MEG Energy Corp

TSX:MEG

| US |

|

Johnson & Johnson

NYSE:JNJ

|

Pharmaceuticals

|

| US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

Financial Services

|

| US |

|

Bank of America Corp

NYSE:BAC

|

Banking

|

| US |

|

Mastercard Inc

NYSE:MA

|

Technology

|

| US |

|

Abbvie Inc

NYSE:ABBV

|

Biotechnology

|

| US |

|

Pfizer Inc

NYSE:PFE

|

Pharmaceuticals

|

| US |

|

Palantir Technologies Inc

NYSE:PLTR

|

Technology

|

| US |

|

Nike Inc

NYSE:NKE

|

Textiles, Apparel & Luxury Goods

|

| US |

|

Visa Inc

NYSE:V

|

Technology

|

| CN |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

Retail

|

| US |

|

3M Co

NYSE:MMM

|

Industrial Conglomerates

|

| US |

|

JPMorgan Chase & Co

NYSE:JPM

|

Banking

|

| US |

|

Coca-Cola Co

NYSE:KO

|

Beverages

|

| US |

|

Realty Income Corp

NYSE:O

|

Real Estate

|

| US |

|

Walt Disney Co

NYSE:DIS

|

Media

|

| US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

Technology

|

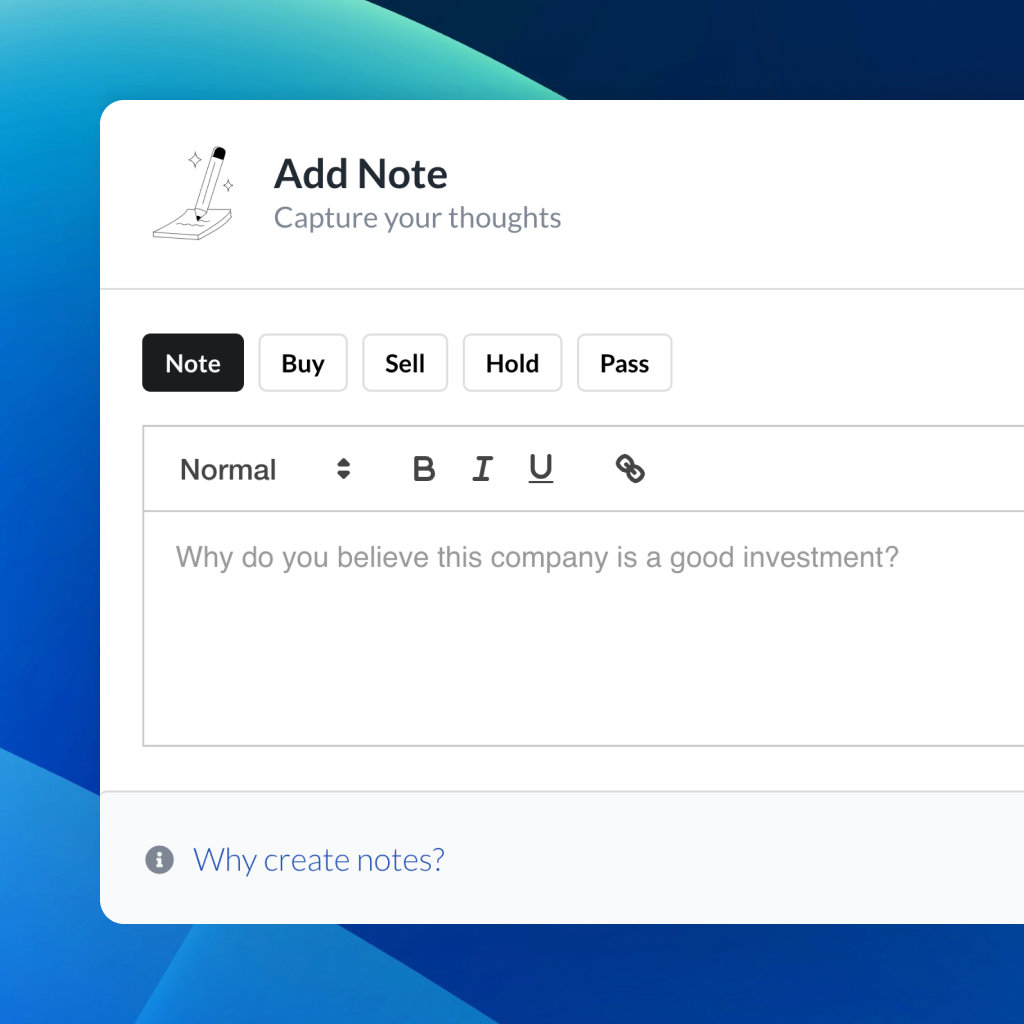

Utilize notes to systematically review your investment decisions. By reflecting on past outcomes, you can discern effective strategies and identify those that underperformed. This continuous feedback loop enables you to adapt and refine your approach, optimizing for future success.

Each note serves as a learning point, offering insights into your decision-making processes. Over time, you'll accumulate a personalized database of knowledge, enhancing your ability to make informed decisions quickly and effectively.

With a comprehensive record of your investment history at your fingertips, you can compare current opportunities against past experiences. This not only bolsters your confidence but also ensures that each decision is grounded in a well-documented rationale.

Do you really want to delete this note?

This action cannot be undone.

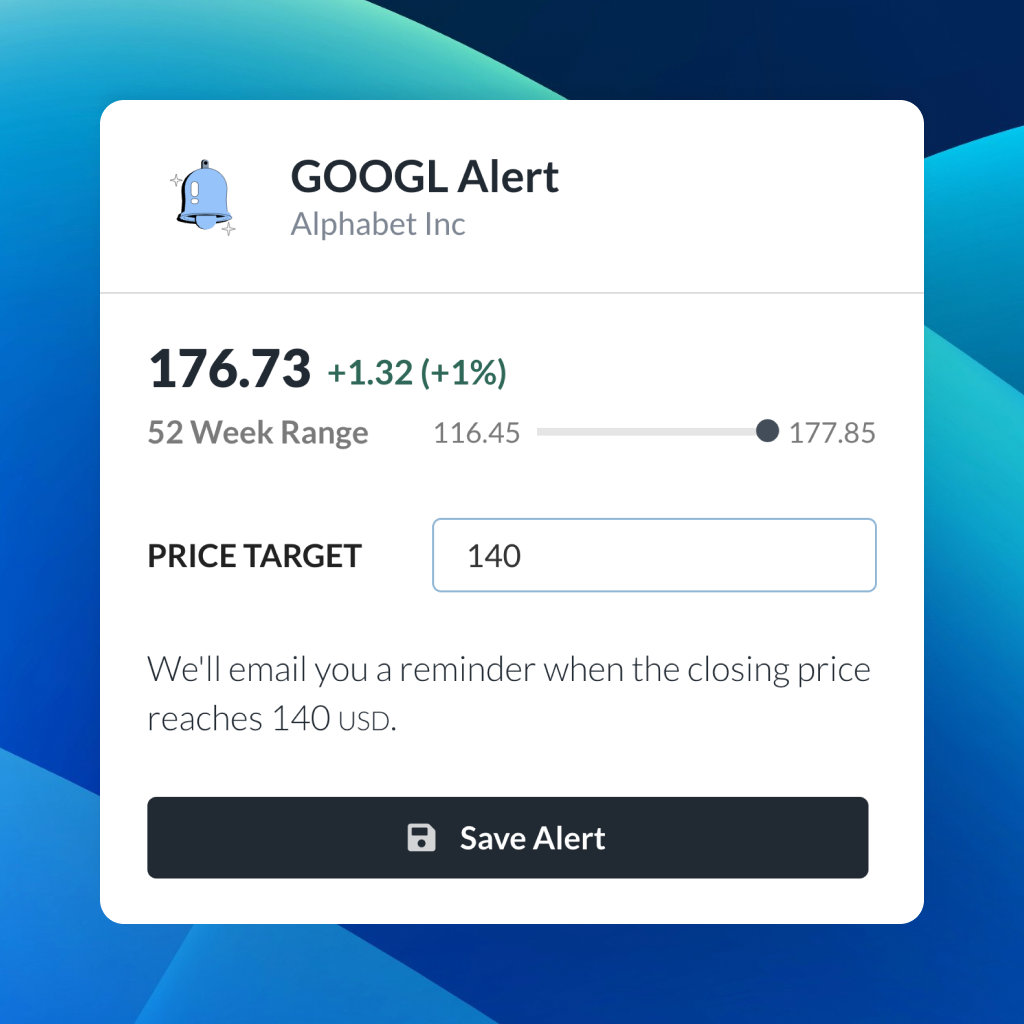

| 52 Week Range |

22.67

33.43

|

| Price Target |

|

We'll email you a reminder when the closing price reaches CAD.

Choose the stock you wish to monitor with a price alert.

|

Johnson & Johnson

NYSE:JNJ

|

US |

|

Berkshire Hathaway Inc

NYSE:BRK.A

|

US |

|

Bank of America Corp

NYSE:BAC

|

US |

|

Mastercard Inc

NYSE:MA

|

US |

|

Abbvie Inc

NYSE:ABBV

|

US |

|

Pfizer Inc

NYSE:PFE

|

US |

|

Palantir Technologies Inc

NYSE:PLTR

|

US |

|

Nike Inc

NYSE:NKE

|

US |

|

Visa Inc

NYSE:V

|

US |

|

Alibaba Group Holding Ltd

NYSE:BABA

|

CN |

|

3M Co

NYSE:MMM

|

US |

|

JPMorgan Chase & Co

NYSE:JPM

|

US |

|

Coca-Cola Co

NYSE:KO

|

US |

|

Realty Income Corp

NYSE:O

|

US |

|

Walt Disney Co

NYSE:DIS

|

US |

|

PayPal Holdings Inc

NASDAQ:PYPL

|

US |

This alert will be permanently deleted.

MEG Energy Corp

MEG Energy Corp

You don't have any saved screeners yet

You don't have any saved screeners yet

Good morning. My name is Joanna, and I will be your conference operator today. At this time, I would like to welcome everyone to the MEG Energy Third Quarter Conference Call. [Operator Instructions] Thank you. Mr. John Rogers, you may begin your conference.

Thank you, Joanna, and welcome everyone to MEG's third quarter conference call. I have in the room with me Derek Evans, our CEO; Chi-Tak Yee, our COO; Eric Toews, our CFO; and Helen Kelly, our Director of Investor Relations. First of all, I'd like to remind everyone our call contains forward-looking information, so please refer to the filings on SEDAR. Derek is going to give -- provide a commentary on Husky's unsolicited bid and also touch base on the quarter and discuss our newly unveiled 5-year plan, after which we will open the floor to questions. Now other than Derek's commentary on the Husky bid, we really have no further comment to make on this matter and will not be taking any questions on that subject any further. So as usual, Helen and I will be around after the call to answer your detailed modeling questions. With that, I'll pass it over to Derek.

Thank you, John. Good morning, everyone. This is my first conference call as CEO of MEG, so let me extend a warm welcome to those on the call, particularly those I haven't had the pleasure of meeting yet. I have for a long time known that MEG possessed a world-class asset that was being exploited by best-in-class technology and team. But having been on the inside for the last 3 months, I can now attest to the fact that MEG indeed offers one of the greatest value propositions in the Canadian heavy oil space. Having met with all the staff, both at Christina Lake and in Calgary, I've been very impressed with the caliber of talent we have and the innovative spirit that has allowed the company to invent and deploy technology that enables extremely efficient capital reinvestment and our industry-leading cost structure. MEG is at an inflection point. As it transforms from a net consumer of cash to a generator of significant cash flow, well in excess of future capital investment requirements. It has taken 10 years of hard work to get here and the time has arrived. The 5- and 10-year fully funded growth plans that we unveiled 2 weeks ago demonstrate the significant long-term value-creation that is to come. Over the next 5 years, we'll be growing productions at a compound rate of 11% with significant cash flow above and beyond our capital commitments. Before I move on to discuss the quarter, let me spend a minute touching on a subject that I know is on everyone's minds. As I've noted earlier, we believe that MEG offers one of the greatest value propositions in the Canadian oil and gas business. So it's not a surprise that a company like Husky would see that value and want to participate in our assets, technology, people and our upside. The fact that Husky, by their own statement, has agreed with just how valuable we are is a flatter. However, everything comes at a price, and MEG's board has unanimously agreed for a second time that Husky's $11 cash and share offer valued today at approximately $9.61 per share is inadequate. The timing of Husky's bid was opportunistic, taking advantage of the current weakness in the market, especially the near-term pressure on differentials, which is expected to be resolved in the first half of 2019. I'll expand on this subject a bit more with our results. I think it's fair to say there's a tremendous amount of intrinsic value within the company. Our proprietary technology, which has been refined over the last 8 years, has allowed us to grow with one of the best capital efficiencies in the oil industry and with industry-leading operating costs. We either have or are in the process of having regulatory approvals in place for up to 0.5 million barrels per day of resource development. Our proprietary technology applied across our world-class resource of 2.8 billion barrels of 2B reserves supports a significantly higher price than Husky is currently offering. Importantly, from 2019 onward, MEG expects to be fully -- to be able to fully fund all of its future growth, which is substantial from internal cash flow and still have enough money remaining to pay down debt and/or return to shareholders. This gives MEG the ability to generate substantial shareholder value over time. Husky's bid does not reflect this value-creation. MEG's superior assets and growth rate, in addition to our torque to higher prices, have been the catalysts for our premium trading multiples and the reason why MEG has been one of the best-performing PSX energy stocks in 2018 even prior to Husky's bid. Combination with Husky would significantly reduce the upside that MEG's shareholders have been expecting. Plus, by their own admission, Husky can afford to pay a lot more for MEG. The double-digit accretion figures they show in 2020 reflects the acquisition of MEG at a price that benefits MEG's -- or Husky's shareholders and penalizes MEG's shareholders. A significant amount of upside potential and value that MEG's shareholders have been patiently waiting for immediately accrues to Husky's shareholders with this offer. Over the last 2 weeks, we have been in touch with most of our top shareholders, and I think it's fair to say, they agree with our view that MEG possess significantly more value than the current bid on the table. We've talked a lot about Husky. However, management and board are not currently focused on the Husky bid. We are focused -- what we are focused on is the formal process that is underway to explore a full range of strategic alternatives to maximize value for our shareholders. We've engaged financial advisers and opened a data room to help interested parties establish the true value of the company. Our process is underway, and we cannot update or comment on the process until it has reached its conclusion. On behalf of the board, I'd once again urge our shareholders to reject Husky's bid and not tender your shares. We are committed to maximizing value for you, our shareholders. With that out of the way, now let me give you an update on the quarter. We achieved record production in Q3, averaging approximately 98,800 barrels a day of bitumen, accompanied by record low net operating cost of $4.34 a barrel. We tied in 11 new wells related to the implementation of eMSAGP. We're on track to deliver to the high end of our production guidance of 87,000 to 90,000 barrels of bitumen a day and our non-energy operating cost guidance of $4.50 to $5 per barrel of bitumen. We saw stronger oil prices and higher sales volumes coming out of the turnaround at Christina Lake and this has supported adjusted funds flow from operations of $116 million in Q3 or $0.39 per share. Funds flow from operations, excluding realized net hedging losses of $88 million, totaled $0.68 per share. Quarterly cash flow was nearly $100 million higher than last quarter, illustrative of what MEG is capable of doing in a more sustainable oil price environment. Capital spending to date is approximately $483 million. During third quarter, we essentially completed all spending related to Phase II of eMSAGP, below our revised estimate of $350 million for a total of $320 million or $16,000 of flowing BOE. We expect to exit 2018 with $270 million to $280 million of cash on our balance sheet. During the quarter, we delivered approximately 31% of our blend sales to the U.S. Gulf Coast, where the barrels realized a $15 per barrel uplift net of transportation relative to sales in Edmonton. 34,000 barrels a day was sold by the Flanagan Seaway pipeline, despite posted apportionment of 45% on the Enbridge mainline. MEG's rail movements also doubled during the third quarter, averaging 8,000 barrels a day. Overall, our diversified marketing strategy resulted in USD 50 per barrel uplift in our realized blend sales priced this quarter versus the WCS index in Edmonton. Looking forward, we have substantial assets in place to mitigate the ongoing impact of apportionment. We anticipate to deliver similar Flanagan volumes for the next 12 to 18 months. We have plans to rail approximately 15,000 barrels a day in the fourth quarter and to increase the use of rail up to 30,000 barrels a day by the end of Q1 2019. Subsequent to the quarter end, we execute an agreement to access 30,000 barrels a day of unit train loading capacity at the Bruderheim Terminal. This agreement is for 3 years with an option to extend for 1 year. We also have 3 million barrels of storage facilities throughout North America. Despite very challenging headline WCS differentials for Q4, we anticipate them to moderate into the high to low 20s through 2019 as Canadian rail export volumes increase significantly and PADD 2 refineries come back online after what has been the largest turnaround season in the last 5 years, which impacted approximately 700,000 barrels a day of heavy oil refining capacity. In addition, to mitigate the financial impact of wider forecast differentials in the fourth quarter, we are bringing forward a portion of our 2019 scheduled maintenance program into November. The 21-day turnaround will reduce our fourth quarter production by approximately 4,000 to 6,000 barrels per day without impacting our 2018 annual guidance. In addition, we can vary the pace which we ramp back up after the turnaround depending on market conditions. In the medium term, the doubling of crude by rail, Line 3 completion and improvements to the Enbridge nomination process will begin to clear congestion out of the Western Canadian sedimentary basin. We're also encouraged by the recent developments coming out of TransCanada for the progression of Keystone XL. We believe we're well positioned to take advantage of our Flanagan Seaway capacity, which will double to 100,000 barrels a day in July 2020. Most importantly, taking a step back, let's remember that the assets of this company can support production for up to -- for 40 to 50 years. This is a long life asset with a long-term value-creation opportunity. It is through this lens that we should think about the impact to egress and temporary market constraints. Looking forward, we're very close to completing our Vision 20/20 program with production of approximately 100,000 barrels a day. We're only 13,000 barrels a day of bitumen away from realizing the goals we've been working towards over the last 2 years. We expect to exit 2018 with a significant level of cash on hand to partially fund our 2019 capital program. The majority of capital spending in 2018 and going forward will be directed toward Brownfield expansions. As we look at our 5-year plan, we have a pipeline of execution-ready Brownfield projects at $20,000 to $25,000 per flowing barrel that will sustain an 11% CAGR through internally generated cash flow at $70 WTI, while delivering in excess of $3 billion of free cash flow over that period. Further, we have the ability to more than double our current production over the next decade. In conclusion, MEG is at an inflection point. We are very excited to see the hard work that the organization has put in close to coming to fruition with the Vision 20/20 plan. And we are thrilled with what our 5-year plan, that looks beyond 2020, can further accomplish for the company. With this and the ongoing strategic review process underway, our board and management are committed to delivering and maximizing value for our shareholders. With that, I'll pass the call over to John.

Thanks. Thanks, Derek, for your remarks on the unsolicited bid from Husky and also on the quarter and our long-range vision. Joanna, we're now ready to open it up for questions. So if there's any questions on the line, we'll be happy to take them.

[Operator Instructions] Your first question is from Phil Skolnick from Eight Capital.

Just on your -- the rail deal, is it safe to assume that the all-in cost is going to be, kind of, in the high-teens U.S. dollar per barrel, just, kind of, taking the read through from Cenovus' recently announced deal?

Phil, it's Derek. I think that's fair to assume that they -- you're looking at a high-teens type number, which is really indicative of unit train highly efficient operations -- rail operations to the U.S. Gulf Coast.

And how should we think about the ramp up of it? Is it -- been able to get that 30,000 Day 1 or is it ramping up over time -- over '19?

So in the third quarter, we moved about 8,000 barrels a day. And today, the fourth quarter, we're talking about railing somewhere between -- we talk in the -- in our remarks here about being somewhere in the neighborhood of 15,000. I think that's on the low end of our estimate. I would expect that we're continuing to see opportunities to load out Bruderheim, where we have existing capacity. But as we move into the first quarter, we should be able to move in that 25,000 to 30,000 barrels a day.

[Operator Instructions] And your next question is from Nick Lupick from AltaCorp Capital.

Acknowledging that I know you don't want to answer any questions regarding the Husky bid, I was wondering if you could give us any kind of a time line on the strategic process, given that obviously, the bid is due or good until January. I was just wondering could give us any kind of sense of time line that you expect the strategic process to take until.

No -- it's, John, Nick. No, we can't. It's an active process obviously and it's -- the Husky bid is open till middle of January and it's just an active process today and that's really all we can say about it now.

And at this time, we have no further questions. You may proceed.

Well, thanks. Listen, thanks, everyone, for listening in. We realize it's a very busy day for earnings releases today. We really appreciate your interest and listening in. And of course, Helen and Megan and I will be available for calls subsequent to the call should you have any further questions. And with that, we'll say to everybody hope you have a good day, and we'll talk to you soon. Bye now.

Ladies and gentlemen, this concludes today's conference call. We thank you for participating, and we ask that you please disconnect your lines.