CLNN

vs

CLNN

vs

S&P 500

S&P 500

CLNN

CLNN

S&P 500

S&P 500

Over the past 12 months, CLNN has significantly outperformed S&P 500, delivering a return of +42% compared to the S&P 500's +14% growth.

Stocks Performance

CLNN vs S&P 500

Performance Gap

CLNN vs S&P 500

Performance By Year

CLNN vs S&P 500

Compare the stock's returns with its benchmark index and competitors. Gain insights into its relative performance over time.

Clene Inc.

Glance View

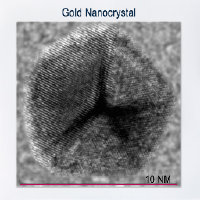

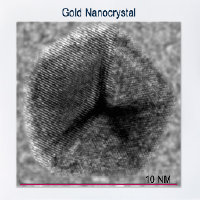

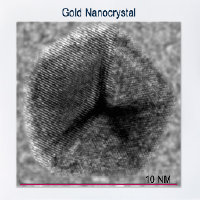

Clene, Inc. is a clinical-stage biopharmaceutical company, which focuses on the development of therapeutics for neurodegenerative diseases. The company is headquartered in Salt Lake City, Utah and currently employs 95 full-time employees. The company went IPO on 2018-08-27. The firm is focused on the treatment of neurodegenerative disease with potential first-in-class nanotherapeutics to treat energetic failure and neurological diseases. The Company’s lead drug candidate, CNM-Au8, is an oral suspension of gold nanocrystals that drive critical cellular energetic metabolism in the central nervous system (CNS). CNM-Au8 increases energy production and utilization to accelerate neurorepair and improve neuroprotection. CNM-Au8 is being evaluated in a Phase III registration trial in amyotrophic lateral sclerosis (ALS) and a Phase II trial for the treatment of chronic optic neuropathy in patients with stable relapsing multiple sclerosis (MS). The firm has also advanced into the clinic an aqueous solution of ionic zinc and silver for anti-viral and anti-microbial uses.