BHC

vs

BHC

vs

NOVO B

NOVO B

BHC

BHC

NOVO B

NOVO B

Over the past 12 months, BHC has significantly outperformed NOVO B, delivering a return of +47% compared to the NOVO B's 64% drop.

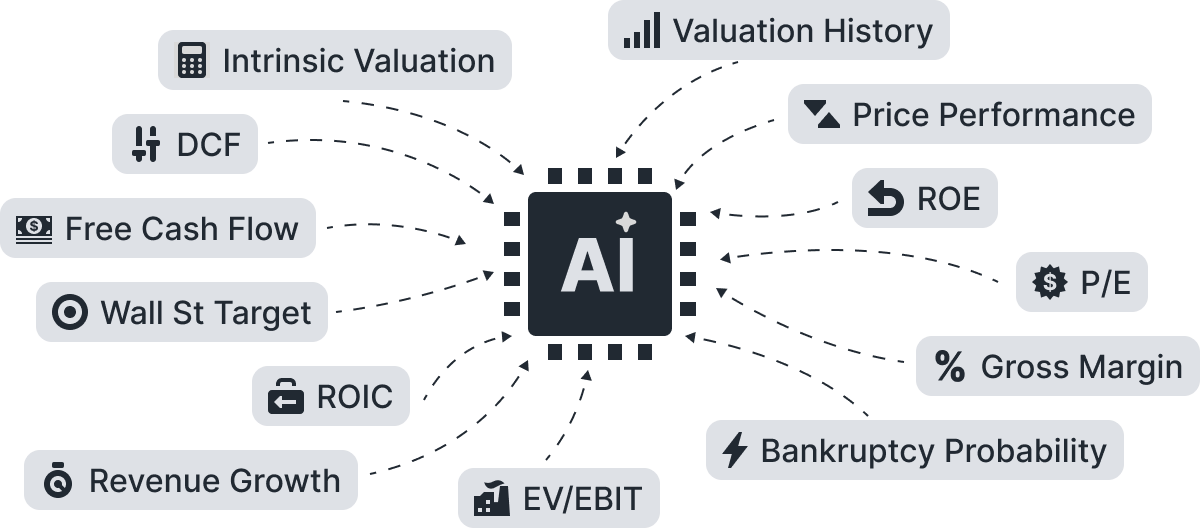

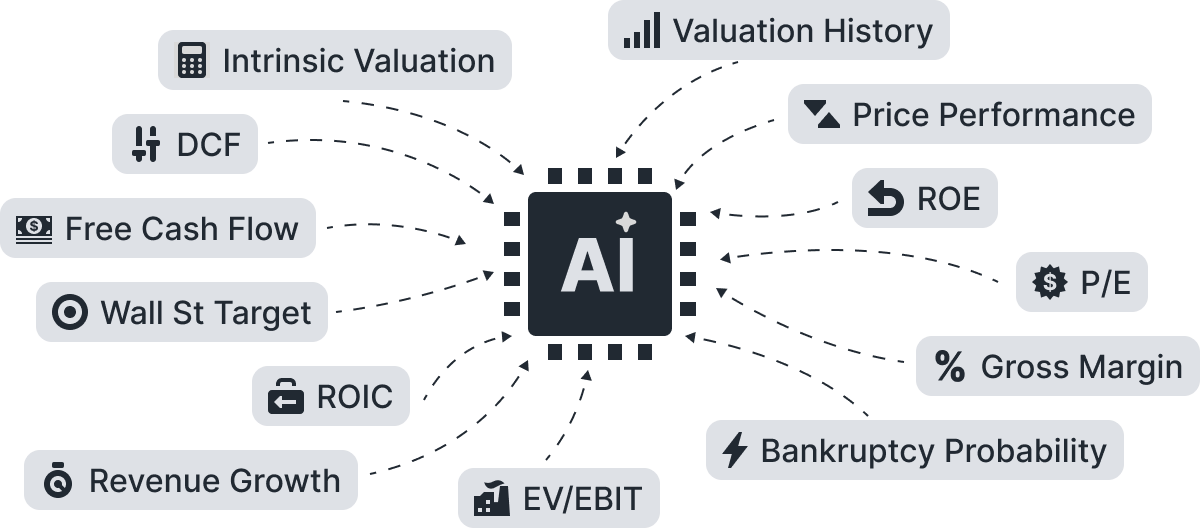

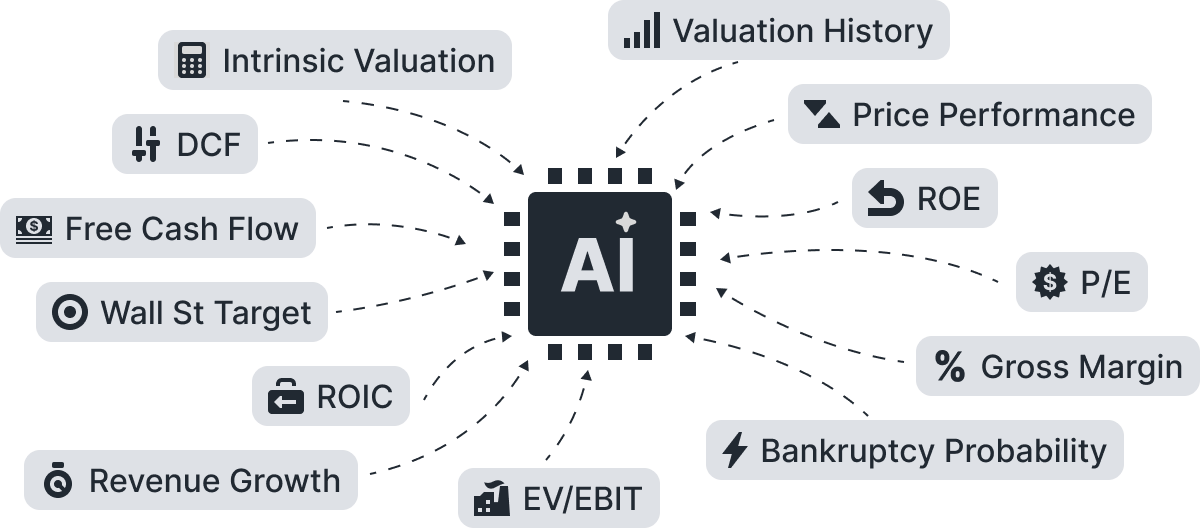

Smart Verdict

AI-Powered

Let AI Decide.

BHC

BHC

NOVO B

NOVO B

Valuation Comparison

Growth Comparison

Growth Over Time

BHC, NOVO B

All metrics are calculated based on data from the last 10 years.

Profitability Comparison

Gross Margin

Operating Margin

Net Margin

FCF Margin

ROE

ROA

ROIC

ROCE

Solvency Comparison

You don't have any saved screeners yet

You don't have any saved screeners yet