Amazon.com Inc Research

NASDAQ:AMZN

Amazon.com Inc Research

NASDAQ:AMZN

Amazon.com Inc Research

Summary

Amazon's dual dominance in retail and cloud is unmatched. After a messy 2022, profits are back on track, and the moat is stronger than ever. The stock looks pricey, but that’s nothing new - it often trades at a premium. For long-term believers, history suggests the business is worth it.

- Amazon is a rare blend of dominant e-commerce and essential cloud infrastructure.

- Its Prime ecosystem, logistics network, and AWS platform create a durable, wide moat.

- Shares look expensive relative to intrinsic value, but premium pricing has historically been part of the story.

- After a tough 2022, the business profits have rebounded as cost discipline and AWS strength kick in.

- Regulatory pressure and capital intensity remain long-term watchpoints.

What the Company Does

Amazon runs one of the largest online marketplaces in the world, connecting millions of buyers and sellers. Its retail engine is built around fast delivery, a massive selection, and competitive prices - all tied together by the Prime membership program, which now has over 200 million subscribers.

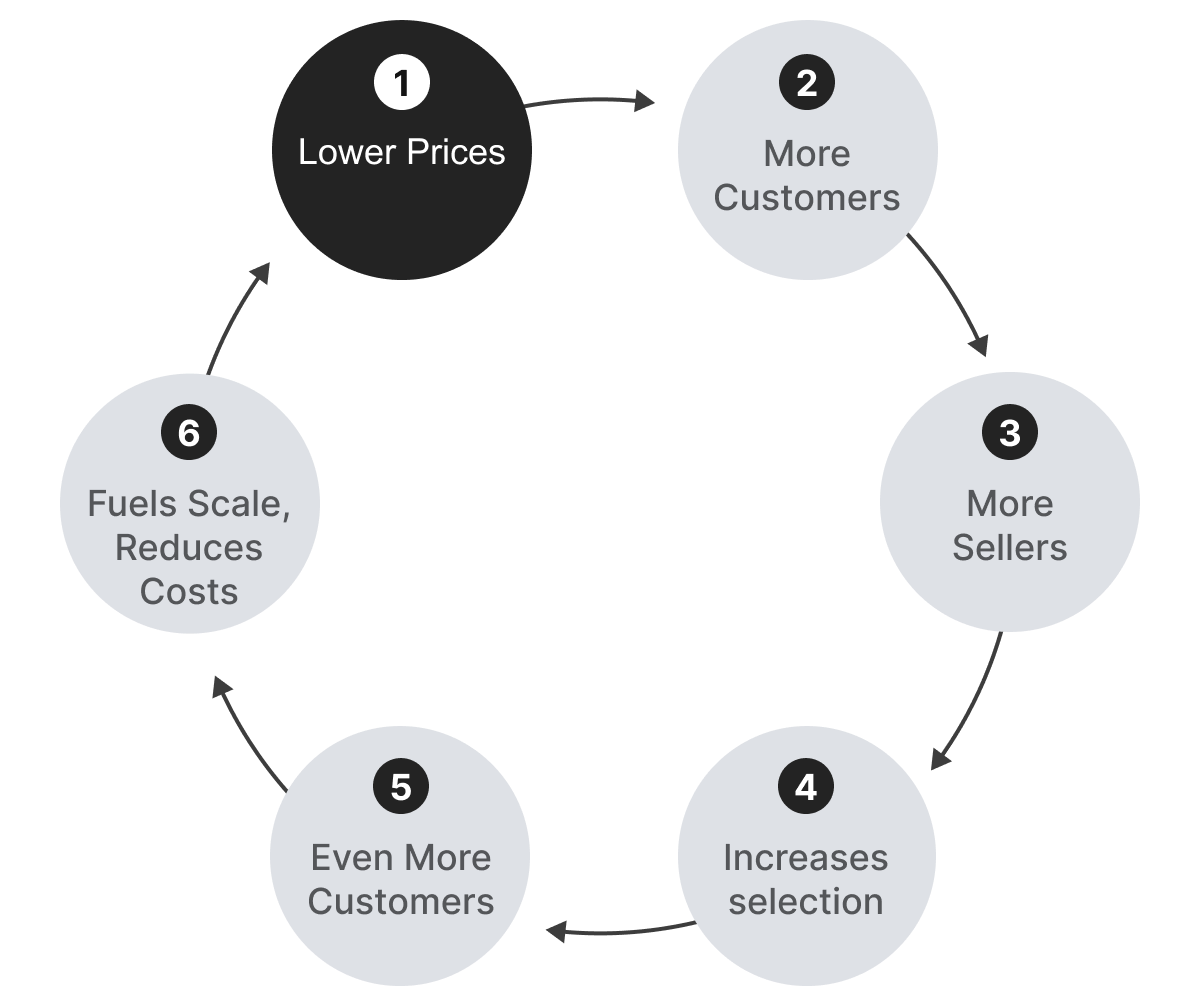

Amazon's business is built on a simple but powerful loop: lower prices attract more customers, which brings more sellers, which increases selection, which drives even more customers.

This flywheel effect fuels scale, reduces costs, and reinforces customer loyalty, creating a growth engine that gets stronger over time.

At the same time, Amazon Web Services (AWS) powers a significant portion of the internet by offering cloud computing, storage, and AI tools. AWS is highly profitable and creates deep customer lock-in, making it the main driver of Amazon's overall profitability.

Beyond retail and cloud, Amazon also monetizes its vast ecosystem through advertising, devices like Echo, and services like Prime Video. Every new touchpoint pulls users deeper into Amazon’s platform, strengthening customer loyalty.

Amazon's business model combines two different engines: a low-margin, high-volume retail machine and a high-margin, recurring-revenue cloud business. Together, they create a resilient, scalable structure that's difficult for competitors to replicate.

Market & Competition

Amazon built the infrastructure for modern shopping and computing. Now it must defend it.

— Alpha Spread Analyst Team

Market Opportunity

E-commerce and cloud computing are two of the largest and most dynamic markets in the world — and both are still far from mature. Online shopping continues to expand across new categories and geographies, while cloud services are becoming the digital backbone for businesses of every size. Amazon sits at the intersection of these two long-term trends, positioned to benefit as both continue evolving.

In retail, the first wave of e-commerce disrupted books, electronics, and apparel. Now, the next frontier is everyday essentials: groceries, healthcare, and local services, areas where digital adoption is still early. Outside the U.S., many global markets are just beginning to build the infrastructure needed for large-scale online commerce. Amazon's investments in logistics, faster delivery, and regional Prime offerings aim to capture this growing demand and lock in customer loyalty as new markets come online.

In cloud computing, the shift is even more structural. Companies are moving from owning servers to renting compute power on demand, a shift fueled by the explosive growth of AI and data-intensive workloads. AWS remains the leading platform for this transition, serving startups, enterprises, and public-sector clients. With much of the world's IT infrastructure still running on legacy systems, the migration to the cloud (and the demand for more scalable, flexible computing) gives Amazon a runway that could stretch for decades.

Competitive Landscape

Retail / E-commerce

Walmart, Shopify, and a swarm of discount marketplaces are targeting Amazon's core strengths: price, selection, and delivery speed. Their strategies range from omnichannel convenience to ultra-low prices shipped directly from factories.

| Competitor | How they compete with Amazon |

|---|---|

Walmart Inc

NYSE:WMT

|

Combines 4,600 U.S. stores with online pickup & same-day delivery to match Amazon's speed on groceries and essentials. |

Shopify Inc

NYSE:SHOP

|

Gives independent merchants their own branded stores, letting them avoid Amazon fees and control customer data. |

Target Corp

NYSE:TGT

|

Leverages curb-side pickup and curated product mix to win higher-income households Amazon courts with Prime. |

PDD Holdings Inc

NASDAQ:PDD

|

Competes through its Temu marketplace, shipping ultra-cheap goods direct from Chinese factories and undercutting Amazon on price. |

Shein

PRIVATE COMPANY

|

Fast-fashion platform with factory-to-consumer logistics; wins on rock-bottom pricing and rapid trend turnover. |

Cloud

Cloud spending is an arms race. Microsoft and Google are closing the gap by bundling AI tools and enterprise software; others chase niche workloads or regional dominance.

| Competitor | How they compete with Amazon |

|---|---|

Alphabet Inc

NASDAQ:GOOGL

|

Uses Google Cloud Platform and Vertex AI to pitch best-in-class data analytics and open-source friendliness for machine-learning-heavy projects. |

Microsoft Corp

NASDAQ:MSFT

|

Competes via the Azure platform, bundled with Office 365, GitHub, and new AI Copilot features that pull enterprise workloads into its ecosystem. |

Oracle Corp

NYSE:ORCL

|

Oracle Cloud Infrastructure (OCI) targets customers running legacy Oracle databases, offering lift-and-shift migrations with lower network-egress fees. |

Alibaba Group Holding Ltd

NYSE:BABA

|

Alibaba Cloud dominates China and parts of Southeast Asia where AWS faces regulatory hurdles, providing localized compliance and competitive pricing. |

IBM Corp

NYSE:IBM

|

IBM Cloud focuses on regulated industries (finance, healthcare) with hybrid solutions and mainframe integrations that appeal to long-time IBM clients. |

Subscriptions

The subscription battlefield is about locking people into ecosystems with irresistible, recurring value. Prime bundles shipping, video, music, and more into one annual fee, but it fights for the same wallet share and screen-time as pure-play streaming services and rival membership programs.

| Competitor | How they compete with Amazon |

|---|---|

Netflix Inc

NASDAQ:NFLX

|

Offers the deepest on-demand video library and a global content pipeline that keeps viewers paying month after month. |

Walt Disney Co

NYSE:DIS

|

Uses Disney+, Hulu, and ESPN+ to pull families and sports fans into a multi-service bundle that rivals Prime Video’s entertainment draw. |

Apple Inc

NASDAQ:AAPL

|

Wraps TV+, Music, iCloud, and Arcade into the Apple One bundle, pitching a simple “all-in” subscription to users already inside the iPhone ecosystem. |

Spotify Technology SA

NYSE:SPOT

|

Dominates audio streaming and podcasts; its all-access music subscription challenges Prime Music for daily listening time. |

Positioning & Economic Moat

Amazon’s strength doesn’t rest on a single advantage - it’s a system of interlocking defenses that reinforce each other. Each major business line supports the next, creating a network of loyalty, speed, and scale that’s hard for rivals to break.

- Prime Membership: By bundling fast shipping, video, music, and other perks into a single subscription, Prime turns occasional shoppers into habitual customers — and raises the emotional and practical costs of leaving.

- Logistics Infrastructure: Thousands of warehouses, planes, trucks, and same-day hubs allow Amazon to promise faster delivery at lower cost — a capability that smaller competitors can’t match without massive investment.

- AWS Integration: Apps and services built on AWS often become so intertwined with Amazon’s systems that switching to a rival cloud would mean costly migrations and operational risks.

However, defending this fortress is expensive. Heavy capital spending on logistics, regulatory scrutiny over marketplace and cloud dominance, and rising competition in ads and subscriptions are all pressuring Amazon's traditional advantages.

The moat remains wide, but it requires constant investment to maintain.

Switching costs are the pain (time, risk, money) of moving from one provider to another. For AWS customers, apps, data, and staff skills are all tied to Amazon’s tools. Shifting to a rival cloud often means rewriting code, migrating terabytes of data, and retraining engineers—so most companies prefer to stay put.

An economic moat is a long-term advantage that protects a business from competition — like a moat around a castle. It makes it harder for others to steal customers, undercut prices, or copy the business model.

Moats come in different sizes:

— No moat: The company competes purely on price or speed. Rivals can easily take market share.

— Narrow moat: The company has some edge — maybe technology, brand, or switching costs — but it’s not untouchable.

— Wide moat: The company has deep, lasting advantages that are hard to copy. Think platforms, ecosystems, or massive scale.

Amazon is widely viewed as a wide-moat company. Its moat doesn't hinge on one product but on the tight weave of Prime's customer lock-in, a global logistics network that delivers faster and cheaper, and the high switching costs that keep enterprises anchored to AWS. Each strand reinforces the other, forming a barrier rivals struggle to cross—even when they dangle lower prices or flashier features.

Growth Performance

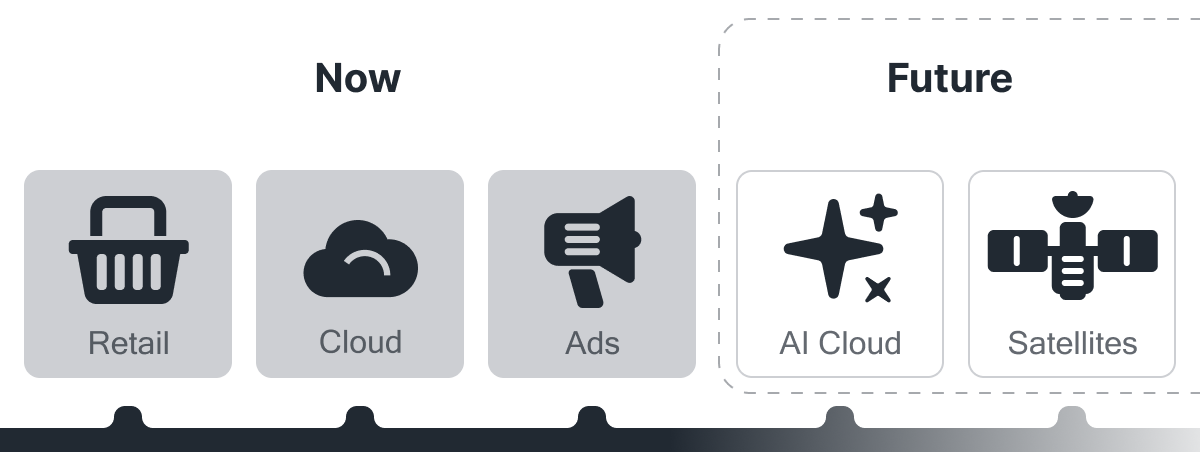

Amazon’s growth story today is built around three pillars: retail expansion, cloud dominance, and the rise of high-margin subscription and advertising businesses. While overall revenue growth has moderated from its early hyper-speed days, Amazon continues to find new ways to expand its reach and deepen its profitability.

Retail

Amazon's retail engine remains massive, but growth has slowed to a steadier, more mature pace. Core U.S. e-commerce sales are growing in the low-to-mid single digits, with groceries, healthcare, and same-day delivery driving incremental gains. International markets still offer an expansion runway, though competition is intensifying. Retail's focus today is more about sustaining loyalty and feeding traffic into Amazon's broader platform.

AWS

AWS continues to grow, but at a slower rate than during its early boom years. Enterprises are still migrating workloads to the cloud, but economic caution and AI-related optimization have led to more measured buying cycles. Even so, AWS remains a critical growth engine for Amazon, with new opportunities in AI infrastructure, data analytics, and industry-specific cloud solutions.

Advertising & Subscriptions

Advertising and subscriptions have become important growth levers. Advertising revenue on Amazon's marketplace is expanding steadily, as brands prioritize reaching high-intent shoppers directly. Subscriptions like Prime, Audible, and Kindle Unlimited continue to build, helping to increase customer engagement and lifetime value. Both segments are compounding steadily alongside the core retail and cloud businesses.

Looking ahead

Amazon's growth profile is shifting from hyper-growth to durable expansion. Retail volume builds scale, AWS provides technology leadership, and advertising and subscriptions create deeper customer relationships. The key growth variables over the next few years will be AWS's traction in new AI-driven services and Amazon's ability to broaden Prime and advertising adoption globally.

It's much harder to grow fast once you're massive. Early Amazon was a smaller company adding new categories and markets. Today, with hundreds of billions in revenue, even strong gains look slower as a percentage. It's the natural math of scale, not a sign that Amazon is shrinking.

AWS remains the most important engine. Cloud computing, AI infrastructure, and data-heavy applications all keep pulling demand toward scalable cloud platforms like AWS. If Amazon can keep leading in AI services and enterprise workloads, it will fuel much of the company’s future expansion.

Some big companies are optimizing what they already use before buying more. It’s like cleaning out your garage before renting extra storage. But long-term, AI actually drives higher cloud demand, because training and running large models needs massive computing power that only platforms like AWS can deliver.

Margins & Profitability

Profitability Snapshot

Amazon's business is a blend of thin and thick margin models. Retail, especially first-party sales, runs at razor-thin margins driven by scale and speed rather than high markups. AWS, on the other hand, operates with much higher margins thanks to its capital-light, usage-based model. Advertising and subscription services are lifting profitability even further by layering high-margin revenue on top of the retail platform. After a margin dip in 2022 driven by rising costs and over-expansion, Amazon tightened operations and returned to a healthier, more efficient base.

Return on Capital

Historically, Amazon's returns on invested capital (ROIC) have been moderate compared to pure software or marketplace businesses. Heavy investments in logistics infrastructure (warehouses, delivery fleets, and data centers) tie up large amounts of capital. However, AWS and advertising require far less ongoing capital to scale. As these higher-return segments grow in the revenue mix, Amazon’s overall capital efficiency is improving, even if it remains lower than ultra-light digital platforms like Alphabet or Meta.

Scalability and Margin Sustainability

Amazon's ability to maintain and expand margins depends heavily on AWS growth and advertising scale. Cloud and ads are structurally higher-margin businesses that offset retail's thin base. Still, the company must keep logistics costs in check and defend its pricing power amid rising competition and regulatory scrutiny. If it balances these forces well, Amazon can continue inching margins higher over time, not through massive jumps, but through steady, durable expansion.

A margin is the slice of each sales dollar the company keeps after paying costs. Gross margin looks at costs to make the product. Operating margin also subtracts running the business (staff, R&D, marketing). Higher margins mean more money left over.

ROIC stands for Return on Invested Capital — basically, it answers the question: “For every dollar Amazon puts into its business, how much profit does it get back?”

It’s a key way to measure how efficiently a company turns its resources into results.

Historically, Amazon's ROIC has been moderate because it invests heavily in warehouses, logistics, and infrastructure - physical assets that take time to pay off. But as higher-return businesses like AWS and advertising grow, Amazon's capital efficiency is quietly improving.

— Margins show how much profit is made from sales.

— ROIC shows how well the company turns investment dollars into profit.

A company can have strong margins but weak ROIC if it spends too much on growth.

Amazon is different: its retail margins are thin by design, but the rise of AWS and advertising (businesses that require less capital to expand) is helping push both profitability and capital efficiency higher over time.

Free Cash Flow

When you judge a company, profits on paper are one thing, but real cash is what ultimately fuels growth, resilience, and returns.

Free cash flow shows how much money Amazon actually keeps after running its operations and making the investments needed to grow. It's the cash left over to build new infrastructure, launch new services, return capital to shareholders, or weather tough cycles. For a company like Amazon, understanding how cash moves through the system is essential.

Business Model & Cash Generation

Amazon's cash engine is a hybrid. Retail operations devour capital for inventory, warehouses, and last-mile delivery. AWS also requires big upfront spending on data-centres and custom servers, but those assets earn revenue from thousands of customers for years and need almost no working capital, so each dollar invested stretches further. Advertising is even more cash-efficient: it layers high-margin revenue on top of the traffic Amazon already has.

After a volatile post-pandemic stretch, when expansion costs squeezed cash generation, Amazon has shifted back toward stronger and more predictable free cash flow.

Stability and Growth of Cash Flow

Today, Amazon's cash generation is becoming more stable and resilient. Retail provides a broad, steady revenue base, while AWS and advertising contribute higher-yield cash streams. As these capital-efficient segments grow within the mix, Amazon's overall free-cash profile looks less volatile and more scalable, even as it continues to invest heavily in infrastructure and content.

Use of Cash

Historically, Amazon reinvested most of its cash flow into building out logistics networks, expanding AWS capacity, and creating Prime content. That hasn’t changed, but the company is more disciplined after its 2022 reset. Spending now targets high-return areas, and Amazon has started modest share buybacks, signalling a gradual shift toward balancing growth investments with shareholder returns.

Earnings can be shaped by accounting rules, but free cash flow is the money that actually lands in the bank.

Net income includes non-cash items like stock-based compensation, depreciation of warehouses and servers, and accounting estimates that may not reflect real cash moving in or out. Amazon’s reported profits can swing depending on investment cycles, especially when it ramps up spending on logistics or cloud infrastructure.

Free cash flow strips out that noise. It shows what’s left after Amazon runs its operations, builds new fulfillment centers, expands AWS, and invests in new services.

That leftover cash funds logistics expansion, cloud investments, Prime content, occasional buybacks, and future bets like healthcare and satellite internet. For investors, free cash flow gives a clearer signal of Amazon’s underlying financial health.

When Amazon uses its cash to repurchase its own stock, those shares are permanently removed from circulation. As a result, the company’s earnings, cash flows, and assets are divided among fewer shares.

You still own the same number of shares, but each one now represents a slightly larger piece of Amazon’s business. Over time, this can boost earnings per share (EPS) and support a higher stock price, even if total profits stay steady. In short, buybacks quietly increase the ownership stake of every remaining shareholder.

Management

Bezos graduated from Princeton University in 1986 with degrees in electrical engineering and computer science. After college, he worked on Wall Street in a variety of related fields, including a role at D. E. Shaw & Co., a hedge fund. In 1994, he left his lucrative job to found Amazon, initially an online bookstore, operating out of a garage in Seattle, Washington.

Under Bezos’s leadership, Amazon rapidly expanded beyond books to become a dominant force in online retail. Known for his customer-centric approach and innovative strategies, Bezos diversified the company's offerings into numerous sectors, including digital streaming, cloud computing with Amazon Web Services (AWS), and artificial intelligence with products like Alexa. His commitment to innovation extended to creating physical stores without checkouts and the development of delivery drones.

Throughout his tenure, Bezos was known for his focus on long-term growth and reinvestment of profits into the business, which occasionally drew criticism from Wall Street while enabling Amazon to stay at the forefront of technology and retail operations.

In addition to his work with Amazon, Bezos founded Blue Origin, a space exploration company, in 2000, with the aim of reducing the cost of space travel and eventual human colonization of space. Blue Origin has successfully launched several suborbital missions and is working on more ambitious projects, such as orbital and lunar missions.

In February 2021, Bezos announced that he would step down as CEO of Amazon to focus on other ventures, including Blue Origin and The Washington Post, which he owns. He transitioned to the role of Executive Chairman in July 2021, handing over the CEO position to Andy Jassy.

Bezos has been the recipient of numerous awards and honors, reflecting his impact on business and technology, and his influence extends beyond his companies to philanthropy, notably through initiatives like the Bezos Earth Fund, focusing on climate change, and the Bezos Day One Fund, supporting homeless families and education. His leadership style and business acumen have left a lasting imprint on global commerce and technology.

Jassy joined Amazon in 1997, right after completing his MBA at Harvard Business School. He was a significant part of the team that initially formulated the idea for AWS, which launched in 2006. Under Jassy's leadership, AWS grew into a multi-billion-dollar business, becoming the world's leading cloud services platform, which considerably contributes to Amazon's overall profitability.

Known for his strategic acumen and deep understanding of the technology sector, Jassy has been recognized for fostering innovation and driving business growth. His leadership style is often described as detail-oriented and principled, with a focus on customer-centric solutions.

Before becoming CEO, Jassy served as the CEO of AWS from its inception until July 2021. His transition to the role of Amazon's CEO marked a significant shift in the company's leadership, reflecting the growing importance of cloud services within Amazon's broader business strategy. Jassy's tenure as CEO is expected to emphasize continued innovation and expansion across Amazon's diverse portfolio of services.

Before becoming CFO, Olsavsky was the Vice President of Finance and CFO for the company’s Global Consumer Business, where he was instrumental in leading the finance functions for Amazon’s worldwide retail and marketplace businesses. His leadership has been pivotal in guiding the company through significant periods of growth and investment in new technologies and services.

Prior to joining Amazon, Brian Olsavsky worked at Fisher Scientific, where he held a variety of financial and business management roles. He holds an MBA from Carnegie Mellon University and a Bachelor’s degree from Penn State University. Under his financial stewardship, Amazon has continued to expand its global footprint and diversify its business operations, further cementing its position as a leader in the tech industry.

Before joining Amazon, Zapolsky was a partner at the law firm Dorsey & Whitney LLP, where he specialized in commercial litigation. He holds a Juris Doctor (J.D.) degree from the University of California, Berkeley, School of Law, and an undergraduate degree from Columbia University. David Zapolsky's extensive experience and leadership skills have been instrumental in navigating Amazon through various legal challenges and regulatory environments as the company has grown into a global e-commerce and technology powerhouse.

With a deep background in retail and consumables, Herrington has been instrumental in expanding Amazon's grocery and consumer goods sectors. Before his tenure at Amazon, he co-founded webvan, an online delivery service for groceries, and held positions at companies such as Guilbert and The Pillsbury Company.

Herrington is recognized for his strategic vision and leadership qualities, steering Amazon's retail operations towards innovation and customer-centric approaches. His expertise and long-standing tenure at Amazon underscore his importance in navigating the complexities of the retail industry as e-commerce continues to evolve.

Reynolds joined Amazon in 2006 and has since been a key part of the finance leadership team. Her vast experience and expertise significantly contribute to Amazon's robust financial management strategies. Prior to joining Amazon, she gained extensive experience at Deloitte & Touche LLP, where she served in various roles, including audit and advisory services, which provided her with a strong foundation in financial practices and operations.

Reynolds is known for her commitment to excellence and her ability to lead complex financial projects and teams, ensuring that Amazon maintains its reputation for transparency and accountability in financial reporting. Her leadership is vital in navigating the challenges of Amazon's vast and dynamic marketplace.

Dr. Vogels holds a Ph.D. in Computer Science from the Vrije Universiteit Amsterdam in the Netherlands. Before his tenure at Amazon, he was a research scientist at Cornell University, where he focused on scalable and reliable enterprise systems, an area that played a crucial role in his later work at Amazon.

As CTO, Dr. Vogels is responsible for driving the company's technological vision and strategy. He is known for his work on Amazon's distributed systems and for being a vocal advocate of cloud computing, which transformed how businesses deploy and manage their IT infrastructure.

A respected figure in the tech community, Dr. Vogels often shares insights and innovations through public speaking engagements, his blog "All Things Distributed," and various industry conferences. His work has significantly contributed to Amazon's reputation as a leader in cloud services and technological innovation. Dr. Vogels is recognized for his commitment to customer-centric development, ensuring that Amazon's technology serves the needs of its diverse and global customer base.

Fildes has been with Amazon for several years, and during his tenure, he has contributed to shaping Amazon's communication strategy concerning its financial disclosures and market positioning. His efforts have been central during periods of significant company activity, such as quarterly earnings reports, mergers and acquisitions, and responses to market trends affecting Amazon's operations. His expertise in investor relations plays a vital part in how Amazon's business endeavors are perceived on Wall Street.

His role requires a deep understanding of Amazon's complex business model, financial metrics, and strategic direction. By effectively managing investor communications, Fildes helps to ensure that Amazon's market value reflects its business fundamentals and long-term potential.

Her journey also includes a pivotal role at Mondelez International (formerly Cadbury), where she was instrumental in driving marketing strategies across diverse markets. With a strong educational background, including studies at prestigious institutions, Anuradha Aggarwal has developed a deep understanding of consumer behavior and digital transformation.

At Amazon.com Inc., Anuradha Aggarwal holds a key position, where she leverages her expertise to enhance customer experiences and drive growth initiatives. Her leadership is marked by a focus on innovation, strategic thinking, and a commitment to leveraging data-driven insights to meet business objectives.

With a background in engineering and an M.B.A. degree, Galetti brings a strategic and analytical approach to her role. Her leadership style emphasizes innovation in HR practices, data-driven decision-making, and fostering an inclusive workplace culture. Before joining Amazon, she held various leadership positions in the logistics and healthcare sectors, which helped her develop a diverse skill set applicable to her current responsibilities.

Galetti's work has had a significant impact on shaping Amazon's approach to workforce management, particularly during periods of rapid expansion and increased scrutiny regarding labor practices. Her efforts focus on enhancing employee experiences, implementing cutting-edge technology solutions, and aligning human resources strategies with Amazon's overall business objectives.

Leadership

Amazon is led by CEO Andy Jassy, who took over from Jeff Bezos in 2021. Jassy spent over two decades at Amazon, most notably building AWS from scratch into the world’s leading cloud platform.

His leadership style is operational, disciplined, and detail-driven - a contrast to Bezos’s big-vision, founder mentality.

Since stepping into the CEO role, Jassy has focused on tightening Amazon’s cost structure, improving profitability, and prioritizing more measured, efficient growth.

Culture & Execution

Amazon's culture has always been built around customer obsession, operational excellence, and willingness to invest for the long term - and that hasn't changed.

Under Jassy, the company has sharpened its discipline, pulling back on overexpansion and focusing more on profitable scaling. Execution remains strong across core businesses, with clear attention to efficiency, capital allocation, and strengthening Amazon's infrastructure for future growth.

Ownership & Alignment

Jeff Bezos remains Amazon's largest individual shareholder, maintaining a significant influence even after stepping down.

Andy Jassy holds a smaller equity stake by comparison, reflecting Amazon's evolution from a founder-driven startup to a professionally managed giant. While insider ownership is not as dominant as in some tech companies, cultural alignment around long-term thinking and customer obsession remains strong.

Long-Term View

Amazon's next decade hinges on whether it can keep turning its vast infrastructure into high-margin growth while regulators and deep-pocketed rivals attack on every front.

— Alpha Spread Analyst Team

Amazon reshaped how people shop and how businesses power their technology. It built one of the world’s largest online marketplaces and the most profitable cloud platform. But its future will depend on building new growth engines, not just expanding the old ones.

AWS must evolve from a cloud leader into the backbone of the AI economy, winning against Azure and Google Cloud by scaling custom chips and managed AI services. Retail must push deeper into everyday categories like groceries, pharmacy, and local services. Advertising must keep growing without undermining the shopping experience.

At the same time, Amazon faces heavy investment demands (data centers, satellites, logistics) and rising regulatory pressure. Mistakes in capital allocation, cloud competition, or consumer trust could slow growth and erode margins.

If Amazon layers new growth engines on top of its core businesses while keeping execution sharp, it can transition into a higher-margin, multi-engine cash machine. If it stumbles, it risks slowing to retail-level growth and losing the premium it once commanded.

The next decade will decide whether Amazon compounds or fragments.

Training large AI models needs far more computing power than typical cloud workloads. Microsoft and Google are bundling their own chips and models to lure developers away. Amazon counters with its Trainium/Inferentia chips and Bedrock service. Staying the easiest, cheapest place to build AI apps is key to keeping AWS in the lead.

Amazon’s sprawl - retail, cloud, ads, groceries, health, and soon satellites - has regulators worried about unfair cross-leveraging. Possible outcomes range from fines and stricter rules to forcing business separations, any of which could weaken the flywheel that makes Amazon powerful.

Valuation

Amazon’s shares currently command a noticeable premium to intrinsic value, something the market has long been willing to pay. Investors aren't confused about what Amazon is; they’re rewarding a company that blends a dominant marketplace, the leading public-cloud platform, and a fast-growing ad network under one roof.

History shows Amazon often grows into rich valuations, but each time it required a breakthrough engine: first Prime, then AWS, now advertising and, potentially, AI infrastructure.

To justify today’s price, AWS must pivot from cloud default to AI backbone, advertising must keep compounding without spoiling the shopping experience, and retail must push deeper into high-frequency categories like grocery and healthcare while holding logistics costs in check. None of those hurdles are impossible - Amazon has the scale, data, and culture to clear them - but they leave little room for execution missteps or regulatory shock.

Investors therefore face a familiar trade-off: accept a full price today for the chance that Amazon’s next act justifies it—or wait for a rarer window, knowing it might never arrive.

It's our best estimate of what the stock is worth based on the company's cash flows and market comparisons - not on today's share price. Think of it as a "fair price" tag.

We model Amazon's future cash flows, discount them back to today at a rate that reflects business risk, then add a sanity check using comparable companies. Market mood doesn't drive the model. Fundamentals do.

DCF is powerful but sensitive to small tweaks. Cross‑checking with peer multiples (P/E, EV/EBITDA, etc) keeps the valuation grounded in market reality.

Should you buy it

Paying up for Amazon isn’t new - only deciding if today’s premium still feels justified.

— Alpha Spread Analyst Team

Amazon’s stock rarely looks cheap, and the current tag is lower than some past peaks but still far above a classic value entry. You’re buying a platform that has repeatedly turned heavy investment into new cash engines, yet must now prove it can do the same with AI-driven cloud, grocery, and global advertising.

Investor Fit

- Fits long-term investors who accept paying a premium for an ecosystem that keeps adding new profit engines: cloud, ads, AI, and soon satellites.

- Suits believers that AWS will remain the default place to build AI apps, and that Prime can deepen loyalty as it moves into groceries, health, and streaming sports.

- Not ideal for value-driven buyers hunting for a clear margin of safety: Amazon rarely trades at one, and today is no exception.

- Not for dividend seekers looking for steady cash payouts; Amazon still reinvests most of its free cash into data centers, logistics, and new bets like Project Kuiper.

It will help us to make research reports better.