PROZONINTU

vs

PROZONINTU

vs

1925

1925

PROZONINTU

PROZONINTU

1925

1925

Over the past 12 months, PROZONINTU has underperformed Daiwa House Industry Co Ltd, delivering a return of 0% compared to the Daiwa House Industry Co Ltd's +13% growth.

Paid Plans

Want to analyze multiple companies at once? Paid plans let you compare up to 5 stocks side by side.

Sign Up

Smart Verdict

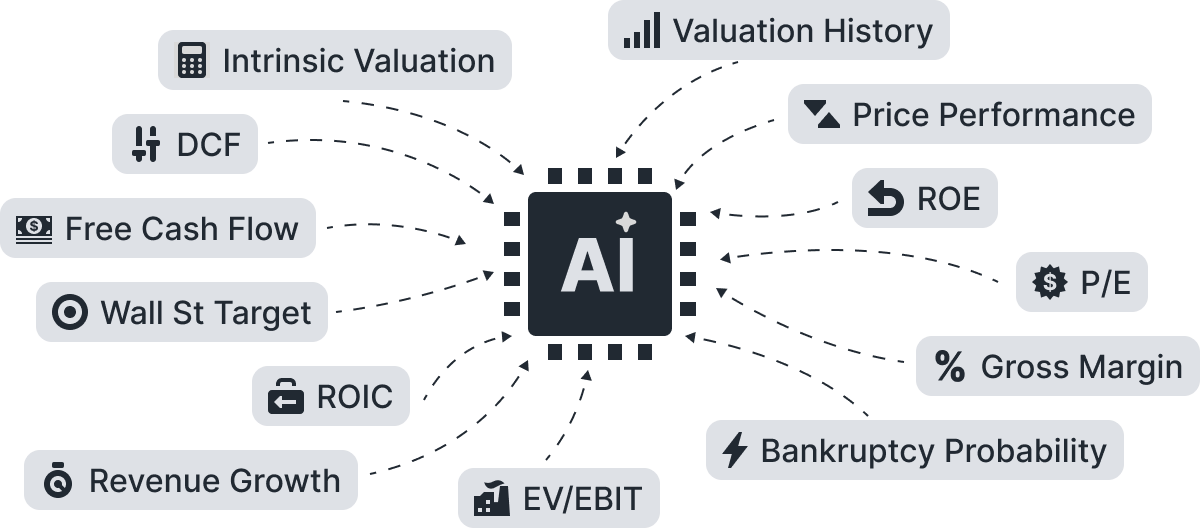

AI-Powered

Let AI Decide.

PROZONINTU

PROZONINTU

1925

1925

See Who Stands Out.