TM

vs

TM

vs

7270

7270

TM

TM

7270

7270

Over the past 12 months, TM has outperformed Subaru Corp, delivering a return of +7% compared to the Subaru Corp's +6% growth.

Smart Verdict

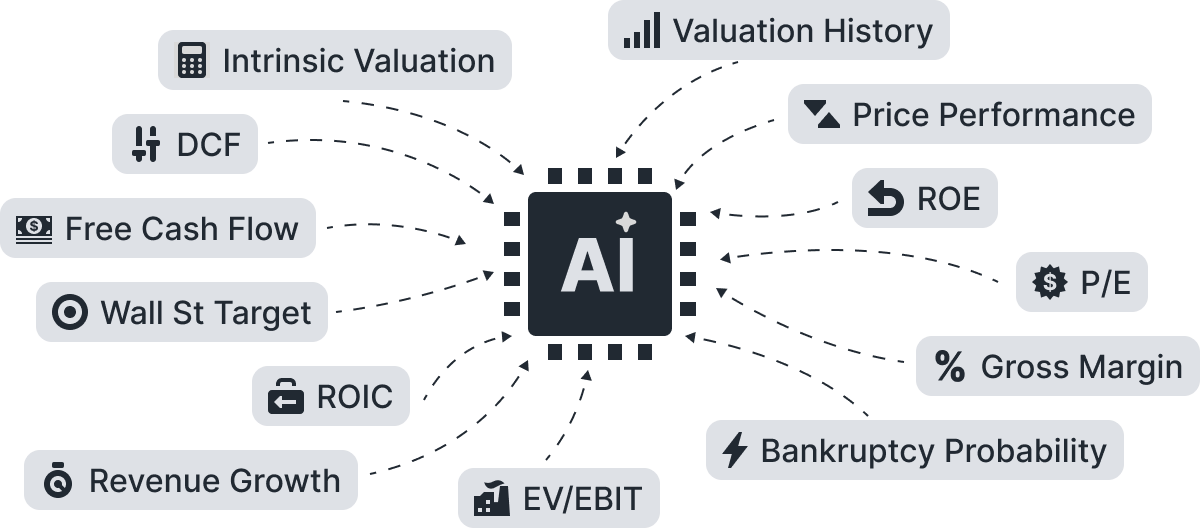

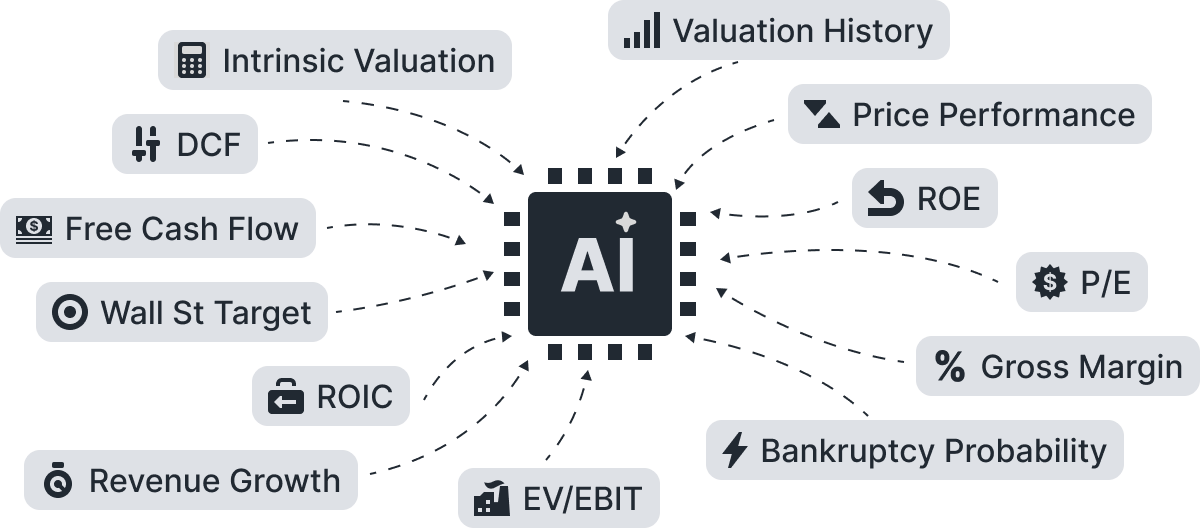

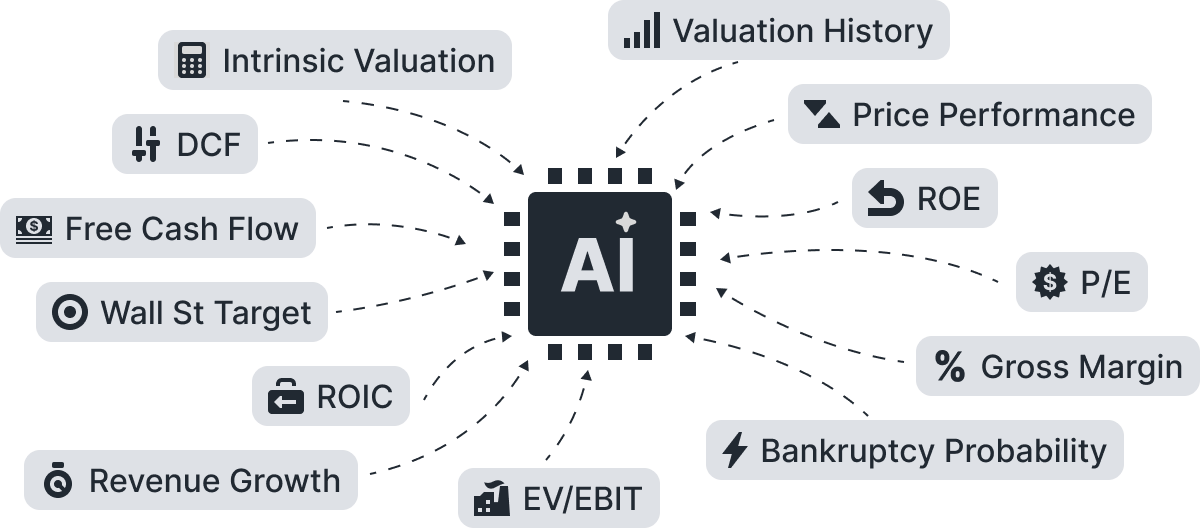

AI-Powered

Let AI Decide.

TM

TM

7270

7270

Valuation Comparison

Growth Comparison

Growth Over Time

TM, 7270

All metrics are calculated based on data from the last 10 years.

Profitability Comparison

Gross Margin

Operating Margin

Net Margin

FCF Margin

ROE

ROA

ROIC

ROCE

Solvency Comparison

You don't have any saved screeners yet

You don't have any saved screeners yet