Equinix Inc

NASDAQ:EQIX

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

Abbvie Inc

NYSE:ABBV

|

Biotechnology

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Realty Income Corp

NYSE:O

|

Real Estate

|

| US |

|

Walt Disney Co

NYSE:DIS

|

Media

|

| US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

Technology

|

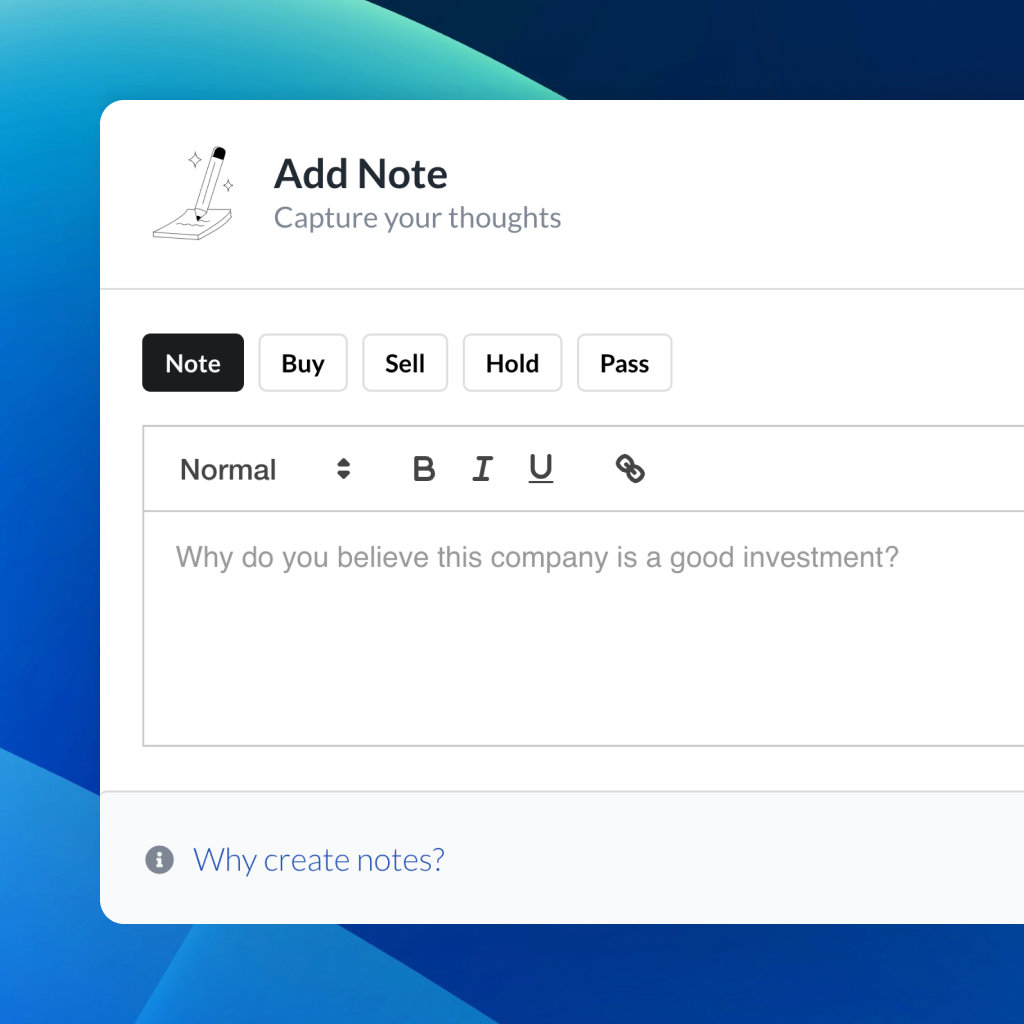

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

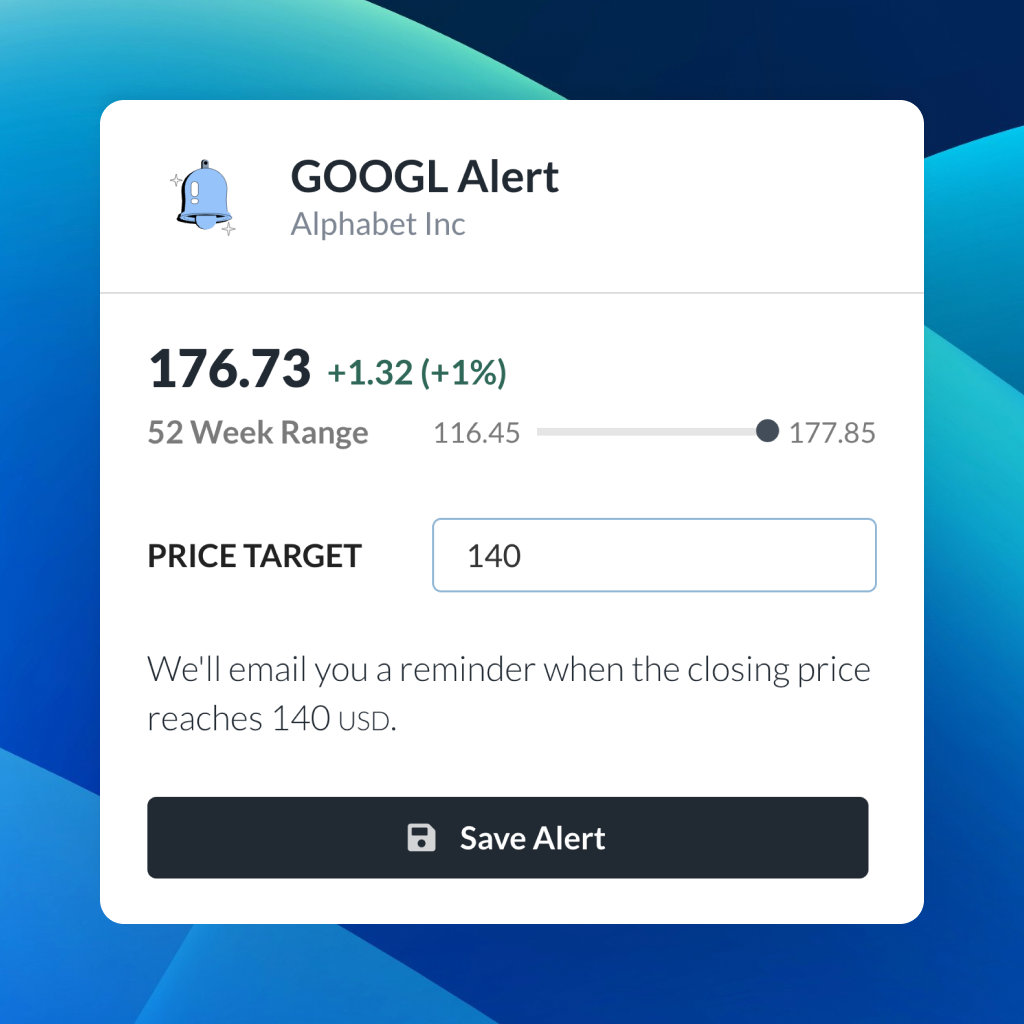

| 52 Week Range |

682.24

913.66

|

| Price Target |

|

We'll email you a reminder when the closing price reaches USD.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

Abbvie Inc

NYSE:ABBV

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Realty Income Corp

NYSE:O

|

US |

|

Walt Disney Co

NYSE:DIS

|

US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

US |

This alert will be permanently deleted.

Equinix Inc

Equinix Inc

You don't have any saved screeners yet

You don't have any saved screeners yet

Good afternoon and welcome to the Equinix Second Quarter Earnings Conference Call. All lines will be able to listen-only until we open for questions. Also, today's conference is being recorded. If anyone has any objections, please disconnect at this time.

I'd now like to turn the call over to Katrina Rymill, Vice President of Investor Relations. You may begin.

Good afternoon, and welcome to today's conference call. Before we get started, I'd like to remind everyone that some of the statements we'll be making today are forward-looking in nature and involve risks and uncertainties.

Actual results may vary significantly from those statements and may be identified by the risks we identified in today's press release and those identified in our filings with the SEC, including our most recent Form 10-K filed on February 21, 2020 and 10-Q filed on May 7, 2020. Equinix assumes no obligation and does not intend to update or comment on forward-looking statements made on this call.

In addition, in light of Regulation Fair Disclosure, it's Equinix' policy not to comment on its financial guidance during the quarter, unless it is done through an explicit public disclosure.

In addition, we will provide non-GAAP measures on today's conference call. We provide a reconciliation of those measures to the most directly comparable GAAP measures and a list of the reasons why the company uses these measures in today's press release on the Equinix IR page at www.equinix.com.

We have made available on the IR page of our Web site a presentation designed to accompany this discussion along with certain supplemental financial information and other data.

We'd also like to remind you that we post important information about Equinix in the IR page from time to time and encourage you to check our Web site regularly for the most current available information.

With us today are Charles Meyers, Equinix' CEO and President; and Keith Taylor, Chief Financial Officer. Following our prepared remarks, we'll be taking questions from sell-side analysts. In the interest of wrapping this call within an hour, we'd like to ask these analysts to limit any follow on questions to just one.

At this time, I'll turn the call over to Charles.

Thank you, Katrina. Good afternoon and welcome to our second quarter earnings call.

As we all continue to navigate various health, economic and social changes occurring in our world, our key priorities remain clear, focusing on health, safety and well being of our colleagues, customers and communities, and enabling our customers to respond effectively to the increased urgency of digital transformation as a critical business priority and a driving force in the global economy.

Even in the face of an uncertain macro environment created by the global pandemic, the Equinix business continues to perform well, in our relevance in enabling digital business and conductivity remains a core tenet of customer purchasing decisions. In Q2, we delivered the third best gross bookings in our history driven by a record quarter in the Americas continued strength in channel bookings, robust inter connection performance and high volume of small deals.

Our expanding go-to-market engine continues to fuel the business generating over 4200 deals in the quarter across more than 3000 customers. And the importance of our global reach continues to shine as our customers scale and expand across the globe, leveraging our platform across 56 metros in 26 countries. We're continuing to increase the scope of customer deployments and customers operating in all three regions now represents 62% of revenue, up 1% quarter-over-quarter.

Our organic expansions continue opening Hamburg this quarter and adding Bordeaux as a strategic subsea landing location in support of a key hyperscale. And we're using disciplined M&A as a tool to enter new markets and scale our platform.

On June 1, we announced our intent to acquire 13 Bell Canada data centers, expanding our coverage in Canada to a national platform and unlocking opportunities for global corporations to capture growth and innovation in the Canadian market. This acquisition which is expected to be immediately accretive upon closing Q4, reflects Equinix has continued commitment to executing platform enhancing acquisitions on financially attractive terms.

Before we get into the detail quarter of the results, I want to share a few thoughts on our commitment to social change and our continued work to build a culture and community that can have a meaningful sustainable impact on the future of our society.

Recent events in the U.S. have triggered outrage and an outpouring of emotions around the world. We have actively tapped into this energy fostering a rich and inclusive dialogue on the topics of equity and social justice, with a focus on improving our collective understanding of each other and creating a commitment to action, which is imperative to moving us forward positively as individuals, as a company and as a society. While still early in our journey, our vision remains clear for Equinix to be a culture where every employee, every day can truly say I'm safe, I belong and I matter. And for our workforce at all levels to better reflect and represent the communities in which we operate.

We acknowledge that we have work to do in achieving this vision but are fully committed to demonstrating measurable, enduring progress against a multi-year strategy and continue to believe that our culture remains a key competitive differentiator. Our approach includes traditional aspects such as diversity targets, bias training and mitigation, community plan the programs and employee mobilization. But we also believe that lasting change will only happen by pushing ourselves even further in our pursuit of becoming a truly equitable and global organization.

Our objective is to continue to make our culture a critical competitive advantage, seeking to engage every leader and every employee at Equinix and integrating diversity, inclusion and belonging in every aspect of how we run the business. As a company, we will continue to put in the work and reaffirm our commitment to cultivating a workplace in a society that embraces and vigorously defends equality and diversity.

Now turning to our results, as depicted on Slide 3 revenues for the second quarter were $1.47 billion up 8% year-over-year. Adjusted EBITDA was at 9% year-over-year and AFFO was again meaningfully ahead of our expectations. Interconnection revenues continue to over index substantially, growing 16% year-over-year, reflecting the important role of interconnection in digital transformation and highlighting our clear market leadership in this area.

Unit volume was fueled by growth in provision capacity to support increased traffic and solid new product performance reflecting our ability to meet the evolving connectivity requirements of hybrid and multi-cloud architectures. These growth rates are all in a normalized in constant currency basis. We now have over 378,000 interconnections and we continue to see healthy expansion of our dynamic ecosystems across the globe.

In Q2, we add an incremental 8000 interconnects driven by streaming, video conferencing, enterprise cloud connectivity and investments in local aggregation to support work from home. Internet exchange had one of its best quarters ever with peak traffic up 44% year-over-year as the peering community augmented capacity for video conferencing, gaming and over the top video replacing headroom that had been exhausted by COVID related traffic growth.

ECX Fabric also had a great quarter, eclipsing 2200 participants and demonstrating robust multi-cloud adoption, particularly from network providers with one-third of them scaling bandwidth to five or more clouds. We're also making good progress in integrating the packet business with strong new logo engagement and continue go-to-market integration as we work to deliver on our vision for platform Equinix to underpin the foundational infrastructure for today's digital leaders.

We're also strengthening Equinix's leadership position in the cloud ecosystem through expansion of our hyperscale strategy, allowing us to service both retail and large footprint in key markets. While maximizing the efficiency of our balance sheet through our partnership with GIC. We're seeing strong customer demand in our initial xScale JV in Europe and will soon expand this JV to include our seventh asset Paris 9. This facility is slated to open early next year, it is immediately proximate to our market leading Paris campus and its already 100% pre-leased to a major hyperscaler. We're also tracking to close our new xScale JV in Japan with GIC in q4, adding new locations in Osaka and Tokyo.

Now, let me cover highlights from our verticals. Our network vertical achieved record bookings driven by robust reseller activity and network expansion to support traffic growth. Expansions included Colt a global telecom provider adding capacity at the interconnected edge to support increasing user demand, as well as Vocus Communications an Australian specialty fiber and network solution provider deploying infrastructure to increase scale and improve end-user experience.

Our financial services vertical heads second highest bookings with strengthen global financial and insurance firms as they accelerate digital transformation. New wins and expansions included a leading Nordic insurance company leveraging hybrid multi-cloud and distributed data and Galileo Financial Technologies, a payment solutions platform rearchitecting their network and securely connecting the ecosystem partners. Our content digital media vertical also saw solid bookings with particular strength in gaming and video, driven by the spike in demand for indoor entertainment. New wins and expansions included IOTA, a leading audience technology platform, looking to expand their footprint to serve the ad tech industry. And Moody's, leveraging ECX Fabric to rearchitect their network and multi-cloud access for increased performance.

Our cloud and IT vertical also showed strong bookings led by the infrastructure and software sub-segments with continued momentum and cloud adoption. We continue to extend our market leading cloud density adding 10 cloud on ramps this quarter alone, as cloud providers expand services into new metros including Bogota and Mexico City.

New wins and expansions included Cisco extending service capabilities to additional regions to support new product offerings and security and client demand for Cisco WebEx communication solutions, and BMC Software, a leading platform provider of digital workflow solutions, deploying infrastructure to support their expanding customer base across the region. Our enterprise vertical saw solid bookings and broad-based demand with particular growth in business and professional services, government and energy despite some COVID-related friction. COVID continues to shift enterprise spending patterns resulting in increased demand for various cloud-based services including telephony, messaging and conferencing..

New enterprise wins include a Swedish engineering company, optimizing its global network to provide optimal employee experience; the global [spirits] [ph] distributed that switch from building its own on-premise data centers to Equinix to support rapid deployment, as well as Fung Group, a global leader in supply chain solutions leveraging ECX Fabric to digitize its supply chain ecosystem. Our channel program had a record quarter accounting for over 30% of bookings and delivering great productivity from this go-to-market vector.

The channel program continues to be a new logo engine for the company generating over 60% of all new logos. We had great wins with reseller and alliance partners including Orange business, Cisco, AT&T, Microsoft and Dell, across a wide range of industry segments, with projects focused on both digital transformation and COVID-19 response.

New channel businesses quarter included notable wins with AT&T, for a global insurer transitioning from on-premise data centers to a hybrid multi-cloud solution to enhance elasticity and performance and the Vodafone for a premier global energy company supporting their adoption of SD WAN and hybrid multi-cloud enabling.

Now, let me turn the call over to Keith to cover the results for the quarter.

Thanks, Charles, and good afternoon to everyone. It's nice to speak with you again. Charles and I, hope you and your families are doing well and staying safe.

With respect to Equinix the business continues to perform well. Q2 revenues adjusted EBITDA, AFFO and AFFO per share were ahead of expectations despite disruptions experienced by our customers, our suppliers and partners or employees over the past few months. In the quarter we had significant gross PAG and net bookings including very strong net positive pricing actions.

Interconnection activity was very healthy, both as a physical and the virtual level. We're making a solid progress across our new edge services products. Our performance scans our key operating metrics was again positive, including solid increases in our MRR per cabinet and global cabinet metrics.

For the quarter, we're tracking against our expectations on COVID-19 related impacts and costs. As expected, there are certain cost trends going both directions and will continue to make the appropriate adjustments to our forecast as needed.

And as you've heard us say before, but it's certainly worth repeating again, achieving an investment grade rating and now from each of our three credit rating agencies after Moody's May upgrade has proven to be a highly strategic and valuable milestone, enabling us to access the debt capital markets expeditiously, while broadening the investor base and tightening the credit spreads under issued debt. This is particularly important during times of great volatility and disruption like today.

In June, we refinanced 2.6 billion of high yield debt at a blended interest rate of 2.07%, the lowest interest rate ever achieved by any triple BBB minus rated issuer. Interest savings on an annualized basis will approximate 50 million and these savings more effectively offset the dilution associated with their $1.27 billion equity raise in May.

We have an active construction pipeline with 29 projects underway across 20 markets in 14 countries and we continue to work closely with our suppliers and partners to deliver capacity as close to the target date as possible.

Now let me cover the quarterly highlights and note the growth rates in the section are on a normalized and constant currency basis. As depicted on Slide 4, global Q2 revenues were 1.47 billion, up 8% over the same quarter last year, our 70th consecutive quarter of revenue growth including a $3 million net FX benefit when compared to our prior guidance rates.

We've seen positive momentum in the first half of the year driven by strong net bookings and price increases, resulting in a healthy recurring revenue uplift but lighter than planned non-recurring revenues due to the timing of custom work and decreased smart hand revenues.

Global Q2 adjusted EBITDA was 720 million or 49% of revenues up 6% compared to the prior quarter, and 9% over the same quarter last year, due to strong operating performance and favorable revenue mix, including a $1 million net FX benefit when compared to our prior guidance range.

Global Q2 AFFO was 558 million above our expectations on a constant currency basis, largely the result of strong operating performance. We continue to manage the business in support our AFFO per share goals.

Turning to our retail highlights, whose full results are covered on Slides 5 through 7. EMEA and APAC were the fastest MRR growing regions on a year-over-year normalized basis at 16% and 10%, respectively, followed by the Americas region at 3%.

The Americas region saw record gross bookings but healthy pricing and strong exports to the other two regions in the quarter. The Americas growth rate was partially muted by our decision to waive certain smart hand fees and the timing of planned churn. We expect the Americas growth rate to step up in the second half of the year.

We also completed the integration of the Mexico assets and won several key internationally based magnets into our network and cloud verticals, as customers start to leverage the value of Equinix platform into our Mexico markets.

Our EMEA region saw strong bookings in the quarter particularly across a number of smaller and emerging markets including Dublin and Madrid. Paris continues to perform well and our market networks were seeing an increase in demand and the tightening of supply, a broad build out addition across the region remains active. Interconnection was substantially up on a year-over-year basis driven by volume and pricing initiatives and billing cabinets stepped up in the quarter.

And finally, the Asia Pacific region saw another very strong quarter bookings including a record into our Japan markets and the region enjoyed solid exports particularly into EMEA. APAC interconnection had a strong quarter with many providers scaling network connections for future growth but higher than average net adds and cross connects and inter-metro connections.

And now looking at our capital structure, please refer to Slide 8. We continue to increase our operating and strategic flexibility through the management of our balance sheet and capital allocation decisions. Pro forma for the debt refinancing activities, we approximately 2.7 billion of unrestricted cash and investments on the balance sheet, our total liquidity, including our available revolving line of credit of almost $5 billion.

We will use this liquidity alongside our capital and balance sheet initiatives to opportunistically expand the business, both organically and inorganically, as we work to maximize long-term shareholder value creation including the benefit of the $1.7 billion equity transaction completed in May, our net debt leverage ratio decreased approximately 3.3x in Q2 annualized adjusted EBITDA well within our target leverage range.

Turning to Slide 9 for quarter capital expenditures were approximately 482 million including recurring CapEx of 30 million. We had seven openings in Amsterdam, Chicago, Dallas, Hamburg, Hong Kong, Toronto and Washington DC. This included the opening of Dallas 11, a new IBX completed on the Infomart Dallas campus, which is an interconnection epicenter and a major hub for the southern U.S.

We announced four new expansion projects the majority of these projects to be developed on own land being Bordeaux, Hong Kong, Milan and Warsaw. We continue to expand your ownership acquiring land for development in both Frankfurt and Manchester markets.

For the year, we now expect capital expenditures to increase by approximately 150 million, which reflects the anticipated timing of the closing of the Japan joint venture with GIC. Once this transaction closes, GICs portion of the capital expenditure spent prior to the close date will be reimbursed Equinix and amount that is expected to range between $150 million and $200 million, including certain pre-existing current costs.

Revenues from owned assets is currently 55%, a metric that we anticipate will increase over the next 18 months. Our capital investments deliver strong returns as shown on Slide 10, 148 stabilized assets increased recurring revenues by 6% year-over-year on a constant currency basis. These stabilized assets are collectively 84% utilized and generate a 28% cash on cash return on the gross PP&E invested.

Please refer to Slides 11 through 15 for our summary of 2020 guidance and bridges, Starting with revenues, we expect to deliver an 8% to 9% growth rate for 2020 a reflection of the continued momentum in the business and includes a net FX benefit of $23 million compared to our prior guidance range. Non-recurring revenues are expected to remain at these levels for the rest of the year. MRR churn is expected to remain in our targeted range of 2% to 2.5% per quarter for the remainder of the year.

We expect 2020 adjusted EBITDA margins of approximately 48% excluding integration costs, the result of strong operating leverage in the business including the revenue mix, offset in part by the anticipated investments on a go-to-market and profit organizations and higher than initially planned severance and benefit costs.

We expect to incur $20 million of integration cost in 2020 for the integration of our various acquisitions. And when raising our 2020 AFFO, which is expected to now grow between 14% and 18%, compared to previous year. For 2020, we expect AFFO per share to grow between 8% and 12% including the effects of the capital market activities completed in Q2.

So, let me stop here and turn the call back to Charles.

Thanks, Keith. We're delighted with our Q2 results and are pleased with the continued outperformance of the business a result of our focus on providing customers distinctive and durable value as they embrace digital transformation.

Our impact for customers and the financial results that follow as a reflection of the dedication, flexibility and ingenuity of our teams. Over the course of Q2, we like many others had to rapidly adapt our business, adjusting our go-to-market motion of the current realities, evolving operating procedures while maintaining our exceptional service reliability and executing on highly attractive equity and debt deals to enhance liquidity and drive AFFO.

Customers remain at the center of everything we do and our customer satisfaction rating moved up the last two quarters to its highest score in the last three years. While we are delighted with how the business is performing, we fully recognize the strain, the shifting challenges and the continued uncertainly we are all facing and as such, we will remain diligent and closely monitoring market dynamics and further adapting our business as appropriate through the back half of the year.

The secular drivers of demand for digital infrastructure have never been stronger. And we believe that Equinix is uniquely positioned to execute on the expanding opportunity presented by the accelerating importance of digital transformation and the shift to hybrid and multi-cloud as the architecture of choice.

We remain steadfastly focused on evolving our platform to respond to this unparalleled market opportunity. Investing to drive top-line growth, leveraging our operating scale to fuel the AFFO per share growth to our investors and delivering positive impact to our many stakeholders as we continue to build an enduring and sustainable culture and business.

So let me stop there and open it up for questions.

Thank you. [Operator Instructions] Our first question comes from Tim Long with Barclays. Your line is open.

Wanted to start off with a smaller newer piece of business with packet if I could. Sounds like it's moving along pretty well, just curious, if you can give us an update on how you're moving along with features and the sales force and the channel with the ability to sell the new products? And maybe just a little color with the business that you're doing. Now, if you can give us a sense maybe what kind of customers or applications are being sought out by those to take on this new business for you? Thank you.

Sure, Tim. Thanks. Its Charles. I guess it's important to have backup and continue to put the acquisition of packet into overall context. I think that, as we have talked about on prior calls, this was a way for us to continue to adapt to the changing consumption patterns of our customers in terms of how they want to sort of gain access to the value, if you will, of the Equinix platform. And I think we are adding the bare metal service that packet brings to the table and integrating that with the bare metal service that we had under development organically, we think is really, really represents a big opportunity for us to continue to adapt to those changing needs.

The integration is doing well. We've now aligned on a coordinated and integrated roadmap for and coordinate that into a single offering that we will as a company. We continued to integrate the go-to-market motion. And we've actually taken some folks from within the Equinix organization, blended them into the sales team and have that acting as a bit of an overlay today to our larger sales force, still early days there. And I think probably a lot of the customer activity is with some of the more digitally native targets that packet had traditionally been serving. But we're really starting to see a building funnel of enterprise targets, particularly large enterprise targets, as well as some service provider sort of types that are really resonating with the packet opportunity and that offering.

So it continues to go well, again -- still very early days. But one of the things that we've been talking about internal as we talked about delivering physical infrastructure and software speed, which has kind of been a rally crier, a tagline that really resonates with us internally and more importantly resonates with our customers.

So, again, a product roadmap is well aligned now, the engineering teams are underway on bringing a fully enterprise features set -- the full enterprise feature set to the bare metal offering over the coming quarters and go-to-market motion still relatively early but good momentum in the pipeline.

Okay. In fact, the precursor to a quick follow up you talked about pricing looks like Europe and Asia saw a pretty good MRR per cabinet, ASP growth, could you just give us a little highlight on why you're seeing better pricing there. I'm done. Thank you.

Sure. The key to pricing for us is really continuing, targeted discipline -- discipline in our sales targeting. And we've talked about that for many years now, right, delivering the -- targeting the right customers with the right use cases into the right IBX locations. And I think we're really doing that well in terms of adapting or delivering against the use cases that are really important to customers right now in terms of hybrid multi-cloud implementations, win [rearchitecture] [ph], distributed security, a number of things that are really highly featured, and I think their digital transformation plans. And when you're doing that, I think you're able to deliver outsized value and therefore get good solid pricing. And we're seeing that show up in our yields.

So I think and if you look at it, the way our quarter was composed in terms of bookings, we talked about 4200 deals across 3000 customers, that means we're doing a lot of deals, more sort of small to mid size deals, interconnection oriented, ecosystem centric and that really helps us on the pricing front.

In Europe in particular, we're also seeing the effects now as a realtor of the interconnection pricing adjustments that we've made. And I think those have gone really well obviously, generally customers don't jump up and applaud when you raise pricing and your services. But I think in this case, our team has done a really good job of articulating the value that people are getting from interconnection. And I also think we've been very measured and kind of appropriate about how we phased those implementations and those price implementations and working with customers. And so that's far it's gone well, we're starting to really see that roll through -- in the impact on the EMEA numbers in particular.

Thank you. Our next question comes from Jon Atkin with RBC. Your line is open.

Thanks very much. Two questions. First one probably for Keith. I'm just interested in kind of the medium term margin, puts and takes as we think about where you are in Asia Pac now comfortably past the 50% margin threshold. What are the factors to kind of think about at a corporate level of you getting towards those levels over the next kind of several years? And then I have a follow up on an xScale. Thanks.

Yes. Sure, Jon. I think overall as it relates to margins, as we sort of said in our prepared remarks, we're very pleased with where we are pleased with where we are, pricing actions have certainly been a net positive to us. So that's representative, it sounds very well in our gross profit, or EBITDA and our AFFO margins.

All that said, there is a number of things that are going on in the business. One of the things that we did want to surely highlight was we want to continue to invest in our go-to-market and product organization. And this ties nicely back towards Charles, when we talked about with packet. So there's an examples of where we can continue to drive profitability up. I think Q2 was, I don't want to say it's aberrational, because obviously, it's an outcome of many, many great things including revenue mix, where non-recurring revenue came down and recurring revenue went up, and as a result, we got a favorable mix shift, something that we think will continue for the rest of the year.

But the other part is, we want to continue to invest in the business and we think we're on track to deliver against our expectation. Again, I'd refer you back to the June 18 Analysts Day, we believe we can deliver 50% EBITDA margins or greater. I don't think that's ever a question for us, doing it with the right discipline and mindset knowing that we want to continue to invest in the business. And right now we just see a very substantial opportunity, not only in the assets we have today, the ones we're acquiring an example being Bell Canada. And so we'll continue to make those investments and the same time, I think we can continually find ways to drive more profitability in the business if we're not investing in our future growth.

And then I don't know, Charles, if you would have anything to add to that. But my second question was just on xScale. And I think there have been, maybe some management changes one or two, maybe getting a commentary on that. And it kind of milestones around future JV financings? And then, if you could maybe provide a little bit of color or maybe reminder on the fee structure that you've secured in these agreements, so we can kind of understand more of the impact on AFFO?

Sure, Jon. Yes, maybe I'll make just a couple reiterate, couple of comments on the margin side and just again, say I think we're seeing, as we've talked about the past, we're continuing to try to look at driving operating leverage in the business. I think we're being successful in doing that. And then, again, we're seeing some positive benefits associated with mix of business, mix shift. And then again, that's balanced against the reality that we want to continue to position ourselves to take advantage of what we think is a really big growth opportunity in front of us as hybrid and multi-cloud really plays out. And so we will continue to invest in the business and that will be both on the CapEx side and the OpEx side, which I think will be a bit of a moderating factor on the margins. But I think we can continue kind of up into the right, in terms of over the long haul.

Relative to xScale, things continue to really go well, in that overall, we did have some adjustments. Jim Smith has made the decision to step down from his role as Managing Director of the program that does remain as an advisor to the initiative. And we've asked Krupal Raval, who's been on the xScale team now for a period of time and incredible background and we've asked him to step into the MD role. He's done that and really kept the continuity with the team is recruited in there, I think is incredibly strong, very experienced and is really starting to hit their stride.

So it's going well, we've talked about in the script that we are probably likely adding or very soon adding the Paris 9 asset that is 100% pre-leased to hyperscaler. And we continue to see good customer interest in pipeline on the other facilities. The JV in Japan has now been announced. We're working towards closing that later in the year. And then, we're looking at additional JV beyond that, so good momentum overall.

And then relative to the fees, maybe I'll let Keith comment quickly on kind of how that's structured and impact on the business.

Sure. So, Jon, just as it relates to the fees, there's really full and primary fees. So put aside the equity ownership right now. We're treating the businesses both looks like the Japanese JV will be an equity oriented investment likewise, initial media JV. And so the way it works is, there's basically an asset management fee, a facilities fee, a development fee and sales and marketing fee. And when you break those down, some are recurring revenue, some are non-recurring. And then, the benefit we get from the profitability created by the joint venture that comes in below the line through income from an affiliated entity.

So that's how it sort of the fee structure works right now, still pretty early on, as you know, because we've just got the first two assets up. Charles alluded to Paris 9 and having that 100% pre-leased. And we're actively engaged across a number of other assets, both in development and also in the marketing of those assets across the platform. So we're pretty excited about the performance that a group is going to cave to take a leadership role and in this entity, so great progress today.

Thank you. Our next question comes from Colby Synesael of Cowen. Your line is open.

Just a few. Last quarter, you called out a zero to $50 million headwind to guidance --revenue guidance for COVID-19. I was wondering what the headwind or impact was in the second quarter. And if you still feel that you're going to be within that zero to 50. And maybe you could tighten that up a little bit, if possible at this point.

Secondly, your Americas growth, missed our estimate, I think that was probably one of the weaker parts of the quarter. Keith, I know you mentioned the smart hand wave fees. I think there's just a $3 million impact. And on the churn side, when I look at least the cabinet and the interconnects, both those numbers still went up, yet the revenue came down, which seems just more of a pricing impact. So, I'm trying to get a better understanding there.

And then, before Katrina kills me, just one last one. Your previous guidance on organic growth was 7% to 9%. You raised it to 8% to 9%. And I believe that excludes that fact that the only change I saw in your guidance was in fact FX, I'm wondering where that extra 1% to 8% of the loan came from. Thank you.

Charles do you want me to take the first part. Just want to make sure because we're in different locations, everybody, so we're just making sure that we're going to organize accordingly.

Let me first start off by saying look, we're absolutely delighted Colby with the performance of business for the second quarter. And as you know, when we went into the quarter, we give ourselves a relatively wide range, wide berth from zero to 50 and for this quarter as you know, we basically delivered slightly above the top-end of our guidance range. So said differently then we basically got a lot of flexibility through the second half of the year. And we chose to leave it intact other than FX, very similar to what Charles did last quarter, he made the reference to the fact that we're going to adjust for currency and here's a range of zero to 50. And we're also going to hold absent FX, we're going to hold AFFO, we're going to target a midpoint.

Well, when we look at the second half of the year, there's just a lot of uncertainty that still remains -- not too much in our business per se. But the reality of how all of the terminal gets manifested into our results. We let that flexibility inside our guide. And so what you're seeing is not per se specific headwind. On the margin, there's a few adjustments that are affecting us. We have seen pretty larger bad debt reserves than we had before but was planned for. I've made some reference to the fact that there's cost going both directions, clearly our travel and entertainment, or is relatively low -- almost zero. But that offsetting that of course, is our salary and benefits cost, less attrition, less paid time off. And we're doing a very good job of hiring the staff that were slated to be hired. It's our salaries are a little bit higher.

So I think that sort of deals with perhaps the majority of the discretion other than the Americas. Americas, as we said, relatively flat this quarter. Colby, you're right there is $3 million of smart hand fees. There's also the impact of the Brazilian currency, fairly substantial segregation to an unhedged currency and then, you've got non-recurring revenues.

When you look at it from a pricing perspective, though, MRR per cabinet was relatively flat quarter-over-quarter. And so we're delighted with where we are, we allude to the fact of pricing strong, good gross bookings, we have momentum in the business. But you also have some things timing of churn and smart hands, plus non-recurring in Brazil all affecting the results. And that's the benefit we get there for having a very global and diverse set of assets that things are going to move around on a continuous basis, in this case, you're starting to see currency trends moving in our favor. And so, albeit we might be a little bit more susceptible to weaker currencies in the Americas. You're seeing uplift in Asia and in Europe. So let me stop there. Charles, you jump in if there's anything you want to add, or if there's anything you need to clarify.

No. I mean, I think again, I'm on the zero to 50. Obviously, we saw the smart hands impacts across the regions in the quarter as well as, a fairly meaningful impact on our custom MRR and so, but, so the MRR was meaningfully impacted. I think we had a strong recurring revenue quarter bookings were solid. We are seeing some level of friction still out there. But as our results imply the team powered through that and had a good quarter but we have to two sort of big step up quarters remaining in front of us in the back half the year and as we looked at that way and plus I think, very uncertain environment still in terms of sort of second wave, if you will on COVID and the implications of that and how the protracted economic impacts are going to begin to affect companies et cetera. We felt like it was proven to sort of maintain the revenue guidance and just book the FX impacts into there. So that's where we landed.

Thank you. Our next question comes from Frank Louthan with Raymond James. Your line is open.

So talk to us a little bit about more in the Americas. We've talked in the past about what's going on with the Verizon space and how that's going and talk just a little bit about that. And then, follow up thoughts on inorganic growth for the remainder of the year and they've already done one deal clearing not shying away. What are your thoughts on those opportunities? Thanks.

And Frank, I'm sorry, the first one was on Verizon assets.

Yes. The Verizon assets where you are, as far as, fill that that space out to maximize the utilization there.

Yes. Again, it's been a good long time now that we've kind of integrated these. So we tend to think about them all as really part of the platform now. So it's tough for us to think about or even, fully measure that but we are seeing good utilization, obviously made some investments into some of the assets. We actually had some really strong deals this quarter into Miami and Culpeper actually. And so we're seeing good progress on some of the very key assets there.

Overall, as we said, I think that the Americas business, we expect that to step up to more like a 5% growth rate in the back half of the year. Again, it was a really solid quarter from a bookings perspective. And so overall, I think, with a start, I think really having worked through the issues on the Verizon portfolio in terms of the churn and things that happened there. And seeing that stabilize I think we're looking at a solid back half of the year for the Americas there.

And relative to inorganic, I think that, there are plenty of opportunities out there still. We think that -- we're going to continue to have a posture that -- if you really look at it, our strategy remains unchanged, we have used M&A for market entry for market scaling, for sort of capturing strategic interconnection assets and now for sort of capability additions as we look at the future of platform Equinix and what that means.

And I think there are opportunities in all those categories. Obviously, the Canadian deal was really an opportunity for us to really scale in a market and reach national presence in Canada. We think there are some other opportunities, in terms of new market entries that areas that we're continued to be focused on, that are potentially actionable out there. And so, and it's one of the reasons really, that we went and did the equity deal is making sure that we kept some dry powder on the balance sheet to be appropriately opportunistic about growth opportunities that present themselves.

Thank you. Our next question comes from Michael Rollins of Citi. Your line is open.

I was curious if you could delve a bit more into what you're seeing out of the enterprise vertical, in terms of the ability for them to make decisions and the growing interest that they manage team's been describing that you're seeing for hybrid cloud architectures. Thanks.

Sure. Thanks, Mike. Yes, I think that we're seeing a -- there's a few things. One, I do think that we've seen some projects have delayed decision-making, so things pushed out, further in the pipeline. But I think that's been offset to some degree by a broader realization that I think you've heard us and probably many other companies in ours and related spaces, for example, the cloud providers talk about this elevation of awareness around digital transformation and the priority that exists there even in sectors of the economy that are meaningfully impacted by COVID.

I think that what people are seeing is that those companies that were better prepared are further ahead in their digital strategies weathering the storm better. And I think that's leading people say we've got to make that investment. In some cases, even if their businesses are a bit on their back, they kind of say, look, we're going to take that medicine, but we're going to invest in the business and in the future, and make sure we're making the digital investments that are necessary.

So, that is I think, we are seeing a little bit of sort of both sides of the coin there, which has some delays, particularly new projects that might be delayed just by a variety of factors, including -- taking longer to be able to visit sites, although they are and we are now having tours and visits into the sites on an appointment basis, and so we're sort of freeing up, some of the wheels are turning on that.

But there is some of that, if you look at new logos that are a little bit lower than our pre-COVID levels, but we also -- they targeted more at larger accounts with bigger wallet sizes. And so a little bit of a mixed bag, we are on balance, I think, what the enduring phenomenon that we think we're really seeing is this increased commitment to digital and also very much in terms of people saying, look, we still have private infrastructure requirements. We want that private infrastructure over time to be, is probably going to be smaller than what we are doing now. But we need what remains to be immediately proximate to the cloud and deliver both performance and economics in a different way. And we think Equinix really rises to that challenge for them.

Thank you. Our next question comes from Matthew Niknam with Deutsche Bank. Your line is open.

Just to if I could, first go back to the last question in terms of sale cycles, any notable delays during the quarter that you'd call out that may have deferred some bookings into the third quarter. And then secondly, on the competitive front, if you can talk about the competitive backdrop in Europe, whether you've seen any changes in the landscape in recent months after some of the recent M&A, larger scale M&A in the region. Thanks.

Sure. As I said, yes, we have, obviously, we've got a very sort of deep command in the pipeline in terms of deals that are in there. We did, there were certainly some opportunities that we had originally, as targeted to close this quarter that pushed out, but that's the case every quarter. Obviously, there's some of that, and but some of those were, you know, that people would chalk up to COVID related sort of delays and decision making.

But on balance, when you look at it, you see, our third best gross bookings for quarter ever record in the Americas. Obviously, we've been able to sort of power through some of that and still deliver, strong overall bookings, results. So there's some of that. What we are seeing, I think quite encouragingly is that, those are just delays, they're not cancellations of projects. And at this point, we think it's just a matter of when we're going to bring those opportunities in.

So on balance, I think feeling very good and feel like, the team really rallied and delivered an exceptional quarter, given the broader circumstances that we face.

In terms of the competitive backdrop, I would say, not a meaningful change, I feel like particularly in, I know, relative to commenting on the sort of post interaction, digital combination in Europe and impact there. I would say it's still very much seems to be in a digestion phase. And I think customers are working to sort of figure out what that means for them. I think employees are of those companies are trying to or now that company are trying to figure out what it means for them. And we're trying to stay focused and deliver and execute effectively while that digestion occurs.

And so, I think obviously the performance of our business in EMEA sort of speaks for itself in the quarter. And we continue to as I've always said interaction was always a very credible competitor for us in Europe. And I expect they will continue to be one, but we are right now, I think we're seeing the digestion period and we're trying to take advantage of that while it exists.

Thank you. Our next question comes from Simon Flannery of Morgan Stanley. Your line is open.

Just coming back to xScale. I think when you were talking about the project, initially, you talked about mid teens type returns. I wonder if you could update us on what -- given you've done some leasing now, you've got a better sense of pipeline and economics. What's your latest thoughts on the return profile on these projects? And just coming back to the enterprises, what's going on the renewal side? What sort of pricing are you achieving on renewals obviously, your pricing commentary has been pretty bullish overall. But, we do see a lot of pressure on IT budgets broadly. And are you seeing any of that coming through in terms of customers trying to get some relief when they renew with you? Thanks.

Sure. Yes. I would say that relative to xScale and return expectations, I would say that, when you look at it, we obviously get some of the benefit, particularly as it relates to our lens on the returns of both fees flowing through as well as the development returns, which give us a bit of a lift on the returns overall and I think will allow us to continue to have those into the double digits.

I do think there is some pressure on returns caused by just an overall pricing environment that continues to be aggressive, I think In terms of people competing aggressively for the hyperscale business and that is out there. So I think there's been probably a bit of pressure there. But I think that it continues to be a very attractive return profile, I think both for us and for our partners. And for us, I think being able to do that with relatively limited sort of dry powder off our balance sheet, which we want to allocate to our higher returning retail business. I think that strategy still makes a ton of sense for us.

But I would say some, some downward pressure on returns, it will be interesting to see, whether that persists. I do think that, Keith mentioned for example, there are markets where we see supply tightening. And obviously, that tends to improve pricing. But you do have a very powerful set of customers in the hyperscalers that are looking to sort of get the best available terms. So, there's been a bit of downward pressure there.

Relative to enterprise renewals, as I said, what we're seeing I think is generally people are continuing to figure out how they can make most effective use of Equinix in pursuing their long-term, hybrid multi-cloud architectures. And so that might mean that people are downsizing sort of elements of their architecture as they move certain applications to cloud. And then, focusing their private infrastructure or the private part of their hybrid cloud into Equinix facilities proximate to the cloud and are still willing to renew those at what we consider to be very attractive rates that are good for us and deliver significant value for the customer.

We do see some sawtoothing, which is because we have escalators -- annual escalators built into our contracts virtually across the board. Oftentimes, when you see a renewal, you might see that if you implemented a 3% to 5% annual escalator over say a five year contract that at renewal you may be above market and you may see a sawtoothing of that occur. But that's all sort of part and parcel that are all included in our overall model, which again continues to reflect overall positive net pricing actions, which we think reflects the value that we deliver for customers.

Thank you. Our next question comes from Jordan Sadler of KeyBanc. Your line is open.

So, just wanted to come back to xScale one more time. It does sound like you characterized the overall bookings solid and seeing maybe a little bit of friction because we talked to maybe overall enterprise. Is that also, that characterization pertains the xScale business as well and was Paris 9 leased during the quarter?

Yes. I would say the -- I think the dynamics are a little bit different in that, obviously, we're targeting a much smaller set of customers. And so when you look at the xScale dynamics, I think it's a bit more about where are these hyperscalers are in their expansion, how that matches up relative to a sort of capacity where it's needed, kind of element. And so, if you look at hyperscalers, we're actually, if you look at the performance and results of some of the other companies that are more focused on that, they tend to be lumpy. They have sort of a bit more boom and bust in their quarters based on the timing of sale or timing of bookings and kind of where hyperscalers are in their cycles of expansion.

And so, I think the dynamic is a bit different. But yes, the leasing was completed in the quarter for Paris 9. And so we were very pleased to get that done. And we do see a strong pipeline, it just takes -- those are a bit bigger more complex deals with longer sales cycles. And I think the results in any given quarter tend to be a bit lumpier.

Okay. And then just as a follow up, I think you touched on interconnection pricing in Europe, the adjustment that you've made there, where are you in the rollout of those adjustments and what sort of the magnitude of that pricing adjustment?

We're reasonably well advanced. I think that we'll continue to see those adjustments flow through over the course of the next year or so because we try to be fair and balanced and not kind of overly aggressive or greedy about how to -- the timeline on which we wanted to implement those as we tried to -- as we talked to our customers and tried to implement something that we thought was fair and balanced. And so it'll continue, I think through the course of -- the remainder of this year and well into in the next year, I think probably through the course of next year as well.

But I think we've probably seen, a good chunk of that probably more than -- well, more than half of that roll through and begin into our results, but there is more work to be done. I think it will be a bit slower as we go through the course of the next several quarters. And in terms of magnitude, I forget what the percentage increase was, it was meaningful and that is showing up in the results. But again, you still are seeing interconnection prevailing pricing in Europe meaningfully below what it is in the Americas and I don't think we will be in a point where we will equalize that, but we are making progress in terms of delivering a pricing that's more consistent with the value delivered to the customer.

Thank you. Our next question comes from Nick Del Deo with MoffettNathanson. Your line is open.

First, Keith, I want to drill down a little bit more on the EBITDA, which was pretty meaningful. I think you suggested it was a function of revenue mix. And you said you expect those mixed benefits to continue but your guidance implies lower EBITDA in dollar terms, the next couple of quarters relative to Q2 and margins that are quite a bit lower. Was there anything else besides the mix shift that we should be bearing on in like, power costs or anything along those lines?

Overall, but when we look at the second quarter specifically, we made a comment about price increases across the board. Number one was, good to see ramping, most of that was really focused in the EMEA region. And then offsetting that was non-recurring revenue, you saw the step down to roughly 4.8% of our revenue of non-recurring. And so that comes into different margin profile. So you've got the benefit of those two things happening. So, revenues are roughly at the high end of our guidance range and currency neutral basis, but the mix is favorable. And you saw the benefit of that going to the EBITDA.

In addition, we also saw was some moderation in our utility consumption until we got some benefit attached to that. And then, in some of the markets, particularly one I will refer to is Singapore, those making concession due to the current climate. And those concessions come through in a couple of different fashions, is tax abatements, it is rent abatement, in some cases, salary adjustments that is not you don't apply for you allocated and the company was the recipient of certain dollars from the Singaporean government as an example.

But overall, I was just saying, we're on top of our numbers, I think the look forward is, as Charles alluded to, it is giving us the flexibility to look at the next two quarters invest in the places that we need to and therefore that's why you see revenues are moving up nicely. But we're also keeping the cost model at roughly 48% pre-integration costs. And that gives you a sense of that we're still spending in the areas go-to-market, new product.

The other thing I did, I referred to in one of my prior remarks, salaries and benefits are going up inside the business and that's not because that was something sort of an implication coming out of the pandemic, less people are taking vacation in that and how it gets represented in the financials something that we want to certainly encourage people to do more and more time off. And also just the timing of our hiring, because when you're getting the full quaterization of the hiring, we had a record hiring quarter in Q2, 400 net adds to the business, quarter and that's going to run through the quarter -- the next two quarters as well.

Now, last thing, I would say there's some seasonality built into our spent recurring CapEx Q4, more specifically, and that's why you see the impact coming through our guide on the AFFO as well. So overall, we look at on an annual basis, we allocated dollars appropriately, some of it just a little bit more front loaded than originally anticipating, and you'll get the full quarterization impact of it.

Yes. And I guess, I just reiterate the S&B, that's salary and benefits piece of that which is, we are -- one we were seeing lower attrition. I think that partially due to maybe concerns about the pandemic, also, I think it is just a reflection of people, sort of being very excited about where we are and the culture and what the opportunities in front of us are.

But I think that's rolling through in ways and we're hiring -- we're moving forward to hiring plans across both go-to-market product technology because we believe the opportunity is really big in front of us. The net impact of that, in terms of is that, we have more cost on the books, and I think that we're kind of calibrating on that in terms of pace of hiring and that kind of thing. But even if we were at the same sort of targeted number of heads, with the attrition being a bit higher, you get some time in there where it takes to rehire and that sort of keeps things a little lower. So we are seeing a little bit of that. And I think that's part of what is impacting that in the back half the year.

Okay, got it. That's great detail. And maybe one quick one on ECX Fabric. I think earlier this year you dropped a node into a partner facility in Belgium. Since first, when you've done like that. Any initial insights into how that's going or updates as to whether we'll see more deals like that.

Still very early days, we have not seen it. And I think it's obviously happened right in the teeth of the pandemic. So, I think probably still too early to tell there. I would say that I think that more broadly speaking, are thinking about how we want to extend the utility and the reach of ECX Fabric, both within our facilities continuing to do our build outs, align the ECX Fabric closely with our packet offering to make a more powerful edge offering in our own facilities.

And then, I think also look to potentially position that as something that could be deployed, in non-Equinix facilities. And so I don't know that it would look exactly like what we did in Belgium. But I do think the notion that we would be looking at extending the reach of the ECX Fabric and ensuring that the ability to use the ECX Fabric as a way to plug back in from -- a bit of a further edge back into the ecosystem, in particular, the cloud ecosystem is something that we are absolutely actively looking at. So I do think that's something that we'll be continuing to monitor and look at how to do that over time.

Thank you. And our last question comes from Brett Feldman of Goldman Sachs. Your line is open.

It's really just a point of clarification. You've talked throughout this call about an outlook for improved revenue growth in the Americas in the back half of year and last quarter, you were talking about growth -- improving to something in the range of 5% or maybe better than 5% as you were getting into the fourth quarter. I think that's still the -- what's embedded in your outlook based on your commentary. But I just want to clarify that you're still targeting that 5%. And then, whether it's 5% or anything, it seems like it's going to be better and I just want to be sure we understand where the momentum is coming from the extent to which it's in MRR as opposed to non-recurring because if it is on the MRR side, it would seem like you have really good momentum into 2021 as well. Thanks.

Keith, you want to take that?

I will take that Charles. So the reference that Charles already said earlier on but in my prepared remarks said the second half of the year and Q3 looks like the quarter that we will achieve that step-up and goes back to your comments. Number one, we saw good pricing, we saw record bookings. We still see some element of churn inside the Americas business for the next few quarters. That all said when we calibrate across the remaining part of the year, we're firmly believe that between the pricing and the momentum of the business, including a strong pipeline, you should see a step up in the growth rates. And that's something that from our perspective, it would carry on into 2021. So early to give guidance on that, but there's no reason why we wouldn't see that momentum continue.

That concludes our Q2 call. Thank you for joining us.

Thank you for your participation in today's conference. Please disconnect at this time.