MEG Energy Corp

TSX:MEG

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

Abbvie Inc

NYSE:ABBV

|

Biotechnology

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Realty Income Corp

NYSE:O

|

Real Estate

|

| US |

|

Walt Disney Co

NYSE:DIS

|

Media

|

| US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

Technology

|

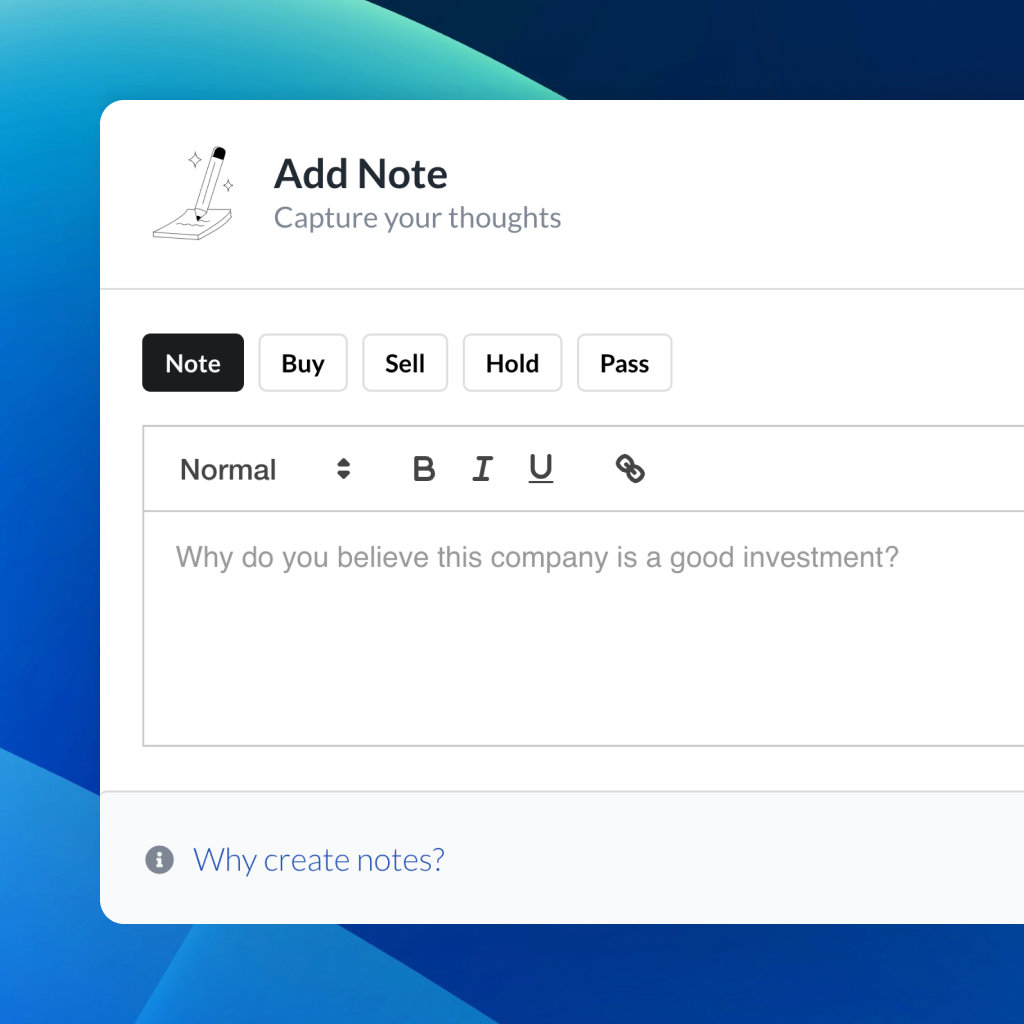

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

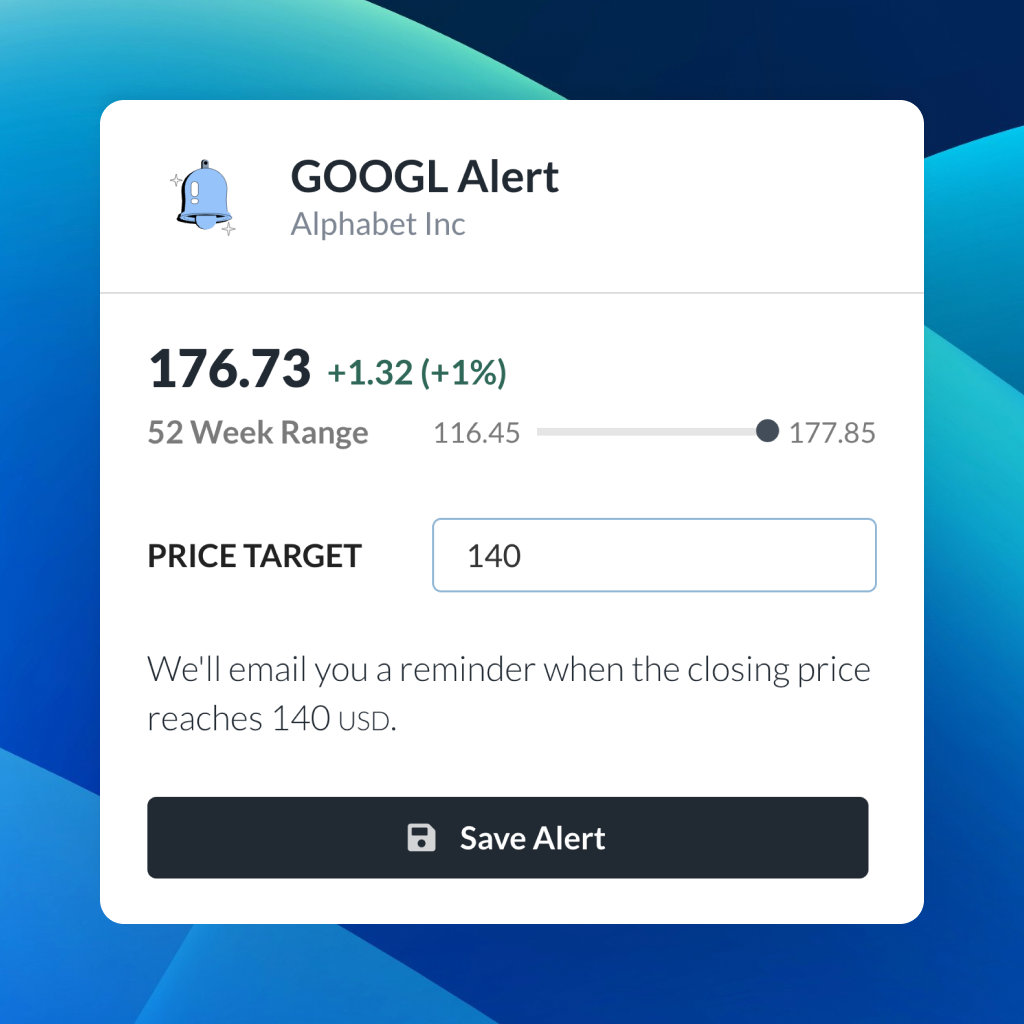

| 52 Week Range |

22.67

33.43

|

| Price Target |

|

We'll email you a reminder when the closing price reaches CAD.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

Abbvie Inc

NYSE:ABBV

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Realty Income Corp

NYSE:O

|

US |

|

Walt Disney Co

NYSE:DIS

|

US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

US |

This alert will be permanently deleted.

MEG Energy Corp

MEG Energy Corp

You don't have any saved screeners yet

You don't have any saved screeners yet

Good morning, ladies and gentlemen. My name is Michelle, and I will be your conference operator today. At this time, I would like to welcome everyone to the MEG Energy 2023 Q1 Results Conference Call. [Operator Instructions]

At this time, I would like to turn the conference over to Mr. Derek Evans, CEO. Please go ahead, sir.

Thank you, Michelle. And good morning, everyone, and thank you for joining us to review MEG Energy's 2023 Q1 operating and financial results. With me, on the call this morning are Ryan Kubik, our Chief Financial Officer; Darlene Gates, our Chief Operating Officer; and Lyle Yuzdepski, our General Counsel and Corporate Secretary.

I'd like to remind our listeners that this call contains forward-looking information. Please refer to the advisories in our disclosure documents filed on SEDAR and on our website. I'll keep my remarks brief today and refer listeners to yesterday's press release along with the MD&A and financial results that you can find on SEDAR.

Our top priority at MEG is our focus on health, safety, and the environment that ensures nobody gets hurt eliminates serious incidents, and delivers operational excellence. I'm extremely proud of the safety, operating, and financial performance delivered by our team. Their focus on safety, plant reliability, steam utilization, and ongoing well optimization have all contributed to a strong operational quarter.

Our operations team have begun our scheduled turnaround at the Christina Lake facility. Our priority is to remain safe and reliable operations throughout the turnaround.

Before I turn the call over to Darlene and Ryan to share details of our results, I'd like to briefly touch on some of the first quarter highlights. Bitumen production rose 6% to approximately 107,000 barrels per day, an industry-leading steam-oil ratio of 2.25 with an operating cost structure that was positively impacted by low natural gas and higher power prices. These strong operational results enabled our ongoing commitment to debt reduction.

We continued to execute on our debt repayment strategy, repaying approximately CAD117 million, with net debt declining to USD1 billion approximately or approximately CAD1.4 billion at the end of the first quarter. Approximately 50% of 2023 free cash flow is being allocated to debt reduction, with the remainder being applied to share buybacks. Once we achieve the $600 million debt repayment target, MEG will return 100% of free cash flow to our shareholders.

I'll now ask Darlene Gates, our COO, to speak to our operating results, and ask Ryan Kubik, our CFO, to talk to our financial results. Before I open the call to questions, I'll provide an update on the Pathways Alliance efforts this year. Darlene, over to you.

Thanks, Derek, and good morning, everyone. In the first quarter, MEG maintained its position as a leader in innovative and responsible energy development. The continued strong operational performance I will highlight today is underpinned by a commitment at all levels of our organization to ensure we take care of the safety of our employees, contractors, and the communities in which we operate.

In the first quarter, we executed a high level of activity while achieving one of our lowest quarterly total recordable injury rates in the past several years at 0.24 incidents per 200,000 work hours. Our first quarter production averaged 107,000 barrels per day, a 6% increase over the same period. This production was delivered for Christina Lake at a top-tier steam-oil ratio of 2.25.

Since exiting 2022 at record production rates, we've gained valuable knowledge surrounding water treatment optimization associated with the higher throughput rates at the facility. Our team's continuous improvement mindset has been instrumental in proactively managing this.

Total operating expense is comprised of nonenergy and energy costs of $6.13 per barrel for the first quarter. This is a 31% reduction from the same period last year. In the quarter, we continued to realize substantial benefits from our cogeneration facilities which helped reduce energy operating cost net of power revenue of $1.36 per barrel.

Nonenergy costs remained essentially flat from the same period a year ago at $4.77 per barrel, and that's in line with our full-year guidance of $4.75 to $5.05 per barrel.

As Derek mentioned, executing a safe and effective turnaround is a top operational priority for us in our second quarter. This turnaround will be focused on our Phase I and II facilities and is expected to have a full-year production impact of 6,000 barrels per day. This translates into a second quarter volume outlook of approximately 84,000 to 88,000 barrels per day.

Our teams recently completed safe ramp-down of the facilities and have begun conducting scheduled maintenance focused on maintaining regulatory compliance and delivering improved performance. Despite continued pressure on short-cycle labor availability and associated service rate, I believe we're well-positioned to deliver a productive and impactful turnaround.

Turning to development. This quarter, we executed a robust winter drilling program. Preliminary results continue to validate quality of our long-term resource base. We also kicked off our 2023 infill and redevelopment drilling program, which pairs high-quality resource with proven innovative subsurface technologies. This supports our previously announced production guidance of 100,000 to 105,000 barrels per day.

Looking ahead, we're focused on continuing to maintain a strong safety and environmental performance record to consistently deliver sustainable value to our shareholders.

With that, I'll hand it over to Ryan.

Thanks, Darlene. MEG generated $274 million of adjusted funds flow or $0.94 per share in the first quarter of 2023. The 6% production increase over the first quarter of 2022 was more than offset by a 49% decrease in our bitumen realization after net transportation and storage expense. As a result, cash operating netback declined to $34 per barrel from $70 per barrel in the first quarter of 2022.

In 2023, we sold 56% of our AWB blend in the U.S. Gulf Coast, generating a $2.25 per barrel premium relative to the Edmonton AWB Index. In addition, operating expenses net of power revenue declined to $6.13 per barrel, reflecting a 78% increase in our realized power price and lower natural gas prices compared to the first quarter of 2022.

Crown Royalties also declined to $3.18 per barrel as a result of lower bitumen revenue. We had estimated that our Christina Lake project would reach royalty payout late in the first quarter. However, advanced expenditure timing provided additional royalty shelter during the quarter and moved that time into early Q2.

After funding $113 million of capital expenditures, MEG generated $161 million of free cash flow for debt reduction and share buybacks in the first quarter of 2023. We repurchased $86 million of senior notes and ended the quarter with $1 billion of net debt. In addition, we bought $103 million or 4.9 million MEG shares in the quarter at a weighted average price of $20.88.

Thanks. And with that, I'm going to hand it back to Derek.

Thanks, Ryan, and I apologize for the noise in the background. Seems to be lots of fire engines rolling around.

Before we move into questions, I'd like to share an update on the Pathways Alliance. MEG, along with its Pathways Alliance peers, is progressing prework on the proposed foundational carbon capture and storage project, which will transport CO2 via pipeline for multiple oil sands facilities to be stored safely and permanently in the Cold Lake region of Alberta.

Significant amount of work is underway. With the Pathways Alliances, we also progress environmental assessments and early engineering work for the carbon capture and storage project and also advance other technologies. This quarter, the Alliance made progress in engineering by awarding a contract to a global engineering firm to continue development plans for the 400-kilometer CO2 transportation pipeline.

Conversations with the provincial and federal governments about their role in partnering with us to advance decarbonization efforts continue to go well. On March 28, the Canadian Federal Government announced measures in its 2023 budget to provide greater policy certainty to support and incentivize investment in clean technologies, including CCS projects that are critical to meeting Canada's emissions reduction goals. We continue to engage with federal and provincial governments in aligning how the Pathways Alliance can support Canada in reaching its climate commitments.

As I bring my remarks to a close, I once again want to extend my thanks to our team for their commitment and perseverance. I'm proud of what we've been able to accomplish and confident in our future and our commitment to sustainable, innovative, and responsible energy development. On behalf of MEG's Board of Directors and our management team, I want to thank you for your continued support.

With that, I'll turn the call back over to Michelle to begin the Q&A.

Thank you, sir. [Operator Instructions]. Your first question will come from Greg Pardy at RBC Capital Markets. Please go ahead.

Mr. Pardy, your line is open.

Your next question will come from Menno Hulshof at TD Securities. Please go ahead.

Thanks, and good morning everyone. I'll start with a question on growth. On the last call, Derek, I believe you talked about potentially growing production to 120,000 barrels per day over the next two to three years. But can you just elaborate on how you arrived at that target? Is it largely being driven by the 20,000 barrels per day increase to takeaway capacity that you're going to get through TMX or do other factors come into play? And then when we think about capital efficiencies for that growth, how much of it can be delivered through lower capital efficiency opportunities like redrilling of existing pads versus higher-cost options like new pads?

Menno, I'll take a cut at that, and Darlene may want to step in with some details on redrills and the capital efficiencies associated with those. Our -- the growth that I talked about, the small, moderate growth of 2% to 3%, going from 110,000 to 120,000, is really predicated on two things. It's predicated on -- well, it's really three: One, that our investors do not want us spending large amounts of capital drilling. Typically, the types of expenditures we're talking about are really debottlenecking expenditures inside of our facility as well as short-cycle redrills and that sort of work that has very high capital or very low capital sort of reinvestment cost, very quick payout in a matter of months.

But I think the way -- it's not being driven by our takeaway capacity in any way, shape, or form. So, it's nice to have that takeaway capacity. We see the biggest value of the takeaway capacity being that it's really going to tighten up that WCS differential even tighter as it pulls up to 600,000 barrels a day of product away from the U.S. Gulf Coast and puts it on the West Coast.

Darlene, I don't know if you want to talk a little bit about capital reinvestment efficiencies.

Thanks, Menno. And thanks, Derek. I think Derek hit most of the main points, but a couple of adds I would throw in there is we have some pretty exciting new pad development from our pad design that the team is working on pretty hard that we'll see come out in the next one to two years. And that's going to help us really drive that capital efficiency for the new pads.

Derek really reinforced our program has a lot of exciting opportunity as we go and use the technology for the 4-D seismic that's helping us really optimize the existing [indiscernible], and that gets after those quick redrills and infills that we're pursuing at this time. I'd also always want to do another shout-out to the optimization team that does from the facilities and the workovers that our team is working on, again, just keep dialing in the reservoirs, we learn it to get more familiar with it.

And then looking to the future, our winter program, as I mentioned, looks pretty exciting to us. We've got a lot of great reservoir to go pursue, and then the surface side of it is really going after that capital efficiency cost opportunity. So, a lot of exciting work on the way and I think will really help capture those capital efficiencies.

Excellent. Thanks, Darlene, and Derek. Just the second question relates to the 500,000 barrels per month of contracted dock space on the Gulf Coast. I guess my question is, is that the end game for dock space? Or is there potential to expand that? And then I guess if we take it to a higher level, what are your midterm goals for growing export capacity?

So -- Menno, it's Derek. Look, 500,000 barrels a day is basically the -- in the U.S. Gulf Coast about what you can put in an Aframax. So that's -- we have the capability of effectively loading an Aframax a month at the current time. That is not our ambition. We would love to be able to have a better or clearer sight to increase volumes of the U.S. Gulf Coast or across the dock. So, you should think about it as a starting point and not an end-point. And that if it's going to grow, it should grow in sort of 500,000-barrel-a-day type of pieces.

As we think about our export strategy, I think it's long been a desire of Western Canadian producers to get their product, their heavy oil to the U.S. Gulf Coast. And now that everybody is successfully doing that, we've managed to move the pinch point in terms of pricing and move the pricing power away from Pad two down to Pad three. Our strategy is we should be working hard to find other buyers for that product to take that product away from the U.S. Gulf Coast and make sure that we're very much better balanced between supply and refinery demand in that area.

So, I don't want to get into too much specifics, but you've heard us continue to talk about the big driver in the WCS differential coming in as tight as it has been, incremental barrels moving across the dock in this last quarter to China. But India has also been a big buyer of this product, and we expect that to continue. And you should expect us to try and continue to move volumes in excess of what we've currently got dock space to those markets.

Your next question will come from John Royall at JPMorgan. Please go ahead.

Hi, good morning. Thanks, for taking my question. I just wanted to see if there was an update to the timing on reaching your net debt four. I think year-end 2024 was the most recent and your release from 1Q just says beyond 2023 current oil prices. So, is year-end next year still the right time-line to think about? Or is there any update there?

Hi, John, it's Ryan. I would say that with the narrowing differentials we've seen over the last little while we've seen the cash flow -- free cash flow coming in a little bit higher than we had anticipated, and that's allowing us to repay debt maybe a little bit sooner. So, it is into 2024 at current oil prices, maybe in the second half of 2024 at this point in time relative to the end of 2024 previously. So, the longer we see narrower differentials, higher oil prices, it's going to shift. But still second half 2024-ish.

Okay. Great. And then could you just talk a little bit about the drivers of the working capital headwind in 1Q? I think it was about $110 million. Do you expect any reversal in 2Q or in 2023 in general?

A lot of that depends on the oil price. The biggest driver is our accounts receivable rising. This quarter, we did see an increase in AR around purchased product sales. Actually, we did see WTI go down relative to the first quarter of the prior period -- or relative to the end of the year, I should say. And we still saw our accounts receivable go up because we did sell some purchased product. So that was the main driver. We did have some interest payments that always impacts the first quarter as well. Those are probably the two big drivers.

We could see it reverse if oil prices fall, I guess, but I would say that the best view is that we'll see it pretty stable at this point in time.

Your next question will come from Neil Mehta at Goldman Sachs. Please go ahead.

Good morning, Ryan and Derek. And thanks for taking the time. I guess the first question is around sustaining CapEx. It's tracking around $400 million this year. How do you see that evolving over time? And what are the puts and takes, right [indiscernible] inflation to volumes.

Neil, it's Derek. Thank you for that question. Neil, it's one that we talk about often both externally and internally, and you hit on the biggest single unknown, which is inflation and what is the impact. So, over the last two years, you've seen that sustaining capital moved up fairly aggressively to that $400 million number as a result of over, I would say, or approximately 20% inflation. We're in the process of, and continuing to watch inflation this year.

We're still seeing inflationary pressures on two fronts, on basically salaries. Wages are still a hot button moving anywhere in that 5% to 7% in both the field and in the office side of the business. But I'd also say the other aspect on this is availability of people. And that cuts into your sustaining capital in two ways. One, it takes longer. If you can't find the people, it takes longer to get the job done. And if you can't find experienced people, the effectiveness of and cost effectiveness and the safety and everything else that's associated with green hands or inexperienced people adds to your cost structure and also adds to your safety risk.

So, it's too early for us to really be able to tell you what we think is going to happen in terms of inflation on that sustaining capital number, but that is the single biggest driver at this point in time.

And the follow-up is on WCS and then TMX associated with that. So, we've seen WCS tighten up a lot here. How much of this is do you think structural versus seasonal and an element of that? It seems more structural in nature, especially given the OPEC cuts. But curious on your perspective on that.

And then as it relates to TMX and the cost overruns, how should we think about any financial impact that would have on the shippers, recognizing that's a moving target right now?

Yes. Yes. So structural versus seasonal on WCS, my thesis and our thesis that MEG has been that this is structural. This has largely been driven by increased loads across the dock to -- at least in this year, the biggest driver has been incremental loads going into China as they've come out of their COVID shutdowns. We don't see that dropping off. So, we would say, that is a structural piece, and you should expect to see that continue.

I would be remiss if I didn't say there is some seasonality associated with this, but it's at the margin and I think quite small. I think, though, as you move, you roll the clock forward, if you think about what's going on in that more macro picture with the Mexican refinery dock focus coming up at somewhere in the neighborhood of 340,000 barrels, TMX coming on in the fourth quarter or early in the first quarter next year, all of a sudden, you're pulling another 1 million barrels away from that U.S. Gulf Coast market. I would expect that you could see further structural tightening in that market as we drive forward.

So, I think the outlook on WCS is quite positive and should be very supportive of our business going forward. And -- but you will continue to see variations in that differential, which are sort of well understood from a seasonal perspective.

On TMX, I've got to -- we are a shipper. We ship about 20,000 barrels a day, or we will be shipping 20,000 barrels a day of deal bit. It's still too early for us to be able to talk to with any degree of certainty, what the impact of those cost overruns will be. We are precluded from providing information by virtue of an NDA that we have signed. So, I really can't elaborate or talk about in great detail about this other than to say this is an important piece of infrastructure for the Western Canadian sedimentary basin.

It provides another 600,000 barrels a day of egress. And especially when you think that our major market is the U.S. Gulf Coast and it's pulling that 600,000 barrels a day away from there and is going to impact the WCS differential, we believe positively on our whole business. Talking about a toll on a specific part of that line, probably wouldn't do it justice in terms of the economic value that it's going to bring to the table for us.

And Derek, the follow-up on this. I don't know if you can comment on it, but our understanding that TMX as well, there was a cost overrun, it's still tracking on schedule from a timing perspective. Is that fair?

Yes, that's the -- that's our understanding as well.

Your next question comes from [indiscernible]. Please go ahead.

Hi, thanks, for taking my question. A couple of questions for Ryan. In the reconciliation from funds from operation to adjusted fund flow, we have $87 million in realized equity price risk management gain which is a double from last quarter. Maybe you can give some explanation of this account.

And the second question will be about the return of shareholders. We have spent $120 million in debt repayment, but our net debt is flat, CAD1,389 million, flat from last quarter. And also, the repurchases, we have spent $100 million in repurchases, but only the share account decreased by half of the $5 million that we have repurchases, which accounts only for $50 million. So, there's $50 million there, $170 million corporate [ph], and debt repayments. Maybe you can give us some color about that.

Sure. Tray to Ryan, and down, so remind me if I don't it all the questions. But the first one was on the $87 million of equity price risk management. That was the equity risk management hedge that was put in place to manage the risk around the LTI that was issued back in 2020 at a relatively low price in the $1.57 range. And so, we did a good piece of business there, brought in about $120 million to the company by hitting that LTI position.

It did settle in the period. The 2020 LTI settled during the period. And so, the $87 million that you're seeing there is the realized gain from that position. We have recognized for our accounting purposes about $78 million of that at the end of the year. So, it went from unrealized $78 million to realized $87 million, a $9 million move during the quarter. So, you're just seeing the impact of a shift to realize from unrealized, if that makes sense.

Yes, you had a question on net debt. Why it only fell -- why it didn't fall maybe as much as you would have anticipated. The reason for that is the earlier question on working capital build. The working -- we did generate $160 million of free cash flow during the period. We had a couple of hundred million dollars of cash available to repay debt and buy back shares. But with that $160 million of free cash flow, a portion of that is sitting in accounts receivable and wasn't actually collected as cash. So, cash fell to buy back stock and the debt during the period, and a portion of the free cash flow that we generated is sitting in accounts receivable yet to be collected. So that's the impact you're seeing there.

Net debt did fall, it just didn't fall as much as you might have expected because the cash balance fell to help us buy back that $103 million of stock and about $117 million of debt. So that was your second question, working capital build.

And then the last question was on the number of shares. We bought back 4.9 million shares during the period, but the actual share balance didn't fall that much. The reason for that is we actually issued some LTI during the period. So, we did have an offsetting issue of stock. Not all the LTI is cash-based. Some of it is share-based and was issued in shares during the period.

[Operator Instructions]. There are no further questions on the phone line, so I will turn the conference back to Derek Evans for any closing remarks.

Thank you, Michelle, and thank you to everybody who joined us this morning for our Q1 results conference call. We're excited about what we were able to achieve this last year and look forward to updating you on our operational performance and return of capital program when we release our Q2 results in July. Hope everybody has a great day, and thank you again for joining us.

Ladies and gentlemen, this does conclude your conference call for this morning. We would like to thank you all for participating and ask you to please disconnect your lines.