SVIK

vs

SVIK

vs

WCN

WCN

SVIK

SVIK

WCN

WCN

Over the past 12 months, SVIK has significantly outperformed WCN, delivering a return of +110% compared to the WCN's 1% drop.

Paid Plans

Want to analyze multiple companies at once? Paid plans let you compare up to 5 stocks side by side.

Sign Up

Smart Verdict

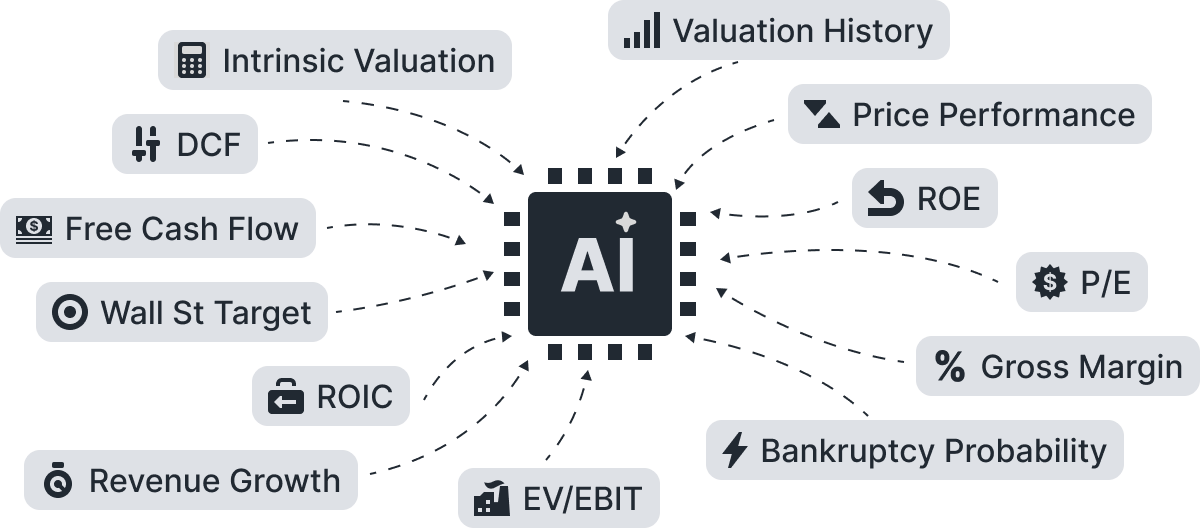

AI-Powered

Let AI Decide.

SVIK

SVIK

WCN

WCN