying margin and exceptional cash conversion. In a subscription-based revenue model, we cater to all digitalization needs of SMBs, including solopreneurs. We are the leading provider in Europe and have a sizable business in North America as well. Moving to the center of the page, let us have a look at our cloud business, around 11% of our revenues for Q1 stemmed from our Cloud Solutions business. Here, IONOS is steadily gaining recognition as a trusted cloud partner for small and medium businesses. Our recent success in this area, winning the German federal government as our customer demonstrates the progress we have made in this field. I will give more details on the deal shortly. This accomplishment further strengthened our belief that we are on the right path. Currently, being self-sustaining, we anticipate this business area to contribute positively to our EBITDA in the near future. Additionally, we have our aftermarket business, which is about buying, selling and parking of domains. This area accounts for roughly 18% of revenues in the first quarter. However, as the exceptional high growth of the last quarter is coming down to market level, as anticipated and communicated, the dilutional effect of this lower margin business on our overall EBITDA margin is already easing off. I will talk about the detailed development of the different business areas in a minute. Let us now have a look into some details how we are benefiting from AI throughout our business. We distinguish between customer-facing AI features and products and the internal use of AI to enhance various aspects of our business operations. Firstly, we are continuously enhancing our product portfolio with AI features to improve customer experience and up and cross-selling opportunities. For example, already in May 2023, we launched our first AI-driven text and image generator for my website, which simplified content creation. And this is one of the major issues for our customers. We are constantly adding new features in order to enhance the customer experience even further. In our last presentation, we additionally already talked about the promising potential of AI model hosting with a wide range of use cases. Our secure, scalable cloud environment supports diverse applications, enabling businesses to leverage AI innovation with the highest data privacy standards, establishing our platform as a central facilitator of AI-driven solutions. Leveraging AI's transformative power, we aim to extend these advanced capabilities to SMBs. Our enterprise cloud platform streamlines AI model deployment, offering a range of open source LMMs, tax to image and tax to speech models. Since Q3 2023, selected customers have had an early access with a broader rollout planned for this quarter. Secondly, we are leveraging AI internally in many areas like coding, pro detection, next best offer prediction, customer care experience and a wide range of content creation, just to name a few. We are very committed to pushing the boundaries of AI technology to improve our products and services continuously while leveraging internal efficiency and cost improvements. AI is just one driver of the growing demand for cloud products. The ongoing strong push in digitalization is also driving the demand for Cloud Solutions. As you may have seen in the media, IONOS has been awarded a significant contract with ITZBund, the German Federal Information Technology Center. ITZBund has commissioned IONOS to set up a special private enterprise cloud that will be operated in the ITZBund's data centers. This so-called air gap cloud ensures complete physical and logistical isolation of our cloud infrastructure without a direct connection to the Internet. This project represents a significant milestone for IONOS. The contract has a 5-year term and the order volume is variable without any minimum guarantees. Nevertheless, we expect to generate revenue in the low 3-digit million euro range over the next 5 years. The trial operation is scheduled to start at the end of 2024. At the same time, we are also successfully implementing similar large-scale projects with other important public sector organizations such as ITNAV, dataport and the HPI School Cloud. These projects illustrate our commitment to providing innovative technologies in the area of high security Cloud Solutions for the public sector. However, it is important to emphasize that despite the importance and prestige of these major projects, our loyal target group, SMBs, remain the focus of our business. At IONOS, we remain firmly committed to providing solutions and first-class services to small- and medium-sized companies. Now let's have a look at our operational performance in the first three months. Increase of our customer base is one of the main drivers of our growth. In our full year 2023 webcast, we discussed the promising end of 2023. This positive momentum continued into the first quarter of 2024, reflecting a sustained trajectory of growth. The reliability of our mission-critical products backed by the dedicated support of our personal consultant once again helped us to develop and maintain a very loyal customer base. We've kept our churn rates remarkably low around 13% to 14% annually or approximately 1% monthly. Moreover, we have been able to accelerate the customer growth, resulting in a strong net customer growth of around 200,000 customers year-over-year or 70,000 customers in the first -- first three months 2024, which compares to 60,000 customers in the same period last year. On the right-hand side, you can see that our ARPU increased by a very healthy 9.7% year-over-year to EUR 15.80 per month despite a strong increase in customers. Please keep in mind that new customers usually benefit from starting discounts, so diluting the ARPU in the first 6 to 12 months. The growth of 9.7%, therefore, supports our continued and improved up and cross-selling ability as well as our pricing power. The expansion of our cloud solution business additionally fosters ARPU growth as average ARPUs are generally much higher. Overall, those numbers demonstrate the successful execution of our business strategy, underpinning our predictable growth in revenue and profitability. The strong performance of our core business in the first quarter of 2024 has set the foundation for the year. Revenues in Q1 2024 reached EUR 373 million, showing a growth of 5.4% compared to Q1 2023. Our core business, meaning web presence and productivity and cloud solution, excluding aftermarket, grew very strongly at 12.8% compared to the previous year. Adjusted EBITDA for Q1 '24 reached EUR 105.8 million with an adjusted EBITDA margin of 28.4%. This represents a significant increase compared to Q1 2023 when the margin was 24.4%, marking a 22.7% growth in adjusted EBITDA year-over-year. Total marketing investments, however, remained relatively stable compared to the previous year. Due to the various sports events this year, such as the European Football Championship, the distribution of marketing investments over the quarters will be somewhat different than in the previous year and more skewed towards the middle of the year. Around EUR 22 million of investment was dedicated to brand in Q1, which is significantly lower than the EUR 24 million spend in Q1 '23. The brand investment for the full year remained flat compared to the previous year with around EUR 65 million to EUR 70 million planned. As we move forward, our strategic focus continues to be on optimizing our brand spend between brand campaigns and performance marketing in order to ensure profitable growth and enhance customer [indiscernible] as measured by CLTV overcut. With the goal of driving sustainable growth, we will adapt our marketing strategy flexibly based on channel performance and market conditions to achieve optimal results across our business. Let's have a look at the performance of the different revenue lines on Page 9. The core web presence and productivity, excluding aftermarket grew by -- very healthy, 13.3% year-over-year. Excluding currency effect, web presence and productivity, excluding aftermarket, grew by 12.6%. As mentioned earlier, this is a result of sustained [Audio Gap] million euro in the first quarter of '24. This is driven by the low-margin domain parking business, which temporarily fell short of the previous year due to a market-driven product transition and therefore, a weaker advertising market for domain parking.With the completion of the product transition and the advertising markets recovering, which is already becoming apparent, an uptake in sales development is expected. Our Cloud Solutions business, which is still the smallest business in our group, grew by 13.7% in Q1. Excluding currency effects, Cloud Solutions grew by 13.4% in the first quarter. As already pointed out, we are optimistic about the continued growth of our Cloud Solutions business and are excited about the opportunities it presents for expansion in the future. Moving forward, we are committed to enhancing our product offering and services in order to further establish our position as a competitive player in the industry. Let's turn to Page 11, focusing on capital expenditure. As you know, we have the advantage of having highly predictable maintenance CapEx requirements, which are bolstered by favorable [server] economics, economies of scale and our state-of-the-art technological platform. This stable foundation allows us to effectively manage and plan for the ongoing maintenance and improvement of our operations, ensuring reliable service for our customers. On the other hand, our growth CapEx is directly linked to future revenue and customer growth prospects, particularly in the area of Cloud Solutions and AI, providing a well-defined path to achieving payback on these investments. Maintenance CapEx in the first quarter remains low with 0.6% of revenues. Growth CapEx is slightly higher compared to the previous year, mainly driven by different phasing and outstanding deliveries in Q1 2023. The current growth CapEx of 3.7% of total revenues is on a usual level and is what we guided for. Our expectations for total CapEx for the full year remain at approximately EUR 100 million, which represent around 6% to 7% of our total revenues. This takes into account the anticipated fulfillment of outstanding deliveries. By maintaining a balanced approach to our CapEx allocation, we are still in an excellent position to take advantage of growth opportunities, improve our capabilities and drive sustained and profitable revenue growth. Our leverage and debt position is summarized on Page 12. In the first three months, we have reduced our net debt to just over EUR 1 billion. As a result, our net debt to adjusted EBITDA ratio has improved to 2.5x. This aligns well with our target to reduce 0.5x leverage per year. Therefore, we anticipate further deleveraging for the full year 2024. As already mentioned in our last webcast in December 2023, we successfully refinanced the majority of our debt with the consortium of banks. The external bank loan totaling around EUR 800 million and the fixed annual interest rate and is covenant light. The remaining debt continues to be covered by a shareholder loan from United Internet, which also has a fixed interest rate and no covenants. Both loans mature mid-December 2026. The weighted average interest rate currently stands at 5.3%, which is expected to decline as we plan to gradually repay the shareholder loan, reducing the average interest rate further. On Page 13, you can see the reconciliation from adjusted EBITDA to free cash flow. Adjusted EBITDA for the first 3 months of '24 is around EUR 106 million. From this, we deduct adjustments totaling EUR 5 million, mainly for stand-alone cost and cost of the long-term incentive program. Next, we deduct the total CapEx of $60 million, $9 million for tax payments and add back EUR 2 million for LTIP as this is noncash. There is a negative working capital effect of EUR 9 million as some payments for expenses in Q4 last year were not due until the first quarter 2024. As already last year, we expect this to level out throughout the year. This results in a free cash flow before leasing of EUR 70 million. Free cash flow after leasing stands at EUR 66 million. This compares to EUR 33 million in Q1 last year. However, the last year included a EUR 13 million payout from the LTIP after the IPO. Comparable free cash flow stands at EUR 58 million, with interest payment being comparatively low in Q1 as interest for the bank loan is to be paid half yearly with the first payment due beginning of July. Based on the solid performance of our core business in the first three months, we are confirming our guidance for 2024 and '25. New customer acquisitions are robust. We are successfully up and cross-selling to existing customers. Brand perception is increasing, and we are looking forward to the launch of innovative product enhancements and new AI products. Additionally, the introduction of new pricing structures in the third quarter of '23, instilled confidence in our ability to maintain and enhance our financial position. Due to the phasing effect in relation to the market-driven product transition in the aftermarket business and therefore, temporarily lower sales, we expect sales growth to remain slightly slower in the first half of '24 and to amount to around 8%. For the second half, currency adjusted sales growth is expected to increase to around 12%. And thus, the full year '24 to be in line with the previous forecast of approximately 11%. For the web presence and productivity revenues, we are aiming for a growth rate of around 10% to 12%, mainly driven by the strong performance of our core web presence and productivity, excluding aftermarket.For Cloud Solutions, we expect a further acceleration of sales growth to around 15% to 17% in 2024. Our confidence in capitalizing on growth opportunities in these sectors is strong, backed by increased investment in Cloud Solutions by key clients. The adjusted EBITDA margin is expected to be around 28.5% compared to 27.4% in '23, resulting in adjusted EBITDA of around EUR 450 million, and therefore, adjusted EBITDA growth exceeding revenue growth. We anticipate the adjusted EBITDA margin will steadily increase and reach approximately 30% by 2025. Let me now summarize the key highlights from today's presentation on Page 15 that are essential to keep in mind. First and foremost, our business is built on a strong foundation marked by sustainability and resilience. The majority of our revenues come from recurring sources, providing a stable platform for consistent growth. Looking ahead, we have a clear vision of our CapEx requirements for the upcoming years, thanks to the well-founded asset base we have in place, which also includes our thriving Cloud Solutions business. The slowdown of the aftermarket growth was anticipated and will dilute the adjusted EBITDA margin less in future. Brand investments reached their peak in 2023 and will remain at this level in absolute terms. These investments are crucial to support our revenue and margin expansion as we progress forward. A lot of the investments into the Cloud Solutions business have been made already, like investments for building up infrastructure as a service features, creating a great opportunity for future growth and EBITDA contribution. Our product portfolio has been successfully redesigned for cross and upselling opportunities and seamless expansion. In terms of AI integration, we are capitalizing on significant opportunities, both in our product suite and internal operations, promising a more efficient and improved customer experience. Thanks to our high profile and increasing reputation in the market, we are capturing more and more market share, especially in our Cloud Solutions business. Overall, we are very well positioned for future growth. With this, I would like to hand back to the operator to open the webcast for any open questions.

Ladies and gentlemen, at this time -- we would begin the question and answer session. [Operator Instructions] The first question is from George Webb with Morgan Stanley.

I have two around aftermarket to kick off with, please. Firstly, you've called out the advertising market conditions makes sense. You also mentioned in the financial report that performance was impacted by temporary phasing effects in connection with a new product launch. Could you go into more detail around what that product launch is, please? And then secondly, what visibility do you have into the aftermarket performance improving? The previous slide you showed you had that expected revenue growth at 8% for the group in H1 as a whole. So that's implying a pretty sharp uplift already in Q2. So, I want to ask whether you can confirm that you've already seen improved aftermarket trading in April?

Hey George, let me start with your last question first. So yes, we already see improved performance in the aftermarket section already in April. This is what gives us confidence moving forward with -- and this is partially related to your first question around the product. There's currently a transition in products taking place. There will be a new product introduced for domain parking. So, the traffic arbitrage business, which we are running in the aftermarket business, it is called RSOC and this offers additionally to what we already see with the advertising market picking up already in the domain parking business. It offers additional opportunities to improve the performance of the business.

That's clear. And actually, just one on the Cloud Solutions, we're still slightly below the full year guidance range there. Are you expecting to climb into that range as early as Q2? Or do you expect it to be more second half loaded?

It will be a little bit more second half loaded, but we should see an uptick in Q2 already.

Next question is from Andrew Lee with Goldman Sachs.

I just had one question on your pricing power that you mentioned kind of towards the start of your presentation. You mentioned the pricing power or the ARPU growth of just under 10% gave you confidence in pricing power, and I think that's obviously diluted by net adds. But I wonder if you could just talk about whether you feel like you've pushed your pricing power hard enough through 2023 and whether there's scope to exert more pricing power in terms of ARPU uplift in 2024 and onwards? And how you think about balancing that and phasing, timing, etc.? And then second question was just on marketing costs in the quarter. So I think marketing costs were a bit lower in the quarter. I just wondered if you could give us an insight into exactly how much that benefited in the first quarter and whether that will fully swing back in the second quarter?

So let me start with the ARPU growth and the balance. So we always try to achieve a balance between customer experience, delivering new features, customer satisfaction and the prices we charge for this. As you know, we have been relatively reluctant in the past in increasing our prices. We have taken the opportunity in 2023 given the macroeconomic environment to dig deeper into this and increase our prices a little bit higher than we did before. Obviously, there will be price increases as well in future, and we do think that we do have pricing power. Keep in mind that our ARPU with EUR 16 now is less than the average energy bill our customers are paying. But we strive to always keep a balance in order to deliver customer satisfaction and experience. But with new features being on the road map, we think there's more opportunity as well in the future to look into price increases. It will not be maybe as strong as it is today, but more adjusted to inflationary trends. In terms of marketing, as we said, brand marketing was lower than it was last year, stand at EUR 22 million compared to EUR 24 million. Performance marketing is expected to grow in line with revenue growth, so it stays flat on percentage of revenues. But as we said before, there is a little bit of a skew towards especially Q2 and the second half and the middle of the year, driven by the different sports events, which are coming up, where we would like to put more marketing power in.

The next question is from [indiscernible] with JPMorgan.

I was just wondering on the gross margin improvement from 46% in Q1 last year to 51% this year. Some of that was flat was driven by economies of scale, but also the aftermarket weakness. So how sustainable should we expect this level going forward as the aftermarket recovers? And then just a quick follow-up question, just on the adjusted EBITDA margin phasing for the year, just given that you flagged sort of aftermarket recovery, which, of course, has lower margin, but also the kind of marketing spend being more weighted to Q2 and the middle of the year. What should we expect from the EBITDA margin phasing for 2024?

Yes, I'm not sure if I got your last question, right? Just commenting on the gross margin, you're absolutely right. It's partially driven by economies of scale, obviously, as well the price adjustments, which we have done, which increases gross margin. And then the remainder is driven by aftermarket. So, the first two will continue. Aftermarket will be leveling out throughout the year as we expect sales performance to pick up there. And then on the EBITDA margin, I'm not sure where you are hinting to. So we are guiding for the 28.5%. So it will be progressing going forward, depending and looking into the different quarters. I think as we already mentioned, most of the market -- or more marketing spend is expected to come in throughout the middle of the year. But overall, we will end up with the guidance which we gave out with the EUR 450 million approximately or 28.5%.

Next question is from Stéphane Beyazian with ODDO.

I've got two questions, if that's possible. The first one on the ITZBund contract. Is it possible to have an idea of how much investment you may need to do related to this contract? And what sort of margin you're expecting out of this contract compared to what you're already doing in your Cloud Solutions and whether that could help you to break even faster than what you've guided so far? And my second question is regarding traffic. And I was wondering whether you can tell us anything about how much traffic growth you are seeing on your data centers and whether you think there might be any, let's say, issue in terms of electricity sourcing in the future?

So for ITZBund, the CapEx, which we would need there is included in the guidance of 6% to 7% of revenues, EUR 100 million this year. So there's nothing more to be expected for this year. Of course, it will help us to get towards the breakeven or the contribution to EBITDA a little bit faster. We always said that will be in a couple of years, but we are really confident that it should be by end of '25, turning into '26. I cannot give any details on the margin, but it's a fairly good deal for us still. But of course, for competitive reasons and for privacy in that case, I cannot give out any details. This is why we are as well a little bit reluctant in terms of revenues to give it out. But we are happy that we won the deal and it will help us to scale our Cloud Solutions business and especially in terms of reputation, it's definitely something which has additional value besides the EBITDA margin, which we will be generating there. And in terms of traffic growth and data centers, so we are confident that we can fulfill everything which we need there. But obviously, given the energy prices, we are -- but this is part of usual operations. We are constantly optimizing our data center structure looking into where we put most of the load that it would go rather into lower energy countries, etc. For example, we do have a data center in France. So, there's always optimizing going on, but nothing which is not part of the guidance we gave for CapEx.

No concern there. Just a follow-up. Is it possible to have an idea of the traffic growth you're experiencing overall on your data centers, a rough idea?

I actually don't know the traffic growth, which we are seeing there, and I'm not sure whether we are not measuring it in traffic growth, but it would be rather load. But Stéphane, we will come back to you and give you a sense.

The next question is from Usman Ghazi with Berenberg.

I just wanted to ask, Britta, on -- you mentioned that the NPS decline post the price increase was less than what you had expected internally. Could you perhaps give an indication of what was expected and where you landed up at? And then on the cloud business, I just wanted to confirm some numbers that you've given on the call. So, you mentioned that this is going to be kind of a 3-digit million revenue contribution. Obviously, its massive given your cloud business is in $100 million at the moment. So, I mean, you also said that the margin that your cloud business, you expect it to be -- to turn positive in 2025 or 2026. I just wanted to confirm the details there. And just on this contract, could you perhaps indicate who you were up against? And what were the kind of key reasons that IONOS [indiscernible] ahead of the rivals?

So I cannot comment a lot on the different participants in the tender as we actually don't know all details as well. But you can imagine that there was merely everybody which is offering Cloud Solutions was on that deal. And as well for why did they pick us? I think there have been statements in the press. It's definitely the performance and the reliability IONOS is delivering. So they are really confident that we will be able to deliver the secure Cloud Solutions they are looking for. And yes, I can confirm the low 3-digit number, which we are expecting in terms of revenue. Please keep in mind it's still variable and depends on what they are asking for in the end, and it will start end of this year presumably. And yes, for Cloud Solutions being -- or contributing to EBITDA, we are expecting this to be achieved by end of '25, beginning of '26. So that's it on Cloud Solutions. I hope that answers all of your questions there. On NPS, I think -- we had a dip of roughly 2% compared to the previous year. Usually, our -- we want to achieve a higher NPS each and every year, which obviously, at some point in time, is it possible. But we thought it would be a mid-single-digit drag down. And please keep in mind, we started the increase of the prices in Q3. And the NPS is measured on the average of Q4. So it still takes the full impact more or less of what we've done there. So the 2 less is a significant achievement for us.

The next question is from Nizla Naizer with Deutsche Bank.

I just have a follow-up to the previous question on the contract with the federal authorities. Two things I'd like to clarify Britta firstly. Did you mention how much of revenue it could contribute on a stand-alone basis next year? I'm assuming the entire contract value is that 3 digit low -- 3-digit million number. But on an annual basis, for 2025, could you just reconfirm what the impact could be to Cloud Solutions? And secondly, could you give us some color as to whether this was an entirely new project that the authorities were doing? Or did you sort of replace an existing provider where they were trying to sort of find a new partner of Cloud Solutions? Some color there would be great. And linked to that, do you think that winning this contract would also garner interest among other government authorities outside of Germany? And are you already seeing any interest come your way? Some color there would be great.

So indeed, you said, yes, so over the five years, we are expecting this low 3-digit million number. It's hard to predict what will come in 2025. I would say it would be -- but that's a little bit of a crystal ball as it's depending on how the project is going on, but it's a low double-digit million, which we are expecting for next year, presumably. In terms of are we replacing everything? As far as I know, that is a new attempt for them. We are building, as we said, an air-gapped cloud, which will be run in their data center. We will be operating it on our technique and our products.So I think it's a new attempt helping the German government to digitize. And then for sure, it is a door opener to other public bodies, especially in Germany, for sure. It has a very strong prestige effect, and we are as well seeing it as a strong marketing measure for SMBs, especially because we are running the most secure Cloud Solutions, which is existing in Germany, which gives a lot of confidence to our other customers. So that's the value I was talking about before. So, it has a certain marketing value, which we see from that. For outside of Germany, usually, the governments tend to go to their local providers more, but we are running -- we do have a brand in Spain where we do run a couple of government Cloud Solutions already smaller in size, but nevertheless, there might be more coming, but this is, I think, more of midterm opportunity.

The next question is from Zahir Ramcharan with Redburn Atlantic.

Just one quickly on the customer commentary that we got that sort of gave the split of the net adds, saying the $15,000 were from Germany and then $55,000 were from abroad, notably U.K., France and U.S., that's really helpful. Could we get any color on how that compares to recent quarters, please? And secondly, just on the aftermarket revenues. How much of the revenues are sort of transactional by nature and how much is driven by ad revs? Any detail there would also be much appreciated.

Could you repeat your last question? How much is driven by --

Sort of transactional trading and actually buying and selling of domains and taking commission versus the ad revenues on parking warehousing those domains.

Yes. So, the majority of aftermarket revenue is driven by the parking and especially most of the revenue growth, the transaction business in terms of buying and selling of domains is performing well, by the way, and -- but it offers a lower revenue growth, and it's a smaller part of the business. In terms of customers, we do see customer growth and have seen as well in the past it well being well divided between the different core markets. So, there's nothing -- no country which sticks out from what we -- at the moment.

So that commentary from this quarter is all fairly consistent with previous quarters?

Yes. Correct.

Ladies and gentlemen, that was the last question. I would now like to turn the conference back over to Stephan Gramkow for closing remarks.

Yes. Thank you, operator, and thank you, everyone, for attending our today's call. Please don't hesitate to get in touch for any follow-up questions, and have a nice day and stay safe, and goodbye.

Thank you, and goodbye.

Ladies and gentlemen, the conference is now over. Thank you for your participation.