Sierra Wireless Inc

TSX:SW

Sierra Wireless Inc

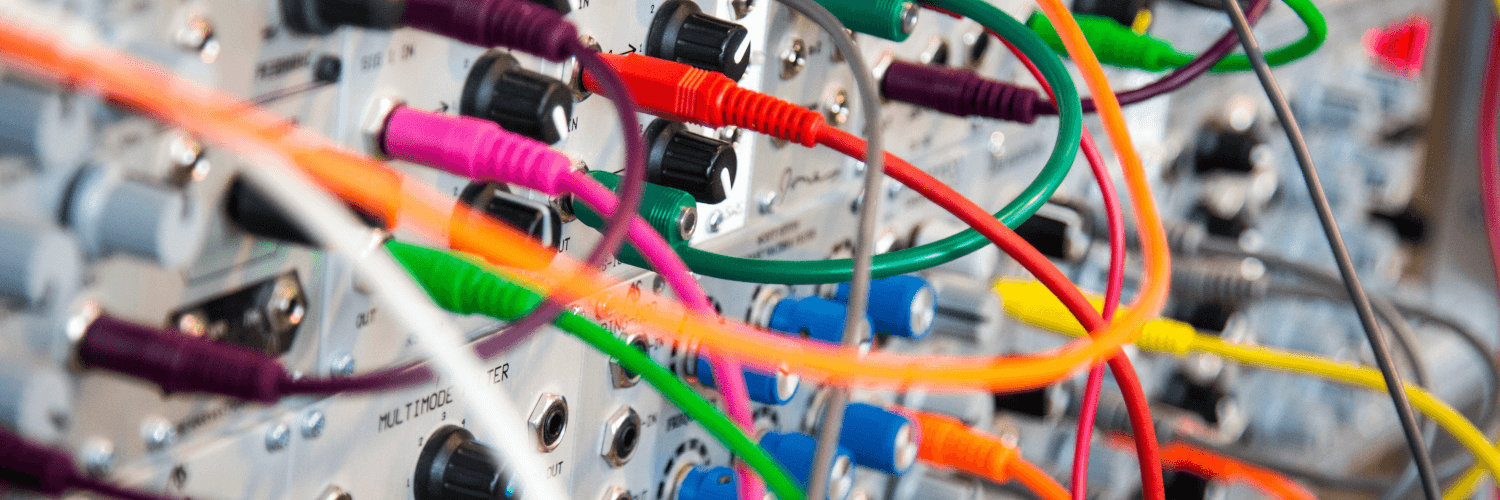

Sierra Wireless Inc., an enduring player in the realm of technology, has woven itself into the fabric of the Internet of Things (IoT) landscape with unrivaled expertise. Founded in 1993 in Richmond, British Columbia, this company has mastered the art of connecting machines, devices, and enterprises to the digital universe. Its journey from creating simple wireless data solutions to comprehensive IoT systems reflects a paradigm shift towards a more interconnected world. Sierra Wireless harnesses its prowess in designing and manufacturing wireless devices, forming the backbone for various applications, from smart cities to industrial IoT and mobile broadband. This integration with the IoT not only fuels innovation but also reshapes how industries operate daily, epitomizing the blend of technology and functionality.

At the heart of Sierra Wireless's revenue model lies a symbiotic relationship between hardware and connectivity services. The company derives its earnings by selling embedded wireless modules and gateways that are integral for connecting devices to networks. But Sierra’s ambition doesn't stop there; it leverages this hardware prowess by providing comprehensive connectivity services and cloud management solutions. These recurring service revenues create a robust financial stream, ensuring stable returns while empowering customers with seamless data management and integration solutions. Sierra Wireless's dual approach of hardware and service reflects a synergistic model, enabling the company to flourish in the competitive IoT ecosystem, and continually adapt and innovate alongside the ever-evolving technological frontier.

Sierra Wireless Inc., an enduring player in the realm of technology, has woven itself into the fabric of the Internet of Things (IoT) landscape with unrivaled expertise. Founded in 1993 in Richmond, British Columbia, this company has mastered the art of connecting machines, devices, and enterprises to the digital universe. Its journey from creating simple wireless data solutions to comprehensive IoT systems reflects a paradigm shift towards a more interconnected world. Sierra Wireless harnesses its prowess in designing and manufacturing wireless devices, forming the backbone for various applications, from smart cities to industrial IoT and mobile broadband. This integration with the IoT not only fuels innovation but also reshapes how industries operate daily, epitomizing the blend of technology and functionality.

At the heart of Sierra Wireless's revenue model lies a symbiotic relationship between hardware and connectivity services. The company derives its earnings by selling embedded wireless modules and gateways that are integral for connecting devices to networks. But Sierra’s ambition doesn't stop there; it leverages this hardware prowess by providing comprehensive connectivity services and cloud management solutions. These recurring service revenues create a robust financial stream, ensuring stable returns while empowering customers with seamless data management and integration solutions. Sierra Wireless's dual approach of hardware and service reflects a synergistic model, enabling the company to flourish in the competitive IoT ecosystem, and continually adapt and innovate alongside the ever-evolving technological frontier.

This earnings call has not been analyzed yet.

If you’d like us to analyze this earnings call, click the "Request Earnings Call Analysis" button below.