Equinix Inc

NASDAQ:EQIX

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

Abbvie Inc

NYSE:ABBV

|

Biotechnology

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Realty Income Corp

NYSE:O

|

Real Estate

|

| US |

|

Walt Disney Co

NYSE:DIS

|

Media

|

| US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

Technology

|

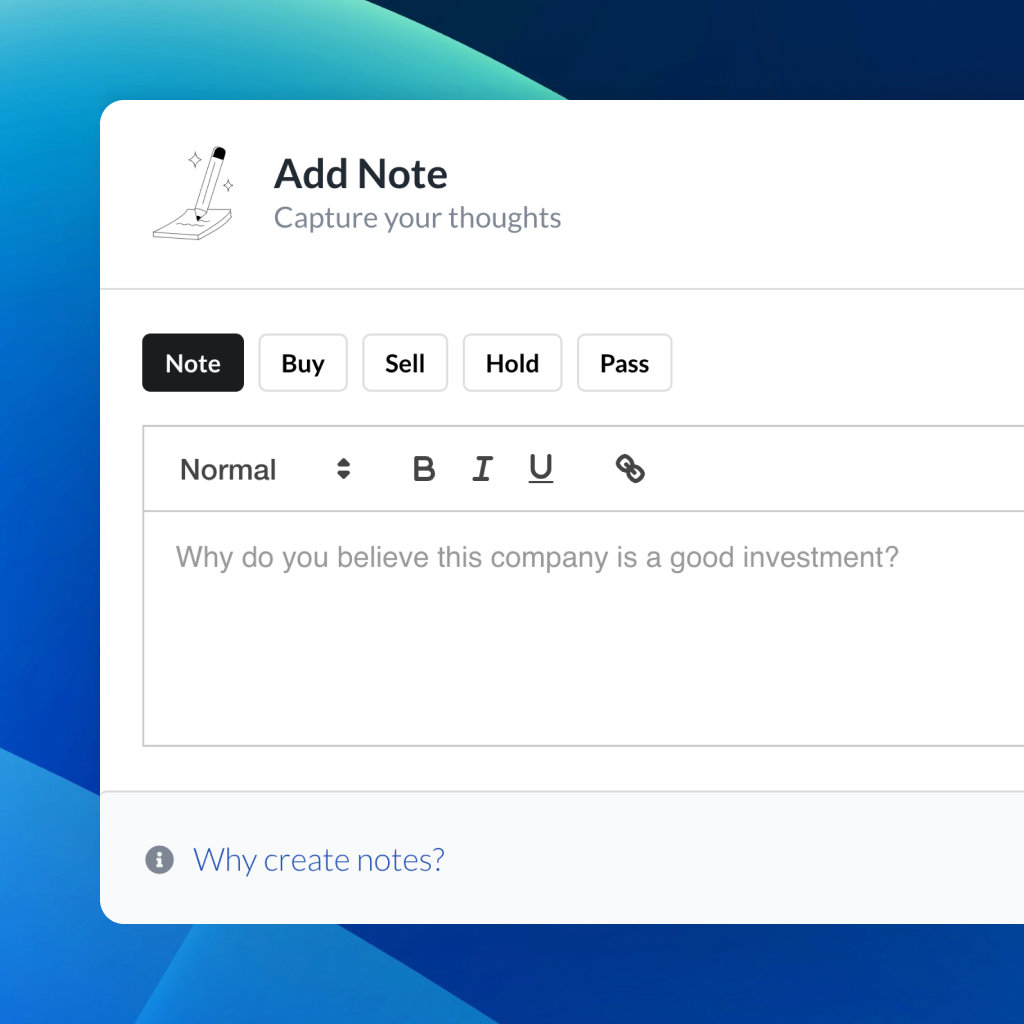

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

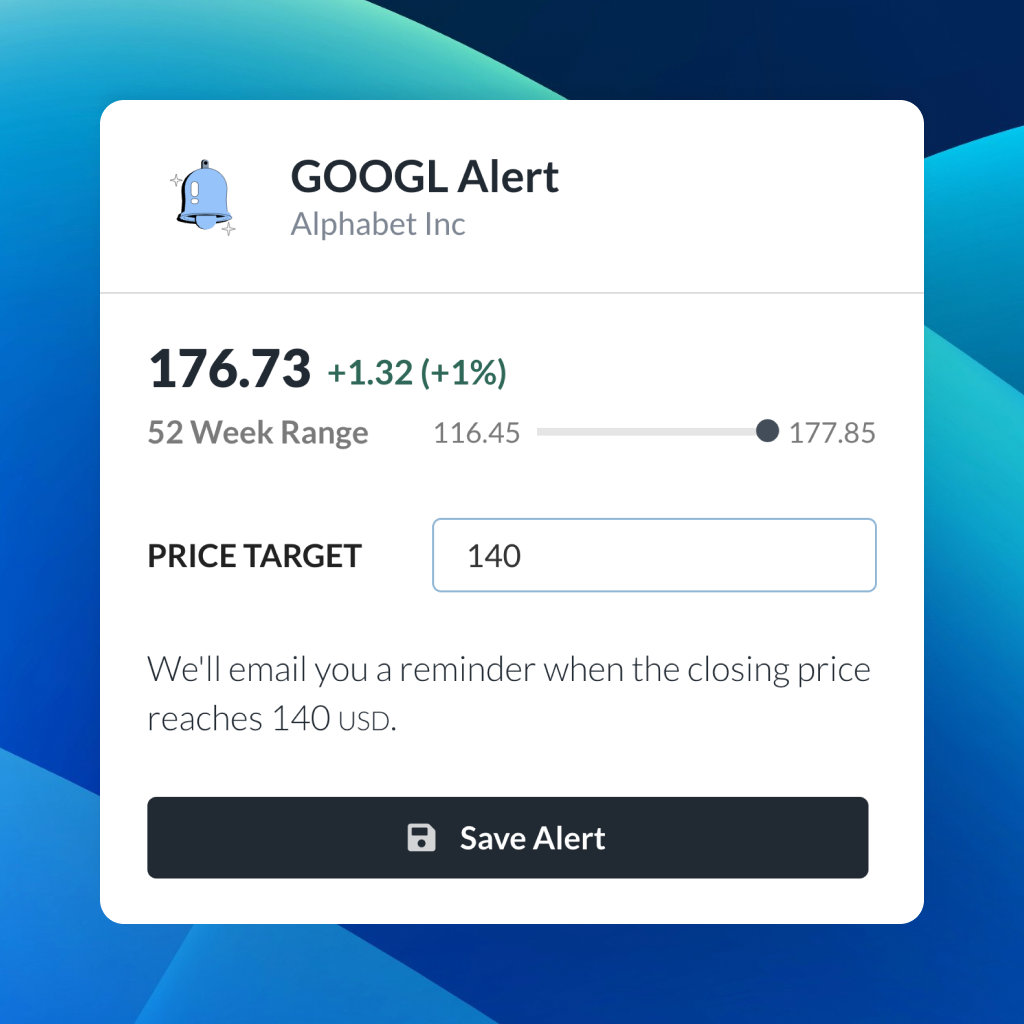

| 52 Week Range |

682.24

913.66

|

| Price Target |

|

We'll email you a reminder when the closing price reaches USD.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

Abbvie Inc

NYSE:ABBV

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Realty Income Corp

NYSE:O

|

US |

|

Walt Disney Co

NYSE:DIS

|

US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

US |

This alert will be permanently deleted.

Equinix Inc

Equinix Inc

You don't have any saved screeners yet

You don't have any saved screeners yet

Good afternoon, and welcome to the Equinix Third Quarter Earnings Conference Call. [Operator Instructions]. Also, today's conference is being recorded. If anyone has objections, please disconnect at this time.

I'd now like to turn the call over to Katrina Rymill, Vice President of Investor Relations. You may begin.

Thank you. Good afternoon, and welcome to today's conference call. Before we get started, I'd like to remind everyone that some of the statements we'll be making today are forward-looking in nature and involve risks and uncertainties. Actual results may vary significantly from those statements and may be affected by the risks we identified in today's press release and those identified in our filings with the SEC, including our most recent Form 10-K filed on February 22, 2019, and 10-Q filed on August 2, 2019. Equinix assumes no obligation and does not intend to update or comment on forward-looking statements made on this call.

In addition, in light of Regulation Fair Disclosure, it is Equinix' policy not to comment on its financial guidance during the quarter, unless it is done through explicit public disclosure.

In addition, we will provide non-GAAP measures on today's conference call. We provide a reconciliation of those measures to the most directly comparable GAAP measures and a list of the reasons why the company uses these measures in today's press release on the Equinix IR page at www.equinix.com.

We have made available on IR page of our website a presentation designed to accompany this discussion, along with certain supplemental financial information and other data. We'd also like to remind you that we post important information about Equinix in the IR page from time to time and encourage you to check our website regularly for the most currently available information.

With us today are Charles Meyers, Equinix' CEO and President; and Keith Taylor, Chief Financial Officer. Following our prepared remarks, we'll be taking questions from sell-side analysts. [Operator Instructions].

At this time, I'll turn the call over to Charles.

Thank you, Katrina. Good afternoon, and welcome to our third quarter earnings call. We had our best-ever third quarter bookings, reflecting strong execution of our strategy and demonstrating our ability to deliver clear and quantifiable value to our customers as they pursue their digital transformation agenda. Our retail business continues to thrive, generating over 4,400 deals in the quarter across 3,100 customers, with the majority of our bookings comprised of small to midsized multi-metro deals, fueling one of the strongest interconnection quarters in our history. We're executing effectively on our commitment to unlock the power of Platform Equinix for our customers, expanding our geographic reach, enhancing our market-leading interconnection portfolio and responding to evolving customer needs with the launch of new and innovative edge services offerings.

By focusing on driving enhanced operating leverage in the business, we're enabling investment across our traditional retail business, while layering in incremental capabilities, which together will drive higher attach rates, reduced churn and sustain and enhance cabinet yields over the coming years, allowing us to continue to deliver industry-leading returns.

We are aggressively activating our channel, combining the value of Platform Equinix with partner solutions to accelerate our customer's journey to hybrid and multicloud as the clear architecture of choice. We outgrew the market globally with notable momentum in EMEA, and Equinix now holds the #1 position in 18 of the 25 countries in which we operate. And we continue to extend our global reach, announcing our plans to enter Mexico, the second largest economy in Latin America, with two new markets serving Mexico City and Monterey. In tandem with our strong operating performance, we're advancing a bold sustainability agenda with meaningful progress across environmental, social and governance aspects. We've made significant progress on our goal to use 100% clean and renewable energy for our data centers, with over 90% of our energy consumption today now covered by renewable sources.

We were recognized by the U.S. EPA for our leading Green Power use, ranking #4 on the EPA's National Top 100 Partners List, and receiving the Green Power Leadership Award for the third consecutive year, recognizing our contribution in advancing the development of the nation's voluntary Green Power market.

During the quarter, we also announced the addition of Sandra Rivera to our Board of Directors and the hiring of Justin Dustzadeh as our new CTO. We are thrilled to add their deep and diverse experience as world-class technology leaders as we continue to refine and expand our vision for the future of Platform Equinix. Turning to the quarter, as depicted on Slide 3, revenues for Q3 were $1.397 billion, up 8% year-over-year. Adjusted EBITDA was up 9% year-over-year, and AFFO was ahead of our expectations, including -- excluding FX and FX-related impacts.

Interconnection growth again outpaced colocation revenues, growing 13% year-over-year, driven by solid traction across all interconnection products and particularly strong momentum across our Cloud Exchange fabric. These growth rates are all in a normalized and constant currency basis.

In October, we closed our first hyperscale JV, a greater-than-$1 billion deal with GIC, the Singaporean sovereign wealth fund. This is a strategic milestone for Equinix, enhancing our ability to respond to the rapidly expanding needs of the world's largest cloud and hyperscale companies, while strengthening our leadership in the cloud ecosystem. We look forward to launching similar JVs in other operating regions and believe these efforts will continue to further differentiate Equinix as the trusted center of a cloud-first world. We now have over 356,000 interconnections, adding more per quarter than our top 10 competitors combined. In Q3, we added an incremental 8,500 interconnections, with high gross adds from both enterprise and network segments accompanied by lower-than-expected churn. We also surpassed 20,000 virtual connections, more than 5% of our overall count, and we expect these connections, which are dynamic and operationally efficient, to accelerate as customers leverage the capabilities on our SDN-enabled ECX Fabric.

With over 1,800 customers now on ECX Fabric, we're seeing the strong ecosystem effects driven by expanding use cases, including WAN rearchitecture, distributed data, and rapid adoption of hybrid cloud across an increasingly rich range of cloud destinations.

We also saw a growth of our Internet exchange in the existing and new markets, with 27% year-over-year increase in IX provision capacity. Our newly launched Network Edge product is generating strong market interest with a robust pipeline. This offer provides enterprises a faster and more efficient way to deploy virtual network services at Equinix, including routers, firewalls and load balancers from their technology providers of choice, including Cisco, Juniper and Palo Alto Networks. Now let me cover highlights from our verticals. Our network vertical experienced record bookings, led by the major telcos subsegment and significant global MSP reseller activity as we partner with global providers to evolve their architectures and serve rapidly expanding enterprise demand.

New wins and expansions included Silica networks, a leading fiberoptic provider, optimizing network to support growing customer demand; and Telia, a Nordic provider extending coverage with regional edge deployments.

Our financial services vertical achieved robust bookings and strong new logo growth, with an uptick in the banking subsegment as firms continue to embrace digital transformation. Key new wins included Sterling Bancorp, rearchitecting the network to securely connect to partners, and a U.S. exchange startup, leveraging the depth and reach of our expansive electronic trading ecosystem.

Our content and digital media vertical produced solid bookings, led by strong growth in publishing, advertising and video subsegments. New wins and expansions included a global social media firm upgrading infrastructure to support their growing product line as well as a leading global ad tech firm, transforming network topology to distribute and analyze data.

Our cloud and IT vertical continues to over index with strength in the security subvertical as well as a strong increase in ECX Fabric participants as cloud consumers diversify towards hybrid and multicloud architectures. We continue to lead in cloud connectivity with over 3x as many metros with multicloud arm ramps as our nearest competitor.

Our enterprise vertical experienced diversified growth across professional services, retail as well as notable strength in government. New wins included PruittHealth, deploying on Platform Equinix to support its growing health care ecosystem; Steve Madden, rearchitecting network and connecting to multicloud to better enable digital business; the Myers-Briggs Company, optimizing network and interconnecting the business partners to support data management requirements; as well as further expansions from Walmart, deploying distributed infrastructure to support AI use cases.

And our channel team had another great quarter, accounting for more than 30% of bookings with 60% of this activity going into our enterprise vertical as we use the reach and relationship of our partners to efficiently expand our addressable market. We saw partner wins across all end-user types, including insurance, federal government, banking, public utilities and pharma, with network optimization and hybrid multicloud as a key use cases.

New channel wins this quarter included a multi-partner win with Presidio, F5, Microsoft and Oracle, for a large U.S. energy company supporting their data center consolidation and implementations of hybrid and multicloud access.

Now let me turn the call over to Keith to cover the results for the quarter.

Thanks, Charles, and good afternoon to everyone. Let me start my prepared remarks by saying we remain very pleased with the performance of our business and how Platform Equinix is differentiating us from others in our space. We continue to successfully scale the core business while simultaneously investing in our future, both as it relates to our operating structure and our new products and services. And we continue to invest in sustainability and diversity inclusion and belonging initiatives, 2 areas that are very dear to our communities, our customers and our employees.

We had another solid quarter with our operating results consistent with our expectations, although impacted by FX and FX-related items.

From a booking's perspective, we had our best-ever Q3 gross bookings performance, including very attractive deal mix and strong pricing. Interconnection activity was very strong, both at the physical and the virtual level. We're making good progress across our new edge services. Again, we had net positive pricing actions this quarter. As a result, our MRR per cabinet metric remained firm both on an as-reported and FX-neutral basis. In early October, we closed our first hyperscale joint venture in EMEA, and transferred two of our operating assets into the JV, London 10 and Paris 8. As a result, the joint venture distributed a net $355 million of cash to Equinix, and we expect an additional €60 million over the next four quarters as certain contingent milestones are met. And we continue to expand our global platform with 28 projects underway across 21 metros and 16 different countries, another critical point of separation compared to other companies in our space.

Now let me cover the quarterly highlights. I note that all growth rates in this section are on a normalized and constant currency basis. As depicted on Slide 4, global Q3 revenues were $1.397 billion, our 67th straight quarter of top line growth, up 8% over the same quarter last year, and at the midpoint in our guidance range on an FX-neutral basis. In the quarter, we experienced an unusually high level of FX volatility, largely derived from the Brexit implications to both the British pound and the euro. Also, the Brazilian real weakened considerably, a currency that is typically too expensive to hedge. And as previously guided, there were a number of one-off advance that impacted the quarter-over-quarter revenue step up, including lower tenant recoveries from a favorable tax decision in Q3 related to our Infomart Dallas asset and then lower-than-expected nonrecurring revenues.

Q3 revenues, net of our FX hedges, included an $8 million negative FX impact due to the stronger U.S. dollar in the quarter when compared to the prior guidance rates. Global Q3 adjusted EBITDA was $675 million, up 9% over the same quarter last year despite higher seasonal utility cost and the expansion drag. Q3 adjusted EBITDA was better than expected, primarily due to lower maintenance costs. Q3 adjusted EBITDA performance, net of our FX hedges, included a negative $4 million FX impact when compared to the prior guidance rates.

Global Q3 AFFO was $473 million, an 18% increase over the same quarter last year, above our expectations on a constant currency basis, while still absorbing the higher-than-anticipated increase in our recurring CapEx. Also, AFFO, on an as-reported basis, absorbs a net $16 million higher-than-planned income tax expense, attributed to FX-related tax gains from our hedging program. Based on the current FX exchange rate through October, we expect a significant portion of this tax expense to reverse in Q4, and accordingly, has been reflected in our AFFO and AFFO per share guidance. Q3 Global MRR churn was 2.3%, consistent with our targeted range. For Q4, we expect MRR churn to remain in our guided range of 2% to 2.5%.

Interconnection revenues increased significantly over the prior quarter with momentum in each of our regions. Interconnection revenues now represent greater than 17% of our recurring revenues, a significant quarter-over-quarter step up. Interconnection -- our interconnection portfolio grew at a healthy pace, driven by strong net adds from both the physical and the virtual connections, while also provisioning significant incremental port capacity. The Americas and EMEA interconnection revenue stepped up to 24% and 10% recurring revenues, respectively, while APAC was 14%.

Turning to the regional highlights, which full results are covered on Slides 5 through 7. APAC and EMEA were our fastest MRR growing regions at 13% and 12%, respectively, on a year-over-year normalized basis, followed by the Americas region at 4%. The Americas region saw continued strong bookings with a high mix of small deals, healthy pricing and strong new logo adds. And Export Bookings to the other 2 regions continues to remain at a high as the Americas region does an excellent job of selling across our global platform. And a new federal segment had a stellar quarter, and we remain very excited about the potential opportunities we see across this customer set.

Our EMEA region had another very strong quarter led by our German and French businesses, including strong network service provider activity. EMEA had a robust increase in billable cabinets, firm deal pricing, while experiencing its best ever net cross-connect adds in the quarter, and we opened up capacity in 3 new markets in EMEA: Helsinki, London and Stockholm.

And Asia Pacific region showed continued momentum over the quarter despite the U.S. trade dispute with China and the unrest that we see in Hong Kong. We enjoyed strong bookings in both our Hong Kong and Singapore businesses. And we opened our first data center in Seoul, South Korea, entering into one of the most vibrant digital economies in the world, our 25th country to operate from. To date, the Seoul business is tracking ahead of its bookings plan.

I'm now looking at the capital structure. Please refer to Slide 8. Our unrestricted cash balance is approximately $1.4 billion, lower than the prior quarter's operating cash flow and proceeds from the ATM program were more than offset by our quarterly capital expenditures and our cash dividend. Our net debt leverage ratio was 3.5x our Q3 annualized adjusted EBITDA, up slightly due to the lower cash balance, yet still well within our targeted range.

As a new investment grade-rated company and given the current interest rate environment, we expect to drive substantial interest rate savings through the refinancing of our currently outstanding debt as well as enjoy a lower cost to borrow on any new incremental capital raise to fund our future initiatives. At the end of Q3, our liquidity position, alongside the strong balance sheet, continues to provide us a strategic and unmatched business advantage.

Turning to Slide 9. For the quarter, capital expenditures were approximately $557 million, including a recurring CapEx of $47 million. Q3 had 6 new expansion projects completed, adding 2,800 cabinets of capacity, including new IBXs in Helsinki and Seoul. And we continue to expand our land bank, acquiring land for development in Tokyo and Warsaw.

Our capital investment delivered strong returns, as shown on Slide 10. Our 136 stabilized assets increased revenues 3% year-over-year on a constant currency basis, similar to last quarter. Our stabilized assets are collectively 85% utilized and generate a 30% cash-on-cash return on the gross PP&E invested.

And now please refer to Slides 11 through 15 for an updated summary of 2019 guidance and the bridges. For the full year of 2019, on a constant currency basis, we're maintaining our full year revenue guidance while raising our adjusted EBITDA guidance by $6 million due to strong operating performance. This guidance applies -- implies a revenue growth rate of 9% over the prior year and a healthy adjusted EBITDA margin of approximately 48%. Also, we're reducing our 2019 integration cost to now be $9 million.

And given the strong operating performance, we're also raising our 2019 AFFO by $8 million, while our growth range will range between 13% and 14% compared to the previous year on a normalized and constant currency basis. We do expect slightly lower net interest expense in Q4. AFFO per share is expected to grow 8%, including the dilutive impact of both our Q1 equity raise and the effects of the ATM program activity. We've assumed a weighted average 84.8 million common shares outstanding on a fully diluted basis.

And finally, we expect our 2019 cash dividend to now approximate $825 million, a 13% increase over the prior year and reflects an 8% year-over-year increase on a per share basis.

So with that I'm going to stop, and I'm going to pass it back to Charles.

Thanks, Keith. In closing, we had another great quarter, building on our unique source of competitive advantage in demonstrating the underlying strength of our business. We continue to separate ourselves from the competition, using our diverse go-to-market channels and our expansive balance sheet as tools to extend the scope, scale and velocity of our flywheel business, while partnering with world-class players like GIC to enable us to simultaneously capture strategic footprints and deliver attractive returns in the hyperscaler market.

We also continue to build new capabilities that will allow us to achieve our vision for the future of Platform Equinix, a future that will our customers to reach everywhere, connect with everyone and integrate everything on their digital transformation journey. I am extremely pleased and privileged to work with our team of over 10,000, focused on building on our products and platform, and executing against an ambitious set of priorities in service to our customers, all while steadfastly ensuring that our culture continues to thrive, making sure that we have the right people in the right roles at the right time, building a company that is positively impacting their world and wherever employee can confidently say I'm safe, I belong, and I matter.

So let me stop there and open it up for questions.

[Operator Instructions]. And our first question is from Philip Cusick with JPMC.

First, maybe you can dig into the tax issue in the Infomart and if that impacted the Americas colo revenue? And then second, what are the incremental costs, Keith, of the green initiatives that we should expect from here?

Phil, very astute question that you asked vis-à-vis the tax implications. We've talked about two sort of currency or tax matters in our prepared remarks this quarter. First and foremost, as it relates to the revenue side of the equation, because we -- when we bought Infomart, there was a, shall we say, a negotiation with the local taxing authorities and the value that gets ascribed to that building and we came to a resolution in Q3. But prior to that, there was a very large assessment that basically was charged, of course, to the tenants of Infomart building. And so we absorbed the cost, and the tenants absorbed, if you will, the pass through of some of those costs.

In Q3, once we settled the arrangement with the tax authorities, there's a meaningful step down in the amount of taxes that we -- collectively, we're going to pay. And as a result, for those tenants that were part of Infomart, they effectively are going to get a reduction on -- of their taxes, and that affects us directly on our recoveries, if you will, the revenues attached to that. But bottom line is, you've got to step back and say, okay, the revenues' come down, but economically, this was good for, not only our tenant, but it was even better for Equinix because of the -- because we have won a large tenant in the facility and we also absorbed a lot of the unused capacity, if you will, in that space, and that tax gets burdened on to us. So that was the first one.

The second matter I just want to raise, because I think it's important, just to make sure, that was a property tax issue and it's always attached to recoveries. The second issue for us, vis-à-vis tax, is income tax attached to a very favorable hedge gains that we had on our hedges. And as a result, our income tax provision went up in Q3 because of how weak both the sterling and euro were relative to the U.S. dollar. As you know, a lot of that is reversed already in Q4, but we had to book the provision in Q3, and that's why you see that, that comes out in the bridge.

And then to go back then to your last question, really, which was on the green initiatives. Suffice it to say, Charles has made comments, as did I. We're very, very focused on ESG as a corporation and our green initiatives. And those green initiatives, of course, come in many different shapes and sizes, if you will, from how we procure our power, to offsets, to variable indirect purchase -- power purchase arrangement. But there is a-- I would tell you, it's somewhere right now, we spend somewhere between $10 million and $20 million that we absorb to become 100% sort of, if you will, green-oriented and -- sorry, 100% focused on driving our power consumption through green initiatives.

And so we're highly focused on that. It is a $10 million to $20 million cost to the business, but we recognize it's important to not only the constituents in the company, but certainly to our communities and very important to our customers, given that we're in their supply chain.

But important to note, Phil, that that's -- basically, we've been doing that for a while, and so that's been kind of already baked into our operating results, and it's fully accommodated in our guide.

Yes. Okay. I heard on the call -- I thought I heard something that it was incremental cost to be absorbed there, but it sounds like that's mostly done.

Yes.

Okay. And then on the -- just following up in the Infomart side. Can you give us an idea of the net impact on revenue from that? Or maybe what the sort of underlying trend of the business would have been without that?

Yes. So basically it would've taken us to the top end of our guidance range, on an FX-neutral than normalized basis. So basically, it was $4 million.

Our next question is from Simon Flannery with Morgan Stanley.

So we obviously had a large acquisition and merger in the industry last night. I was just wondering if what your thoughts would be on how that might change the industry dynamics. Do you have any perspective on what the European market might look like after that? And where does Equinix stand today in terms of looking at additional either acquisitions or on the JVs? You've talked about doing those. Or is that anything we'll see in the near term?

Sure. Yes. We fully expected that question would surface, Simon. Obviously, a big transaction in our industry for sure. So I'll start with this, we've got tremendous respect for both of those companies. It's not too difficult to, I think, to see why each of those parties might be interested in this combination. Interxion has always been a big risk competitor of ours in Europe, and I'm sure they'll remain as such. As for DLR, as I've said in many a public forum, it's my experience that then overlap between our business and DLR's business is actually fairly small. That will probably not be the case with our xScale joint venture, where we're likely to be more consistently head-to-head, but in our core retail business, we only see them sort of selectively as a competitor.

Just to put it into context, according to Synergy Research, DLR's entire retail business outside of Europe and others what we would be appending from a retail perspective on to the Interxion business, that entire retail business outside of Europe is about a tenth the size of Equinix overall. So in reality, I think the combination represents bringing together 2 very different businesses, a strong European retailer and a strong global wholesaler. So I think there's probably merit in the deal and an industrial logic to it. I think it's a bit of a stretch to say that the combination really meaningfully closes the gap in terms of trying to replicate the scope, scale and value of Platform Equinix.

So -- and I would say I think the challenges in combining those businesses, just mechanically, let alone operationally, financially and culturally, will certainly be nontrivial. And even if and when that's done successfully, I think we'll -- what comes out at the other end is a company we'll feel pretty comfortable competing against, certainly in Europe, which we've been doing obviously for years, and in particular, on a global basis.

So I think it's understandable, but I think we're going to continue to sell the strength of our value proposition globally and feel like we're going to have great success with our customers.

From a -- answering the second question in terms of our own M&A, we've said that we're going to continue to be -- we continue to believe that's an appropriate tool. At the same time, we're going to be pretty disciplined about that, and we're not going to chase valuations if we think they don't make sense for the business. Obviously, we feel really good about the transaction we recently announced in Mexico to enter that market. I feel like it was really sized right and priced right and gives us a real nice entry strategy into a very important market for us.

There's few other markets that I think we would entertain as M&A opportunities to enter. And -- but again, we're going to make sure that we do that on a disciplined basis. So we'll -- we feel like it's an appropriate tool in the bag, but one that we're going to use with real discipline.

And the hyperscale JV timing for new markets?

We haven't really -- we're actively working on that. As we had said previously, we're engaged in Japan actively. The exact timing on those, just given the complexity of the transactions is hard to fully predict. But I think if you look out over the next couple of years, we would expect to add several more JVs to the mix in terms of being able to offer the xScale sort of portfolio in key markets around the world.

Our next question is from Jonathan Atkin with RBC.

So Charles, in your prepared remarks, you talked about edge products, and it got me thinking about any sort of trends that you're seeing in your cabinet adds in the Americas and the mix shift between Tier 1 markets and slightly smaller markets. Are you noticing any changes as you sort of develop new capabilities? And could that maybe inform your appetite to enter into, say, minor-league cities rather than just major-league cities?

Yes. We're not any seeing any significant shifts in trends. Obviously, our major metros continue to drive the lion's share of both cabinet adds and revenue growth, but we're -- we do see real health in our other markets. I would say that we're going to start by offering our edge services in probably the more logical major metros. But to the extent we see momentum, I do think those will represent an opportunity for us to deploy infrastructure and drive cabinet yields into those markets as well. And then -- and again, depending on, I think, how use cases evolve, whether or not we would need to continue to look at expanding that reach beyond our current footprint, I think is something we're actively looking at. We have a team that we refer to as the evolving edge team, and we're actively looking at how we would do that.

But I would say right now, the bulk of the use cases that we see are well met by the current footprint that we have. And so being able to deploy our edge services, whether that be Network Edge or some of the others we might contemplate into our very expansive aggregated edge footprint today, we think meets most of the needs of the market and we'll just continue to evolve -- or adapt as use cases might dictate that.

Okay. And then, on Seoul, just interested, are businesses going to you for the very first -- going with you for the first time into that market? Or are they already in market and then they're kind of using you for their expansion needs?

It's more, typically, our existing customers wanting to expand -- extend their infrastructure into Seoul, although we do have a team on the ground that is sort of cultivating local business as well. But we said that our bookings are ahead of plan, thus far. And that's driven by the strength of a couple of key deals where some of our cloud and IT service customers were looking to expand their footprint into that market with a pretty significant deal that we landed in Seoul.

And then, lastly, just on churn, are there any differences you're seeing in what's driving edge? And any reason to think that you would gravitate towards the low end to the high end of your traditional range going forward?

No. It depends more on, I think, it's more timing issues in terms of shifts between quarters, but no substantive shifts. As I said, we've talked about the fact that we are continuing to work through the last bits of the churn tale in the Verizon assets. And I think that we're now feel like we're positioned to get back to growth in 2020 on those assets. And -- but no meaningful shifts.

What we have seen is, there's not a lot of -- our churn is driven mostly by frictional churn, and to some degree, by things like bankruptcies and those kind of things. We see the occasional shift in terms of moving selective workloads to the cloud, but that's typically churning a portion of an implementation rather than the whole thing because again, what we're seeing is people are very much committed to sort of hybrid and multicloud. And so they're maintaining private infrastructure and then integrating that with cloud assets, public cloud assets. And so no meaningful shifts that we're seeing right now from a churn perspective.

I will say, over time, though, I would hope that we're going to be able to -- one of the things that you are seeing in our bookings mix is a very clear discipline around these sort of sweet spot deals, well interconnected that's -- so you're seeing that show up in terms of the volume of transactions and number of deals done as well as levels of interconnection. And so those are really encouraging signals for me in terms of execution of the strategy. And over time, I actually think that will help us hopefully trend towards the lower end of our range in terms of churn.

So that is -- because as I've always said, the best defense against churn is getting the right deployments in to begin with. And so as we look at that, I think some of maybe larger footprints that were more susceptible to longer-term churn are things that we're not going to be doing. We will probably -- we'll be pushing those, particularly a very large footprints off to our -- into our -- into the xScale sort of entity, which is more equipped to deal with those dynamics. And I do hope that will improve our churn position over time.

Our next question is from Frank Louthan with Raymond James.

Can you give us a little color on -- you mentioned the multi-partner win with an energy company. We're the only data center company on that deal and what was in particular anything special about that -- with that? And then I've got a follow up.

Yes. It was -- we were, I believe, the preferred -- the only data center involved in that particular transaction. It was a data center consolidation activity, and also sort of integrating into a hybrid cloud architecture. And so they were really utilizing Cloud Exchange fabric as their mechanism to integrate both their network and their cloud connectivity between -- with their private infrastructure. And so really good multi-partner win and one we're really excited about in the quarter.

Okay. And looking at America's growth, just curious what you might be able to do to maybe accelerate that going forward? And in particular, can you give us an update on the additional land that was around the Infomart that you could expand? And then what's sort of -- where you are in NAP of the Americas to be able to finish building out that facility? And how that might help improve the growth in Americas?

Yes. We -- I think the Americas business continues to perform well, particularly in terms of mix of business. I think we are -- probably the biggest driver is going to be sort of getting us through the last of the churn activity that's been sort of above the -- above prior levels, which is creating a drag in terms of what was essentially a $500 million business, which has not had any growth, and that impacts the overall America's growth rate. And so I think as that subsides, I think we'll start to see some growth there.

I do think we have opportunities to add in some of our key markets. We've already added capacity, which we're filling at a nice rate in NAP of the Americas. The deal -- or the Dallas campus expansion is underway. Over time, we'll probably add both large footprint capability there as well as increasing retail, so that will probably be an opportunity for us to get some additional growth from that market.

But I think the bigger things that I'm excited about longer term is us continuing to -- one, continuing to drive additional quota-bearing head count into the market to capture the significant enterprise opportunity we see. Our gross bookings engine is performing very well in the Americas, and not only in terms of landing bookings in the Americas assets, but also delivering those globally across the platform.

And so I think being able to continue to expand both our channel as well as our direct selling efforts in the region, and then over time, as we add new services, I think we're also going to be able to continue to enhance cabinet yields, but that's going to take some time for those new edge services to really mature.

Our next question is from Colby Synesael with Cowen and Company.

Maybe just following up on the growth. Stabilized growth, I think, was 3%, you said, in the quarter. And I thought at least a few quarters ago, there was talk about getting that number back up to 5%. Just curious what you think the longer-term growth rate for stabilized growth should be? And what are the parts that potentially get us a bit higher? Maybe it's just the improvement in the Verizon assets that you mentioned.

And then secondly, I think in your previous guidance from last quarter, you had assumed that the JV, the GIC JV would close, and I think it was August and they had them closing in October. Curious what the benefit to guidance is in terms of the update you just made for 2019 as a result of that delayed close?

Let me take the first one, and I'll ask Keith to address the timing and the GIC transaction. Relative to stabilized asset growth, yes, we've been kind of hovering around that 3% to 4% mark, Colby. And I think the catalysts for getting back into that 5% kind of range would be, one, as you noted and as I noted in the commentary, getting the Verizon assets sort of through the knothole. I do also think the 10 to 100 gig migrations have impacted those to some degree. We did see a good quarter in that. We actually saw a reduction in interconnection churn. I don't think we're all the way through that though. So I think we're -- it's going to sort of continue to go in ways, although the biggest thing -- the biggest players who I think have -- who were going to make that change have largely made it in the Americas. But there probably will be some more of that, that I think will create some downdraft on the stabilized asset growth.

And we talked about, there also being a few assets that we were actively migrating sort of business out of -- and those kind of impacted as well. So there's a variety of factors. I'm encouraged by what we can do, both with our Network Edge offer as well as with what we see on the horizon in terms of some of the additional edge services because we can deploy infrastructure, shared infrastructure into some of those kind of facilities and get kind of meaningful returns on that and maybe drive some additional growth in cabinet yields into those. But I think that's going to be a longer-term proposition, and we'll probably really stay in that 3%, 4% range for a bit.

And Colby, as it relates to the second question, for Q4 -- for Q3, there's really no meaningful movement, as you know, for the Q3 quarter. And when we offered our prior guidance, it was really more about the influence that was going to take place in Q4. And just to remind you and everybody else on how this is going to get accounted for, recognizing that there is fee income that will come with the joint ventures. And as we continue to scale them up, there's fees that get attached to it. The fees come in through the top line through revenue. The equity ownership, the 20% ownership, that effectively comes through below the line, it will be in AFFO, but below EBITDA in the form of income from affiliated entities. And so that's how it sort of will present itself in our financials.

Suffice it to say, this quarter for Q4 and our guidance and implications on Q3, was -- is negligible. Think about $2 million on either side. And the reason for that is, it's all about timing. It's the timing of the cost, timing of the fees, timing of the income stream associated with how those customers in Seoul and the environment, and those two assets that we have and then as we continue to scale them.

So overall, what we'll try to do is continue to keep everybody fully abreast of not only this JV, but the ongoing JVs on what, if you will, the fund flow is. But for this year, as we said, there's really never going to be any meaningful impact to our financial results, and for all intents and purposes, it's just been absorbed into the ongoing.

Our next question is from Michael Rollins with Citi.

Two questions. First, just curious how you're looking at the opportunities to recycle capital for maybe some of the existing assets, whether it's some market that you may not think of as core to the portfolio or situations where it might be just opportunity to take advantage of the private market. And then the second question is just with the ATM program. Is there a framework or allocation strategy that investors should think about in terms of the timing or ways you may access that program in the future?

So Charles and I are looking at each other. Which one -- who wants to answer that question? I think, on the first one, let's just touch base on that, first and foremost. Overall, as you hear us continually say and talk about, we really referred to Equinix as a platform. Periodically, there are assets that would be disposed of. Not so much because we're trying to recycle capital, but it's more because when you look at the strategic value of that asset relative to what we're doing with our platform and where we want to invest our dollars, we choose occasionally to turn down a site like we've recently done or sell a small asset when it came with an acquisition. And we did that with Switch & Data. We just recently sold one of Verizon's small assets. We referred to as our New York 12. We sold our Istanbul 1 asset, which came -- was part of Telecity.

It's not really about recycling. It's more about making sure we create the momentum and the right assets for ourselves. And again, I think it's really important, Michael, for you and for all the listeners on the call today, we sell across this platform. Every asset is highly important to us. And so that's why we're not probably as traditional as some of the others in thinking about recycling because it is the platform.

As we get then into the discussion around ATM. ATM, I think it ties into a much more broader discussion on how we will fund ourselves in a go forward basis. If we all go back to the June 2018 Analyst Day, we talked about how we could grow the business over the 5-year period in '18 through '22 and what that would mean from capital dollars spent, and if you will, the scale of the dividend and the like.

As a result, we knew at that point in time that we still -- there was going to be funding in the business, funding needed for the business, and it was going to come in the form of both debt and equity. And so what I would tell you is that there's no -- I wouldn't -- there's no perfect way to describe how we use the ATM, other than what we're trying to do is take advantage of it when it makes sense for the shareholder, and stay away from it when it doesn't make sense for the shareholder.

And a perfect example would be, in December of last year, when we're at a 52-week low, we were not in the ATM program. When we're reaching some of our all-time highs, we occasionally pulled down a little bit of equity to fund the business because we know that between now and 2022, there is still some capital need to fund all that we have in front of us, including some of the M&A activities.

And I've said on the last call, you're going to see us do more and more of debt because, one, I think the cost of debt is going down; but two, we've brought some real balance into our capital structure. We'll guard our investment grade rating, and we're at a point where we're well within our targeted leverage range.

So it's a long-winded way of saying that we're going to moderate. We'll do it wisely. It is a cheaper source of -- so it's a cheaper way to go to the equity markets than doing a follow-on offering. Think about 50 basis points versus something ranging from 1 to 1.5 basis points to do those transactions. And we use it -- we do it at our discretion based on market conditions and targets.

And so bottom line is, we'll continue to monitor it. Right now, we have roughly $300 million left on the program that we approved last December. We've got a lot of cash in our balance sheet, $1.4 billion, as I said, at the end of Q3. And then you heard me also say with the October closing of the JV, that brought in another $355 million. So we're going to be really prudent about how we refinance our debt, how we raise new debt and how we use our ATM on a go-forward basis to make sure we maximize the return for our investors. Charles, anything else that you want to add or?

No.

Okay.

Our next question is from Jordan Sadler with KeyBanc Capital Markets.

Just moving back to sort of the drivers during the quarter, EMEA was called out as a powerful driver for the quarter. Can you give us a little bit of an update in terms of where we stand vis-à-vis the accelerated demand you're seeing in the region? Or maybe the catch-up versus the Americas? And then I have a follow-up.

Yes. I mean, I think we've seen relatively broad-based sort of demand and strength in the European market. So honestly, our U.K. market continues to be strong despite sort of Brexit uncertainty, et cetera. I think that we have the luxury of a really broad-based business on the continent. And so I think it continues to perform very well. Whereas, I do think we are still seeing the movement of cloud providers into that market more comprehensively. And so that has driven both our direct business with us in terms of their network nodes and their private interconnection nodes, and I think now will fuel the JVs business in a significant way associated with the large footprint.

And then you're seeing the enterprise movement to hybrid and multicloud really start to catch up, I think, with where the Americas have been as well. So overall, it's been a pretty broad-based strong market for us. And I think the breadth of our business there is showing up nicely. And the teams are doing a great job. We're seeing strong channel activity in that business as well. I would say both Europe and Asia were a little bit sort of a little later in terms of the adoption of the channel, but we're seeing really strong channel uptick there as well.

So I wouldn't -- in that point, say necessarily anything in particular, but it definitely is a strong market overall.

And the outlook continues to be good, right? It sounds like it still has legs?

It does. Yes, we're not -- we're definitely not seeing a softening there. We're -- we have the luxury of when we look at new projects and the fill rates that go with them, we have deep visibility into our pipeline. We have a really clear understanding of what our fill rates have been, and so we're continuing to allocate capital. We probably had a bit of a peak of -- or a bubble of capital that came through over the last couple of years in Europe. But definitely, there's sustained demand there, and so we'll continue to invest in that market as well.

Was there incremental hyperscale leasing volume during the quarter that you could speak to?

No. We're still working through in terms -- but I would say that we have a very strong pipeline. And so we're relatively fresh off close in the JV and really getting our pipeline and forecasting and processes really refined between ourselves and our partner. But I would say that we have had really productive discussions with the 12 or so companies that we see as the primary drivers of hyperscale demand. And so I feel like we've got plenty of pipeline to support the JV aspirations.

And then, just lastly, if I may, maybe for Keith. I think you talked about overall best ever bookings, deal mix and pricing. Can you elaborate on the pricing strength that you're seeing? Is that a function of sort of escalators, renewal spreads that you're seeing? Or is this just -- is it -- what is it?

Yes -- no, Jordan. I think -- so to just add, I just want to make sure. This was the -- one of our top performing quarters when we look at it across the whole year, but it was our best ever Q3. There's always a little bit of seasonality that comes into play. No surprise in our business.

I did hear that correct. I'm sorry. I misspoke.

Yes. And -- but the real drivers behind that are threefold. Number one is, and you heard Charles refer to it, is the deal mix is very, very positive. So the average deal size is a lot smaller, and that allows us to enjoy a better return on a per cabinet basis than we would otherwise see with a larger deal volume. No surprise. Second, you've got to add to that, the interconnection revenues and the opportunities that, that presents itself. But we do a very good job and we have done a very good job of selling this platform. And then you add to that the ancillary services that aren't -- clearly, they're just starting out, if you will. The attach rate that we would see to revenues on a go-forward basis could be very, very attractive. And again, Charles referred to that.

But the third piece is, and I hope it isn't lost on people. When we think -- but look, we're always having to live within the environment that we operate in, and market conditions at times make it very competitive. But when we renegotiate with our customers and this time there are price adjustments downwards, I think what you should draw great comfort for is that you keep on hearing us talk about positive pricing actions. That means those are the price escalators that are pushing pricing upwards. And so we tend to be in a very net positive position.

And so as a result, you've got 3 things that are working to your advantage, and hence, why you see the firmness across all 3 regions of the world despite the currency impact that we're seeing as we report all of this in USD, as you know. But despite all of that, you see very, very firm pricing, and I think it's a reflection of who we are and what we do and where we're taking the business. You can't lose sight of the fact that what Charles and all of us believe right customer with a right application, and the right data center makes a huge difference. And if we can mitigate some of that churn by all the incremental services you're going to continue to see, I would argue, a very firm pricing on a go-forward basis.

Yes. I'd just reinforce that, Jordan. I think that when you look at -- that's one of the reasons why disciplined execution of the strategy, even though it's hard to drive the growth using -- with the smaller deal sizes, it requires significant volume and you've got to really drive the selling machine. It's the right thing to do, we think, in terms of generating long-term returns and value for our customers. And so we're really committed to that.

And when we look at the broader industry, in terms of what people are seeing, in terms of, really, spreads, particularly people who are exposed to the wholesale -- primarily the wholesale, or even the Hyperscale market and what sort of at pricing looks like, current pricing versus what maybe the entry was and what therefore that implies for re-leasing spreads, it's not a, I think it's not always a pretty picture. And so, luckily, I think we have limited exposure to that on a relative basis for sure.

And again, what we're seeing is essentially positive spreads because we're able to get the cumulative effect of PIs which we're very successful in implementing in our contract across huge number of contracts that are sort of rolling through the system. And even if that means that we do a price adjustment on a single contract on a net basis in the quarter, we're continuing to actually deliver more than sort of an overall positive price action. So that's really important dynamic in our business that I think is quite unique.

Our next question is from Aryeh Klein from BMO Capital Markets.

Maybe related to the channel strength, how broad-based is that geographically? And is there an opportunity to further build out those relationships in new markets? And then separately, you are adding some meaningful new capacity next year in the Americas. Would you expect that to drive an acceleration in net cabinet adds in that market?

Yes. Great questions. The answer to both is probably a simple yes, but let me give you a little more color. I think, channel-wise, I do think we are able to continue to add both geographic coverage and coverage in terms of additional partner types that I think are going to be able to give us both increased reach. We, like many channel programs, see a bit of a sort of 80-20 rule, which is we see our 20% of our partners delivering a big chunk of our bookings. Although, it's interesting, we're seeing greater productivity across the full basis that we're starting to really get more breadth in the channel. So I do think both from a geographic standpoint and a partner-type standpoint, we're going to continue to add.

But our focus is less on adding new partners as it is making our existing partners more productive. And so that's really -- and our team is really doing a great job all right that. I'm super excited about some of the -- some of our key channel partners. If you look at two of the major partners here in the U.S., with AT&T and with Verizon, both is really critical strategic partners of ours. And now, really, they're leaning on our data center portfolio as the key way to deliver into their customers. And so we're super excited about that and have seen a lot of momentum.

And then also working with the hyperscalers themselves. And most of them are really seeing that their customers are saying, yes, we want to continue to consume more and more of your services, but we're doing it and we're integrating it with private infrastructure. And we want that private infrastructure to be immediately approximate to the cloud. And so that's really driving joint selling with the hyperscalers.

And then the -- relative to your second question, on the Americas. Yes, I do think -- any time you add new capacity, I think you tend to see a little bit of uplift. And so hopefully we'll see some -- we typically contemplate some anchor customers inside of larger phases, and so you might see some lift there. But again, we're -- I do think that we'll be able to get a bit of lift on that. But what you're seeing, I think, in terms of cabinet adds, is really just the really tight discipline on the business, and then a really attractive mix profile.

Our last question is from Sami Badri with Credit Suisse.

I just wanted to follow up on the prior question. If you could just rank the regions that contributed or basically hit over this 30% hurdle rate that you guys reported this quarter from bookings, which regions were above the 30%? Which ones were below? And then I have a follow-up.

I don't know if I have that right off the top of my head. I expect that the Americas was meaningfully above that. And I'm not sure if the others were at or below the 30% in terms of their indexing. But I would say that from a trajectory standpoint, both APAC and Europe are really meaningfully increasing their percentage of bookings.

I would expect they probably were both lower than 30s, and that U.S. was the over-indexed piece there, but I'd have to go back and confirm it. But I would tell you that I think all three regions continue to trend positively in terms of channel bookings as a percentage of overall.

Got it. And then at what point do you think would be the limit or the ceiling to this contribution, right, from this kind of sales motion? Would it -- would you throw out like 40%, 50% of bookings any given quarter. Is that where this is going to top out? Or maybe you could give me any kind of idea on where we could expect this thing to top out in the future?

Yes. I think it's going to depend a little bit on how our business mix and new product portfolio continues to perform. Over time, I think that we're delivering digitally-enabled services, in some cases, like Network Edge. If you look at that service, it is one that should be able to be consumed by our customers directly and via channel partners with relatively limited friction. And I think that will enable us to increase the percentage of bookings that are done through our channel. I would say that we're still, at this point, more of a sell with sort of motion in our channel, and we're fine with that. We still get the expanded reach and relationship that those partners are giving us, and has very attractive economics.

But I think that, over time, I think we'll have a combination where we're really getting sell-through activity on a broader portfolio. And I've said it in the past, there's no reason it can't be north of 50% for sure. And so I don't know what the timing of that is. I think it will depend on a variety of factors, but we're really encouraged by the trajectory we're seeing there because at the end of the day, the customer's trying to solve a problem. And very often, almost always, that problem means combining the value add of another player with the compelling value proposition of global reach ecosystems, interconnection and service excellence that Equinix brings to the table. And combining those and solving the needs of a customer is what fuels the business. And so we're really excited about that. I think there's a lot of upside potential for it.

Great. And then one last question. Sorry to keep everybody on this call. But on stock-based compensation, Keith, could you probably just give us a little bit more color on how come stock-based comp grew 34% year-on-year and now makes up about 4.5% of revenues? Whereas, the same time last year, it was more around 3.5% or a bit above that? Can you just give any color on the recent increase and intensity? It's about the second quarter this happened. So just give us an idea for this quarter. And how do we...

Yes. That's what a strong stock price does, as you can appreciate. So I mean, think about where the stock was on December of last year and where it is today. And so I think the most important part is we look at not only our Compensation Committee, but certainly Charles and myself and Brandi, who runs HR with us. We're always looking at appeasing the burn. And it's very important, number one, that we look at compensation and we look at it on a relative basis to what we need to do to attract the right people into the organization. But we also look at the burn and how that affects our financial results, and then what I'm more referring to here is the AFFO on a per share basis. And so all of these things are considered as we figure out how to fund our business and drive value into the share.

But no surprise to you, when the stock performed exceedingly well and you're growing a business, stock-based comp as a percent of revenue does go up. But that does not mean that dilution -- that we're diluting our stockholders anymore. It's just -- it's a reflection of what takes place. And as you look forward, of course, with the stock where it is, it's all about delivering value to an employee. And all else being equal, you would issue less shares next year because of the value of the stock as it is in its present form. So those are the thoughts I have. Happy to take it offline with you a little bit further, but there should be no surprise, our stock-based comp has been going up.

Great. That concludes our Q3 call. Thank you for joining us.

Thank you for participating in today's conference. All lines may disconnect at this time.