Reinsurance Group of America Inc

NYSE:RGA

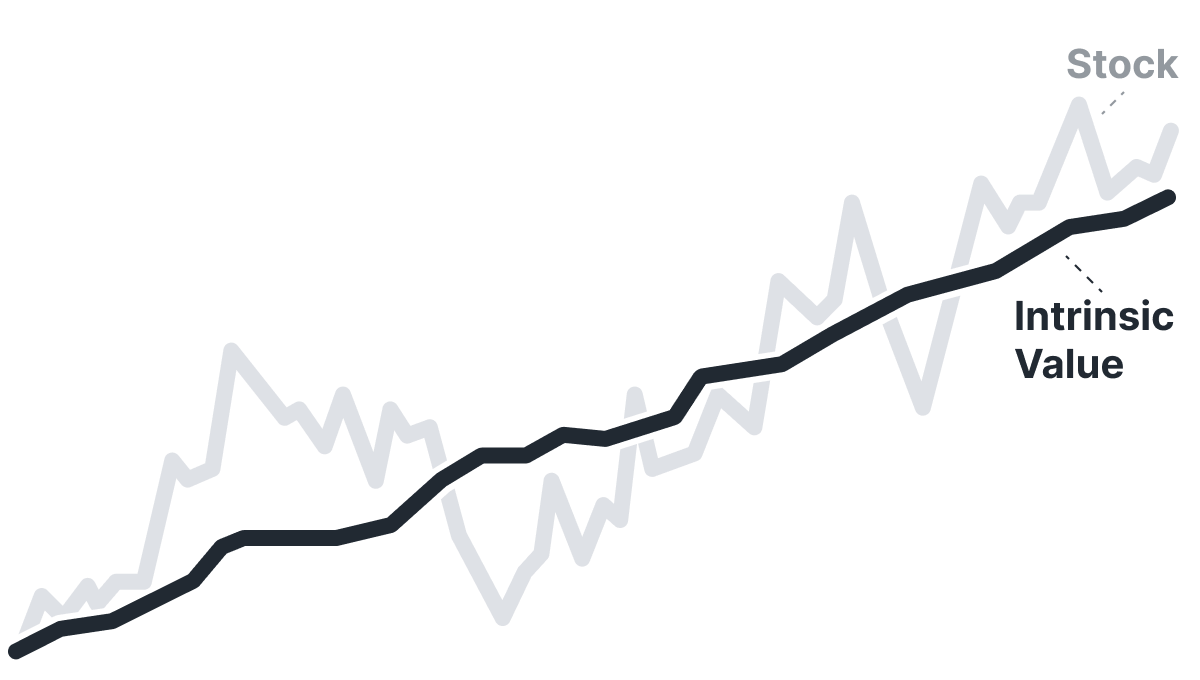

Intrinsic Value

The intrinsic value of one

RGA

stock under the Base Case scenario is

hidden

USD.

Compared to the current market price of 196.08 USD,

Reinsurance Group of America Inc

is

hidden

.

RGA

stock under the Base Case scenario is

hidden

USD.

Compared to the current market price of 196.08 USD,

Reinsurance Group of America Inc

is

hidden

.

The Intrinsic Value is calculated as the average of DCF and Relative values:

Valuation History

Reinsurance Group of America Inc

RGA looks undervalued. But is it really? Some stocks live permanently below intrinsic value; one glance at Historical Valuation reveals if RGA is one of them.

Learn how current stock valuations stack up against historical averages to gauge true investment potential.

Fundamental Analysis

Unexpected shifts in mortality or longevity trends—such as pandemic outbreaks or accelerated advancements in healthcare—could significantly erode RGA’s underwriting margins, exposing the firm to higher claim losses than anticipated.

RGA holds a leading position in the global life reinsurance market, supported by extensive expertise in mortality and longevity-risk analysis and long-standing relationships with major insurers.

Balance Sheet Decomposition

Reinsurance Group of America Inc

| Cash & Short-Term Investments | 5.2B |

| Insurance Receivable | 3.7B |

| Deferred Policy Acquisition Cost | 5.6B |

| Long-Term Investments | 105.5B |

| Other Assets | 8.2B |

Wall St

Price Targets

RGA Price Targets Summary

Reinsurance Group of America Inc

According to Wall Street analysts, the average 1-year price target for

RGA

is 246.2 USD

with a low forecast of 204.02 USD and a high forecast of 298.2 USD.

RGA

is 246.2 USD

with a low forecast of 204.02 USD and a high forecast of 298.2 USD.

Dividends

Current shareholder yield for  RGA is

hidden

.

RGA is

hidden

.

Shareholder yield represents the total return a company provides to its shareholders, calculated as the sum of dividend yield, buyback yield, and debt paydown yield. What is shareholder yield?

The intrinsic value of one

RGA

stock under the Base Case scenario is

hidden

USD.

RGA

stock under the Base Case scenario is

hidden

USD.

Compared to the current market price of 196.08 USD,

Reinsurance Group of America Inc

is

hidden

.

Reinsurance Group of America Inc

is

hidden

.

You don't have any saved screeners yet

You don't have any saved screeners yet