Axalta Coating Systems Ltd

NYSE:AXTA

Gross Margin

Gross Margin shows how much money a company keeps from each dollar of sales after paying for the products it sells. It tells how profitable the company`s core business is before other expenses.

Gross Margin shows how much money a company keeps from each dollar of sales after paying for the products it sells. It tells how profitable the company`s core business is before other expenses.

Peer Comparison

| Country | Company | Market Cap |

Gross Margin |

||

|---|---|---|---|---|---|

| US |

|

Axalta Coating Systems Ltd

NYSE:AXTA

|

7.4B USD |

Loading...

|

|

| US |

|

Sherwin-Williams Co

NYSE:SHW

|

88.9B USD |

Loading...

|

|

| US |

|

Ecolab Inc

NYSE:ECL

|

85.3B USD |

Loading...

|

|

| JP |

|

Shin-Etsu Chemical Co Ltd

TSE:4063

|

10.8T JPY |

Loading...

|

|

| CN |

|

Wanhua Chemical Group Co Ltd

SSE:600309

|

266B CNY |

Loading...

|

|

| CH |

|

Givaudan SA

SIX:GIVN

|

27.8B CHF |

Loading...

|

|

| US |

|

PPG Industries Inc

NYSE:PPG

|

28B USD |

Loading...

|

|

| DK |

|

Novozymes A/S

CSE:NZYM B

|

165.6B DKK |

Loading...

|

|

| IN |

|

Asian Paints Ltd

NSE:ASIANPAINT

|

2.3T INR |

Loading...

|

|

| CH |

|

Sika AG

F:SIKA

|

19.9B EUR |

Loading...

|

|

| US |

|

International Flavors & Fragrances Inc

NYSE:IFF

|

20.6B USD |

Loading...

|

Market Distribution

| Min | -24 813% |

| 30th Percentile | 28.9% |

| Median | 43% |

| 70th Percentile | 60.5% |

| Max | 10 905 714.3% |

Other Profitability Ratios

Axalta Coating Systems Ltd

Glance View

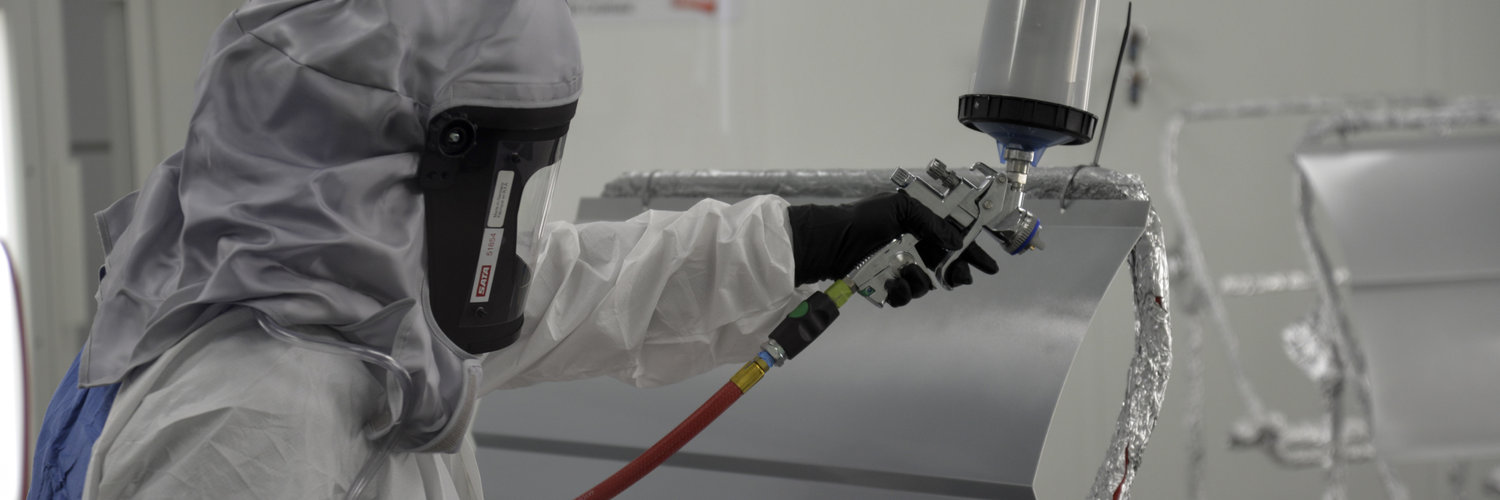

Axalta Coating Systems Ltd. stands as a global leader in the coatings industry, with a rich legacy that traces back over 150 years. Emerging from roots embedded deeply within the paint and chemicals sectors, the company has evolved into a powerhouse for innovative coating solutions. Axalta's business model revolves around providing high-performance coatings for a wide array of applications, serving sectors as diverse as automotive, industrial, and commercial transportation. Their products are not just about looks; they play critical roles in protecting surfaces from corrosion, wear, and environmental impact, which adds immense value to their industrial partners by extending the lifespan and enhancing the appearance of materials. The company has strategically delineated its operations into two significant segments: Performance Coatings and Transportation Coatings. The Performance Coatings segment caters primarily to industrial markets, including refinish applications and a variety of substrates like wood and building products. Meanwhile, the Transportation Coatings division focuses on supplying coatings for light and commercial vehicles. Axalta's revenue streams thus rely heavily on their capacity to innovate and deliver tailored solutions that meet the stringent quality and durability standards required by their diverse clientele. By investing consistently in research and development, Axalta ensures that its products remain on the cutting edge of technological advancement, thereby securing its position as a leading player in an ever-evolving industry.

See Also

Gross Margin is calculated by dividing the Gross Profit by the Revenue.

The current Gross Margin for Axalta Coating Systems Ltd is 34.4%, which is above its 3-year median of 32.7%.

Over the last 3 years, Axalta Coating Systems Ltd’s Gross Margin has increased from 29% to 34.4%. During this period, it reached a low of 29% on Dec 31, 2022 and a high of 34.6% on Jun 30, 2025.