CBLT Inc

XTSX:CBLT

ROE

Return on Equity

ROE, or Return on Equity, is a key financial ratio that measures a company's profitability. Specifically, it measures how many dollars of profit are generated for each dollar of shareholder's equity. A higher ROE indicates better financial performance and effective use of capital, making it a valuable metric for investors assessing a company's earning potential.

ROE Across Competitors

| Country | Company | Market Cap | ROE | ||

|---|---|---|---|---|---|

| CA |

|

CBLT Inc

XTSX:CBLT

|

3.1m CAD |

46%

|

|

| AU |

|

BHP Group Ltd

ASX:BHP

|

193.9B AUD |

26%

|

|

| AU |

|

Rio Tinto Ltd

ASX:RIO

|

177.8B AUD |

21%

|

|

| UK |

|

Rio Tinto PLC

LSE:RIO

|

70.1B GBP |

21%

|

|

| CH |

|

Glencore PLC

LSE:GLEN

|

35.3B GBP |

-4%

|

|

| MX |

|

Grupo Mexico SAB de CV

BMV:GMEXICOB

|

842.6B MXN |

18%

|

|

| SA |

|

Saudi Arabian Mining Company SJSC

SAU:1211

|

154.3B SAR |

6%

|

|

| UK |

|

Anglo American PLC

LSE:AAL

|

29.4B GBP |

-13%

|

|

| ZA |

A

|

African Rainbow Minerals Ltd

JSE:ARI

|

34B Zac |

6%

|

|

| IN |

|

Hindustan Zinc Ltd

NSE:HINDZINC

|

2.2T INR |

91%

|

|

| CN |

|

CMOC Group Ltd

SSE:603993

|

161.6B CNY |

23%

|

CBLT Inc

Glance View

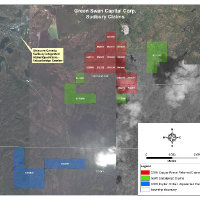

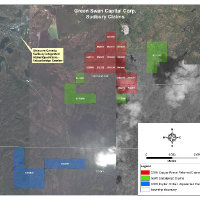

CBLT, Inc. engages in the acquisition, exploration and development of mineral properties. The company is headquartered in Burlington, Ontario. The company went IPO on 2008-10-07. Its properties include Big Duck Lake, Burnt Pond, Chilton Cobalt, Copper Prince, Geneva Lake, Northshore Gold, Otto Lake, and other properties, which include Mikayla and Ryliejack. The Big Duck Lake covers approximately six square kilometers (km) of geology, east of Thunder Bay, Ontario and approximately 100 km west of the prolific Hemlo Gold mines. The Burnt Pond Zinc-Copper property in central Newfoundland is located in the Tally Pond volcanic belt which hosts Teck Resources Ltd’s Duck Pond Mine and other CopperZinc-Silver-Gold massive sulphide deposits. The Chilton Cobalt is in the Grenville Subprovince in Quebec, approximately 40 km east of Saint Jovite in the Laurentian region of Quebec. The company covers approximately 496.4 hectares over nine claims. The Copper Prince is located within Falconbridge Township, in the Sudbury mining district.

See Also

ROE, or Return on Equity, is a key financial ratio that measures a company's profitability. Specifically, it measures how many dollars of profit are generated for each dollar of shareholder's equity. A higher ROE indicates better financial performance and effective use of capital, making it a valuable metric for investors assessing a company's earning potential.

Based on CBLT Inc's most recent financial statements, the company has ROE of 46.5%.

You don't have any saved screeners yet

You don't have any saved screeners yet