Manual

DCF Valuation

DCF Valuation

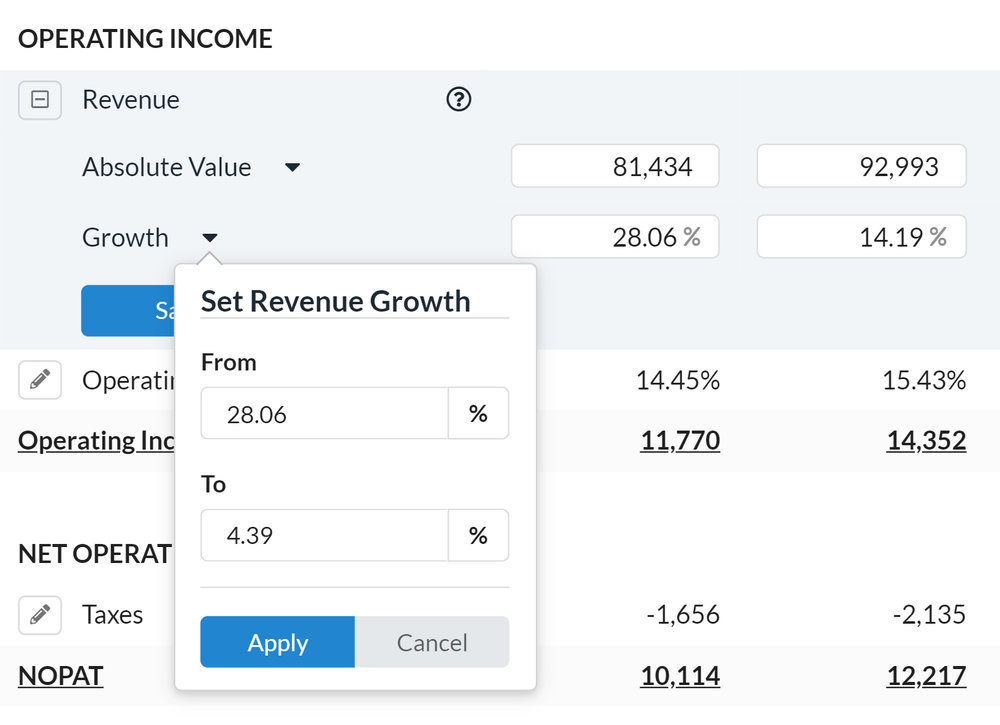

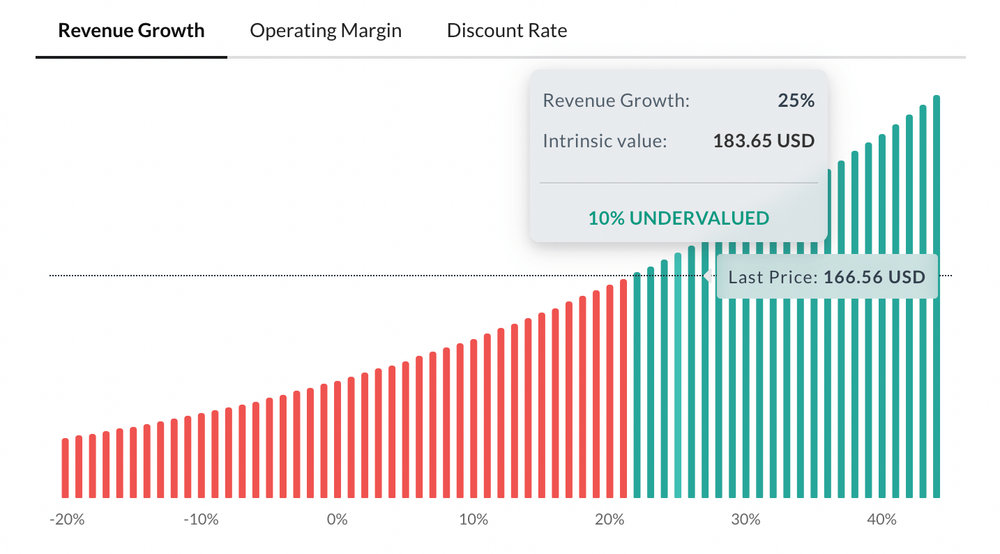

Alpha Spread offers a comprehensive set of tools that allow you to manually calculate the DCF value, giving you full control and flexibility to analyze stocks based on your own assumptions and preferences.