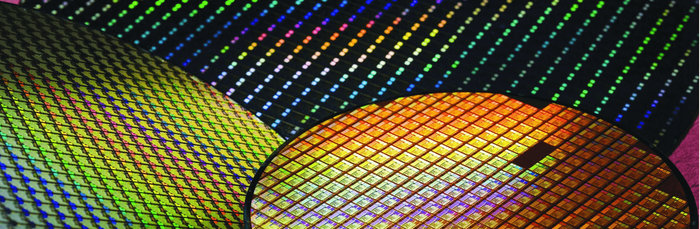

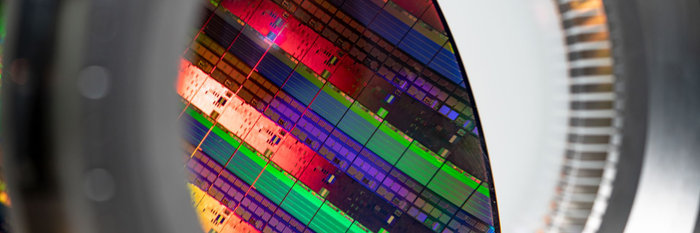

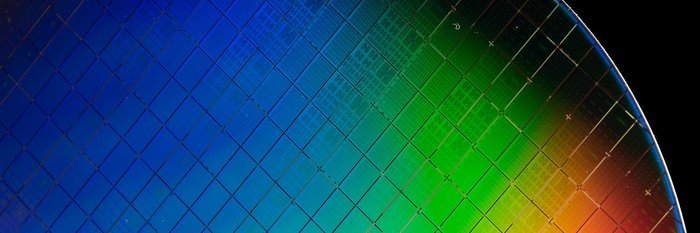

Semiconductors

Designers and fabricators of integrated circuits and related equipment. Capital intensity is extreme; growth drivers include data centers, mobile, AI and automotive electronics. Designers and fabricators of integrated circuits and related equipment. Capital intensity is extreme; growth drivers include data centers, mobile, AI and automotive electronics. Designers and fabricators of integrated circuits and related equipment. Capital intensity is extreme; growth drivers include data centers, mobile, AI and automotive electronics.

| Company | Intrinsic Valuation | Profitability Score | Solvency Score | Market Cap | ||

|---|---|---|---|---|---|---|

|

NVIDIA Corp

NASDAQ:NVDA

Loading...

|

28% Overvalued |

90

/ 100

|

99

/ 100

|

$4.6T | |

|

Taiwan Semiconductor Manufacturing Co Ltd

TWSE:2330

Loading...

|

33% Overvalued |

72

/ 100

|

92

/ 100

|

$1.6T | |

|

Broadcom Inc

NASDAQ:AVGO

Loading...

|

28% Overvalued |

63

/ 100

|

61

/ 100

|

$1.6T | |

|

ASML Holding NV

AEX:ASML

Loading...

|

44% Overvalued |

72

/ 100

|

74

/ 100

|

$577.1B | |

|

SK Hynix Inc

KRX:000660

Loading...

|

55% Overvalued |

67

/ 100

|

86

/ 100

|

$477.7B | |

|

Micron Technology Inc

NASDAQ:MU

Loading...

|

22% Overvalued |

53

/ 100

|

86

/ 100

|

$474.4B | |

|

Advanced Micro Devices Inc

NASDAQ:AMD

Loading...

|

6% Overvalued |

49

/ 100

|

97

/ 100

|

$318.1B | |

|

Lam Research Corp

NASDAQ:LRCX

Loading...

|

59% Overvalued |

75

/ 100

|

83

/ 100

|

$303.3B | |

|

Applied Materials Inc

NASDAQ:AMAT

Loading...

|

54% Overvalued |

66

/ 100

|

85

/ 100

|

$294.9B | |

|

Intel Corp

NASDAQ:INTC

Loading...

|

42% Overvalued |

38

/ 100

|

46

/ 100

|

$216.9B | |

|

Texas Instruments Inc

NASDAQ:TXN

Loading...

|

34% Overvalued |

61

/ 100

|

68

/ 100

|

$199.8B | |

|

KLA Corp

NASDAQ:KLAC

Loading...

|

53% Overvalued |

77

/ 100

|

77

/ 100

|

$194.9B | |

|

Analog Devices Inc

NASDAQ:ADI

Loading...

|

42% Overvalued |

51

/ 100

|

74

/ 100

|

$172.7B | |

|

Qualcomm Inc

NASDAQ:QCOM

Loading...

|

15% Undervalued |

58

/ 100

|

68

/ 100

|

$150.4B | |

|

Tokyo Electron Ltd

TSE:8035

Loading...

|

53% Overvalued |

62

/ 100

|

78

/ 100

|

$131.8B | |

|

Arm Holdings PLC

NASDAQ:ARM

Loading...

|

74% Overvalued |

55

/ 100

|

81

/ 100

|

$130.3B | |

|

Advantest Corp

TSE:6857

Loading...

|

65% Overvalued |

75

/ 100

|

93

/ 100

|

$125.2B | |

|

MediaTek Inc

TWSE:2454

Loading...

|

19% Overvalued |

58

/ 100

|

90

/ 100

|

$92.2B | |

|

H

|

Hygon Information Technology Co Ltd

SSE:688041

Loading...

|

58% Overvalued |

57

/ 100

|

81

/ 100

|

$87.2B | |

|

K

|

Kioxia Holdings Corp

TSE:285A

Loading...

|

68% Overvalued |

60

/ 100

|

46

/ 100

|

$78.6B | |