Equinix Inc

NASDAQ:EQIX

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

Abbvie Inc

NYSE:ABBV

|

Biotechnology

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Realty Income Corp

NYSE:O

|

Real Estate

|

| US |

|

Walt Disney Co

NYSE:DIS

|

Media

|

| US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

Technology

|

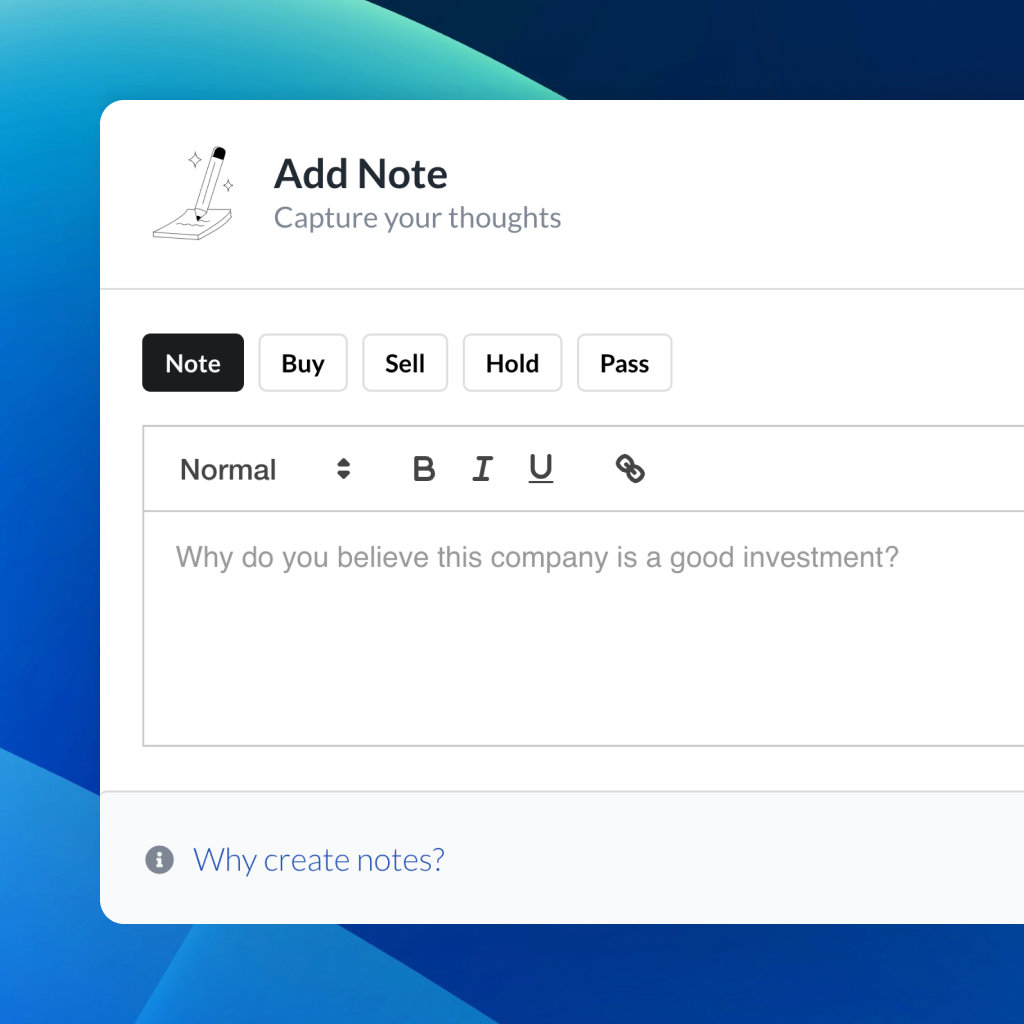

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

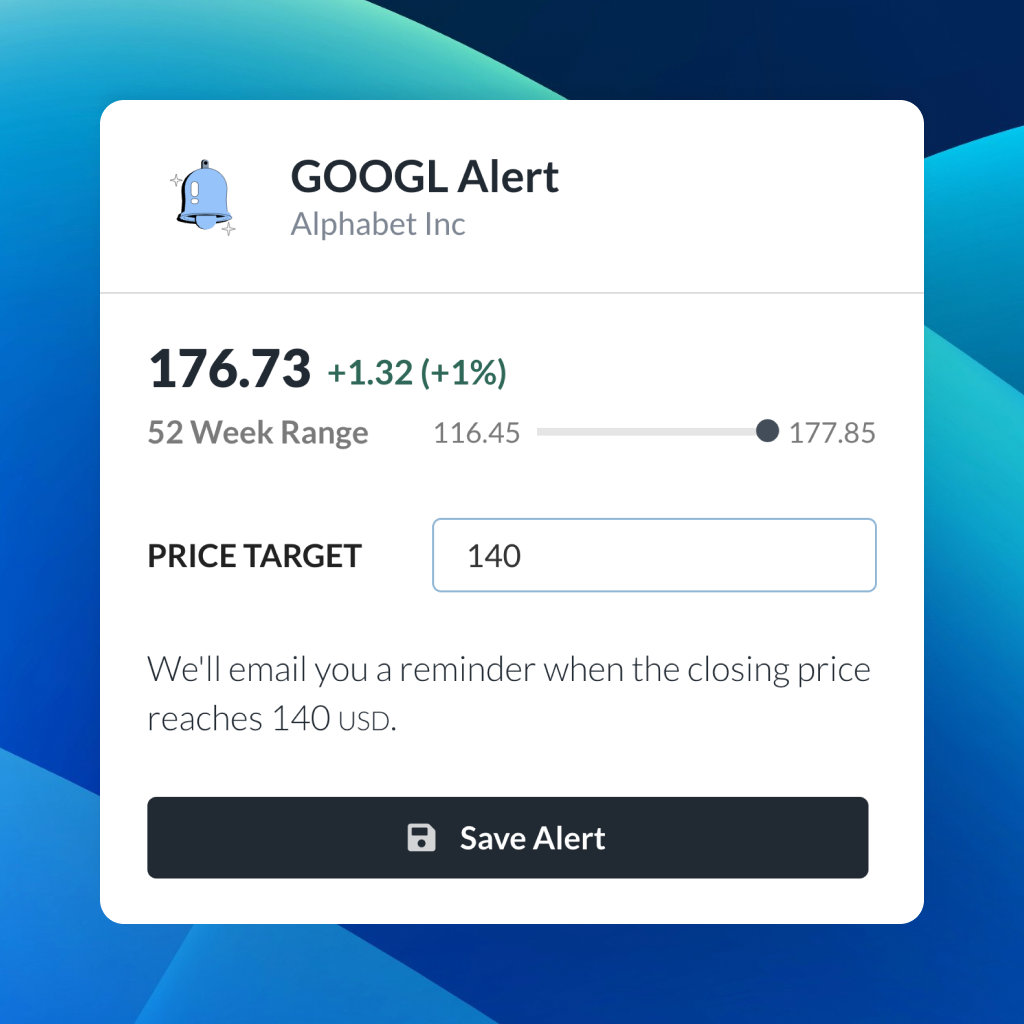

| 52 Week Range |

682.24

913.66

|

| Price Target |

|

We'll email you a reminder when the closing price reaches USD.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

Abbvie Inc

NYSE:ABBV

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Realty Income Corp

NYSE:O

|

US |

|

Walt Disney Co

NYSE:DIS

|

US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

US |

This alert will be permanently deleted.

Equinix Inc

Equinix Inc

You don't have any saved screeners yet

You don't have any saved screeners yet

Good afternoon, and welcome to the Equinix's First Quarter Earnings Conference Call. All lines will be able to listen only until we open for questions. Also, today's conference is being recorded. If anyone has objections, please disconnect at this time.

I would now like to turn the call over to Katrina Rymill, Vice President of Investor Relations and Sustainability. You may begin.

Good afternoon, and welcome to today's conference call. Before we get started, I'd like to remind everyone that some of the statements we're making today are forward-looking in nature and involve risks and uncertainties. Actual results may vary significantly from those statements and may be affected by the risks we identified in today's press release, and those identified in our filings with the SEC, including our most recent Form 10-K filed on February 19, 2021. Equinix assumes no obligation and does not intend to update or comment on forward-looking statements made on this call. In addition, in light of Regulation Fair Disclosure, it is Equinix's policy not to comment on its financial guidance during the quarter unless it is done in explicit public disclosure.

In addition, we will provide non-GAAP measures on today's conference call. We provide a reconciliation of these measures to the most directly comparable GAAP measures and the list of the reasons why the company uses these measures in today's press release from Equinix IR page at www.equinix.com. We have made available on the IR page of our website a presentation designed to accompany this discussion, along with certain supplemental financial information and other data. We'd also like to remind you that we post important information about Equinix in the IR page from time to time and encourage you to check our website regularly for the most current available information.

With us today are Charles Meyers, Equinix's CEO and President; and Keith Taylor, Chief Financial Officer. Following our prepared remarks, we'll be taking questions from sell-side analysts. In the interest of wrapping this call within an hour, we'd like to ask these analysts to limit any follow-on questions to just one.

At this time, I'll turn the call over to Charles.

Thank you, Katrina. Good afternoon and welcome to our first quarter earnings call. We had a great start to the year delivering one of the strongest net bookings quarters in our history, fueled by strong demand across our platform, our lowest churn quarter in many years, and continued momentum in our Americas business. With the addition of the Bell Canada assets, we are now the market leader in 19 of the 26 countries in which we operate. And we are delighted to now be the market leader in retail colocation across all three regions of the world, taking the number one spot in Asia Pacific for the first time this quarter.

Our bookings performance continues to highlight the consistency and scale of our go-to-market engine, executing 4,300 deals with more than 3,200 customers. We have a robust build pipeline to support this demand, including 36 major projects underway across 28 markets in 19 countries, one of our most active build years ever. We fully recognize that COVID remains a very acute issue with continued tragic impacts in key markets around the world, including India and Brazil. Our hearts go out to our colleagues and customers in those markets, and we are actively taking steps to support those communities. But as we navigate toward a post pandemic world, we believe Equinix remains uniquely well positioned. Digital Transformation continues to accelerate, and businesses across a broad range of verticals are recognizing that their infrastructure can be a key source of competitive advantage in an increasingly digital world.

Demand is as strong as ever. With global IT spend expected to rebound above pre pandemic levels as enterprises increase hybrid cloud spending, and service providers build out their delivery platforms to tap into this demand. Against this backdrop, we remain focused on the clear set of priorities I outlined at the start of the year, investing in our people and culture, simplifying and scaling our business, accelerating our digital services, and expanding our global reach both through our retail footprint and our rapidly growing xScale business. While we're delighted with our business results, were also highly attuned to our responsibilities as a market leader and continue to advance a bold sustainability agenda across all dimensions of ESG. Supporting our people and strengthening our culture continue to be foundational to our strategy. And in a time where it matters more than ever, our vision remains clear. For Equinix to be a place where every employee every day can confidently say I'm safe. I belong and I matter. And for our workforce at all levels to better reflect and represent the communities in which we operate.

In early April, we hosted our second annual days of understanding where 1000s of our employees around the world attended workshops to listen, learn and promote a culture of mutual understanding and inclusion as we continue to build and foster an engaged diverse workforce.

Our people show up every day inspired by our purpose, to be the platform where the world comes together, enabling the innovations that enrich our work, life and planet. As we pursue this purpose, we are also deeply committed to our role as an important component in creating digital infrastructure. We recently published our 2020 corporate sustainability highlights and I am proud that Equinix once again achieved more than 90% renewable energy coverage for our global data center footprint and received an A minus score for our CDP climate change survey, a leading environmental rating system focused on climate related transparency and action.

In January, we announced alongside other providers the formation of the European Climate Neutral data center pact, committed to ensuring data centers in Europe are carbon neutral by 2030. We continue to invest significant resources in our ESG leadership, and will roll out additional global ambitions over the coming quarters in both our environmental and social initiatives.

Now turning to our results, as depicted on slide 3, revenues for Q1 were $1.6 billion, up 7% year-over-year, adjusted EBITDA was up 10% year-over-year, and AFFO was meaningfully ahead of our expectations. These growth rates are all on a normalized and constant currency basis. Our leading interconnection franchise continues to perform well with revenues substantially outpacing colocation, growing 13% year-over-year, driven by the continued strength of Equinix Fabric. We now have over 398,000 interconnections and added more organic interconnections year-over-year than the next 10 competitors combined.

In Q1, we added an incremental 6,700 interconnections fueled by hyperscaler build outs and strong enterprise demand, offset by a slight seasonal increase in network grooming activity. Internet exchange saw peak traffic up 9% quarter-over-quarter and 28% year-over-year, driven by the cloud and network segments. Equinix Fabric also saw strong growth driven by expanded use of our inter metro offering and continued diversification of n destinations. More than 2,500 customers are now on Fabric and we remain focused on driving higher attach rates for this product across our platform.

We're also seeing strong customer interest in our Equinix metal offering and continue to deliver on our commitment to expand the availability and feature set of this offering enabling as a service consumption of our value proposition across 18 Global metros. On the xScale side of our business, we're accelerating our pace and continue to make meaningful progress on our ambitious plans for 2021 as rapid growth in the digital economy, drives increased demand for global cloud connectivity. With our xScale facilities hyperscale companies can add large footprint core deployments to their existing network and onramp footprints at Equinix. Enabling faster time to market and offering direct interconnection to a vibrant ecosystem with their customers and strategic partners. Our more than $3 billion program finance with the support of our JV partners will develop over 290 megawatts across our first two JVs with several more already in the works.

We are broadening our reach with the first building of our Dublin five campus which is JV ready, and already 100% pre-leased to a major hyper scalar. Additionally, after quarter end, we pre-leased our entire London 11 asset. These two deals alone represent nearly 40 megawatts of capacity fully committed in advance of delivery.

Now, let me cover highlights from our verticals. Please note that we updated our customer segmentation approach to better reflect industry classifications and use cases as well as combined our financial services and enterprise segments to reflect the true scale and momentum of the enterprise opportunity. Going forward, we'll report under these four key verticals. Our network vertical saw strong bookings led by the previously mentioned strength in the Americas as firms expand their capabilities and capacity for digital business and momentum begins to build for industrial 5G applications.

A meaningful part of our network vertical is resale, an indication of the momentum of our channel efforts as we work with partners to deliver more complete solutions to support enterprise digital transformation. Expansions this quarter include British Telecom, a leading telecommunications provider, optimizing network and connecting to multi cloud for their global enterprise and customers. And Elextra, one of the first Mexican cloud service providers leveraging Equinix Fabric to provide a multi-cloud product offering and SUB.CO, a leading subsea cable system development firm deploying a cable node to establish the first route between Oman and Australia.

Content and digital media achieved solid bookings as indoor entertainment continues to drive activity in the social media, gaming and streaming platforms. Expansions included marquee wins like Roblox expanding across platform Equinix to support the rapidly growing user base and big data requirements, as well as a global edge cloud provider expanding capacity and deploying network nodes to support accelerating demand for video content. Our cloud and IT vertical delivered strong bookings led by hyperscalers, continuing their global growth, and is worth noting that these bookings results do not include the previously referenced xScale wins, which are additive to this strong retail performance.

Q1 was also an exceptional quarter in terms of cloud on ramp additions, with 21 new on ramp wins in the quarter, roughly equivalent to our cumulative volume over the prior four quarters and representing a 75% share of on ramps launched in our metros. As a result, Equinix customers can now enjoy low latency access to multiple clouds in 31 metros across the globe, including eight of the world's top 10 metros by GDP. Expansion this quarter included a fortune 30 software provider deploying infrastructure to support digital transformation and IT initiatives and Everest and Australian cloud services provider specializing in healthcare, expanding to meet country specific data compliance requirements and improve user experience.

Our enterprise vertical continued to be a major contributor to overall booking performance, driven by strength in the retail and financial services sub segments, as enterprises shift from pandemic initiatives such as work from home and collaboration to a broader focus on digital transformation. Expansions included CME Group, a top global financial derivatives exchange, expanding their footprint to support growing demand of matching engines resulting from a new platform launch, as well as a leading global airline re-architecting to connect to their preferred network and cloud partners and tap into our growing transportation ecosystem. And our channel program continues to deliver exceptional results, contributing more than 30% of our bookings and accounting for over 60% of our new logos. We had great wins with resellers and our alliance partners including AT&T, Dell and IBM across a wide range of industry segments focused on digital transformation efforts and COVID-19 response.

Partner wins included working with Verizon, utilizing their network as a service strategy to help a large US healthcare provider modernize their mission critical contact center, and leverage a new cloud architecture supporting 12 million members across the US, as well as a win with a global Canadian manufacturer deploying in Canada and Germany for WAN optimization and cloud access, utilizing Cisco's SD-WAN solution interconnected to Equinix Fabric.

Now let me turn the call over Keith and cover the results for the quarter.

Thanks, Charles. And good afternoon to everyone. On the heels of our record end to 2020 we delivered a great Q1 with strong gross bookings. In fact, our best Q1 ever and our second best net bookings quarter ever with solid performance across virtually all of our key metrics. Our platform continues to shine with strong inter and inter region activity with a high interest in our expanded product and service capabilities, further separating us from our peers. Interconnection revenues now represent 19% of our recurring revenues reflecting our continued interconnection momentum. With a great start to 2021 and increased visibility over the rest of the year, we're raising our guidance substantially across revenues, adjusted EBITDA, AFFO and AFFO per share on a constant currency basis.

Now let me cover the highlights for the quarter, note that all growth rates in this section are on a normalized and constant currency basis. As depicted on slide 4, the global Q1 revenues were $1.596 billion, up 7% over the same quarter last year, our 73rd quarter of top line revenue growth due to strong business performance led by the Americas. As expected, nonrecurring revenue decreased quarter-over-quarter to 5% of revenues. But as noted on our last earnings call, we anticipate a meaningful rebound in Q2 MRR due to forecasted custom installation work across a number of markets highlighting the inherent lumpiness of this revenue source. Q1 revenues net of our FX hedges included a $6 million headwind when compared to our prior guidance rates.

Global Q1 adjusted EBITDA was $773 million, up 48% of revenues, up 10% of the same quarter last year, significantly outperforming our expectations due to strong operating performance and net utility costs. Our Q1 adjusted EBITDA performance net of our FX hedges included a $3 million FX headwind when compared to our prior guidance rates, and $4 million of integration costs. Global Q1 AFFO was $627 million meaningfully above our expectations due to strong operating performance and more seasonal recurring capital expenditures. Q1 global MRR churn was 2%, a meaningful step down with lower short across all three regions. This improved churn is a reflection of our continued disciplined strategy of selling the platform to the right customer with the right application and into the right footprint. For 2021, we continue to expect MRR churn to average between 2% and 2.5% per quarter.

Turning to our regional highlights whose full results are covered on slides 5 through 7. APAC and EMEA were the fastest MRR growing regions on a year-over-year normalized basis at 10% and 9%, respectively, followed by the Americas region at 4%. The Americas region saw continued momentum with record price adjusted gross and net bookings through pricing, and a large step up in cabinets billing. We're seeing good momentum across many markets in the region with particular spans in Dallas, New York and the smaller metros of Denver and Mexico City. We have a strong booked but un-built backlog and continue to expect a large step up in billing cabinet through the first half of 2021 as partially experienced in Q1 and with more to follow in Q2.

Based on this momentum, we expect the Americas normalized quarterly revenue growth rate for the remainder of the year to be at or near 6% or better. Also, our prior hedging strategy minimizes the impact our business from the utility price spikes in Texas during extreme weather situation in February. Our power hedging program along with a world class operational management ensured we also protected our customers from these price spikes as well. There is no incremental revenue due to this unexpected weather situation. Definitely our Texas and Oklahoma wind farm settlements trended positively during this quarter.

Our EMEA region saw strong bookings in the quarter, including healthy exports and record intra region activity. Although our flat markets remain core to the region's booking engine, we're also seeing increased customer interest in our edge metros with strong momentum in Dublin, Madrid, and Stockholm and our new market of Muscat and our soon to be open Bordeaux facility. Revenue growth remained strong, although moderated from previous levels as expected. As we lap past for successful cross connect repricing initiative. Interconnection revenue stepped up to 13% of recurring revenues, showing continued momentum. And finally, the Asia Pacific region has solid net bookings with good pricing and strong enterprise and cloud growth led by our Singapore and Japan businesses. Utilization rates continue to remain high, but with open capacity in key markets this quarter and will add additional capacity through 2021 to ease potential inventory constraints.

And now looking at our capital structure, please refer to slide 8. We ended the quarter with cash of approximately $1.8 billion, an increase over the prior quarter, largely due to our inaugural euro denominated green bond refinancing, which raised EUR 1.1 billion and a weighted average interest rate of 66 basis points. As a result, Equinix now has the lowest weighted average cost of debt capital and the longest weighted average maturity of any publicly traded debt data center company. We also expect to refinance our remaining US or high yield bond over the near term. Further driving down our average cost of debt. Our net debt levels remain low relative to our peers at 3.7x at Q1 annualized adjusted EBITDA. We continue to work alongside our credit rating agencies and are pleased to announced that earlier today, S&P upgraded Equinix to BBB flat and widened our leverage tolerance to five times. One, we're very appreciative of the continued support we get from S&P and importantly, we're delighted with this increased financial flexibility.

Looking forward as stated previously, we'll continue to take a balanced approach to funding our growth opportunities while creating long-term value for our shareholders.

Turning to slide 9 for the quarter, capital expenditures were approximately $564 million including recurring CapEx of $20 million. We opened eight new retail projects this quarter adding 7,400 cabinets including a new IBX in Milan. On the xScale side of the business, we opened three new facilities in London, Paris and Tokyo adding an initial 28 megawatts of capacity in our JVs. All this hyperscale capacity has been pre sold. We also purchased land and buildings for development in Montreal and Mexico City. Revenues from owned assets represent 56% of our total revenues now. Our capital investments deliver strong returns as shown on slide 10. Our now 154 stabilize assets increase recurring revenues by 5% year-over-year on a constant currency basis. Also consistent with prior years during Q1 we completed the annual refresh of our IBX categorization exercise. Our stabilized asset count increased by net seven IBXs. These stabilize assets are collectively 85% utilized and generate 27% cash on cash return on the gross PPE 0:20:14.6invested.

Now, please refer to slide 11 through 15 for update and summary 2021 guidance and bridges. Do note our 2021 guidance does not include any financial results related to the pending APAC - and acquisition, which is expected to close in Q2, or any future capital market activities. For the full year 2021, we're raising our underlying revenues guidance by $40 million and adjusted EBITDA guidance by $33 million, primarily due to strong operating performance and favorable net utility costs. This guidance implies a normalizing constant currency growth rate of 7% to 8% year-over-year, and an adjusted EBITDA margin of approximately 47%.

And given the operating momentum of the business, we're raising our 2021 AFFO by $26 million to grow between 10% and 12% on a normalized and constant currency basis, compared to the previous year. We're also raising our 2021 AFFO per share to range to now grow between 9% and 11% on a normalized and constant currency basis. 2021 CapEx is now expected to range between $2.725 billion and $2.975 billion, including approximately $180 million of recurrent CapEx spend, which represents about 3% of revenues. This guidance also includes an incremental $200 million of balance sheet xScale project, funds that we expect to recover, after contributing these investments into our current and our future jayvees. So let me start here, I'll turn the call back to Charles.

Thanks, Keith. In closing, we had a terrific start to the year. As evidenced by our results, the demand backdrop for digital transformation remains strong. And I'm very pleased with our Q1 execution and the continued progress against our key areas of focus. As the world's digital infrastructure company, we are supporting service providers of every size and shape to build out their infrastructure of the digital edge, infrastructure that is more global, more distributed and more cloud connected than ever before. And together, we're leveraging the power of our platform to cultivate scaled digital ecosystems, enabling our enterprise customers to access all the right places, all the right partners and all the right possibilities, as they transform their businesses and seek to accelerate their digital advantage.

On behalf of the 13,000 plus dedicated members of the Equinix family around the world, I want to say thank you to our 10,000 customers for the trust they place in Equinix. Finally, we look forward to our Analysts Day in June, where we'll continue to the discussion of our highly differentiated business model, outlined the enormous opportunity ahead and discuss the actions we are taking and the investments we are making to drive sustained, long-term value creation for our investors and our customers. So let me stop there and open it up for questions.

[Operator Instructions]

And our first question today comes from Ari Klein with BMO Capital Markets.

Thank you. Can you talk a little bit about the lower churn in the quarter? What specifically is driving that and whether or not maybe longer term, you see a path to maybe coming down from that 8% to 10% range that you typically see.

Sure, Ari. Yes, obviously a great quarter on churn, really, as you said in the script, one of the best we've had in a number of years. And, probably a little bit of timing there. We were - we had some kind of pull forward. And we probably pushed a little bit out, but I would say that I think that we are, we continue to believe and as we've talked about this many times that the best, our best way of managing churn is to continue to be really disciplined in our targeting and our execution of the go-to- market engine. And I think that we're seeing that. The mix of business continues to be right on the money for what we want, I think we're selling a lot of business into that the sweet spot of sort of small to mid-size, interconnection heavy applications and use cases. And again, I think that's going to bode well for us over time. So I mentioned this in several other forums, which is we have been the last two quarters up towards the high end of the range, and even slightly over run in q4. But now down right at the bottom of the range. And I think we're really seeing positive trending on the churn. So and we have efforts underway to really identify all of the really project out and look at churn, churn risk in the business in a very sophisticated way, identify and get ahead of it. And I think we're seeing real dividends from that.

Got it, thanks. And then just maybe quickly on the new customer additions, it seems like you're a little bit off the recent pace, there is obviously a lot of activity and you're investing in the go-to-market, is that an area we should expect to see an uptick over the next few quarters?

Yes, I mean, I think that we're - our new logo additions continue to be strong, we had good momentum in new logos through the course of 2020. Q1 is a little bit of a seasonally soft quarter for new logo additions, typically, but we saw good results, I think enterprise demand continues to be very strong, our aggregate customer count is not going up as fast as our new logos, due to a variety of factors, including the fact that we are seeing some consolidation activity at the parent account level, we see some other movement in terms of people leaving the system either due to smaller, some smaller customers that might be leaving the system due to financial constraints or other things. But I would say overall we were seeing good, healthy new logo ads. And I think we're - we expect continuing to see the new customer count grow.

The next question comes from Jon Atkin with RBC.

Thanks. Question about slide 19 on xScale, and then slide 23 on kind of the lease renewal. So, xScale, I'm just wondering, if outlines stuff it's opened up, so it's kind of in the pipeline? Is that the right kind of cadence to think about going forward? Or could that potentially accelerate. And if you could remind us how that translates into fee income, there's like four different ways you get paid, but some of that may be more front loaded than others before, where you would get the revenue before or recognize revenues before the customer actually moves in. And then on slide 23, just on the lease renewals, I'm wondering, what would be a realistic remaining pipeline to think about that would enable you to convert these properties to own properties? Or is it mainly a matter of managing your renewals going forward? Thanks.

Sure. Jonathan, why don't I start with a little bit of color on xScale at a macro level? And then Keith, if you want to jump in and share a little bit more on the fee streams and their impact in flow through into the business, that'd be great. And then we'll pick up the second question. But look, we're delighted with and the efforts of Krupal, and the xScale team and in the group of people supporting them from within the core Equinix, as well as the support we're getting from our partner at GIC, is things are really humming in terms of the xScale business. Obviously, we talked about the fact that we've had great pre-leasing activity on the facilities that we put out there, I think there is an opportunity for us to increase the pace, and we're going to come back to the Analyst Day, and really talk about kind of what we would see as the scope of opportunity for xScale going forward. As you'll recall, we talked about that in 2018, at the Analyst Day.

And I think that we were - we certainly, I've said in a number of other forums, that we're trending more towards the high end of that. And I think we'll give more clarity on what's possible, we think in the xScale, business, but we're targeting the pieces of the pie out there that we think are really strategically important and add to the overall platform value. And again, we're seeing really good momentum in the business right now. I do think there's an opportunity for us to continue to pick up the pace. So Keith why don't you comment on the fee streams and impact in the fall through.

Sure. So Jon, as always, the fees, there's four fee streams, two are recurring in nature and two are nonrecurring. And then the fifth, if you will, stream of value that comes in is global line through income, equity to affiliated entities. So basically, that's our equity ownership in the business. Now, having said all of that, you are starting to see the momentum picked up, as we announced in our prepared remarks, we introduced three new assets in this quarter, and all of them are pre sold. And so it gives you a sense that the momentum is picking, is picking up quite substantially with a fairly robust opportunity in front of us. So what you're going to start to see in the coming quarters is some nonrecurring aspects of the fee income, but you're really going to start to see a ramp up of the recurring fee stream as well. And, again, we'll talk more about it on in the June Analyst Day, but suffice it to say it is exciting to see the momentum coming from that team. Yes, so let me just leave it there. I think we answered your question.

Keith, why don't you pick up the lease renewals as well, and just what the opportunity might be for us to continue to increase ownership.

Sure. And then the second one, as you're talking about Jon about the lease properties, there's a number of transactions that we are currently in the middle of, they are - we have negotiated the purchase price, the purchase of those acquisitions is built into our forward guide, no surprise to you both as relates to cash, but also the anticipated consumption of those lease arrangements inside our financials. So we are continuing to acquire, where we can, there are some that are that clearly are more important than others. And so where we can, we will focus on those that are the most important. Yet at the same time, as we think about our future growth. I think if my memory serves roughly 75%, of all of our future growth right now is on property that is owned or we have a long-term arrangement with our grand lease, and it's 75% is going into major metros, notwithstanding the fact that we still have 30 plus over 35 projects underway across the world in many, many metros in many, many countries. So all that said is you'll start to see that continue to go up, it takes time. And then we'll, I should say, we will answer when we're closer, but suffice it to say there are some transactions that we are anticipating to announce over the not-too-distant future.

Understood. And then just lastly, if I could squeeze this in, the Americas margins came in a lot higher, at least than we were expecting any kind of drivers of that or color you can provide.

I think prepared remarks that I had, and like, first and foremost, the business is performing exceedingly well, the Americas business. One of the things when we report there's two aspects to it and there's the, if you will, the fundamental business that will compare apple-to-apple versus the APAC region, the EMEA region, and then there's the corporate overlay. So if I tell you more specifically the Americas region in and of itself, without the corporate overlay, margins are continuing to improve largely because we have very strong interconnection activity, where we continue to grow our customer base and our scale, and we're driving more profitability into the business. So that's the, if you will, the easy response.

The second part is that just as timing of expenses, as you know, between Q3, Q4 and then this quarter, there's been some movement of costs around different quarters. And as a result we started to see the benefit of those of that movement in Q and Q4. Specifically, as a relates to Q1 though, again one of the comments we made was that we have a very strong utility costs for power hedging program, our operational team operate our businesses very, very effectively the assets, particularly in the Americas, and in this particular case, Texas. And so we have a strong hedging program that protected us against those spikes in price. But we also have a wind farm arrangement, where both in Texas, and in Oklahoma, we have wind farms. And so we had some benefits attached to that. And then there's some seasonality around a repairs and maintenance expense. But overall, you're seeing fundamentally a US business, our Americas business it is performing exceedingly well and continue to drive margin into its financials offset by the corporate investments that we've been making.

And mix a business was really good in the quarter two in terms of strong MRR performance, which always helps the margin. So, yes, really good quarter, we are continuing to invest. We're being disciplined about the pace of that. But and we obviously were pleased with the margin performance, and we do have an eye on margin expansion as a priority for us over time.

The next question is from Sami Badri with Credit Suisse.

Hi, thank you. My first question is to do to visit back on xScale. I know you guys have laid out quite a bit of information on that recently. But the one thing I think that would be very helpful is when we look at the originally published returns that you guys were targeting between 13% and 17%. I believe in the 2018 Analyst Day, did that include all the various forms of income that you're going to be generating from the xScale venture. And is also that the same yield range we should be thinking about for the xScale business.

Keith, do you want to take that?

Sure. We're driving Charles direct traffic since we're in two different places. So pardon the pause. So as it relates xScale, look, number one is going to be very market dependent, right. Some markets are more competitive than other markets and you're looking at unlevered anywhere from sort of unlevered returns of 8% to 12% at the project level, we get a p stream on top of that. And then of course, we put - we some debt on the business. So as a result, when you look at hopefully Equinix position our return profile is as good if not better than what we've shared. Now, having said all of that, if you ask me on a specific project, there'll be some variation. But the team under Krupal's leadership is working really, really well. Not only with our construction team, but with our JV partners, to make sure that we get the right returns and we're negotiating appropriate with the various hyperscalers to get a good long-term contract. So overall, again, I'll just say that there's no material variance from what we said the bending is a little bit better. And as Charles made in his prior comments, in fact, there's probably a broader or bigger appetite over the coming quarters and years, though, given the momentum that we're seeing that you'd see maybe us do more than we originally anticipated, from the June 2018 Analyst Day.

Got it. Thank you. And then just one quick follow up for you, Keith, is I know that guide does not include any further capital markets activity, and you did mention that you're looking to retire the high yield debt that you have, are you going to reissue that as green debt or in another region? Are you targeting, do you have something in mind for when you do revisit that?

Yes, Sami, no surprise to you, there'll be an element of green attached to any transaction that we do, we do anticipate that we will retard over the newer term, as I said, there's a relatively strong positive impact associated with that. And, again, I'll let everybody do the math. And what that is but there will be a blend of perhaps 5, 7, 10 maybe even 30-year terms that make sense that we go out that far, some of them will be green, that would be that tend to be on the shorter end of the curve. And then the only other thing I would say is to extent that we can, we will take advantage of those - the opportunity to make sure that we can retire some of our foreign debt, where possible and arbitrage over a favorable sort of interest rate environment. And the last thing I just want to say is again, we're delighted with the work that our Treasury team has been doing under Melanie's leadership, to negotiate with S&P and get a favorable upgrade. But what was really important here is more financial flexibility.

And as many of you have asked over, both in our private sessions, but also on some of the calls, we've always wanted to have more financial flexibility as it relates to debt. And no surprise to everybody debts are cheapest source of capital. And as a result, you will see us continue to focus on refinancing the debt and then also using debt where appropriate, with some balance to equity, to make sure that we create this long-term investment portfolio that we've announced, from our perspective, I just think it was the best of all situations today that not only getting that upgrade, but also having the flexibility to drive down our cost of capital.

And the next question comes from Michael Rollins with Citi.

Thanks and good afternoon. First, I was just curious if you can just unpack a little bit more of the organic increase in the annual revenue guidance. I think that was up $40 million. And when you consider the size of that change on $6 billion of revenue last year, how does that fit into the organic, constant currency revenue growth guidance range of 7% to 8% for 2021 that was unchanged from when you provided that in the fourth quarter. And then just secondly, just a follow up on xScale. So it seems that for some of the projects, before they enter into the joint venture, you're taking some of this on balance sheet, you're running some of this on balance sheet from just a high-level perspective. Can you just help frame how we should think about the financial impacts? If that's happening relative to what's the core operating business and strategy. Thanks.

Sure. Well, Keith, why don't you go ahead and grab the revenue guide, and we can a pair up on the XScale follow up?

Yes, So Michael, I think there are a couple things. One, when we do the charts, the charts that we've shared in the earnings deck with everybody, we really try to simplify it. There are two aspects to it. One is what is - how are the underlying business performance and its $40 million and uplift. The second part is what currency and based on the forecast rates that we're using it's 61 million down graph. But frankly, if I took the spot rates from today, which we don't do the day off, we also we have forecast rates, that $61 million would more would be cut in half, if not by more, just to give you a perspective. Having said all that, when you look at the fundamental underlying business, it's all about the rounding again, what we've done is we've taken a step up, added $40 million of revenue on $6 billion business. And now you're starting to see us move up into the range in the 7% to 8% range. So before the bottom end of the range, it was slightly below 7%. Now, you're basically you're in - you're well into the range on the 7% to 8%. Again, this is the first step that we've made since the Q4 earnings call, again, there's momentum in the business, and we're just delighted by the ability to be able to raise $40 million on the underlying business.

And where's that $40 million coming from? Regionally or activity supplies?

Yes, I mean, as it relates to our sort of our comments around the Americas business. I'm sure it wasn't lost and you was right to look at our comment that the Americas business for the next three quarters, it's going to be at our 6%, if not better, and so it gives you a sense of the Americas business, it had a record, not only a record bookings quarter, certainly on the net basis, the churn is moderate. And as a result, you're getting in Americas business continuing to perform. And so that's one aspect of it. And then the other two regions sort of down the middle there some aspect due to our prior pricing uplift in Europe sort of having the lappy through, if you will, those price increases, and some of the accounting adjustments we made last year. But the reality is that overall; the business is performing well across our platform.

And that's what excites us most, that if I was to say one specific thing it’s the Americas business, we're just delighted by the momentum that we're seeing. Charles made the comment in his prepared remarks, and there’s over 4,000 transactions with over 3,000 customers in the quarter. We are operating at a scale that is just so substantial. And by the way, our pipeline is exceedingly strong. And so as a combination of all that, that has given us the confidence and the visibility to raise our guidance at this juncture. And we still have three quarters to go. And by the way an Analyst Day.

Yes, and then on the XScale piece, Mike, yes, we are kind of leaning in, and moving projects forward, even advance of those being into the JV structure, because we think the market opportunity kind of is there to grab. And, as Keith said in his script that there's a couple 100 million dollars there, we would expect to come out of that and sort of macro guide he gave overall, which would come in the form of reimbursement once those facilities move into the JV. And so that's something that we -- and but I would say that we our preference obviously, is for projects to be into the JV from the beginning. And I think we're now at a point where many of the projects will be able to do that with, but especially in markets where we are looking to either form new JVs or due to other circumstances, we are leaning in taking advantage of the strength of our balance sheet to move those things forward. But then looking to get, obviously, those things get reimbursed and come back to us, given that we're, again, our capital commitment into those projects is basically, one year that sort of a 10 to 1 ratio, since we're 20% owners, and we expect leverage on those projects.

And if I can just add on to what Charles said there, I think the most important part is to recognize so when we do an uplift, like we said in this particular case of our CapEx spend, unfortunately, when you look at our financials, it looks like our CapEx has been elevated, but ultimately, when we get that reimbursement from the joint venture, it comes to a different line. And so it will be the sale or disposition of that construction and progress into the JV. And so basically, it's a gross up, if you will. And so that's how it gets represented, but going forward as Charles said, our objective is to do most of this work inside the JV instead of on our balance sheet. And we're working really hard and we'll probably spend some more. I anticipate we'll spend much more energy talking about this at the Analyst Day, because I think there's a really good story around that particular topic.

The next question comes from Omotayo Okusanya from Mizuho.

Yes. Good evening. Congrats on the solid quarter. My question has to do more around some of the effects, or the FX impact. When I take a look at the new guidance assumption, just around the Singapore dollar or the Euro or the pound, it seems like there's an assumption here that those currencies are going to get, that the dollar is going to get stronger against those currencies. But all, we're really seeing the dollar getting weaker. So I guess I'm struggling a little bit with why the new FX assumptions are assuming the strength in the dollar, which is kind of causing this FX drag on to kind of otherwise, kind of stellar quarter and outlook.

Sure. Do you want me to take that, Charles or -

You bet, yes, all yours.

Okay, thank you for the question. And sort of thanks for raising it. I think if you were to step back and say what is the overall bias to the US dollar, it's for the US dollar to get weaker. And that is something that we anticipate. Having said all of that, when we go through our exercises to forecast and reforecast like every quarter, we have to look at the prevailing rates, irrespective of what they might be in the future. And so as a company, when we on the Q4 for call, if you recall, we took on 100. And there's $106 million, if you will, when that are back from the weakening of the US dollar versus the basket of currencies that we operate in. This quarter that actually reverse when we analyze the impact avails it was $61 million headwind. But as I said in one of my other responses, that's based on our forecast rate, so we use when we read it reforecast of the year, and we've given you the guidance, how you use the spot rates of today, there basically is that $61 million would drop, actually by $45 million.

So it tells you that the US Dollar weakened again. So again, we try and bring a lot of discipline to how we message. It's at the point in time, if you do the forecast; we are not projecting forward on what might happen. If it does happen, then you'll see a benefit. And you'll see that benefit primarily because roughly 60% of our revenues are earned in currencies other than the US dollar. And so when the US dollar weakens, again, recognize we do have some hedges, and they take time to burn off, then you will see uplift in revenue accordingly. So hopefully that answers your question. And let me stop there and just see if I did answer your question.

Yes, that's actually very helpful. Now, I kind of understand some of the nuances around that. But if you can just indulge me with one more. I mean, when you were at the beginning of the year, it was a lot of concern, just around expansion of sales cycles whether it was in the hyperscale side, or whether it was on the enterprise side. Could you just talk a little bit about again, it seems like given your stellar quarter and some of the comments you've made about your verticals that really isn't a concern anymore. Is that a fair statement?

Yes, we I mean, honestly, we hadn't really experienced that other than I think in the very acute periods of COVID, where people were trying to sort of just figure out how to make the transition to work from home and really dealing with matters of survival. We did not see any sort of extension significant extension of the selling cycle, in fact, I would say that, I think what we're finding is that we're improving our skill set and capability of delivering the sort of the digital transformation-oriented messaging to our enterprise prospects and seeing good momentum in terms of bringing those sales cycle down. And so, yes, we haven't seen that hyperscale sales cycles are a little longer, but I wouldn't say they have protracted, in fact, I think we've made really good progress with several of our key hyperscale customers, trying to define more repeatable terms that we can do business under, which is compressing the timeframe in which we can get deals done. And it's been - that's been an important priority for us and one that we have really put a lot of energy into late and it's really important to our partners and customers. So I would say no, I feel good about sales cycle right now. In fact, I think when we're looking at our funnel, we are seeing a very deep funnel and we're feeling like conversion rates and conversion timing, support optimism about the remainder of the year, which is all kind of reflected in our guidance.

The next question comes from Colby Synesael from Cowen.

Great, thank you. Few questions. So on the - 2Q - yes on Q2 guidance. You mentioned you're using a wider range just given what could be some; I guess volatility within the nonrecurring portion. I was wondering if you could just give us some sense of what you're thinking MRR might look like and could we step back up to the levels we saw in the fourth quarter? And is that a better assumption going forward? And then secondly, just a point of clarification on your CapEx guidance, you maintain the guidance at $2.125 to $2.315 for the nonrecurring portion, but is that including the 425 to 475 for xScale, it felt like you were saying in your prepared remarks that it is included, but the way at least the press release looks like reads, at least reads to me like it's excluded. So I just want to get clarification there. And then just real quickly as relates to the Analyst Day, obviously, xScale is going to be a big focus. It's been a big focus of questions this evening. What else are you planning? Like what is the big focus? I mean, where do you think that investors are maybe a little bit off in terms of their thinking that companies really want to make sure you're going to be hitting home on. Thank you.

Keith why don't you talk about the Q2 revenue range, and MRR and then the xScale CapEx? And I'll pick up that last piece on the Analyst Day focus.

Sure. Yes, Colby, as it relates to the nonrecurring, I think what you could see is that means they step up to if you think about Q4 of '20, you're at - you're starting to get to a percentage of nonrecurring revenue that could look something like that. As we said in the prepared remarks, and again, I know this quite well, because of some of the work that we're doing. And I made a reference a couple quarters back, that there are some large installations that were taking place in the first half of the year, it looks like that those will close and install in Q2, as a result, you'll see a step up, again, look, be more reflective of what you - the percent of revenue coming from nonrecurring that we saw in Q4. And then it moderate back down higher than Q1, but moderate back down more - to a more reasonable level for Q3 and Q4. So hopefully, is that helpful? I want to make sure -

Yes, it's perfect. Thank you.

And then on the xScale, CapEx, Keith.

Yes, I'm sorry, pardon me, as it relates the xScale CapEx that is included number.

And then relative to Analyst Day, there'll be a number of things, yes; we will definitely talk about the momentum in the xScale business. Again, it will start flowing through and at least in positively impacting the overall business. But again, since we don't consolidate revenue there it's not going to be a major driver there other than some very positive flow through on the fee streams, and, of course, the continued strategic importance of that to our platform, overall. But I think our focus is going to be speaking about the overall opportunity giving some additional color on our views on the addressable market, and how it's expanding and how our relevance to digital transformation continues to increase in the eyes of our customers, we'll talk about what we're doing to continue to evolve our go-to-market engine to respond to that, including how we're, what we're doing on the channel side of things. We'll also talk about our roadmap for digital services, and how we're adding to and scaling capabilities like network edge and Equinix metal, and maybe what we have on the horizon in terms of how those digital services are really going to be responsive to how our customers are thinking about consuming and adapting their digital infrastructure for the world ahead. And I think that we're now we're continuing to see great momentum, great response from our customers, and we're eager to hear and share those things coming in June.

And the next question comes from David Guarino with Green Street.

Hey, thanks. Last quarter you guys mentioned the development yields for xScale have declined since you initially entered the hyperscale space. Can you just maybe talk about what's happened to hyperscale cap rates over that same timeframe and what that might mean for Equinix and their ability to achieve better pricing on JV than the initial ones that were done in GIC?

Yes, I mean, I would say that we did mention that and as Keith said, I think that our overall return profile continues to look very attractive in terms of what we think post fees and post leverage the kinds of returns that we're going to be getting on those projects. Although, as he also said, it is a wide range depending on individual projects and individual sort of market circumstances, because I do think there are markets where we've seen that, because I think Keith quoted 8 to 12 is the sort of yields that we're looking at in terms of a range, and there are markets that are certainly at the low end of that, where due to a variety of circumstances, and just the overall competitive nature of the market. But I think in terms of, I think we we're very pleased with the nature of our relationship with GIC, we think that we can continue to extend that and have other JVs of similar ilk around the world, under very favorable set of terms, we find ourselves to be very attractive partner, and based on the engagement that we've had, as we've looked at these JVs. And so we expect, we're going to be able to get very favorable terms for those partnerships, and having them be very much a win-win. So, Keith, I don't know if you want to add anything on that last topic relative to the cap rates.

No. I think that was reflected in the comments. Again, it will be specific to the market, again, when we look at the project level, and then there's a p stream for Equinix. And then the leverage that we put on the business, and overall, we're pleased with the business. And, again, we're going to spend a lot more energy talking about this in the June Analyst Day, and we will be able to break out and give you a little bit more color. I think that will make you probably more satisfied with the overall project, Dave.

Okay, no, that's helpful. And then maybe one more question. We haven't really talked about this topic in a while. But could you share your thoughts on public-to-public M&A for the data center REIT sector, and if Equinix could be a potential player in that?

Sure, I'll comment and Keith if you want to add, feel free. We again, we have always believed and we've been quite successful using M&A as a tool in terms of thinking about how to expand our business and create value for our customers and for our shareholders. That hasn't changed; we continue to believe that there are opportunities out there. I would say that probably more of them are aligned around in the private markets. And we've clearly been active in that regard filling out our platform geographically, and adding key scale in locations in some of our markets around the world. But we're not going to be if we felt like there were transactions that we think were highly strategic, and we're the right economics in terms of how they deal with flow through an accretion basis that we're going to be open to those things. But I'd say there's probably a little bias we're in right now more towards private opportunities and greater opportunities in the private markets, but we're going to always be have our eyes wide open.

And the last question comes from Erik Rasmussen from Stifel.

Yes, thanks. Maybe just back on xScale, you really have been leaning into that initiative over the past few quarters. Can you just maybe comment on the environment as relates to the hyperscalars? Is this more concentrated with a few of the leaders? Or is it more broad based?

Yes, I mean, when we formulated the xScale entity and approach, we talked about a range of players there that would be that we would pursue relationships with and pursue business with. It is to some degree concentrated, I think that's just that's the nature of the hyperscaler community today, is that they the largest end of that is taking up more of the overall demand, or providing more of the overall demand. So it's concentrated at some level, but we have had significant success beyond sort of the three or four that would pop to mind for people right off the top of their head. And so, I think we're going to continue to evaluate those opportunities. But I and I would say that we're really continuing to build on a strong relationship we've had with that full hyperscale community for a very long time, because as I talked about with our - when I characterize our hyperscale relationships at the Analyst Day in 2018, we - they are amongst our largest customers, many of them, and that is a lot of it on the backs of really the important role that we play in terms of their network nodes, their on ramps, and other elements of their infrastructure, outside of sort of availability zones, and really large core deployments that might be more of the focus for xScale. So it's a very multifaceted relationship that we have with them. They're critical, we believe that as people drop adopt hybrid in multi cloud as the architecture of choice, we think doing that at Equinix is really going to be a priority for them in terms of both superior economics and performance. And so their relationships that we have with the xScale, with the hyper scalars are very important to us, and certainly too some degree concentrated from a demand basis, but we're continuing to strive to extend that to larger portfolio customers.

Great, maybe just my last, my follow up then any change in a competitive environment in Europe, around DLR and Interaction year after that deal is closed especially as it also appears that investment activity has picked up and demand still seems to be pretty robust there.

Yes, I would say no, not really. I mean, I think we continue to feel very good about our overall competitive position in Europe, as I said Interaction is, has always been a very critical, credible pan European player there and I think that continues to be the case. But we have, what we think is a much stronger global story. And I've had great success in the market and am going to continue to build on that success and we feel good about our position there.

Thank you. That concludes our Q1 call. Thank you for joining us.

Thank you. That does conclude today's conference. And thank you for participating. You may disconnect at this time.